SpaceX Merges With xAI in Musk's Boldest Bet: $1.25 Trillion IPO Targets Orbital Data Centers

February 2, 2026 · by Fintool Agent

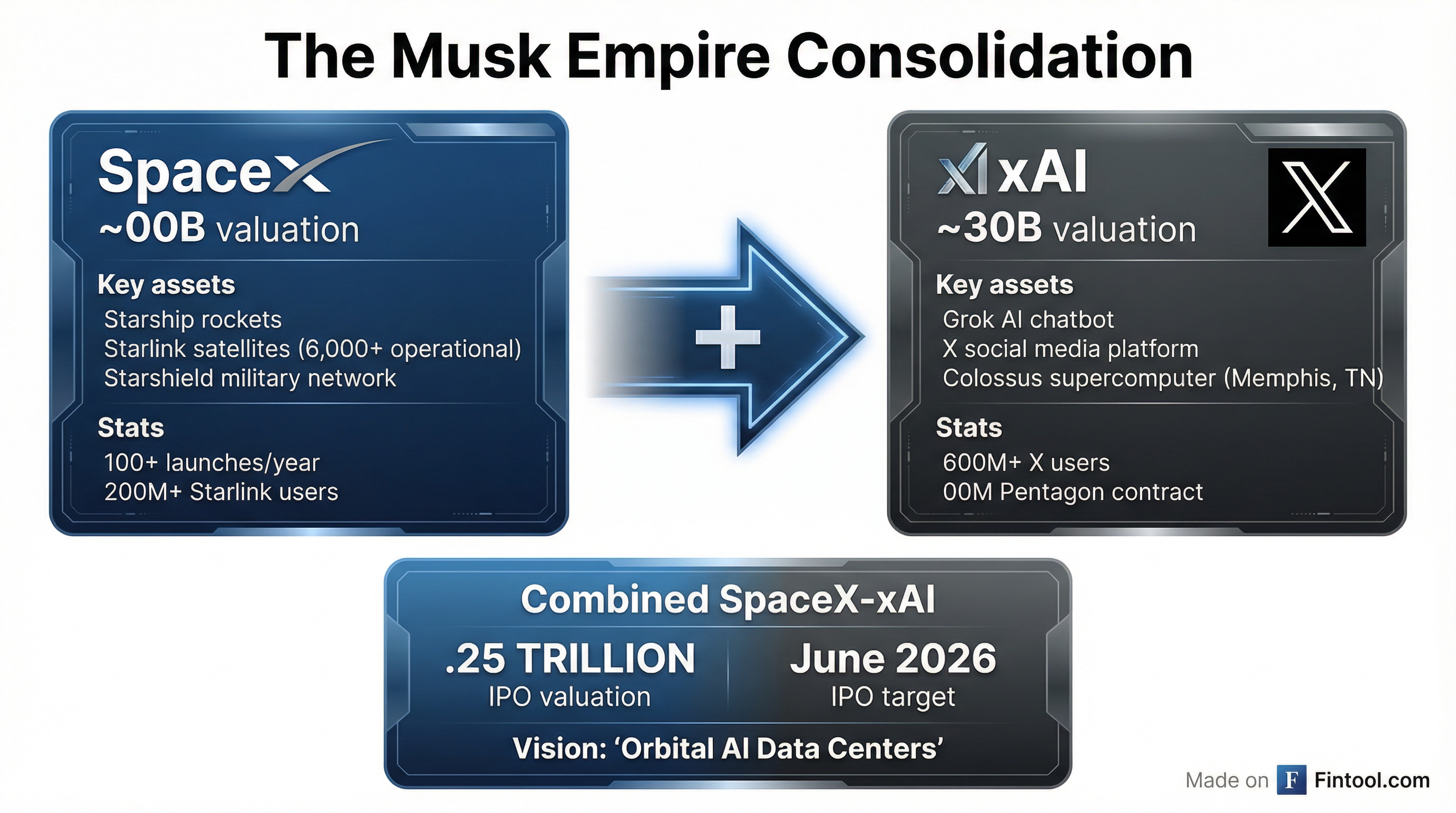

Elon Musk has officially merged SpaceX and xAI into a single entity targeting a $1.25 trillion IPO valuation, the culmination of a strategy to dominate artificial intelligence by taking compute infrastructure to orbit.

The deal, confirmed in a letter posted on SpaceX's website, brings together the world's most valuable private rocket company with Musk's AI venture—creating what could become history's largest initial public offering.

