Earnings summaries and quarterly performance for BridgeBio Pharma.

Executive leadership at BridgeBio Pharma.

Board of directors at BridgeBio Pharma.

Ali Satvat

Director

Andrea Ellis

Director

Andrew Lo

Director

Charles Homcy

Lead Director

Douglas Dachille

Director

Eric Aguiar

Director

Frank McCormick

Director

Fred Hassan

Lead Independent Director

Hannah Valantine

Director

James Momtazee

Director

Jennifer Cook

Director

Randal Scott

Director

Ronald Daniels

Director

Research analysts who have asked questions during BridgeBio Pharma earnings calls.

Biren Amin

Piper Sandler Companies

6 questions for BBIO

Tyler Van Buren

TD Cowen

6 questions for BBIO

Andrew Tsai

Jefferies

5 questions for BBIO

Anupam Rama

JPMorgan Chase & Co.

4 questions for BBIO

Cory Kasimov

Evercore ISI

4 questions for BBIO

Mani Foroohar

Leerink Partners

4 questions for BBIO

Paul Choi

Goldman Sachs

4 questions for BBIO

Salim Syed

Mizuho Securities

4 questions for BBIO

Eliana Merle

UBS

3 questions for BBIO

Jason Zemansky

Bank of America

3 questions for BBIO

Adi Jayaraman

Evercore ISI

2 questions for BBIO

Danielle Brill

Truist Securities

2 questions for BBIO

Greg Harrison

RBC Capital Markets

2 questions for BBIO

Josh Schimmer

Cantor Fitzgerald

2 questions for BBIO

Ryan Mcelroy

Leerink Partners

2 questions for BBIO

Trevor Allred

Oppenheimer & Co. Inc.

2 questions for BBIO

Bennett

Mizuho

1 question for BBIO

Thomas Trimarchi

Raymond James

1 question for BBIO

Recent press releases and 8-K filings for BBIO.

