Earnings summaries and quarterly performance for ARVINAS.

Executive leadership at ARVINAS.

Board of directors at ARVINAS.

Research analysts who have asked questions during ARVINAS earnings calls.

Jonathan Miller

Evercore ISI

6 questions for ARVN

Li Wang Watsek

Cantor Fitzgerald

4 questions for ARVN

Michael Schmidt

Guggenheim Securities

4 questions for ARVN

Sudan Loganathan

Stephens Inc.

4 questions for ARVN

Tazeen Ahmad

Bank of America

4 questions for ARVN

Eliana Merle

UBS

3 questions for ARVN

Ted Tenthoff

Piper Sandler & Co.

3 questions for ARVN

Terence Flynn

Morgan Stanley

3 questions for ARVN

Tyler Van Buren

TD Cowen

3 questions for ARVN

Yigal Nochomovitz

Citigroup Inc.

3 questions for ARVN

Akash Tewari

Jefferies

2 questions for ARVN

Anna

Wolfe Research

2 questions for ARVN

Blake

BTIG

2 questions for ARVN

Bradley Canino

Stifel

2 questions for ARVN

Caroline

Citi

2 questions for ARVN

Daniel Bronder

Cantor Fitzgerald

2 questions for ARVN

Derek Archila

Wells Fargo

2 questions for ARVN

Edward Tenthoff

Piper Sandler Companies

2 questions for ARVN

Francis

TD Cowen

2 questions for ARVN

Jacob

TD Cowen

2 questions for ARVN

Jeet Mukherjee

Leerink Partners

2 questions for ARVN

Kripa Devarakonda

Truist Securities

2 questions for ARVN

Luke

Goldman Sachs

2 questions for ARVN

Paul Choi

Goldman Sachs

2 questions for ARVN

Peter Lawson

Barclays PLC

2 questions for ARVN

Sarah

TD Cowen

2 questions for ARVN

Akash Bivari

Jefferies

1 question for ARVN

Amanda Acosta-Ruiz

Leerink Partners

1 question for ARVN

Andrew Berens

Leerink Partners

1 question for ARVN

Conor MacKay

BMO Capital Markets

1 question for ARVN

Daniel

Craig-Hallum

1 question for ARVN

Derek Arquilla

Wells Fargo

1 question for ARVN

Ellie Merle

UBS Group AG

1 question for ARVN

Etzer Darout

BMO Capital Markets

1 question for ARVN

Evan Seigerman

BMO Capital Markets

1 question for ARVN

Manoj

Jefferies

1 question for ARVN

Manoj Radder

Jefferies

1 question for ARVN

Matthew Biegler

Oppenheimer & Co. Inc.

1 question for ARVN

Srikripa Devarakonda

Truist Financial Corporation

1 question for ARVN

Sudan Laganathan

Stephens

1 question for ARVN

Suranjit Mukherjee

BTIG

1 question for ARVN

Recent press releases and 8-K filings for ARVN.

