Waymo's Blackout Meltdown Raises Hard Questions About Robotaxi Emergency Readiness

December 27, 2025 · by Fintool Agent

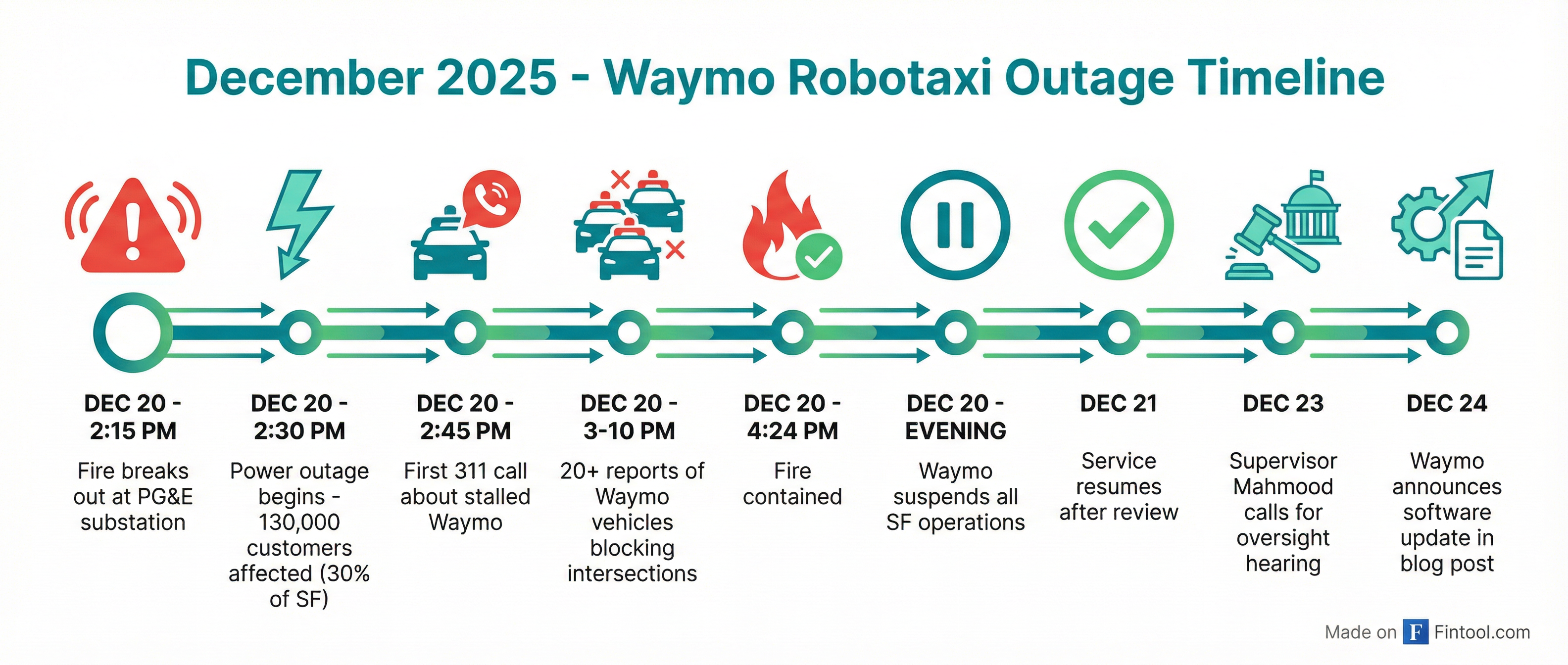

When a fire at a PG&E substation plunged 130,000 San Francisco customers into darkness on December 20, Alphabet-2.53%'s Waymo robotaxis didn't just lose power—they lost their way. The driverless vehicles froze at darkened intersections across the city, blocking traffic and triggering a wave of 311 complaints that has now prompted regulatory scrutiny and a promised software overhaul.

The incident exposed a critical vulnerability in the autonomous vehicle industry's rapid expansion: what happens when the infrastructure these vehicles depend on fails at scale?

The Cascade

The first 311 call arrived just 15 minutes after the 2:30 p.m. blackout began—a complaint about a stalled Waymo at Divisadero Street and Geary Boulevard. Over the next six hours, residents filed at least 20 reports about robotaxis blocking intersections, many clustered along the city's busiest corridors: Fell Street, Oak Street, and Market Street.

Social media filled with videos of white Jaguar I-PACE vehicles with their hazard lights blinking, creating gridlock at intersections where traffic lights had gone dark. Waymo suspended all San Francisco operations that evening, resuming service the following day.