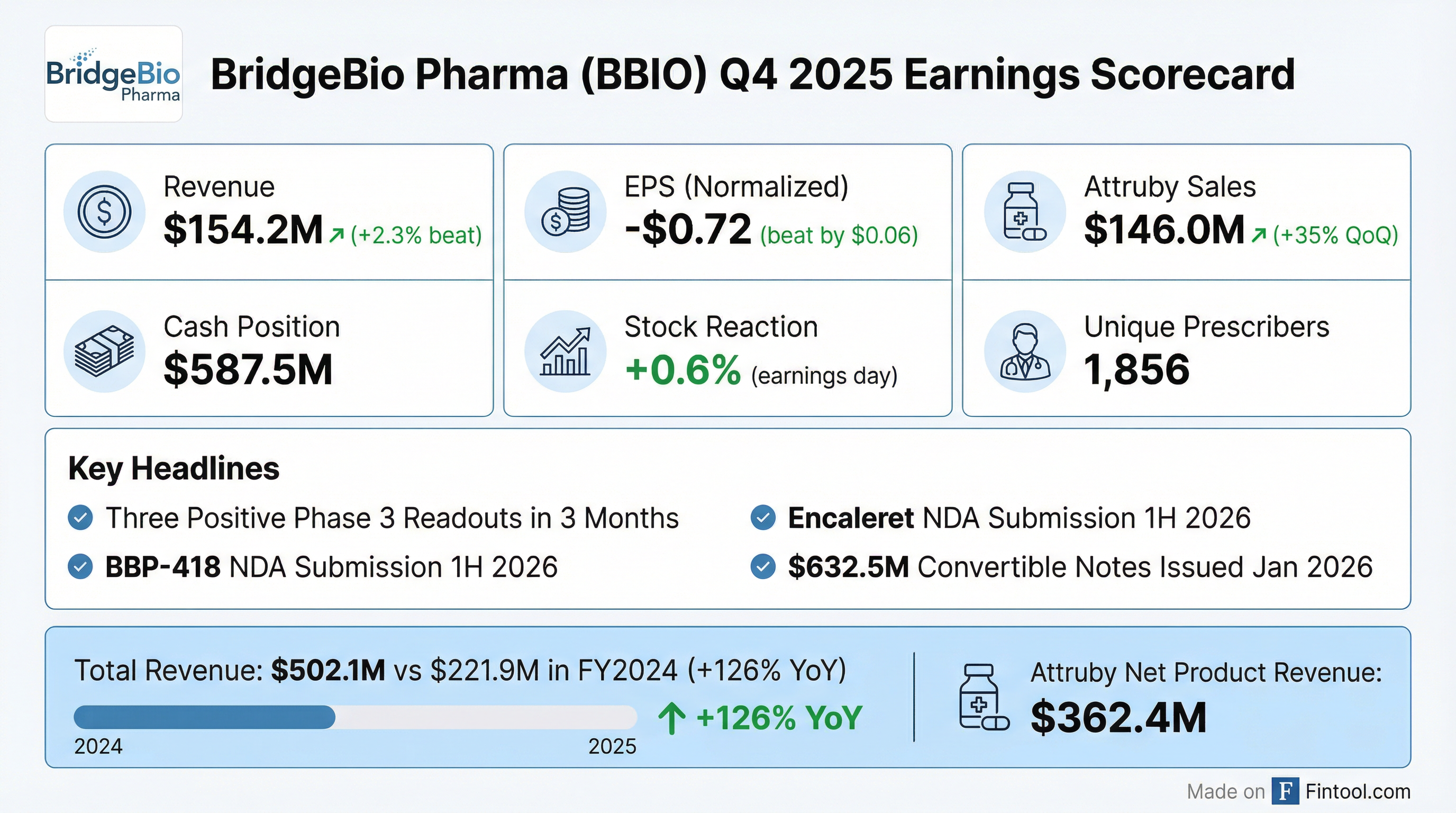

- BridgeBio Pharma reported total revenues of $154.2 million in Q4 2025 and $502.1 million for the full year 2025, primarily driven by Attruby net product revenue of $146 million in Q4.

- The company announced positive top-line Phase 3 results for encaleret in ADH1, BBP-418 in LGMD2I, and infigratinib in achondroplasia, marking a transformative inflection point.

- BridgeBio anticipates its pipeline will transition from a cash-consumptive business to a cash-generating one by late 2027, projecting over $600 million in profit from its four post-Phase 3 assets by 2028.

- The company ended 2025 with $587.5 million in cash, cash equivalents, and marketable securities, and issued $632.5 million in convertible notes in January 2026, providing significant cash runway.

- Three programs, BBP-418, infigratinib, and the Canavan gene therapy program, have received Rare Pediatric Disease Designation, making them eligible for Priority Review Vouchers upon approval.

- BridgeBio Pharma reported total revenues of $154.2 million in Q4 2025 and $502.1 million for the full year 2025, primarily driven by Attruby net product revenue of $146 million in Q4 and $362.4 million for the full year. The company's cash burn for 2025 was $446 million net of revenue.

- The company announced positive top-line Phase 3 results for encaleret in ADH1, BBP-418 in LGMD2I, and infigratinib in achondroplasia, marking a transformative inflection point for the company.

- The Phase 3 study for infigratinib in achondroplasia successfully met its primary endpoint, demonstrating a mean treatment difference against placebo of 2.1 centimeters per year in average height velocity at week 52 (p-value < 0.0001).

- BridgeBio anticipates transitioning from a cash-consumptive business to a significant cash generator, expecting to generate over $600 million in profit by 2028 from its four post-Phase 3 assets. The company also expects to receive Priority Review Vouchers for BBP-418, infigratinib, and its Canavan gene therapy program upon approval.

- BridgeBio Pharma reported total revenues of $154.2 million for Q4 2025 and $502.1 million for the full year 2025, with Attruby net product revenue reaching $146 million in Q4 and $362.4 million for the full year.

- The company announced positive top-line Phase III results for encaleret in ADH1, BBP-418 in LGMD2I, and infigratinib in achondroplasia, with infigratinib demonstrating a mean treatment difference of 2.1 cm per year and a p-value of less than 0.0001.

- Attruby continued its strong commercial momentum, achieving 35% quarter-over-quarter growth in net product revenue in Q4 2025 and 7,804 unique patient prescriptions as of February 20th, 2026.

- BridgeBio ended 2025 with $587.5 million in cash, cash equivalents, and marketable securities, and issued $632.5 million in convertible notes in January 2026 to support its transition into a multi-product business.

- The company anticipates the launch of encaleret and BBP-418 in late 2026 or early 2027, with cash burn expected to hold steady through most of 2026 before decreasing towards year-end due to Attruby's expanding operating margin.

- BridgeBio Pharma reported total revenues, net, of $154.2 million for Q4 2025 and $502.1 million for the full year 2025, primarily from net product revenue of $146.0 million and $362.4 million, respectively. The company recorded a net loss attributable to common stockholders of $192.9 million for Q4 2025 and $724.9 million for FY 2025.