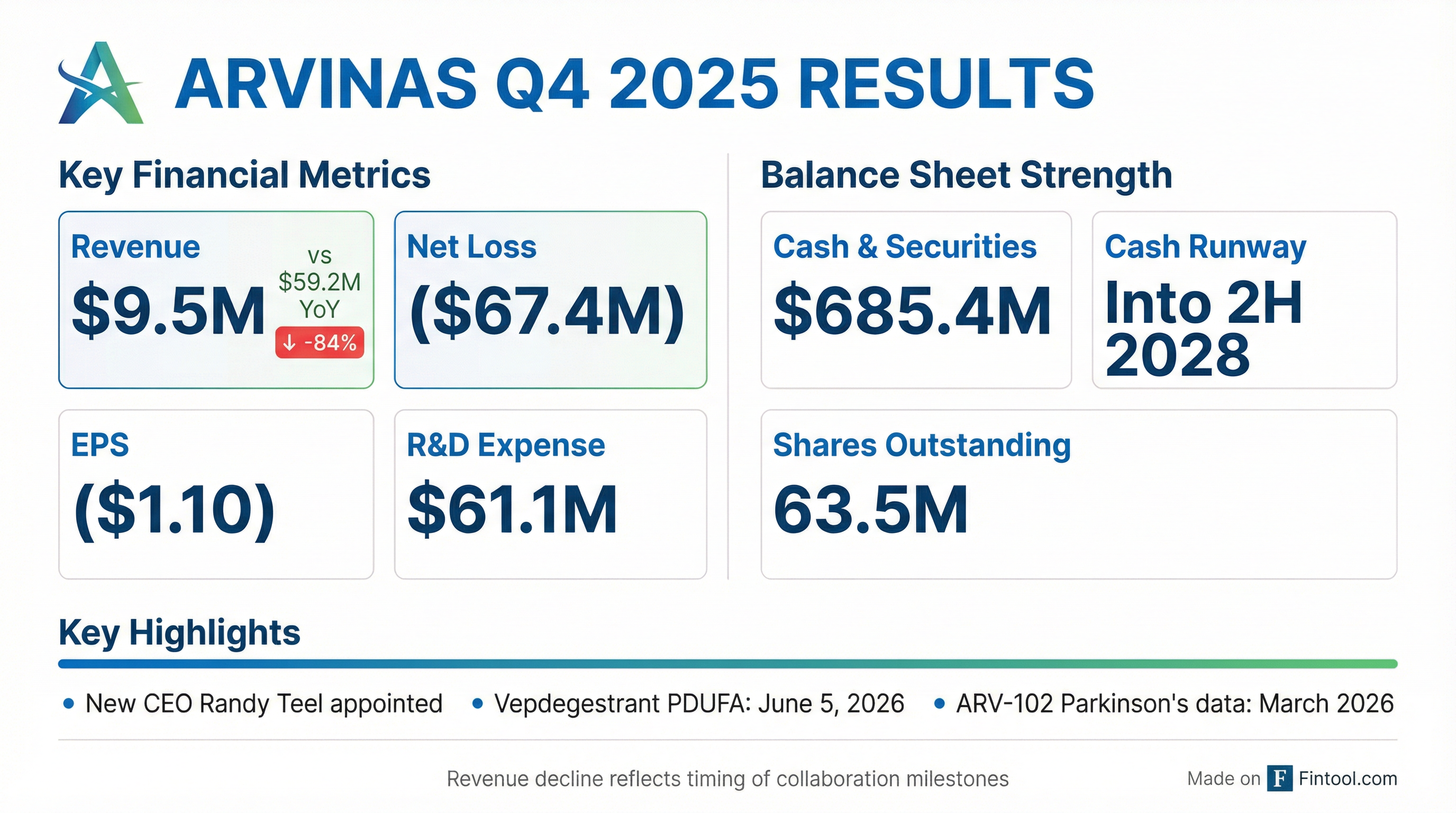

- Arvinas ended Q4 2025 with $685 million in cash, equivalents, and marketable securities , and maintains a cash runway into the second half of 2028.

- For Q4 2025, the company reported $9.5 million in revenue, a decrease from $59.2 million in Q4 2024, primarily due to a $40.3 million reduction from the Novartis license agreement.

- Arvinas has four ongoing clinical trials and recently initiated a first-in-human trial for ARV-027 , with new clinical data from Phase I trials for ARV-102, ARV-806, and ARV-393 anticipated in 2026.

- Key program milestones include the presentation of Phase 1 data for ARV-102 in Parkinson's disease patients in March, with a Phase 1b trial in PSP planned for H1 2026 , and the first data disclosure for ARV-806 expected by mid-2026.

- The company has refocused resources on its Phase I clinical programs and is working to secure a commercialization partner for vepdegestrant before its June 5th PDUFA date.

- Arvinas reported $9.5 million in revenue for Q4 2025 and $262.6 million for the full year 2025, ending the year with over $685 million in cash, equivalents, and marketable securities, and maintaining cash runway guidance into the second half of 2028.

- The company anticipates multiple data readouts and clinical advancements in 2026, including ARV-102 (LRRK2 degrader) data presentation in March and a Phase 1B trial initiation in PSP in H1 2026, ARV-806 (KRAS G12D PROTAC) data disclosure by mid-2026, and ARV-393 (BCL6 degrader) data in H2 2026.

- Arvinas is working with Pfizer to select a third party for the commercialization of vepdegestrant, aiming for an agreement before the June 5th PDUFA date.

- The company completed a $91.9 million share repurchase program in 2025, which is now suspended.

- Arvinas reported $9.5 million in revenue for Q4 2025, a decrease from $59.2 million in Q4 2024, and ended the quarter with over $685 million in cash equivalents and marketable securities, maintaining its cash runway guidance into the second half of 2028.

- The company is advancing four ongoing clinical trials and anticipates multiple data readouts and clinical advancements in 2026, including for ARV-102 (oral presentation at ADPD in March), ARV-806 (first data disclosure by mid-2026), and ARV-393 (data in H2 2026).

- Arvinas has refocused its resources on its Phase I clinical programs, which now include ARV-102, ARV-806, ARV-393, ARV-027, and ARV-6723 (entering clinic later in 2026), with a strategy to develop only highly differentiated treatments.

- The company's share repurchase program has been suspended after repurchasing approximately 10 million shares for $91.9 million as of year-end 2025.

- Arvinas reported cash, cash equivalents, and marketable securities of $685.4 million as of December 31, 2025, with a projected cash runway into the second half of 2028.

- For the full year ended December 31, 2025, the company reported a net loss of $(80.8) million and revenue of $262.6 million.

- Randy Teel, Ph.D., was appointed President, Chief Executive Officer, and Director, succeeding John Houston, Ph.D..

- The company anticipates multiple value-driving milestones in 2026, including data readouts for ARV-102, ARV-806, and ARV-393, and the initiation of a Phase 1 trial for ARV-6723.

- The Prescription Drug User Fee Act (PDUFA) action date for vepdegestrant is set for June 5, 2026, and Arvinas and Pfizer plan to identify a partner for its commercialization.

