Earnings summaries and quarterly performance for AECOM.

Executive leadership at AECOM.

Board of directors at AECOM.

Research analysts who have asked questions during AECOM earnings calls.

Adam Bubes

Goldman Sachs Group, Inc.

5 questions for ACM

Michael Dudas

Vertical Research Partners

5 questions for ACM

Andrew Kaplowitz

Citigroup

4 questions for ACM

Jamie Cook

Truist Securities

4 questions for ACM

Sabahat Khan

RBC Capital Markets

4 questions for ACM

Sangita Jain

KeyBanc Capital Markets

4 questions for ACM

Michael Feniger

Bank of America

3 questions for ACM

Nandita Nayar

Bank of America Merrill Lynch

3 questions for ACM

Adam Thalhimer

Thompson, Davis & Company, Inc.

2 questions for ACM

Andrew J. Wittmann

Robert W. Baird & Co.

2 questions for ACM

Judah Aronovich

UBS

2 questions for ACM

Steven Fisher

UBS

2 questions for ACM

Andy Kaplowitz

Citigroup Inc.

1 question for ACM

Judah Aronovitz

UBS Group AG

1 question for ACM

Kevin Wilson

Truist Securities

1 question for ACM

Sangeetha Jain

KeyBanc Capital Markets

1 question for ACM

Recent press releases and 8-K filings for ACM.

