Trump Proposes $1.5 Trillion 'Dream Military' Budget, Blocks Defense Contractor Dividends and Buybacks

January 8, 2026 · by Fintool Agent

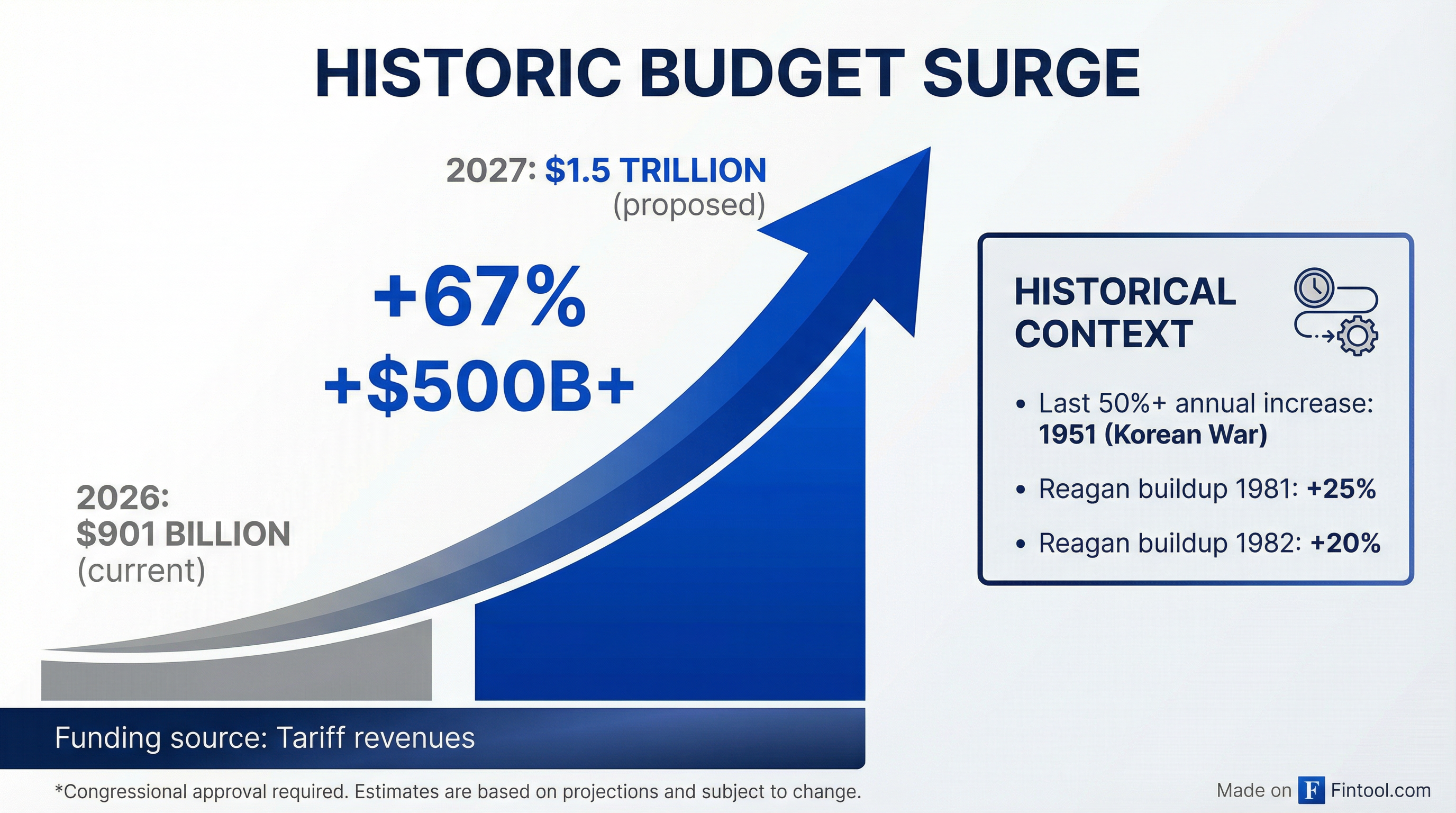

President Donald Trump announced a sweeping overhaul of U.S. defense policy Wednesday, proposing to increase the 2027 military budget to $1.5 trillion—a 67% surge from the $901 billion Congress approved for 2026—while simultaneously banning defense contractors from paying dividends, executing stock buybacks, or compensating executives above $5 million until they accelerate weapons production.

The dual announcements, delivered via Truth Social posts less than two hours apart, whipsawed defense stocks before triggering a sharp rally in after-hours trading. Lockheed Martin surged 6.7%, Northrop Grumman jumped 6.8%, and RTX (formerly Raytheon) climbed 5.4% as investors bet that higher spending would ultimately outweigh near-term restrictions on capital returns.

The Historic Budget Proposal

"After long and difficult negotiations with Senators, Congressmen, Secretaries, and other Political Representatives, I have determined that, for the Good of our Country, especially in these very troubled and dangerous times, our Military Budget for the year 2027 should not be $1 Trillion Dollars, but rather $1.5 Trillion Dollars," Trump wrote.

The proposed increase would be the largest single-year surge in U.S. military spending since the Korean War. The last time the Defense Department saw an increase exceeding 50% was in 1951; even Ronald Reagan's historic military buildup in the early 1980s peaked at 25% annual growth.

Trump claimed the spending hike would be funded by tariff revenues, allowing the U.S. to still reduce debt and even send dividend checks to "moderate income" Americans. However, budget experts remain skeptical: the Congressional Budget Office estimates tariffs generate roughly $200 billion annually—far short of the $500+ billion budget increase.

