Earnings summaries and quarterly performance for AYTU BIOPHARMA.

Executive leadership at AYTU BIOPHARMA.

Board of directors at AYTU BIOPHARMA.

Research analysts who have asked questions during AYTU BIOPHARMA earnings calls.

NR

Naz Rahman

Maxim Group

7 questions for AYTU

Also covers: ASRT, GLMD, NXGL +3 more

Thomas Flaten

Lake Street Capital Markets

5 questions for AYTU

Also covers: ACHV, AQST, ASRT +13 more

EW

Ed Wu

Ascendiant Capital

3 questions for AYTU

Also covers: IGC, QUBT

RB

Robert Blum

Lytham Partners

2 questions for AYTU

Also covers: POCI, SNES

EW

Edward Wu

Ascendiant Capital

1 question for AYTU

Also covers: DXR, IGC

EW

Ed Woo

Ascendiant Capital

1 question for AYTU

Also covers: BLBX, GNSS, INTZ +4 more

Recent press releases and 8-K filings for AYTU.

AYTU BioPharma Reports Q2 2026 Results and EXXUA Commercial Launch

AYTU

Earnings

Product Launch

Guidance Update

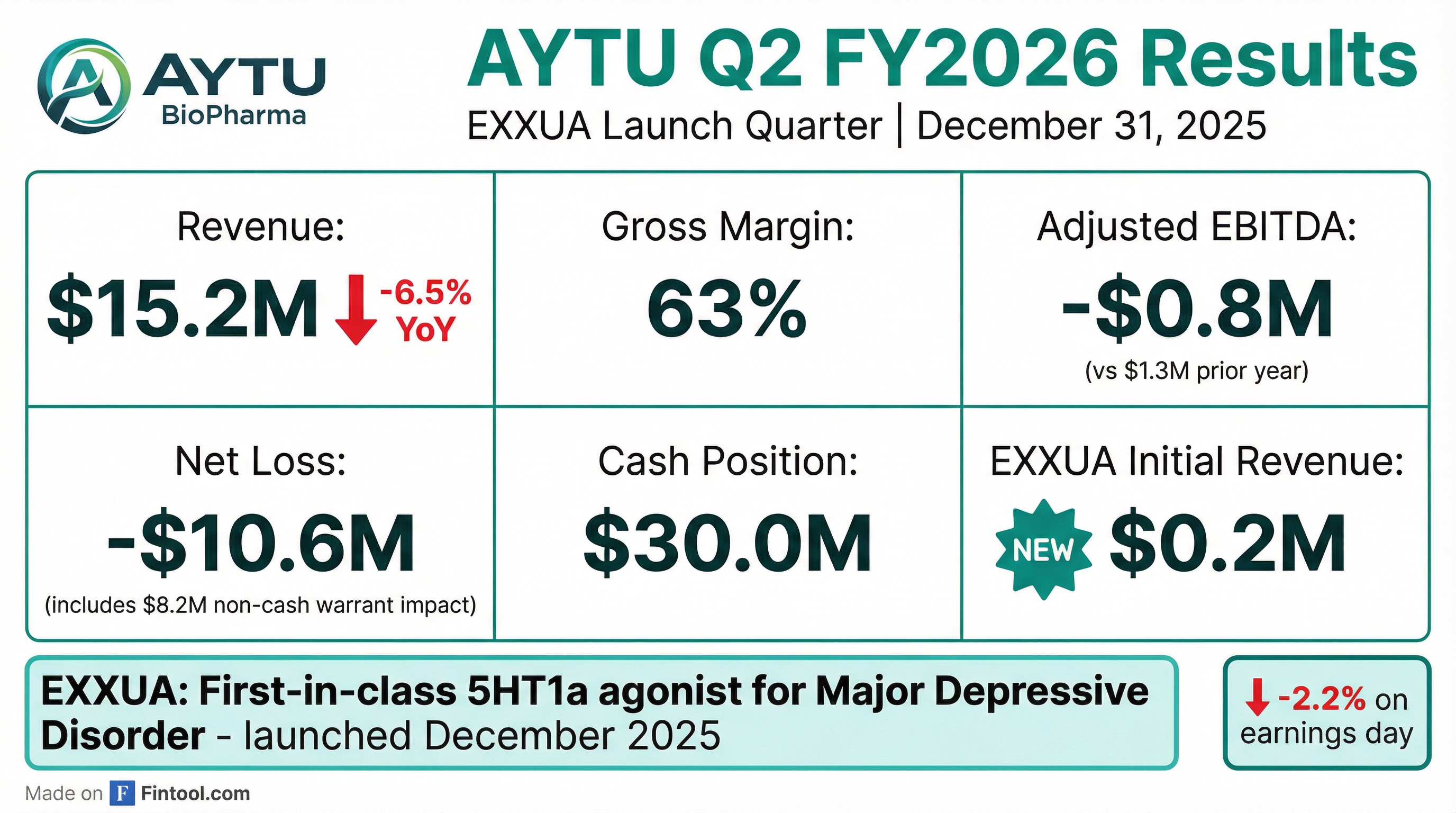

- Aytu BioPharma reported net revenue of $15.2 million for Q2 2026, a decrease from $16.2 million in the prior year, resulting in a net loss of $10.6 million or $5.00 per share basic. Adjusted EBITDA was -$0.8 million, and cash and cash equivalents stood at $30 million as of December 31, 2025.

- The company commercially launched EXXUA, the first and only FDA-approved 5-HT1A agonist for Major Depressive Disorder (MDD), with early positive feedback and over 100 doctors prescribing across 27 states. The launch strategy focuses on prescriber adoption and utilizes the RxConnect platform to ensure patient access.

- For the March 2026 quarter, a small initial ramp in EXXUA net revenue is expected, with recognized revenues increasing as month 3 refills begin in the June 2026 quarter. The EXXUA launch investment budget was reduced to under $8 million, and the company projects a cash breakeven at approximately $16.6 million of net revenue per quarter.

