Earnings summaries and quarterly performance for Artisan Partners Asset Management.

Executive leadership at Artisan Partners Asset Management.

Jason A. Gottlieb

Chief Executive Officer

Charles J. Daley, Jr.

Executive Vice President, Chief Financial Officer and Treasurer

Christopher J. Krein

Executive Vice President and Head of Global Distribution

Eileen L. Kwei

Executive Vice President and Chief Administrative Officer

Eric R. Colson

Executive Chair and Chair of the Board

Gregory K. Ramirez

Executive Vice President and Head of Vehicle and Investor Operations

Laura E. Simpson

Executive Vice President, Chief Legal Officer and Secretary

Samuel B. Sellers

Executive Vice President and Chief Operating Officer

Board of directors at Artisan Partners Asset Management.

Research analysts who have asked questions during Artisan Partners Asset Management earnings calls.

William Katz

TD Cowen

6 questions for APAM

John Dunn

Evercore ISI

5 questions for APAM

Kenneth Lee

RBC Capital Markets

3 questions for APAM

Alexander Blostein

Goldman Sachs

2 questions for APAM

Anthony

Raymond James

2 questions for APAM

Anthony Corbin

Goldman Sachs

2 questions for APAM

Recent press releases and 8-K filings for APAM.

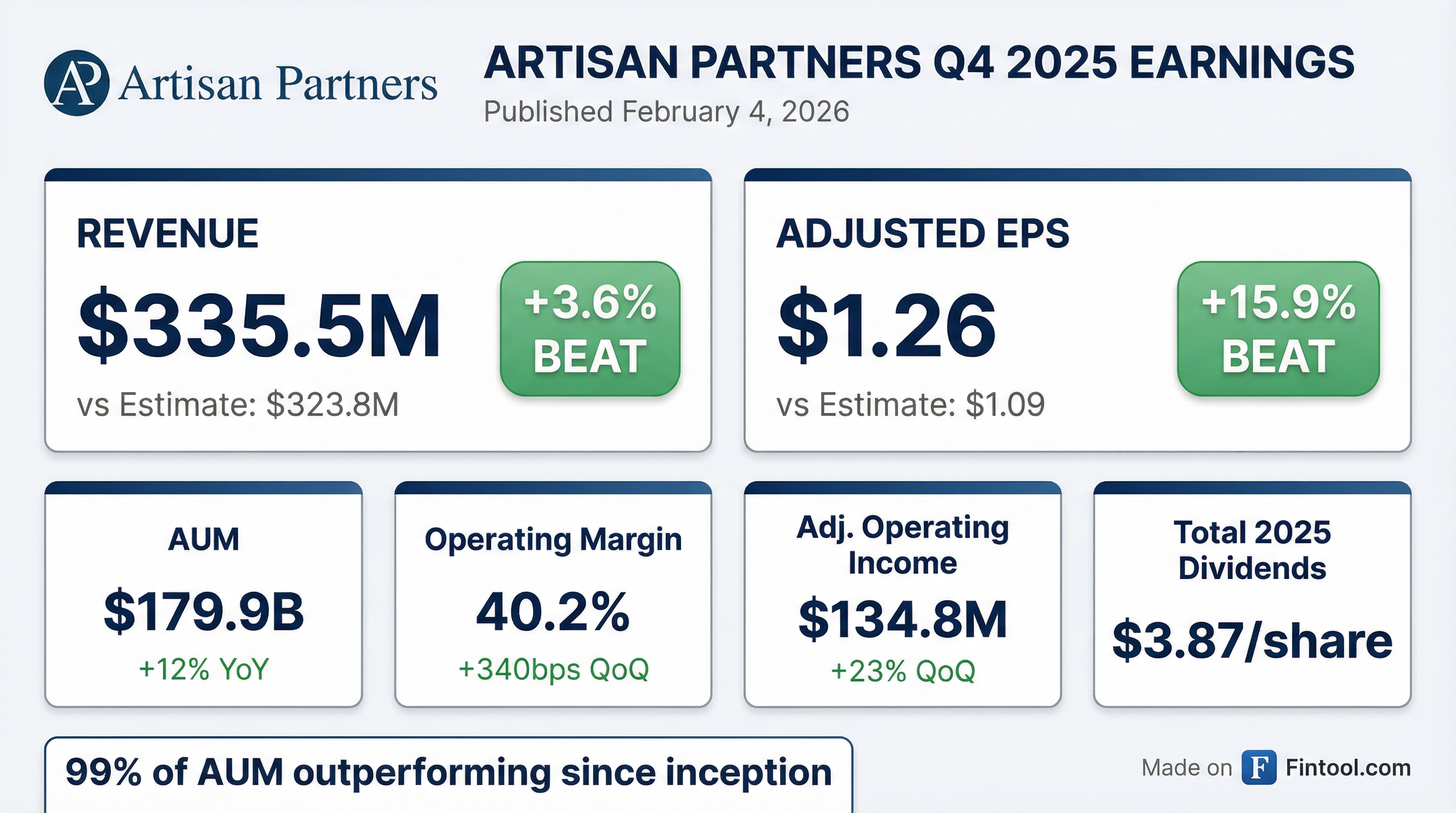

- Artisan Partners Asset Management (APAM) reported Q4 2025 revenues of $336 million, an 11% increase from the prior quarter, and full-year 2025 revenues grew 8% compared to 2024. Adjusted operating income for Q4 2025 increased 23% compared to both the prior quarter and the same quarter last year, with an adjusted operating margin of 40.2%.

- The company concluded 2025 with $180 billion in assets under management (AUM), an all-time high, primarily driven by over $33 billion in investment gains. The credit platform's AUM grew 29% to $17.9 billion with $2.8 billion in net inflows, and the alternatives platform's AUM grew 20% to $4 billion, while the equity platform experienced $15.6 billion in outflows.

- APAM declared a quarterly dividend of $1.01 per share and a $0.57 per share year-end special dividend for Q4 2025. Total dividends declared with respect to 2025 cash generation amounted to $3.87 per share, representing a 98% payout ratio and an 11% increase over 2024 dividends.

