Trump Asks Congress to Cap Credit Card Rates at 10% — Banks Warn of 'Economic Disaster'

January 21, 2026 · by Fintool Agent

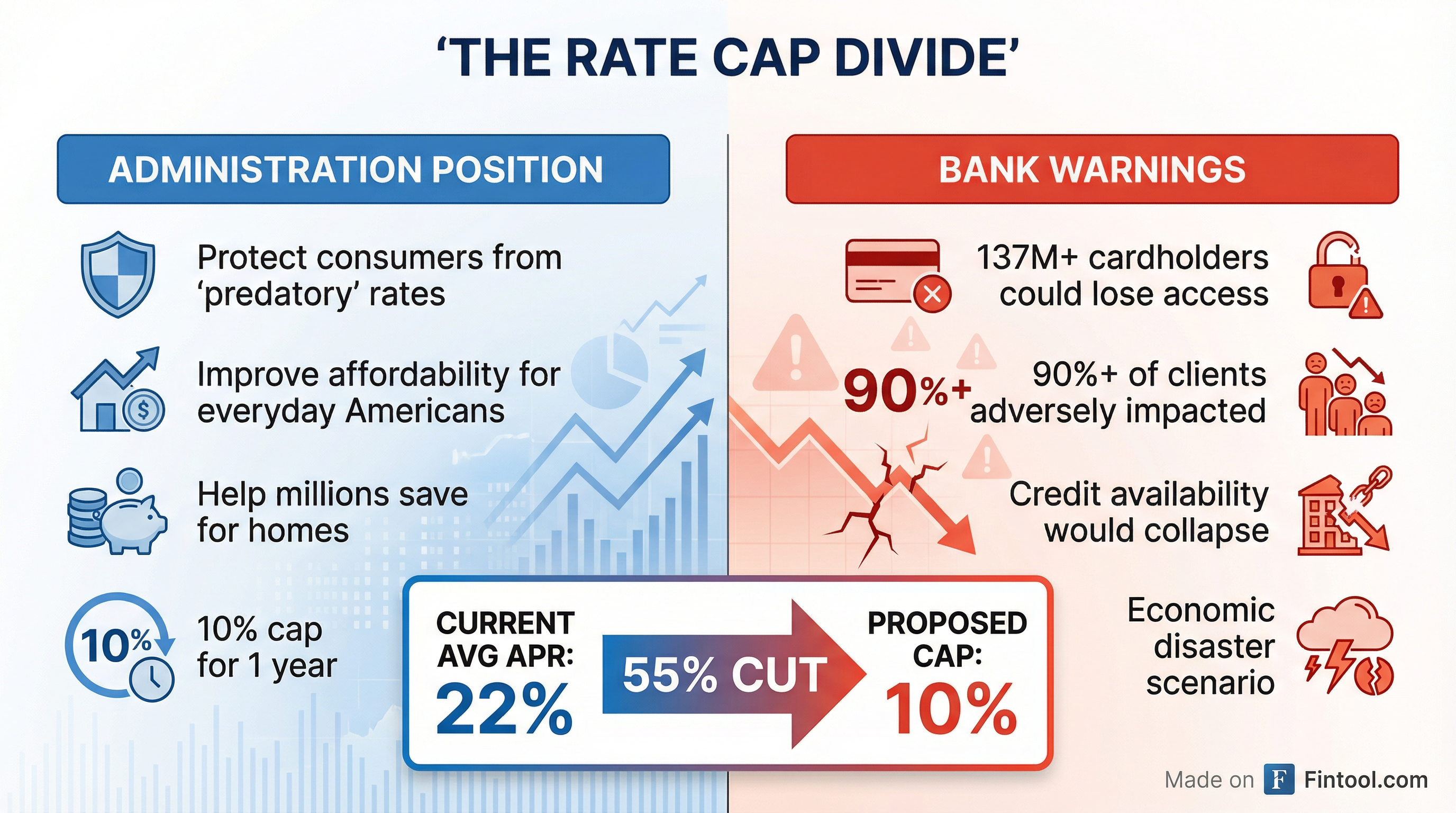

President Trump escalated his campaign against high credit card interest rates at the World Economic Forum in Davos today, formally asking Congress to cap rates at 10% for one year — a proposal the banking industry warns could trigger an "economic disaster" and cut off credit access for over 137 million Americans.

The move marks a shift in strategy after major banks largely ignored Trump's January 20 compliance deadline, which lacked any legal enforcement mechanism.

"I'm asking Congress to cap credit card interest rates at 10% for one year and this will help millions of Americans save for a home," Trump said in his Davos speech.

The Stakes: A 55% Cut in Interest Rates

The proposal would slash credit card interest rates by more than half. The average credit card APR currently stands at approximately 22%, up from around 16% just five years ago — a surge driven by the Federal Reserve's rate-hiking cycle and banks' pricing decisions.