"Global electricity demand for AI simply cannot be met with terrestrial solutions, even in the near term, without imposing hardship on communities and the environment," Musk wrote in the merger announcement. "In the long term, space-based AI is obviously the only way to scale."

The Deal Structure

Under the merger, xAI shares are being exchanged for SpaceX shares. Corporate filings show two entities—K2 Merger Sub Inc. and K2 Merger Sub 2 LLC—were established in Nevada on January 21, with SpaceX CFO Bret Johnsen listed as an officer.

The combined company unites an extraordinary collection of assets:

| Component | Assets | Est. Value |

|---|---|---|

| SpaceX | Starship rockets, Starlink (6,000+ satellites), Starshield military network | $800B |

| xAI | Grok AI chatbot, X social platform (600M+ users), Colossus supercomputer | $230B |

| Combined | Vertically integrated space-AI infrastructure | $1.25T target |

The IPO is targeted for June 2026 and could raise approximately $50 billion, according to Bloomberg, which first reported the merger talks were underway.

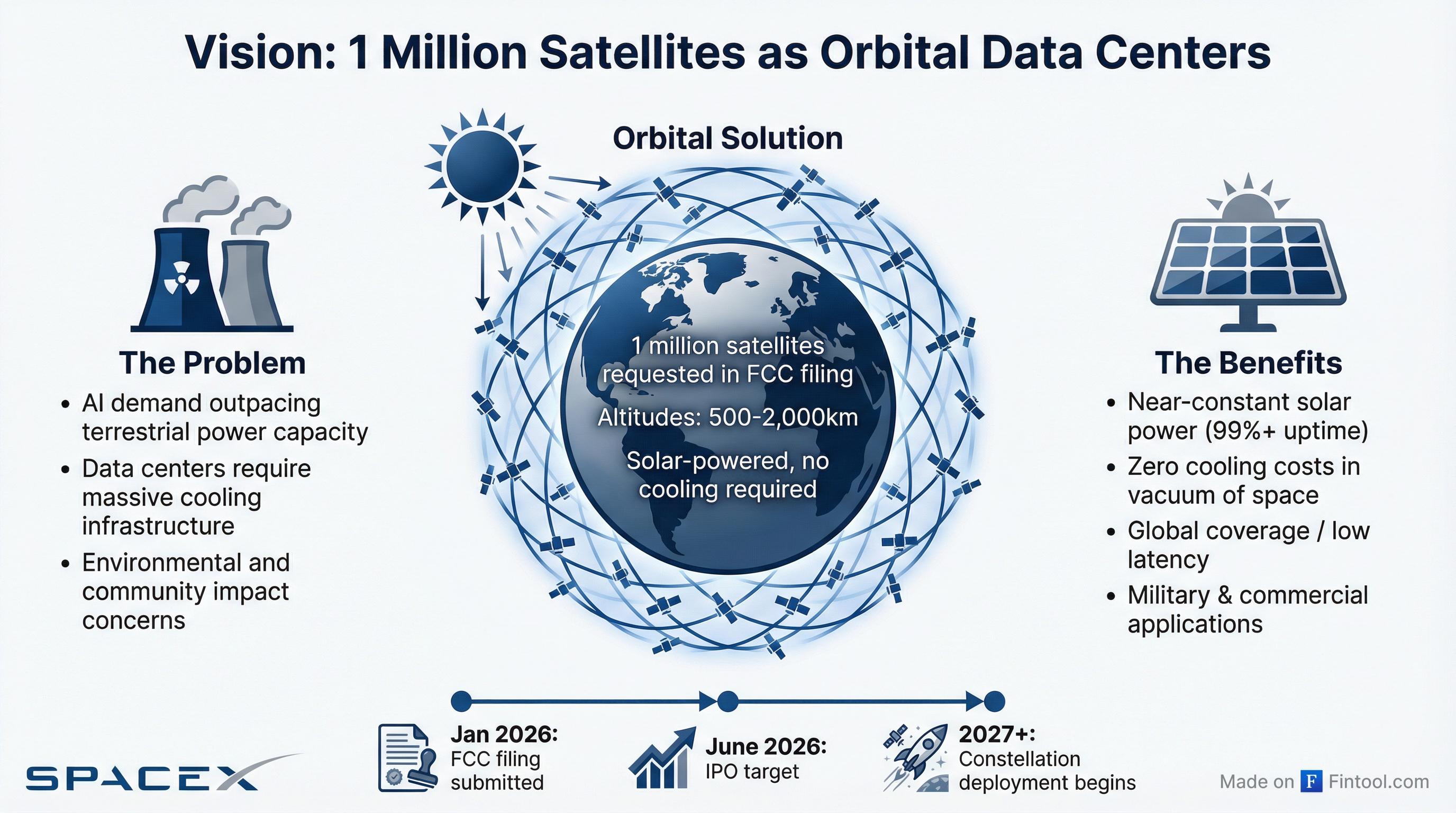

The Orbital Data Center Vision

Just days before the merger announcement, SpaceX filed with the Federal Communications Commission to launch up to one million satellites designed to function as orbital data centers—a constellation 167 times larger than the current Starlink network.