- The ADHD portfolio generated $13.2 million in net revenue, a slight decrease year-over-year but flat sequentially, despite generic competition and a shift in marketing focus towards EXXUA. The pediatric portfolio contributed $1.7 million in net revenue, with resources primarily directed to EXXUA.

3 days ago

Aytu BioPharma Reports Q2 2026 Results Amid Exxua Commercial Launch

AYTU

Earnings

Product Launch

Guidance Update

- Aytu BioPharma reported net revenue of $15.2 million for the second quarter of fiscal 2026, a decrease from $16.2 million in the prior year, resulting in a net loss of $10.6 million or $5 per share basic.

- The company commercially launched Exxua, its new treatment for Major Depressive Disorder (MDD), receiving early positive feedback with over 100 doctors prescribing it across 27 states. Exxua launch investments were reduced to under $8 million.

- The ADHD portfolio generated $13.2 million in net revenue, showing a slight decrease from the prior year but remaining flat sequentially, despite generic competition and a strategic shift in marketing focus towards Exxua.

- Adjusted EBITDA for the quarter was -$0.8 million, and cash and cash equivalents were $30 million as of December 31, 2025. The company projects a breakeven point at approximately $17.3 million in quarterly net revenue.

3 days ago

AYTU BioPharma Reports Q2 2026 Results and Commences EXXUA Commercial Launch

AYTU

Earnings

Product Launch

New Projects/Investments

- Aytu BioPharma commercially launched EXXUA, a novel treatment for Major Depressive Disorder (MDD), with early positive feedback and over 100 doctors prescribing it across 27 states since its commercial availability just over 30 days prior to the earnings call.

- For the second quarter of fiscal 2026, the company reported net revenue of $15.2 million, a net loss of $10.6 million (or $5 net loss per share basic), and adjusted EBITDA of -$0.8 million.