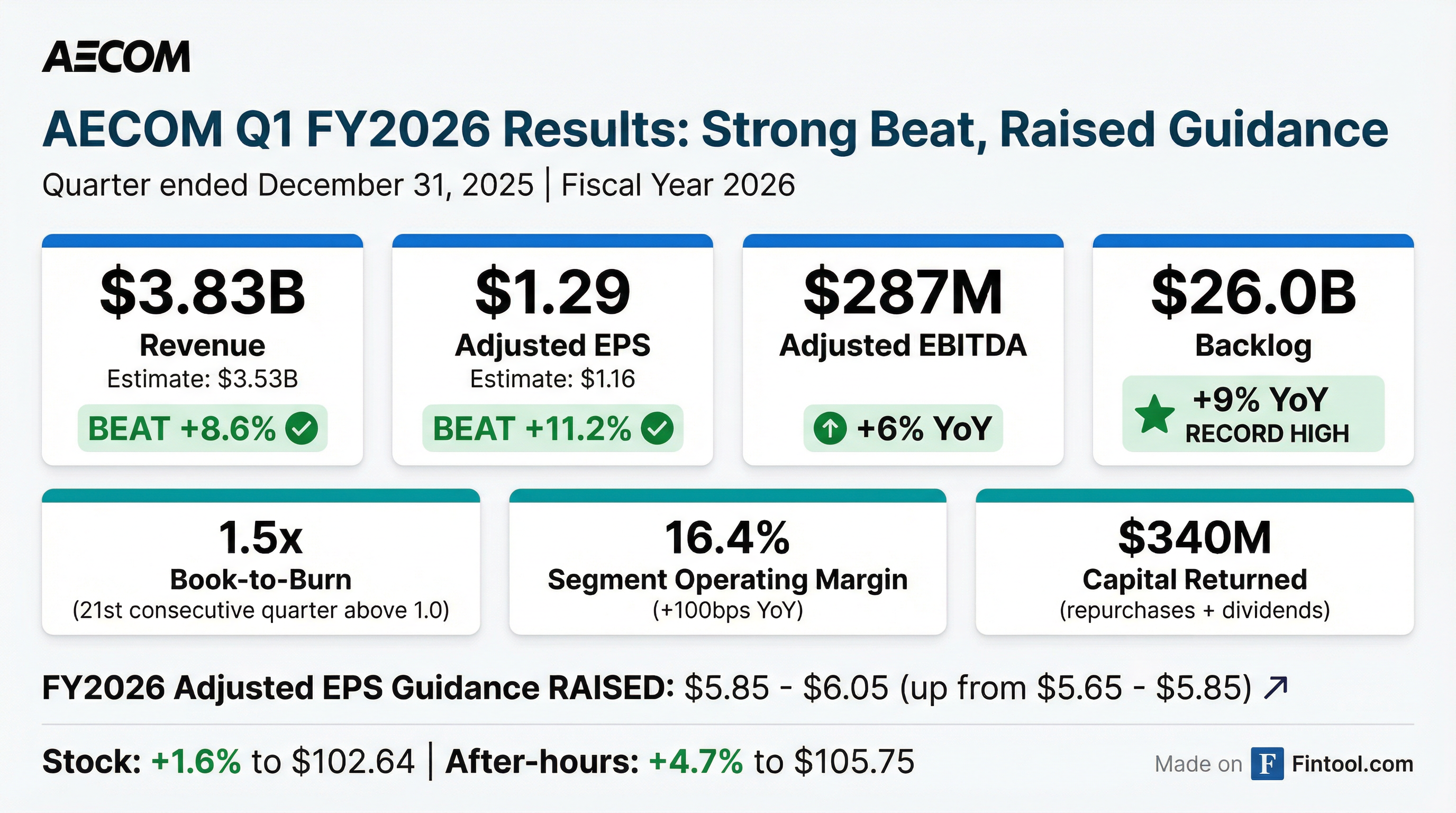

- AECOM raised its full-year FY'26 adjusted EPS guidance to a range of $5.85 - $6.05 and adjusted EBITDA guidance to $1,270 - $1,305 million, citing first-quarter outperformance and capital allocation benefits.

- The company achieved new first-quarter records for net service revenue (NSR), adjusted EBITDA, margins, and backlog, with NSR increasing by 5%.

- Backlog increased by 9% to a record high, supported by $3.5 billion in total wins and a 1.5 book-to-burn ratio, indicating strong future work visibility.

- AECOM returned over $340 million to shareholders via repurchases and dividends and increased its share repurchase authorization to $1 billion.

- AECOM has been selected by Sound Transit to provide design, environmental, and project management services for the Seattle region's light rail, commuter rail, and bus network expansion.

- As the prime firm on a five-year Design MATOC, AECOM will lead civil and structural engineering work.

- The broader program, encompassing 19 MATOCs, is projected to generate $1 billion in engineering services over its performance period.

- AECOM will also contribute as a subconsultant on the Environmental MATOC and provide support on the Project and Construction Management MATOC.

- AECOM reported an exceptional start to the year, exceeding expectations with record first quarter Net Service Revenue (NSR), adjusted EBITDA, margins, and backlog.

- The company raised its full-year fiscal 2026 adjusted EPS guidance to $5.95 at the midpoint, up from $5.75 previously, and increased its share repurchase authorization to $1 billion, having repurchased over $300 million in Q1.

- AECOM concluded its strategic review and will continue to own and operate its construction management business. The Americas segment achieved 9% NSR growth, and the company highlighted strong market conditions, particularly in the data center market, which grew 50% in FY 2025.

- AECOM reported strong Q1 2026 results, exceeding expectations with Adjusted EBITDA of $287 million and Adjusted EPS of $1.29. Net service revenue increased by 5% (adjusted for fewer billable days), and the segment-adjusted operating margin reached a record 16.4%.

- The company increased its full-year fiscal 2026 guidance, now expecting Adjusted EPS of $5.95 at the midpoint, up from $5.75 previously.

- Backlog grew 9% to an all-time high, driven by a 1.5 book-to-burn ratio in Q1 2026, marking 21 consecutive quarters above one. International backlog saw a 25% increase.

- AECOM announced an increase in its share repurchase authorization to $1 billion and repurchased over $300 million in Q1 2026.

- Strategic initiatives include the successful integration of acquired AI technology, with initial performance matching expectations and a focus on the facilities market. The company noted strong market conditions in the U.S. and significant growth in its data center business, which grew 50% in FY 2025.

