Earnings summaries and quarterly performance for ALLIANCEBERNSTEIN HOLDING.

Research analysts who have asked questions during ALLIANCEBERNSTEIN HOLDING earnings calls.

John Dunn

Evercore ISI

8 questions for AB

Craig Siegenthaler

Bank of America

6 questions for AB

Benjamin Budish

Barclays PLC

4 questions for AB

Alexander Blostein

Goldman Sachs

3 questions for AB

Ben Budish

Barclays PLC

3 questions for AB

Dan Fannon

Jefferies & Company Inc.

3 questions for AB

William Katz

TD Cowen

3 questions for AB

Anthony

Raymond James

2 questions for AB

Bill Katz

TD Securities

2 questions for AB

Daniel Fannon

Jefferies Financial Group Inc.

2 questions for AB

Aditya Omprakash

Goldman Sachs

1 question for AB

Nathan

Barclays

1 question for AB

Ritwik Roy

Jefferies

1 question for AB

Robin Holby

TD Cowen

1 question for AB

Recent press releases and 8-K filings for AB.

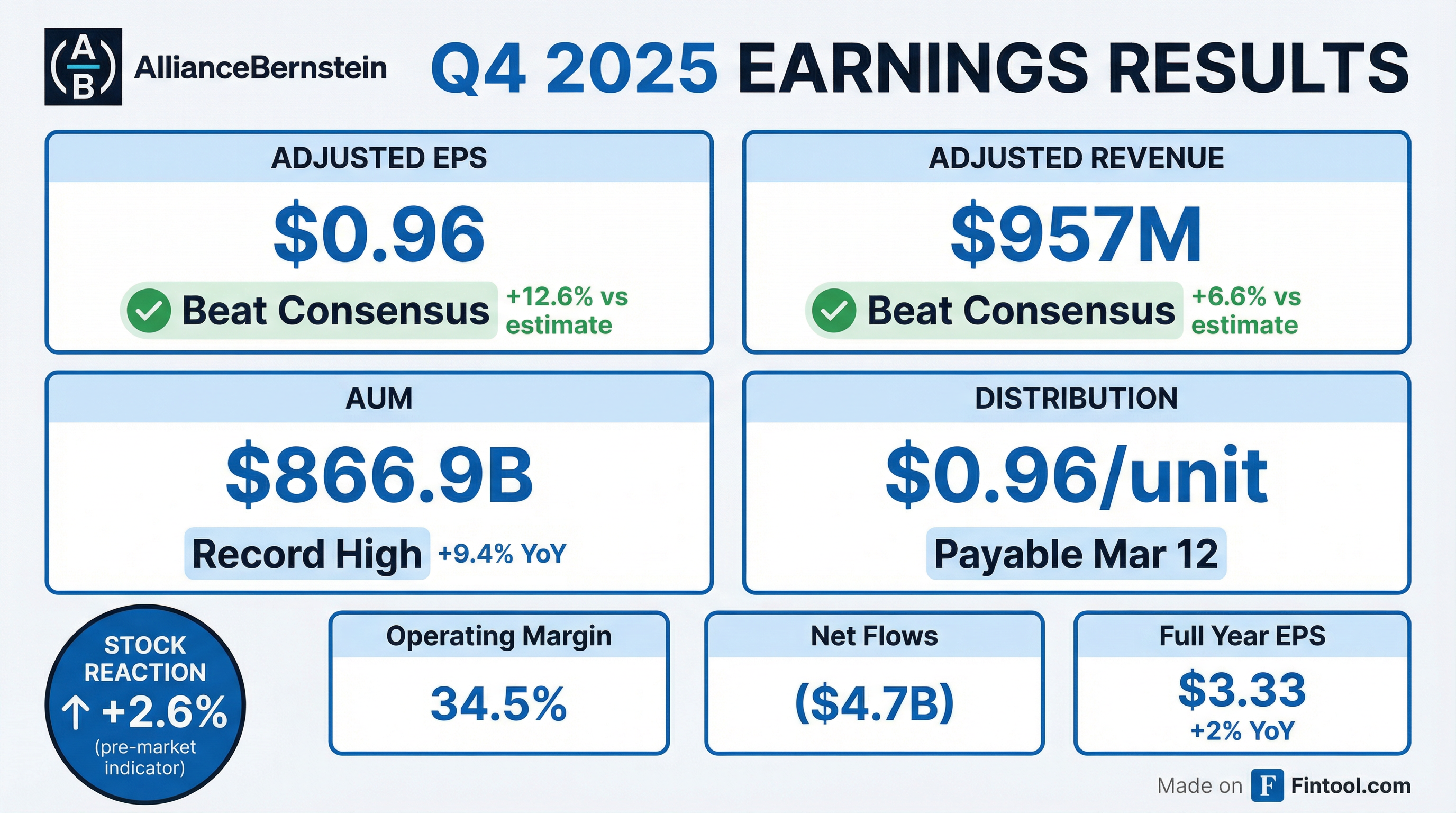

- AllianceBernstein (AB) achieved record assets under management (AUM) of $867 billion at year-end 2025, with its Private Markets platform growing 18% year-over-year to $82 billion.

- For Q4 2025, adjusted earnings were $0.96 per unit, contributing to full year 2025 adjusted earnings of $3.33, a 2% increase from the prior year. Full year revenues were $3.5 billion, and the adjusted operating margin expanded to 33.7%.