- The ADHD portfolio contributed $13.2 million in net revenue, remaining flat compared to the previous quarter despite generic competition, largely due to the RxConnect platform and the launch of an authorized generic.

- Cash and cash equivalents were $30 million as of December 31, 2025. The company expects a slow initial ramp for EXXUA net revenue due to a strategy of removing early access barriers, with significant revenue growth anticipated from month 3 refills starting in the June 2026 quarter.

3 days ago

Aytu BioPharma Reports Fiscal 2026 Second Quarter Results and EXXUA Launch

AYTU

Earnings

Product Launch

New Projects/Investments

- Aytu BioPharma reported total net revenue of $15.2 million for the fiscal 2026 second quarter.

- The company's Adjusted EBITDA was $(0.8) million for the quarter, which included investments for the EXXUA launch.

- EXXUA (gepirone) extended-release tablets were commercially launched in December 2025, contributing $0.2 million in initial stocking net revenue during the quarter.

- Aytu BioPharma ended the quarter with a cash balance of $30.0 million at December 31, 2025.

- The company recorded a net loss of $10.6 million for the quarter, largely impacted by an $8.2 million derivative warrant liability loss.

3 days ago

AYTU Highlights EXXUA Launch and Financial Performance

AYTU

Product Launch

Earnings

New Projects/Investments

- AYTU has launched EXXUA (gepirone) Extended-Release Tablets, a first-in-class treatment for Major Depressive Disorder (MDD) with a novel mechanism of action, positioned to address a $22 billion+ US market.

- EXXUA offers significant competitive advantages, including demonstrated efficacy without common side effects like sexual dysfunction or weight gain, and has patent protection through late 2030.

- For its Go-Forward Rx business, AYTU reported Net Revenue of $66.4 million and Adjusted EBITDA of $9.2 million for FY 2025, with a Gross Margin of 69%.

- As of December 31, 2025, the company's balance sheet shows Cash and cash equivalents of $30,025 thousand and Total stockholders' equity of $14,201 thousand.

- The EXXUA deal includes a 28% base royalty on net sales and milestone payments starting at $5 million when annual net sales reach $100 million.

3 days ago

Aytu BioPharma Recaps Investor Day, Highlights EXXUA Launch and Financials

AYTU

Product Launch

New Projects/Investments

Guidance Update

- Aytu BioPharma held an Investor Day on January 20, 2026, to recap the launch of EXXUA™ (gepirone), the first and only 5HT1a agonist approved by the FDA for Major Depressive Disorder (MDD), which began commercial availability on December 15, 2025.

- EXXUA's product profile is highlighted by no negative impact on sexual function and no clinically significant weight changes, addressing common side effects of other antidepressants.

- The commercialization agreement for EXXUA includes a 28% base royalty on net sales, with potential for increased rates and milestone payments beginning at $100 million in annual net sales.

- As of September 30, 2025, Aytu reported $32.6 million in cash, a trailing twelve months (TTM) adjusted EBITDA of $6.7 million, and a TTM operating cash burn of $1.4 million.

- The EXXUA launch investment budget was reduced to $6-8 million from an original $10 million, and the product is expected to have a gross margin of 66-68%.

Jan 20, 2026, 9:05 PM

AYTU Biopharma Formally Launches Exxua for MDD

AYTU

Product Launch

New Projects/Investments

- AYTU Biopharma formally launched Exxua, the first and only 5-HT1A agonist approved for major depressive disorder (MDD) in adults, with its sales force fully deployed and prescriptions already being generated as of January 20, 2026.

- The Exxua deal structure includes a 28% base royalty on net sales and milestone payments, designed to align financial obligations with product performance rather than maximizing upfront cash.

- As of September 2025, the company reported a cash position of $32.6 million, with a trailing 12-month adjusted EBITDA of $6.7 million and an operating cash burn of $1.4 million.