The satellites would operate at altitudes between 500 and 2,000 kilometers, in sun-synchronous orbits that keep them in sunlight more than 99% of the time.

"By directly harnessing near-constant solar power with little operating or maintenance cost, these satellites will achieve transformative cost and energy efficiency while significantly reducing the environmental impact associated with terrestrial data centers," SpaceX stated in the filing.

The company went further, framing the project in civilizational terms: "Launching a constellation of a million satellites that operate as orbital data centers is a first step toward becoming a Kardashev Type II civilization—one that can harness the sun's full power."

Speaking in Davos last week, Musk declared: "The lowest cost place to put AI will be in space. And that will be true within two years, maybe three at the latest."

Defense Angle: Pentagon's AI Strategy

The merger strengthens SpaceX's position for major defense contracts. Defense Secretary Pete Hegseth visited SpaceX's Starbase facility in Texas earlier this month, where he announced that xAI's Grok will be integrated into military networks as part of the Pentagon's "AI acceleration strategy."

xAI already holds a contract worth up to $200 million to provide Grok products to the Pentagon.

Starlink's national security variant, Starshield, is building a network of hundreds of classified satellites equipped with sensors expected to use AI to track moving targets on Earth.

The AI Race: A Competitive Landscape

The merger positions SpaceX-xAI uniquely in the AI infrastructure race. While Google ($4.1T market cap), Meta ($1.8T), and OpenAI ($300B valuation) battle over AI model supremacy, Musk is betting the next frontier is who controls the physical infrastructure.

Key competitors are responding:

-

Google's Project Suncatcher: Alphabet is researching space-based data centers, partnering with Planet Labs (PL) to explore putting Tensor Processing Units (TPUs) in orbit.

-

Blue Origin's Terawave: Jeff Bezos' space company announced a high-capacity satellite backbone network of thousands of satellites.

-

Terrestrial Giants: Amazon and Microsoft continue massive hyperscale data center buildouts, betting on terrestrial solutions.

Tesla Left Out—For Now

Notable by its absence: Tesla. Bloomberg had previously reported that a three-way merger including the electric vehicle maker was under consideration. While Tesla has invested heavily in AI for autonomous driving and robotics—and operates a growing energy storage business that could complement space-based data centers—it was not included in the final deal.

Tesla shares were roughly flat in after-hours trading following the merger announcement. The stock closed at $421.81 on February 2, down from a high of $439.88 on January 30 when merger speculation peaked.

Risks and Challenges

Space data centers face significant engineering challenges that analysts have questioned:

| Challenge | Description |

|---|---|

| Thermal Management | Radiating heat in a vacuum is fundamentally different from terrestrial cooling |

| Radiation Hardening | Cosmic rays degrade GPUs over time |

| Orbital Debris | 1 million satellites dramatically increases collision risk |

| Scale Uncertainty | No orbital data center has ever operated at scale |

"Building data centers in space remains a risky proposition, especially with AI investment evolving so rapidly and often unpredictably," analysts noted. Some industry executives have questioned whether envisioned energy savings are worth the added costs of tailoring systems for space.

Deutsche Bank has highlighted four major roadblocks for space-based data centers, describing the concept as "exceptionally hard to pull off."

What to Watch

Near-term catalysts:

- FCC review of the million-satellite filing

- IPO roadshow (expected Q2 2026)

- Pentagon AI contract expansions

- xAI's Grok model updates vs OpenAI and Anthropic

Key questions:

- Can SpaceX achieve economics that make orbital compute cheaper than terrestrial alternatives?

- Will regulators allow a constellation 167x larger than current Starlink?

- How will existing AI infrastructure investors (hyperscalers, NVIDIA ecosystem) respond?

The merger represents Musk's most ambitious bet yet: that the future of artificial intelligence will be powered not from data centers on Earth, but from a constellation of solar-powered satellites in orbit. Whether it's visionary infrastructure or financial engineering to inflate an IPO, investors will find out when SpaceX targets the public markets this summer.