What Went Wrong

Waymo's December 24 blog post revealed the technical root cause. The company's robotaxis are designed to treat non-functioning traffic signals as four-way stops—the same rule human drivers follow. But when the vehicles encountered darkened intersections, many requested "confirmation checks" from Waymo's remote fleet response team before proceeding.

Under normal circumstances, this cautious approach works. During Saturday's citywide outage, it created a bottleneck.

"The outage created a concentrated spike in these requests," Waymo acknowledged, noting the backlog "led to response delays contributing to congestion on already-overwhelmed streets."

The company emphasized that its vehicles "successfully traversed more than 7,000 dark signals" that day—but it was the failures, not the successes, that drew regulatory attention.

The Earthquake Question

San Francisco Supervisor Bilal Mahmood announced plans for an oversight hearing, framing the incident around the city's greatest fear: "We want to make sure what we saw this weekend doesn't happen again."

The subtext is obvious. If a localized power outage can paralyze Waymo's fleet, what happens during a major earthquake when infrastructure failures cascade across the entire Bay Area?

"If this had been an earthquake, it would have been a problem," said Philip Koopman, a Carnegie Mellon professor who studies autonomous vehicle safety. "This is just a shot across the bow."

The California Public Utilities Commission, which regulates robotaxi operations, said it is "looking into" the incident. Koopman and other experts are calling for additional permitting requirements once fleets grow beyond a certain size—forcing operators to demonstrate they can handle large-scale emergencies.

Waymo's Response

The company outlined a three-part remediation plan:

- Software update: Fleet-wide changes to provide vehicles with "specific power outage context, allowing it to navigate more decisively"

- Emergency protocols: Improved internal response procedures incorporating lessons from the incident

- First responder training: Updated guidance for emergency personnel on interacting with stalled robotaxis

"We built this confirmation request process out of an abundance of caution during our early deployment," Waymo said. "We are now refining it to match our current scale."