- AYTU is pursuing a capital-efficient launch for Exxua, with a reduced launch budget of $6-$8 million (down from $10 million) and expected gross margins between 66%-68% inclusive of royalty payments. The company plans to expand its sales force from over 40 to 125 territories based on product performance and cash flow generation.

Jan 20, 2026, 4:00 PM

AYTU BioPharma Announces Formal Launch of Exxua and Commercial Strategy

AYTU

Product Launch

New Projects/Investments

Guidance Update

- AYTU BioPharma has formally launched Exxua, the first and only 5-HT1A agonist approved for Major Depressive Disorder (MDD) in adults, with its sales force fully deployed and prescriptions already being generated as of January 20, 2026.

- Exxua is positioned as a first-in-class treatment with a distinct mechanism of action that avoids common side effects like sexual dysfunction and significant weight gain, differentiating it from SSRIs and SNRIs.

- The commercial strategy emphasizes efficient spending and targets 5,500 high-value psychiatry prescribers with a 40-plus person sales force, aiming for strategic expansion based on performance.

- Patient access is facilitated by the proprietary A2Rx Connect network, guaranteeing 100% commercial coverage and a capped out-of-pocket cost of $50 for commercially insured patients.

- The Exxua deal structure is performance-based, featuring a 28% base royalty on net sales and milestone payments, aligning financial obligations with product success. The launch budget was reduced to $6-$8 million from an original $10 million.

Jan 20, 2026, 4:00 PM

AYTU Highlights Financials and EXXUA™ Clinical Profile at Investor Day

AYTU

Product Launch

Guidance Update

New Projects/Investments

- AYTU reported $32.6 million in cash and a $12.5 million term loan outstanding as of September 30, 2025, with a TTM Adjusted EBITDA of $6.7 million and TTM operating cash burn of $1.4 million.

- The company expects no additional cash requirement through profitability and has reduced the original EXXUA™ launch investment budget from $10 million to $6-8 million due to efficiencies and cost management.

- EXXUA™ has an expected gross margin of 66-68% and its deal terms include fixed payments of $3 million at execution and an additional $3 million (or $5 million if net sales exceed $35 million) within 45 days of the first anniversary of commercial launch, along with a 28% base royalty on net sales.

- Clinical trials for EXXUA™ demonstrated significant symptom improvement in MDD patients without causing sexual dysfunction or clinically significant weight gain, though it does prolong the QTc interval, requiring ECG monitoring.

- Discontinuation due to adverse events for EXXUA™ was 7% compared to 3% for placebo, with common adverse events described as mild-to-moderate and tending to resolve early in treatment.

Jan 20, 2026, 4:00 PM

AYTU BioPharma Announces Formal Launch of Exxua for Major Depressive Disorder

AYTU

Product Launch

New Projects/Investments

Guidance Update

- AYTU BioPharma officially launched Exxua, the first and only 5-HT1A agonist approved for Major Depressive Disorder (MDD) in adults, on January 20, 2026, with its sales force fully deployed and national distribution in place.

- The company reported $32.6 million in cash as of September 2025 and does not expect to require additional capital through profitability, with a trailing 12-month adjusted EBITDA of $6.7 million and operating cash burn of $1.4 million.

- The Exxua deal structure includes a 28% base royalty on net sales, milestone payments starting at $100 million in annual net sales, and a reduced launch budget of $6-$8 million (down from $10 million).

- Exxua is positioned as a novel treatment for MDD that does not cause sexual dysfunction or clinically significant weight gain, targeting a market of 21 million adults in the U.S. with MDD.

- The commercial strategy focuses on efficient spending, targeting 5,500 high-value psychiatry prescribers and leveraging the AytuRxConnect network to ensure patient access with a capped out-of-pocket copay of up to $50 for commercially insured patients.

Jan 20, 2026, 4:00 PM

Quarterly earnings call transcripts for AYTU BIOPHARMA.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more