- Arvinas's partnered estrogen receptor degrader, vepdegestrant, has a PDUFA date of June 5, 2026, for ESR1 mutant metastatic breast cancer.

- The company's LRRK2 degrader, ARV-102, demonstrated 75% LRRK2 degradation and reduced neuroinflammation biomarkers in healthy volunteers. Arvinas expects to initiate a Phase 1b study in PSP in 2026 and a larger Phase 2 study by the end of 2026.

- In oncology, the BCL6 degrader ARV-393 is in a Phase 1 study with observed responders, and the KRAS G12D degrader ARV-806 showed 25 to 40 times greater preclinical potency than competitors, with clinical data anticipated in 2026.

- Arvinas reported a cash position of $788 million at the end of Q3, which is projected to fund operations well into the second half of 2028, alongside a $20 million stock repurchase in Q3.

- Arvinas's lead estrogen receptor degrader, vepdegestrant, partnered with Pfizer, has a June 5, 2026, PDUFA date for ESR1 mutant metastatic breast cancer.

- The company is advancing ARV-102, a LRRK2 degrader for Parkinson's disease and PSP, with plans to initiate a Phase 1b study in PSP in the U.S. next year and a larger Phase 2 study by the end of next year, following promising Phase 1 data showing 75% LRRK2 degradation.

- In oncology, Arvinas is progressing ARV-393 (BCL6 degrader), which has shown responders in its Phase 1 study, and ARV-806 (KRAS G12D degrader), which demonstrated 25 to 40 times greater preclinical potency than competitors.

- Arvinas reported a strong cash position of $788 million at the end of Q3, expected to fund operations well into the second half of 2028, including $20 million in stock repurchases during Q3.

- Arvinas, Inc. announced that multiple abstracts on its investigational PROTAC estrogen receptor degrader, vepdegestrant (ARV-471), have been accepted for presentation at the San Antonio Breast Cancer Symposium (SABCS) taking place from December 9–12, 2025.

- The VERITAC-2 Phase 3 study of vepdegestrant demonstrated statistically significant and clinically meaningful improvement in progression-free survival compared to fulvestrant in patients with ER+/HER2- ESR1-mutated advanced or metastatic breast cancer.

- The U.S. Food and Drug Administration (FDA) is reviewing the New Drug Application (NDA) for vepdegestrant, with a Prescription Drug User Fee Act (PDUFA) action date of June 5, 2026.

- In September 2025, Arvinas and Pfizer announced their plan to jointly select a third party for the commercialization and potential further development of vepdegestrant.

- Arvinas is undergoing a strategic "reset" (Arvinas 2.0), focusing on five early development assets, including LRRK2, KRAS G12D, and BCL6, while seeking a third-party partner for vepdegestrant's potential launch next year.

- The company reports a strong financial position with cash runway into the second half of 2028, which does not include potential future milestones or royalties from the luxdeglutamide deal with Novartis.

- The LRRK2 program is highlighted as the lead, with data from its Parkinson's disease study expected in the first few months of 2026 and an IND filing for a Progressive Supranuclear Palsy (PSP) study planned for early 2026.

- Arvinas's LRRK2 degrader has shown 75% degradation of LRRK2 in CSF and reduced neuroinflammation biomarkers in healthy volunteers, suggesting a more potent profile than competitor inhibitors.

- Arvinas is undergoing a company reset, shifting its focus to five early development assets, including LRRK2 for neurodegeneration, KRAS G12D, and BCL6 programs, with data points expected next year.

- The company is actively seeking a partner for Vepdegestrant, which had positive pivotal data and is anticipated for potential launch next year, with a decision expected before its projected June approval date.

- Arvinas maintains a strong financial position, with cash runway extending into the second half of 2028.

- The LRRK2 program is highlighted as the current lead, with a focus on Progressive Supranuclear Palsy (PSP); an IND filing for a PSP study is planned for early 2026, with potential for clinical activity measures within six months due to rapid disease progression.

- The partnership with Novartis for Luxdeglutamide includes a $1 billion upfront and milestone deal plus royalties, which is not fully factored into the current cash runway guidance.

- Arvinas is undergoing a "reset" (Arvinas 2.0), shifting its focus to five early development assets, including three currently in Phase 1 (LRRK2, KRAS G12D, BCL6) and two new programs (Kennedy's disease, HPK1) expected to enter the clinic next year.

- The company is in a strong financial position, with money into the second half of 2028. This financial runway does not contemplate potential future milestones or royalties from the $1 billion upfront and milestone deal with Novartis for Luxdeglutamide.

- The Vepdegestrant program, which showed positive pivotal data, is in the process of being transitioned to a third party for potential launch around next year if approved, with a decision date in June.

- The lead program, LRRK2, targeting Parkinson's disease (PD) and progressive supranuclear palsy (PSP), is expected to have data from its PD study in early 2026, and an Investigational New Drug (IND) application for a PSP study will be filed in early 2026.

Quarterly earnings call transcripts for ARVINAS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more