- The firm recorded $9.4 billion in total net active outflows for 2025, including $3.8 billion in Q4, driven by active equity and taxable fixed income redemptions, though tax-exempt strategies and alternatives saw strong inflows.

- AB plans to onboard over $10 billion of new long-duration assets from Equitable by year-end 2026 and projects full year 2026 non-compensation expenses to be in the range of $625 million to $650 million.

- AB reported record year-end AUM of $867 billion and $140 billion in sales for Full Year 2025.

- The company achieved an adjusted operating margin of 33.7% in 2025, which was at the upper end of its investor day guidance range of 30%-35%.

- For Full Year 2025, Adjusted Net Revenues were $3,525 million, with Adjusted EPU at $3.33 and Distributions Per Unit at $3.38.

- AllianceBernstein (AB) reported record assets under management (AUM) of $867 billion at year-end 2025, with private markets AUM growing 18% year-over-year to $82 billion.

- The company achieved an adjusted operating margin of 33.7% for the full year 2025, reaching the upper end of its target range.

- Adjusted earnings per unit (EPU) for Q4 2025 was $0.96, and $3.33 for the full year 2025, with full year revenues reaching $3.5 billion.

- Firm-wide active net outflows totaled $3.8 billion in Q4 and $9.4 billion for the full year 2025, although Bernstein Private Wealth recorded its fifth consecutive year of positive net flows.

- AB anticipates onboarding over $10 billion in new long-duration assets from Equitable by year-end 2026 and forecasts 2026 non-compensation expenses between $625 million and $650 million.

- AllianceBernstein (AB) achieved a record $867 billion in assets under management (AUM) at year-end 2025. For the full year 2025, adjusted earnings per unit were $3.33 (up 2% year-over-year), with revenues of $3.5 billion and an adjusted operating margin of 33.7%.

- Despite firm-wide active net outflows totaling $9.4 billion in 2025, AB experienced strong inflows in its tax-exempt franchise ($11.6 billion) and alternatives and multi-asset strategies ($10.6 billion). Private Markets AUM grew 18% year-over-year to $82 billion.

- AB is expanding its partnership with Equitable, anticipating the onboarding of over $10 billion in new long-duration assets by year-end 2026 and an additional $3 billion in private asset mandates from strategic insurance partnerships in the first half of 2026.

- For 2026, the company expects full-year non-compensation expenses to be between $625 million and $650 million. Performance fee guidance includes $70-$80 million from private market strategies and at least $10-$20 million from public market strategies.

- AllianceBernstein Holding L.P. reported Adjusted Diluted Net Income of $0.96 per Unit for Q4 2025 and $3.33 per Unit for the full year 2025.

- The company ended 2025 with a record $866.9 billion in Assets Under Management (AUM), an increase of 9.4% year-over-year.

- Despite the record AUM, the firm experienced total net outflows of $4.7 billion in Q4 2025 and $11.3 billion for the full year 2025, with firmwide active net flows turning negative due to $9.4 billion net outflows primarily from active equities.

- AB Holding announced a cash distribution of $0.96 per Unit for Q4 2025, payable on March 12, 2026.

- AllianceBernstein L.P. reported a record $867 billion in assets under management (AUM) as of December 31, 2025, representing a 9.4% increase year-over-year.

- The company experienced $9.4 billion in net outflows for the full year 2025, primarily driven by $22.5 billion net redemptions in active equities, though it achieved over $140 billion in sales during the year.

- For the full year 2025, adjusted operating income grew 4% and adjusted operating margins expanded 140 basis points to 33.7%.

- Full-year 2025 adjusted earnings per unit (EPU) increased 2% to $3.33, and unitholder distributions rose 4% to $3.38 compared to the prior year.

- AllianceBernstein (AB) reported that its preliminary assets under management (AUM) increased to $867 billion as of December 31, 2025, up from $865 billion at the end of November 2025.

- The $2 billion month-over-month increase in AUM was primarily driven by market appreciation.

- Total net flows for December 2025 were slightly negative, as strong Private Wealth and Institutional inflows were offset by Retail outflows.

- For the quarter ended December 31, 2025, the firm experienced preliminary net outflows totaling approximately $5.0 billion.

- AllianceBernstein's preliminary Assets Under Management (AUM) increased to $867 billion in December 2025 from $865 billion in November 2025, primarily driven by market appreciation.

- Total net flows for December 2025 were slightly negative, as strong Private Wealth and Institutional inflows were offset by Retail outflows.

- For the quarter ended December 31, 2025, preliminary firmwide net outflows totaled approximately $5.0 billion.

- AllianceBernstein Holding L.P. (AB) announced preliminary Assets Under Management (AUM) of $865 billion as of November 30, 2025.

- This represents a $3 billion decrease from $868 billion at the end of October 2025.

- The decline in AUM was primarily attributed to client outflows, while market conditions remained largely flat.

- Outflows were mainly concentrated within Institutions, with modest outflows in Retail and slight outflows from Private Wealth.

- AllianceBernstein's preliminary assets under management (AUM) decreased to $865 billion in November 2025, down from $868 billion at the end of October 2025.

- The $3 billion decline in month-end AUM was primarily due to client outflows, while market conditions remained largely flat.

- Outflows during November were mainly concentrated within Institutions, with modest outflows in Retail and slight outflows from Private Wealth.

Quarterly earnings call transcripts for ALLIANCEBERNSTEIN HOLDING.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more