Earnings summaries and quarterly performance for ALLIANCE RESOURCE PARTNERS.

Research analysts who have asked questions during ALLIANCE RESOURCE PARTNERS earnings calls.

Mark Reichman

NOBLE Capital Markets

11 questions for ARLP

Also covers: AZZ, EDRY, EHLB +4 more

NM

Nathan Martin

The Benchmark Company

10 questions for ARLP

Also covers: AMR, ARCH, BTU +6 more

David Storms

Stonegate Capital Partners

8 questions for ARLP

Also covers: ACOG, AMTX, BKSY +19 more

MK

Matthew Key

B. Riley Securities

4 questions for ARLP

Also covers: FEAM, METC, PLL +2 more

MM

Michael Mathison

Sidoti & Company, LLC

3 questions for ARLP

Also covers: ALEX, GNK, HSON +3 more

DM

David Marsh

Singular Research

2 questions for ARLP

Also covers: ARC, CURI, DAIO +7 more

MM

Michael Matheson

Sidoti & Company

2 questions for ARLP

Also covers: PANL, SCWO

TS

Tim Snyder

Snyder Capital

2 questions for ARLP

Recent press releases and 8-K filings for ARLP.

Alliance Resource Partners Subsidiary Acquires Coal Properties for $15.5 Million

ARLP

M&A

New Projects/Investments

Related Party Transaction

- Alliance Resource Properties, LLC, an indirect, wholly-owned subsidiary of Alliance Resource Partners, L.P. (ARLP), acquired coal reserves and surface rights in Ohio County, West Virginia, and Washington County, Pennsylvania, from The Joseph W. Craft III Foundation and The Kathleen S. Craft Foundation for an aggregate purchase price of $15.5 million.

- The Kathleen S. Craft Foundation received a lump sum payment of $7.75 million at closing on January 29, 2026.

- For The Joseph W. Craft III Foundation, Alliance Resource Properties, LLC paid $1,847,550.00 at closing , with the remaining balance of $5,902,450.00 , plus 5% annual interest, payable in equal annual installments from January 1, 2027, until January 1, 2032.

- This transaction involved related parties, as both foundations are controlled by individuals with significant ownership and management roles within ARLP; the terms of the purchase and sale agreement with The Joseph W. Craft III Foundation were unanimously approved by the Conflicts Committee of the Board.