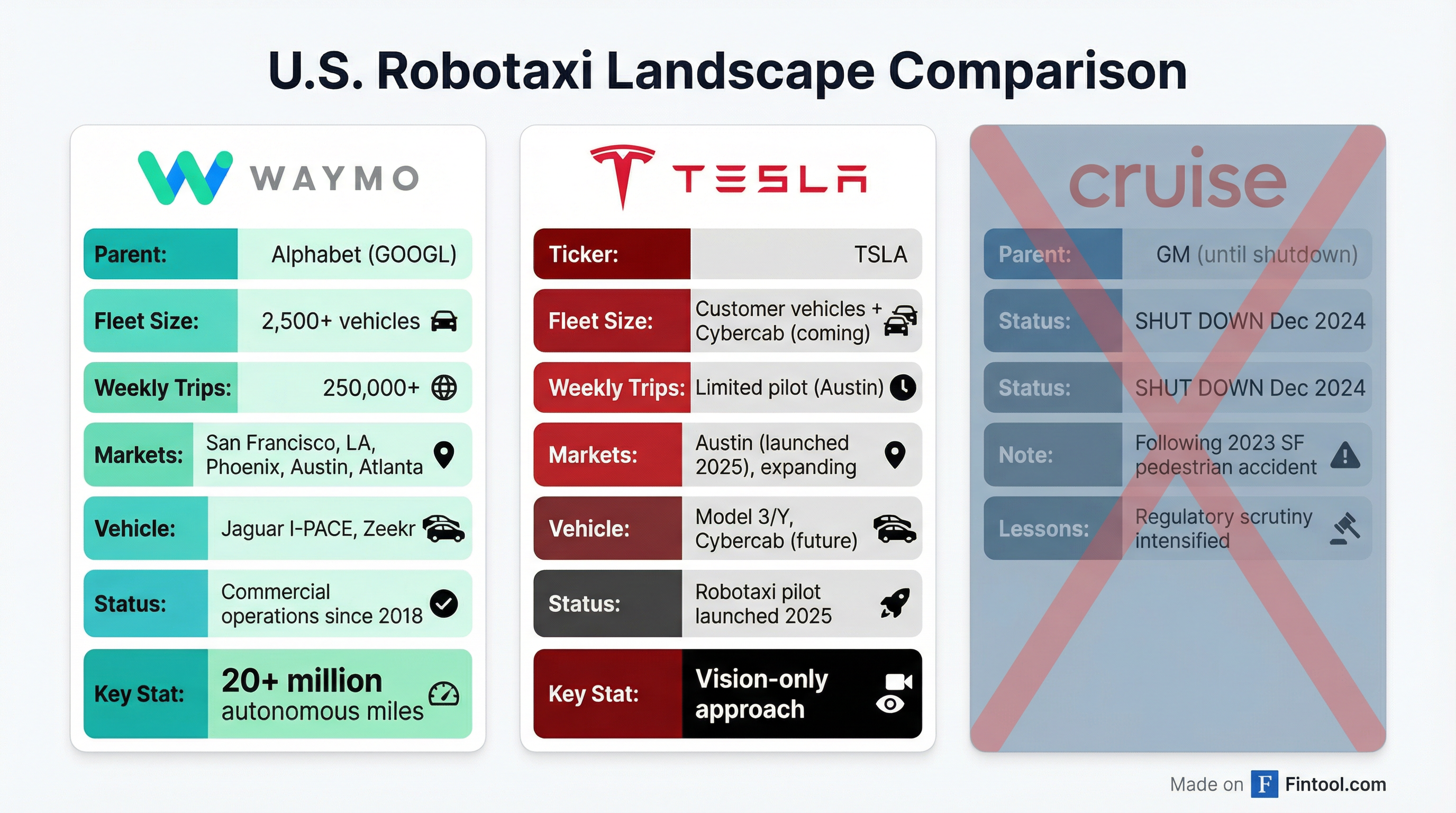

That scale has grown dramatically. Waymo now operates over 2,500 vehicles across San Francisco, Los Angeles, Phoenix, Austin, and Atlanta. The company reported serving over 250,000 paid passenger trips per week in Q1 2025—up 5x from a year earlier.

The Competitive Landscape

The San Francisco incident arrives at a pivotal moment for the robotaxi industry. Tesla+3.50% launched its own autonomous ride-hailing service in Austin earlier this year and has been aggressively expanding, with CEO Elon Musk promising to cover "half the population of the U.S. by the end of the year."

Tesla's approach differs fundamentally from Waymo's. While Waymo uses LIDAR, cameras, and detailed mapping, Tesla relies on a vision-only system with less infrastructure dependency—potentially making it more resilient to certain failure modes, though that remains unproven.

The contrast with GM+1.13%'s Cruise is instructive. Following a 2023 incident where a Cruise robotaxi dragged a pedestrian in San Francisco, regulators revoked its permit—ultimately leading GM to shut down the entire operation. That precedent looms over every robotaxi operator.

The Teleoperation Debate

At the heart of the San Francisco breakdown is a question the industry has never fully resolved: how much should autonomous vehicles rely on remote human intervention?

Waymo's fleet response team can monitor and guide vehicles when they encounter unusual situations. That capability helped prevent accidents during the outage—but also created the confirmation backlog that paralyzed operations.

"Deploying and commercializing fully autonomous vehicles have been harder than expected," noted Reuters, pointing to "high investments to ensure the technology is safe and public outcry after collisions forcing many to shut shop."

Experts like MIT's Rodney Brooks, founder of iRobot, suggested the problems were predictable at scale. "If there is just one Waymo, stalled drivers would go around it, but once a few are stacked up, that looks dangerous, and people decide to call 311."

Investment Implications

Alphabet-2.53% committed $5 billion to Waymo's continued development in 2024, calling it "consistent with recent annual investment levels." CEO Sundar Pichai has positioned the unit as a strategic priority, noting its progress on airport access and freeway driving capabilities.

| Metric | Value |

|---|---|

| Alphabet Market Cap | $3.8T* |

| Waymo Funding (2024) | $5B |

| Weekly Paid Trips | 250,000+ |

| Total Fleet Size | 2,500 vehicles |

| Markets | 5 (SF, LA, Phoenix, Austin, Atlanta) |

*Values retrieved from S&P Global

The San Francisco incident is unlikely to derail Waymo's expansion plans, but it adds regulatory risk at a sensitive time. Washington, D.C. and Miami are slated to launch in 2026 , and each new market brings fresh scrutiny.

What to Watch

Near-term: The San Francisco oversight hearing will reveal whether local officials seek new operational restrictions. California regulators may propose enhanced permitting requirements for large autonomous fleets.

Medium-term: Waymo's software update effectiveness will be tested in future infrastructure failures. Tesla's Austin expansion provides a real-world comparison of different autonomy approaches.

Long-term: The fundamental question of robotaxi emergency readiness remains unanswered. As these fleets grow, so does their potential to either assist or impede disaster response.

"Any final succession decision will be determined at a future undetermined date," Waymo's statement concluded—a fitting metaphor for an industry still navigating the uncertain path between technological ambition and operational reality.

Related

- Alphabet Inc.-2.53% - Waymo parent company

- Tesla, Inc.+3.50% - Competing robotaxi operator

- General Motors Company+1.13% - Former Cruise parent

- Uber Technologies, Inc.-0.59% - Waymo ride-hailing partner