- AECOM reported an exceptional Q1 2026, with adjusted EBITDA of $287 million and Adjusted EPS of $1.29, both exceeding expectations.

- The company achieved a 9% increase in backlog to a new all-time high, supported by a 1.5 book-to-burn ratio.

- Full-year Adjusted EPS guidance was raised to a midpoint of $5.95 from $5.75, reflecting operational outperformance and capital deployment benefits.

- AECOM increased its share repurchase authorization to $1 billion, having repurchased over $300 million in the first quarter.

- Key strategic developments include the decision to continue owning and operating the construction management business and the successful integration of a September AI acquisition, which is now live on projects.

- For Q1 2026, AECOM reported an Adjusted EPS of $1.29 , Net Service Revenue of $1,850.9 million , and Adjusted EBITDA of $286.8 million.

- The company raised its FY 2026 financial guidance, now expecting Adjusted EPS between $5.85 and $6.05 (a 13% increase) and Adjusted EBITDA between $1,270 million and $1,305 million (a 7% increase).

- AECOM's total backlog reached an all-time high of $26.0 billion in Q1 2026, supported by an Enterprise Book-to-Burn ratio of 1.5x.

- The company continues its returns-based capital allocation, returning 100% of free cash flow to shareholders and projecting a $1.24 annual dividend per share payment for FY'26E.

- AECOM reported strong first-quarter fiscal 2026 results, with adjusted EPS of $1.29 and adjusted EBITDA of $287 million, exceeding expectations for the period ended December 31, 2025.

- The company raised its fiscal 2026 guidance, now expecting adjusted EPS between $5.85 and $6.05 and adjusted EBITDA between $1,270 million and $1,305 million.

- Total backlog reached a record high of $25,962 million, an increase of 9% year-over-year, driven by a 1.5x book-to-burn ratio.

- AECOM completed its review of strategic alternatives for the Construction Management business and decided to continue to own and operate the business.

- The company returned more than $340 million to shareholders through repurchases and dividends during the quarter, and the Board approved an increase to the share repurchase authorization to $1 billion.

- AECOM reported strong first quarter fiscal 2026 results, with adjusted net service revenue increasing 5% and adjusted EBITDA increasing 6%.

- The company raised its fiscal 2026 guidance, with adjusted EPS now expected between $5.85 and $6.05 and adjusted EBITDA between $1,270 million and $1,305 million.

- Total backlog reached a record high of $25,962 million, up 9% year-over-year, driven by a 1.5x book-to-burn ratio.

- AECOM returned over $340 million to shareholders through repurchases and dividends, and the Board approved an increase to the share repurchase authorization to $1 billion. The company also decided to continue to own and operate its Construction Management business.

- AECOM (NYSE: ACM), through its Unite32 joint venture with Laing O'Rourke, has been named the official Delivery Partner for the Brisbane 2032 Olympic and Paralympic Games.

- The joint venture is tasked with delivering nearly US$5 billion ($AU7.1 billion) in critical infrastructure and venue projects for the Games.

- AECOM's Chairman and CEO, Troy Rudd, highlighted the company's extensive experience in managing complex, multi-billion-dollar programs for major events, including its role for the Los Angeles 2028 Olympic and Paralympic Games.

- The Unite32 consortium brings significant expertise, having been involved in the delivery of every Olympic and Paralympic Games program since London in 2012.

- AECOM has been awarded a position on the U.S. General Services Administration (GSA) One Acquisition Solution for Integrated Services Plus (OASIS+) contract.

- This contract enables AECOM to provide integrated services, including architectural and engineering design, environmental compliance and remediation, and advisory and program management, to all U.S. federal civilian and Department of Defense agencies.

- The OASIS+ contract is a significant governmentwide program with a 10-year performance window and no contract ceiling, expanding AECOM's opportunities for government work and supporting critical initiatives.

Quarterly earnings call transcripts for AECOM.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more