2 days ago

ARLP Reports Q4 2025 Results and Provides 2026 Guidance

ARLP

Earnings

Guidance Update

New Projects/Investments

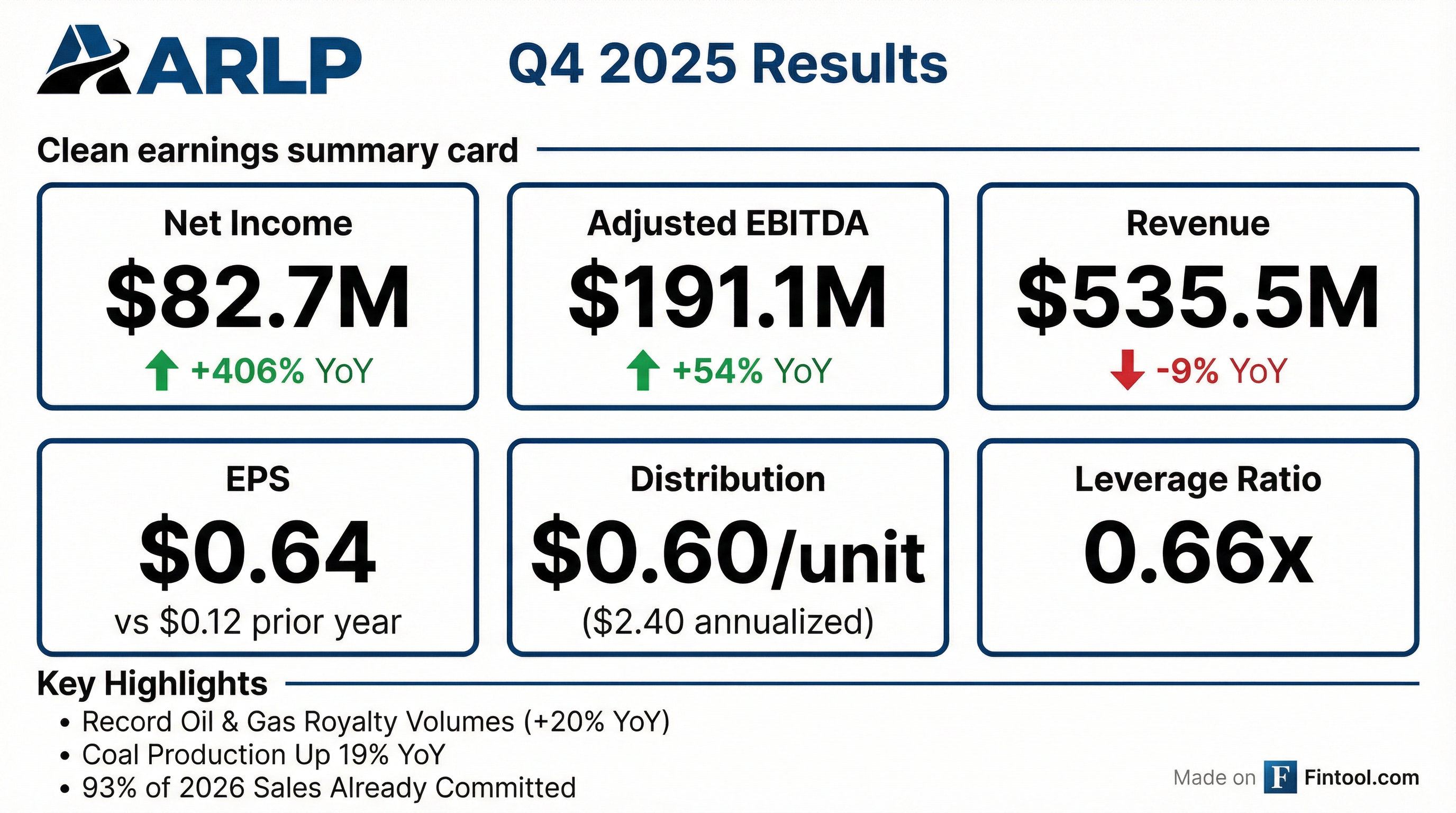

- Alliance Resource Partners (ARLP) reported Q4 2025 adjusted EBITDA of $191.1 million and net income attributable to ARLP of $82.7 million, or $0.64 per unit, on total revenues of $535.5 million.

- For 2026, ARLP anticipates overall coal sales volumes between 33.75 million and 35.25 million tons, with over 93% of expected volumes already committed and priced. Average realized coal pricing is projected to be approximately 3%-6% below Q4 2025 levels.

- The Mettiki mine is expected to experience reduced sales volumes in 2026 due to a key customer's outages and lack of future commitment, while the Hamilton Mining Complex achieved record production volumes and salable yield for the full year 2025.

- The oil and gas royalty segment delivered strong results in Q4 2025 with $56.8 million in revenue and completed $14.4 million of mineral acquisitions. This segment is expected to see increased volumes in 2026.

- ARLP ended Q4 2025 with $518.5 million in total liquidity and generated $93.8 million in free cash flow, resulting in a distribution coverage ratio of 1.29 times.

5 days ago

Alliance Resource Partners Reports Q4 2025 Results and Provides 2026 Guidance

ARLP

Earnings

Guidance Update

New Projects/Investments

- Alliance Resource Partners (ARLP) reported Q4 2025 adjusted EBITDA of $191.1 million and net income attributable to ARLP of $82.7 million, or $0.64 per unit. Total revenues for the quarter were $535.5 million, a decrease from Q4 2024, primarily due to lower coal sales and transportation revenues.

- The company maintained a strong financial position, generating $93.8 million in free cash flow and $100.1 million in distributable cash flow in Q4 2025, with total and net leverage ratios improving to 0.66 and 0.56 times debt to trailing twelve months Adjusted EBITDA, respectively.

- For 2026, ARLP anticipates overall coal sales volumes to increase to a range of 33.75-35.25 million tons, with over 93% of expected volumes already committed and priced. However, full-year average realized coal pricing is projected to be approximately 3%-6% below Q4 2025 levels.