- The acquisition of Grandview Property Partners, a real estate private equity firm managing approximately $880 million in institutional assets, closed on January 2, 2026. This acquisition is expected to have an immaterial impact on 2026 earnings initially but become mildly accretive to earnings per share after the final closing of Grandview's next flagship fund.

- Artisan Partners Asset Management (APAM) reported Q4 2025 revenue of $336 million, an 11% increase from the prior quarter and 13% from Q4 2024, contributing to full-year 2025 revenue growth of 8% compared to 2024.

- Assets Under Management (AUM) reached an all-time high of $180 billion as of December 31, 2025, representing a 12% increase from year-end 2024, primarily driven by over $33 billion of investment gains.

- The company declared a quarterly dividend of $1.01 per share and a 57-cent year-end special dividend for Q4 2025, resulting in total dividends of $3.87 per share for 2025 cash generation, an 11% increase over 2024.

- The acquisition of Grandview Property Partners closed on January 2, 2026, expanding APAM's alternatives platform; it is expected to have an immaterial impact on 2026 earnings and become mildly accretive after the final closing of Grandview's next flagship fund.

- For 2026, fixed expenses are projected to increase by low single digits, including approximately $20 million from the long-term incentive compensation grant and Grandview expenses.

- Artisan Partners Asset Management (APAM) reported record revenues of $336 million for Q4 2025 and 8% revenue growth for the full year 2025 compared to 2024. Assets under management (AUM) reached an all-time high of $180 billion as of December 31, 2025, up 12% from year-end 2024, driven by over $33 billion in investment gains.

- The company's adjusted operating income increased 23% in Q4 2025 compared to both the prior quarter and the same quarter last year, with an adjusted operating margin of 40.2%. Full-year 2025 adjusted operating income grew by 12%.

- APAM expanded its multi-asset class platform with the acquisition of Grandview Property Partners, a private real estate firm managing approximately $880 million in institutional assets, which is expected to be mildly accretive to EPS after the closing of its next flagship fund.

- The board declared a quarterly dividend of $1.01 per share and a 57-cent year-end special dividend for Q4 2025, totaling $3.87 per share for 2025 cash generation, representing a 98% payout ratio.

- While the credit platform saw AUM grow 29% to $17.9 billion with $2.8 billion in net inflows, the equity platform experienced $15.6 billion in outflows.

- Artisan Partners reported Q4 2025 revenues of $335.5 million, with an Adjusted Operating Income of $134.8 million and an Adjusted Net Income per Adjusted Share of $1.26. The Adjusted Operating Margin for the quarter was 40.2%.

- As of December 31, 2025, Assets Under Management (AUM) stood at $179.9 billion. For the full year 2025, the company experienced net client cash outflows of ($12.7) billion.

- Firmwide investment performance showed 79% of AUM outperforming its benchmark over the 3-year period and 74% over the 5-year period as of December 31, 2025.

- The company declared a dividend of $0.57 per share for Q4 2025.

- Artisan Partners Asset Management Inc. reported strong financial results for the full year ended December 31, 2025, with revenue growing 8% and operating income growing 9% compared to 2024.

- Assets Under Management (AUM) reached $179.9 billion at December 31, 2025, marking a nearly 12% increase from 2024, despite experiencing $12.7 billion in aggregate net outflows during the year, primarily from growth-oriented equity strategies.

- The company's board of directors declared a total dividend of $1.58 per share of Class A common stock for the December 2025 quarter, consisting of a variable quarterly dividend of $1.01 per share and a special dividend of $0.57 per share, payable on February 27, 2026.

- Artisan Partners expanded its multi-asset class investment platform with the acquisition of Grandview Property Partners, a real estate private equity firm, which closed in early January 2026.

- Ryan G. Von Hoff was appointed Chief Accounting Officer and principal accounting officer on January 29, 2026.

- Artisan Partners Asset Management Inc. reported preliminary Assets Under Management (AUM) of $179.9 billion as of December 31, 2025.

- On January 2, 2026, a subsidiary of the company completed the acquisition of 100% of the equity of Grandview Property Partners, LLC.

- The Board of Directors appointed Clarence Kane Brenan to the Board and its Compensation Committee on January 9, 2026, increasing the board size from eight to nine directors.

- Artisan Partners Asset Management Inc. (APAM) reported preliminary assets under management (AUM) totaling $179.9 billion as of December 31, 2025.

- This AUM figure includes $87.8 billion from Artisan Funds and Artisan Global Funds, and $92.1 billion from separate accounts and other AUM.

- The reported AUM for December 2025 reflects the impact of approximately $640 million in Artisan Funds distributions that were not reinvested.

- Artisan Partners Asset Management Inc. (APAM) reported preliminary Assets Under Management (AUM) totaling $180.8 billion as of November 30, 2025.

- Of this total, $87.2 billion was attributed to Artisan Funds and Artisan Global Funds, while $93.6 billion came from separate accounts and other AUM.

- The reported November AUM includes an impact of approximately $800 million from Artisan Funds distributions that were not reinvested, with an additional $400 million in distributions expected in December.

- The firm also experienced a $2.7 billion redemption in early December 2025 from a non-U.S. institutional client across three Growth team strategies.

- Artisan Partners Asset Management Inc. reported preliminary assets under management (AUM) of $180.8 billion as of November 30, 2025.

- This AUM was composed of $87.2 billion from Artisan Funds and Artisan Global Funds, and $93.6 billion from separate accounts and other AUM.

- The November AUM figure includes an approximate $800 million impact from Artisan Funds distributions that were not reinvested, with an additional $400 million expected in December.

- The firm also noted a $2.7 billion redemption in early December 2025 from a non-U.S. institutional client across three Growth team strategies, driven by local pension-market dynamics.

- Artisan Partners Asset Management (APAM) has entered into a definitive agreement to acquire 100% of the equity interest of Grandview Property Partners, a real estate private equity firm.

- Grandview Property Partners specializes in originating, developing, acquiring, and managing middle market properties across the United States and currently manages $940 million in institutional assets.

- This acquisition represents a significant advancement in Artisan's strategic expansion into alternative investments, establishing a foundation in private real estate.

- The transaction is expected to close in the first quarter of 2026 and is anticipated to be mildly accretive to earnings per share after the final closing of Grandview’s next flagship closed-end draw-down fund.

Quarterly earnings call transcripts for Artisan Partners Asset Management.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more