Bank Stocks Under Pressure

Financial stocks tumbled Tuesday as the January 20 deadline approached, with Citigroup+5.98% falling 4.4%, JPMorgan+3.95% dropping 3.1%, and Wells Fargo+2.09% declining 1.9%.

Markets stabilized Wednesday morning following Trump's Davos speech, with JPMorgan+3.95% recovering slightly as investors appeared to interpret the congressional route as a slower path to implementation.

| Stock | Jan 20 Change | YTD Performance |

|---|---|---|

| JPMorgan (jpm)+3.95% | -3.1% | -1.8% |

| Citigroup (c)+5.98% | -4.4% | -3.2% |

| Wells Fargo (wfc)+2.09% | -1.9% | +0.5% |

| Capital One (cof)+2.70% | -2.8% | -2.1% |

Source: Market data as of January 21, 2026

"Economic Disaster": The Banking Industry's Response

The financial industry has mounted fierce opposition to the proposal. JPMorgan+3.95% CEO Jamie Dimon warned that a 10% cap would force banks to "strip credit lines for most Americans," potentially affecting 80% of cardholders who would no longer meet risk-adjusted return thresholds.

The American Bankers Association, citing new data from credit card issuers, said at least 137 million cardholders and as many as 159 million would no longer be able to use their cards if the rate cap were implemented.

Us Bancorp+2.67% CEO Gunjan Kedia delivered perhaps the starkest warning: "Our estimate is that 90-plus percent of our clients will see a detrimental impact if there was an across-the-board 10% rate cap on credit cards."

A survey by the Consumer Bankers Association found that six in 10 American adults expect a rate cap would prompt banks to add fees and reduce total credit card approvals.

Why Banks Say They Need High Rates

Credit card interest rates serve as the primary mechanism for pricing unsecured credit risk. Unlike mortgages or auto loans backed by collateral, credit cards are unsecured — meaning banks have no asset to seize if borrowers default.

At Synchrony Financial+1.58%, the country's largest private-label credit card issuer, CFO Brian Wenzel explained the delicate balance during Q2 2025: "We're at 4.5% Fed funds rate where the guide is 16% [net interest margin] was at 2.5%." The company targets net interest margins between 15-16% to maintain profitability across credit cycles.

Wells Fargo's+2.09% credit card portfolio generated $4.8 billion in revenue through the first nine months of 2025, with the segment showing an 8% year-over-year increase as higher purchase volumes and new product launches drove growth.

| Bank | Credit Card Revenue (9M 2025) | YoY Change |

|---|---|---|

| Wells Fargo+2.09% | $4.78B | +8% |

| American Express+1.28% | $25B (total revenues) | +10% |

American Express+1.28% reported a net interest yield on average Card Member loans of 11.8% in Q2 2025, with average card member loans of $142.6 billion.

The Potential Compromise: "Trump Cards"

White House economic adviser Kevin Hassett has floated the idea of "Trump cards" — special credit products that banks would voluntarily offer with lower rates, rather than being forced to cap all card rates by law.

TD Cowen analysts wrote in a note: "We believe there is a political compromise in the works to ensure the President does not push Congress to enact a 10% cap on credit card interest rates."

Potential compromise measures could include:

- No-frills cards that charge 10% but have no rewards

- Lower rates for certain customers based on creditworthiness

- Lower credit limits on capped-rate products

Us Bancorp+2.67% CEO Kedia noted that "just in the last few days, the conversation around the rate cap has shifted more productively."

Legislative Path Forward

A bipartisan bill (S.381) titled the "10 Percent Credit Card Interest Rate Cap Act" was introduced in the Senate in February 2025 and would temporarily cap credit card rates at 10% through January 1, 2031. An identical House bill (H.R.1944) was referred to the House Committee on Financial Services in March 2025.

Neither bill has seen significant movement, but Trump's public backing could change the calculus. Currently, there is no federal law that limits credit card interest rates — issuers operate under state usury laws, which many effectively bypass through charter locations in states with no rate caps.

Citigroup+5.98% CEO Jane Fraser has expressed doubt that Congress would approve such rate caps, suggesting the proposal faces significant legislative hurdles even with administration support.

What to Watch

- Congressional hearings: Expect financial services committees to take up the issue in coming weeks

- Bank earnings: Capital One+2.70% and other pure-play credit card issuers will likely address rate cap risk in upcoming calls

- Voluntary measures: Watch for banks announcing "Trump card" or similar lower-rate products as a political olive branch

- Fed commentary: How rate cuts (if any) could naturally lower credit card APRs

The administration's pivot to Congress suggests this fight is just beginning — but the banking industry's unified opposition and the structural challenges of implementing such a cap mean any actual legislation faces a long road ahead.

Related: