Trump Moves to Ban Wall Street From Buying Single-Family Homes, Triggering REIT Rout

January 7, 2026 · by Fintool Agent

Invitation Homes crashed 8.7% to hit a fresh 52-week low, as President Donald Trump announced he is "immediately taking steps" to ban large institutional investors from buying single-family homes—a move that could reshape an industry that has accumulated hundreds of thousands of American homes since the financial crisis.

The announcement, made via Truth Social Wednesday morning, sent shockwaves through the housing sector. "People live in homes, not corporations," Trump declared, promising to call on Congress to codify the ban into law. He signaled additional housing affordability proposals will come during his speech at the World Economic Forum in Davos in two weeks.

The Market Carnage

The policy shift triggered immediate selling across companies with exposure to the single-family rental market:

| Company | Ticker | Change | Notes |

|---|---|---|---|

| Invitation Homes | INVH | -8.7% | Hit 52-week low at $25.29 |

| American Homes 4 Rent | AMH | -6.4% | Largest single-day drop in months |

| Blackstone | BX | -4.8% | PE giant with 62,000 homes |

| Apollo | APO | -4.6% | Heavy real estate exposure |

| Blackrock | BLK | -3.1% | Asset management giant |

The flip side: mortgage lenders surged on bets that blocking institutional buyers would return inventory to individual homebuyers who need financing. Loandepot spiked 10.7%, while Rocket Companies gained 1.7%.