- Operational challenges include the Mettiki mine's existing contractual commitments concluding in March 2026 with no clear alternative customer, leading to a potential impairment evaluation in Q1 2026, and an extended longwall outage at the Hamilton Mine expected to result in 6%-10% higher Segment Adjusted EBITDA expense per ton in Q1 2026 compared to Q4 2025. The oil and gas royalty segment delivered strong Q4 2025 results with $56.8 million in revenue and anticipates continued growth in 2026.

5 days ago

ARLP Reports Q4 2025 Results and Provides 2026 Guidance

ARLP

Earnings

Guidance Update

New Projects/Investments

- Alliance Resource Partners (ARLP) reported Q4 2025 adjusted EBITDA of $191.1 million and net income attributable to ARLP of $82.7 million, or $0.64 per unit, on total revenues of $535.5 million.

- For 2026, the company anticipates overall coal sales volumes between 33.75-35.25 million tons and full-year average realized coal pricing to be 3%-6% below Q4 2025 levels, with over 93% of expected 2026 volumes already committed and priced.

- Operational highlights include record production at the Hamilton Mining Complex in 2025 and strong performance in the oil and gas royalty segment, which achieved record volumes and completed $14.4 million in acquisitions during Q4 2025.

- The Mettiki mine faces significant challenges due to customer plant outages and lack of future commitments, leading to WARN Act notices, with existing contracts concluding in March 2026.

- Market conditions indicate strengthening demand fundamentals for coal, driven by higher natural gas prices and load growth from data centers and U.S. manufacturing, with coal-fired generation playing a critical role during recent extreme weather events.

5 days ago

Alliance Resource Partners, L.P. Reports Q4 and Full Year 2025 Results and Provides 2026 Guidance

ARLP

Earnings

Guidance Update

Dividends

- Alliance Resource Partners, L.P. (ARLP) reported Q4 2025 net income of $82.7 million and Adjusted EBITDA of $191.1 million, with total revenues decreasing to $535.5 million.

- For the full year 2025, ARLP achieved total revenue of $2.2 billion, net income of $311.2 million, and Adjusted EBITDA of $698.7 million.

- The company declared a quarterly cash distribution of $0.60 per unit.

- ARLP's 2026 full year guidance includes total coal sales tons of 33.75 million to 35.25 million and total capital expenditures of $280 million to $300 million.

5 days ago

Alliance Resource Partners' Mettiki Coal Subsidiary Issues WARN Act Notice, Ceases Production

ARLP

Layoffs

Demand Weakening

Guidance Update

- Alliance Resource Partners, L.P.'s (ARLP) subsidiary, Mettiki Coal (WV), LLC, issued WARN Act notices to its approximately two hundred employees at the Mountain View Mine, leading to an immediate cessation of production.

- This decision is a result of a key customer's reduced demand and lack of commitment for future purchases, which negatively impacted shipments in 2025 and is expected to continue into 2026.

- For the year ended December 31, 2025, Mettiki's coal sales and production volumes were approximately 1.2 million tons, with Segment Adjusted EBITDA less capital expenditures attributable to the operation being approximately $3.5 million.

- ARLP plans to reflect the anticipated impact of these reduced sales volumes in its 2026 guidance, scheduled for announcement on February 2, 2026, and will evaluate any potential impairment in Q1 2026.

Jan 29, 2026, 9:15 PM

Alliance Resource Partners Reports Q3 2025 Results and Updates 2025 Guidance

ARLP

Earnings

Guidance Update

New Projects/Investments

- Alliance Resource Partners (ARLP) reported Q3 2025 total revenues of $571.4 million, net income attributable to ARLP of $95.1 million, and Adjusted EBITDA of $185.8 million.

- Total coal sales volumes increased 3.9% year-over-year to 8.7 million tons at an average sales price of $58.78 per ton.

- The company tightened its full-year 2025 sales guidance to 32.5 to 33.25 million tons and updated segment-adjusted EBITDA expense per ton guidance for Appalachia to $60 to $62 per ton and Illinois Basin to $34 to $36 per ton.