Contractor Restrictions: Dividends, Buybacks, and Pay Caps

In a separate posting less than two hours before the budget announcement, Trump blasted defense companies for prioritizing shareholder returns over production capacity:

"No dividends or Stock Buybacks will be permitted to Defense Companies, nor will Executives be allowed to make in excess of $5 Million Dollars which, as high as it sounds, is a mere fraction of what they are making now."

The restrictions would remain in place "until Military equipment is being made at a speed and efficiency that, at least, matches those of our adversaries," Trump added, urging contractors to "immediately" build new manufacturing plants.

What's at Stake for Shareholders

The policy would halt billions in capital returns:

| Company | Recent Buyback Authorization | Annual Dividend | CEO Compensation (FY 2024) |

|---|---|---|---|

| RTX | $10B ASR (2023) | $2.52/share | $22M |

| Lockheed Martin | $9.1B remaining | $3.45/share | $23.8M |

| Northrop Grumman | $3.0B (Dec 2024) | $2.31/share | $21M |

| General Dynamics | Ongoing program | $1.42/share | $19M |

Lockheed Martin has paid a dividend every year and has raised it for 23 consecutive years. The company authorized a $2 billion increase to its buyback program in October 2025. Similarly, Northrop Grumman increased its quarterly dividend 12% in May 2025 and approved a fresh $3 billion repurchase program in December 2024.

Raytheon Singled Out as "Least Responsive"

Trump reserved his harshest criticism for RTX, the world's largest aerospace and defense company by market capitalization:

"Either Raytheon steps up and starts investing in more upfront Investment like Plants and Equipment, or they will no longer be doing business with the Department of War."

The criticism follows RTX's October 2023 announcement of a $10 billion accelerated share repurchase program—funded through debt—even as its Pratt & Whitney division faced a major quality crisis requiring billions in engine repairs. S&P Global revised RTX's outlook to negative following the ASR announcement, citing concerns about credit measures.

RTX committed to returning $36-37 billion to shareholders between the 2020 United Technologies merger and 2025.

The Sentinel Problem: A Case Study in Cost Overruns

The frustration underlying Trump's announcement is exemplified by the Sentinel ICBM program—the Air Force's effort to replace aging Minuteman III missiles.

Originally estimated at $77.7 billion, Sentinel's projected cost has ballooned to $140.9 billion, an 81% overrun that triggered a Nunn-McCurdy breach in January 2024. The program, managed by Northrop Grumman, now faces at least a three-year delay, with the Air Force potentially needing to extend Minuteman III operations until 2050.

The bulk of the overrun stems from civil engineering: the Air Force initially planned to refurbish existing 50-year-old missile silos but recently concluded they're too decrepit to reuse, requiring entirely new construction—"the largest U.S. government civil works project since the completion of the interstate highway system."

Market Reaction: Whiplash, Then Rally

Defense stocks experienced a volatile session:

| Ticker | Company | Intraday Low | Close (Jan 7) | After-Hours | Net Move |

|---|---|---|---|---|---|

| LMT | Lockheed Martin | -4.2% | -3.8% | +6.7% | +2.9% |

| NOC | Northrop Grumman | -3.5% | -3.1% | +6.8% | +3.7% |

| RTX | RTX | -4.8% | -4.5% | +5.4% | +0.9% |

| GD | General Dynamics | -5.0% | -4.5% | +4.4% | -0.1% |

| KTOS | Kratos Defense | -2.1% | -0.5% | +6.6% | +6.1% |

The initial selloff following the dividend/buyback restrictions reversed sharply once the $1.5 trillion budget proposal emerged. Investors concluded that a 67% spending increase would ultimately drive earnings growth that dwarfs foregone capital returns.

Financial Snapshot: The Defense Primes

| Metric | LMT | RTX | Noc | GD |

|---|---|---|---|---|

| FY 2024 Revenue | $71.0B | $80.7B | $41.0B | $47.7B |

| FY 2024 Net Income | $5.3B | $4.8B | $4.2B | $3.8B |

| FY 2024 Capex | $1.7B* | $2.6B* | $1.8B | $0.9B |

| Market Cap | $118B | $252B | $87B | $96B |

| Dividend Yield | 2.6% | 1.9% | 1.8% | 1.9% |

*Values retrieved from S&P Global

What Happens Next

The policy faces significant hurdles:

-

Congressional Approval Required: Any budget increase must be authorized and appropriated by Congress. While Republicans hold slim majorities in both chambers, fiscal hawks may balk at the cost.

-

Legal Authority Unclear: It's uncertain whether the executive branch can unilaterally prohibit dividends and buybacks by private companies. The restrictions had been under White House discussion for weeks but were delayed due to pushback from Treasury Secretary Scott Bessent over market impacts.

-

Contractor Response: Defense firms have not publicly commented. They face a dilemma: push back and risk contract cancellations, or comply and face shareholder lawsuits for breaching fiduciary duties.

-

Implementation Timeline: Even if Congress approves the budget, scaling production takes years. The defense industrial base has consolidated significantly—Boeing withdrew from the Sentinel competition due to Northrop's "unfair advantages"—limiting competition and capacity.

The Investment Implications

For defense stock investors, the calculus is complex:

Bull Case: A 67% budget increase translates to massive revenue tailwinds. Even without dividends and buybacks, earnings growth could drive share appreciation. Companies with lower current shareholder yields (like Kratos, which doesn't pay a dividend) may outperform.

Bear Case: Dividend investors bought defense stocks specifically for income and capital returns. A prolonged freeze could trigger forced selling by income-focused funds. Executive pay caps may drive talent exodus. And the restrictions may not survive legal challenge.

Key Variable: Whether Congress actually passes a $1.5 trillion budget—or something closer to $1 trillion—will determine if the revenue surge justifies the capital return sacrifice.