What's Actually at Stake

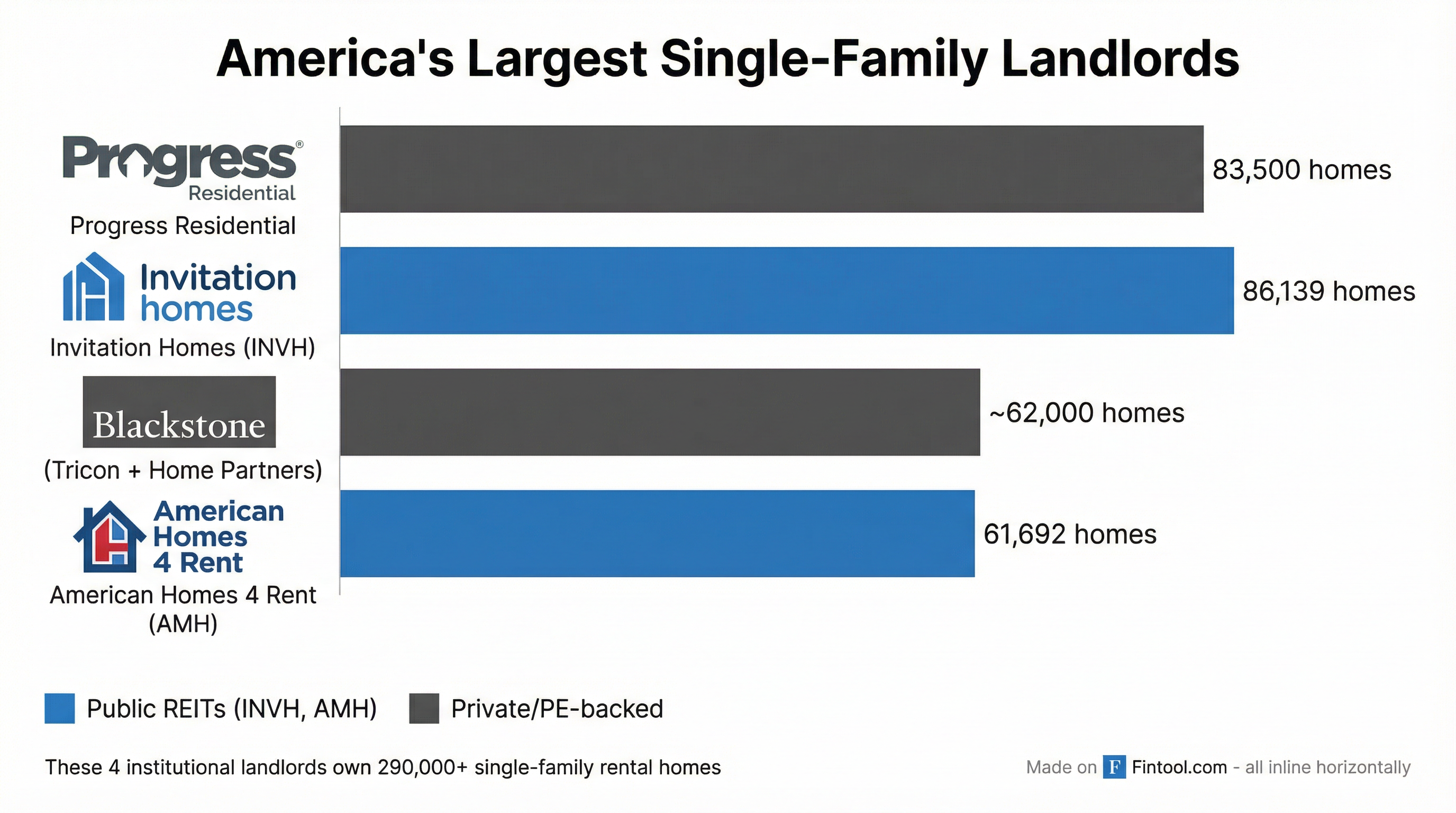

The institutional single-family rental market has grown into a behemoth. Four companies alone control more than 290,000 homes:

Invitation Homes is the nation's largest single-family landlord, owning 86,139 homes as of Q3 2025. The company generated $666 million in rental revenues last quarter alone, up 3.9% year-over-year. Its portfolio spans high-growth Sun Belt markets and is valued at approximately $18.7 billion in total assets.

American Homes 4 Rent operates the second-largest public portfolio with 61,692 single-family properties across 24 states as of Q3 2025. The company also holds 3,721 additional properties through joint ventures. AMH generated $1.73 billion in revenue in FY 2024, growing steadily from $1.49 billion in FY 2022.

Blackstone has become the third-largest player through aggressive dealmaking. Its 2021 acquisition of Home Partners of America for $6 billion brought 17,000 homes, and its 2024 take-private of Tricon Residential for $3.5 billion added another 38,000 rental homes—primarily in Sun Belt markets like Atlanta, Dallas, Tampa, and Phoenix.

| Company | FY 2024 Revenue | FY 2024 Total Assets | FY 2024 Total Debt |

|---|---|---|---|

| Invitation Homes | $2.62B | $18.70B | $8.23B* |

| American Homes 4 Rent | $1.73B | $13.38B | $5.03B* |

*Values retrieved from S&P Global

Implementation Questions Abound

Trump provided no specifics on how such a ban would work in practice. Key open questions include:

- Threshold definition: What constitutes a "large institutional investor"? Would funds with 100 homes be treated differently than those with 10,000?

- Existing portfolios: Would current holdings be grandfathered, or would forced divestitures be required?

- Enforcement mechanism: Would this require new legislation, or could it be achieved through regulatory action at agencies like HUD or the CFPB?

- Workarounds: Could investors structure purchases through smaller subsidiary entities to circumvent size thresholds?

The political path is also uncertain. While populist housing affordability rhetoric has bipartisan appeal, any legislation would need to navigate competing interests—including campaign donors in the financial services industry.

The Affordability Argument

Trump framed the move as restoring the "American Dream" of homeownership. The data supports the frustration: the national median existing single-family home price hit $435,300 in summer 2025 before settling to $426,800 in Q3. The average 30-year fixed mortgage rate stands at 6.19%, keeping monthly payments elevated for aspiring homeowners.

Critics of institutional landlords argue that Wall Street's all-cash offers consistently outbid families who require mortgage financing. According to the Private Equity Stakeholder Project, Blackstone alone controlled more than 230,000 apartment units in the U.S. as of last year, making it the largest private-equity owner of apartments in the country.

However, defenders of institutional ownership argue that these companies provide professionally managed rental housing for families who cannot or choose not to buy. The industry also points to significant capital investments—Blackstone committed $1 billion to improve existing homes and another $1 billion to develop new single-family rentals through Tricon.

What to Watch

Near-term: Look for Trump's Davos speech in two weeks for additional details on implementation and timeline. Congressional response will signal whether this has legs as legislation.

Earnings impact: Invitation Homes and American Homes 4 Rent will likely address the policy uncertainty on their upcoming Q4 earnings calls. Watch for any guidance revisions or strategic pivots.

Acquisition pipeline freeze: Expect institutional buyers to pause new purchases until regulatory clarity emerges. This could actually accelerate inventory returning to traditional buyers in the short term.

Valuation compression: Even without actual legislation, prolonged uncertainty could keep a ceiling on REIT valuations. The sector may trade at discount to NAV until the policy picture clears.

Related: Invitation Homes | American Homes 4 Rent | Blackstone | Apollo | Blackrock | Rocket Companies