- ARLP anticipates increasing sales volumes by approximately 2 million tons in 2026, driven by strong market fundamentals and growing electricity demand from data centers.

- For Q3 2025, the company declared a quarterly cash distribution of $0.60 per unit, with a calculated distribution coverage ratio of 1.37 times.

Oct 27, 2025, 2:00 PM

Alliance Resource Partners Reports Q3 2025 Financial and Operational Results

ARLP

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Alliance Resource Partners (ARLP) reported Q3 2025 total revenues of $571.4 million and Adjusted EBITDA of $185.8 million, an increase of 9% from Q3 2024. Net income attributable to ARLP was $95.1 million.

- Coal sales volumes for Q3 2025 increased 3.9% year-over-year to 8.7 million tons, while the average coal sales price per ton decreased 7.5% to $58.78 compared to Q3 2024.

- The company updated its 2025 guidance for segment adjusted EBITDA expense per ton to $60 to $62 for Appalachia and $34 to $36 for Illinois Basin, reflecting operational improvements at mines like Tunnel Ridge and Hamilton.

- ARLP has 32.8 million tons committed and priced for 2025 and 29.1 million tons for 2026, with expectations for a 2 million ton increase in sales volume for 2026 driven by strong market demand from data centers and a favorable market outlook.

- ARLP maintained a strong financial position with $541.8 million in total liquidity as of September 30, 2025, and declared a quarterly cash distribution of $0.60 per unit, resulting in a 1.37x distribution coverage ratio.

Oct 27, 2025, 2:00 PM

Alliance Resource Partners Reports Q3 2025 Results

ARLP

Earnings

Guidance Update

New Projects/Investments

- Alliance Resource Partners reported total revenues of $571.4 million for Q3 2025, an increase of 4.4% compared to the sequential quarter, driven by higher coal sales volumes and prices.

- Net income attributable to ARLP was $95.1 million, and Adjusted EBITDA reached $185.8 million, representing a 9% increase from Q3 2024 and a 14.8% increase sequentially.

- Total coal sales volumes for Q3 2025 increased by 3.9% to 8.7 million tons compared to Q3 2024, with the average coal sales price per ton at $58.78. Operational improvements at Tunnel Ridge contributed to a 19.3% sequential decrease in cost per ton sold in Appalachia.

- The company tightened its full-year 2025 sales guidance to 32.5 to 33.25 million tons and increased the low end of coal sales pricing guidance ranges for both the Illinois Basin and Appalachia. For 2026, 29.1 million sales tons are already contracted and priced, and the company anticipates a potential 2 million ton increase in total sales volume compared to 2025.

- ARLP invested $22.1 million in a limited partnership that indirectly acquired a coal-fired plant in the PJM service area, positioning the company to benefit from tightening power markets and growing demand for reliable base load generation.

Oct 27, 2025, 2:00 PM

Alliance Resource Partners Reports Strong Q3 2025 Results and Positive 2026 Outlook

ARLP

Earnings

Guidance Update

New Projects/Investments

- Alliance Resource Partners reported Q3 2025 total revenues of $571.4 million and Adjusted EBITDA of $185.8 million, marking a 9% increase year-over-year and 14.8% sequentially. Net income attributable to ARLP was $95.1 million.

- Total coal production increased 8.5% year-over-year to 8.4 million tons, and total coal sales volumes rose 3.9% to 8.7 million tons. Operational improvements, particularly at Tunnel Ridge, led to an 11.7% improvement in Appalachia's segment-adjusted EBITDA expense per ton compared to Q3 2024.

- The company tightened its full-year 2025 sales guidance to 32.5 million tons to 33.25 million tons and has already contracted and priced 29.1 million sales tons for 2026. Management anticipates a 2 million ton increase in total overall sales in 2026 compared to 2025, without requiring additional personnel.

- Strong U.S. coal demand is driven by rapid electricity growth from data centers, with utility coal consumption increasing 15% in MISO and 16% in PJM year-to-date. ARLP also invested $22.1 million in a limited partnership that acquired a coal-fired plant in the PJM service area.

Oct 27, 2025, 2:00 PM

Quarterly earnings call transcripts for ALLIANCE RESOURCE PARTNERS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more