- As of December 31, 2025, BridgeBio held $587.5 million in cash, cash equivalents, and marketable securities and subsequently completed the issuance of $632.5 million in 2033 convertible notes in January 2026 to support operations.

- Attruby (acoramidis) demonstrated strong commercial performance with 7,804 unique patient prescriptions by February 20, 2026, and achieved 35% quarter-over-quarter growth in net product revenue in Q4 2025.

- The company announced three positive Phase 3 trial readouts (for infigratinib, BBP-418, and encaleret) and plans for NDA submissions in 1H 2026 for BBP-418 and encaleret, with anticipated U.S. launches in late 2026/early 2027.

- BridgeBio Pharma reported $154.2 million in total net revenues for the fourth quarter of 2025 and $502.1 million for the full year 2025, primarily from $146.0 million in Q4 net product revenue from Attruby.

- The company ended December 31, 2025, with $587.5 million in cash, cash equivalents, and marketable securities, and completed a $632.5 million aggregate principal amount convertible notes issuance in January 2026.

- BridgeBio announced three positive Phase 3 trial readouts for infigratinib (PROPEL 3), BBP-418 (FORTIFY), and encaleret (CALIBRATE).

- Following these positive results, the company plans NDA submissions in 1H 2026 for BBP-418 and encaleret, with anticipated U.S. launches in late 2026/early 2027, and an NDA submission for infigratinib in 2H 2026.

- For the fourth quarter and full year ended December 31, 2025, the company recorded a net loss attributable to common stockholders of $192.9 million and $724.9 million, respectively.

- BridgeBio Pharma, Inc. announced positive topline results from the PROPEL 3 global Phase 3 pivotal study of oral infigratinib in children with achondroplasia on February 12, 2026.

- The study successfully met its primary endpoint, showing a mean treatment difference of +2.10 cm/year in annualized height velocity against placebo at Week 52.

- Oral infigratinib achieved the first statistically significant improvement in body proportionality against placebo in achondroplasia, with an LS mean treatment difference of -0.05 (p<0.05) in children younger than 8 years old.

- The drug was well tolerated, with no discontinuations or serious adverse events related to the study drug.

- BridgeBio plans to submit New Drug Application (NDA) and Marketing Authorization Application (MAA) in the second half of 2026 for achondroplasia and will accelerate development for hypochondroplasia.

- BridgeBio's oral FGFR3 inhibitor infigratinib met the primary endpoint in the Phase 3 PROPEL 3 trial for children with achondroplasia, demonstrating an average treatment difference versus placebo of approximately +2.10 cm/year in annualized height velocity at one year.

- The trial also showed the first statistically significant improvement in upper-to-lower body proportionality in a randomized achondroplasia trial, particularly in children younger than eight.

- Infigratinib was generally well tolerated, with no drug-related serious adverse events or discontinuations reported.

- BridgeBio plans to pursue regulatory discussions and aims to file a New Drug Application and Marketing Authorization Application in the U.S. and Europe in the second half of 2026.

- Following the positive topline data, BridgeBio shares experienced intraday gains between roughly 5% and 15%.

- BridgeBio Pharma announced positive topline results from the PROPEL 3 Phase 3 study of oral infigratinib for children with achondroplasia.

- The study demonstrated best-in-class efficacy with significant improvements in AHV, height-z score, and proportionality, and the drug was well-tolerated with no serious adverse events related to the study drug.

- The company plans to submit New Drug Applications (NDA) to the FDA and Marketing Authorization Applications (MAA) to the EMA in the second half of 2026.

- BridgeBio Pharma announced positive Phase III results from its PROPEL-3 clinical trial for infigratinib in achondroplasia, demonstrating significant improvements across key efficacy measures.

- Infigratinib met its primary endpoint, showing a mean difference of +2.1 centimeters per year and an LS mean difference of +1.74 centimeters per year in annualized height velocity compared to placebo, both with p-values less than 0.0001.

- The trial also reported statistically significant improvements in height Z-score (LS mean difference of +0.32 standard deviations against placebo, p < 0.0001) and, for the first time, in upper-to-lower body proportionality in children aged 3 to 8 years (LS mean difference of -0.05 against placebo, p < 0.05).

- Infigratinib was well-tolerated, with no safety concerns, no Grade 3 or higher adverse events, no SAEs related to the study drug, and no discontinuations related to the study drug.

- BridgeBio plans to launch infigratinib, anticipating it will be the first and only oral therapeutic option for achondroplasia, with the global skeletal dysplasia market (including achondroplasia) estimated at $5 billion.

- BridgeBio Pharma announced positive Phase 3 results from its PROPEL-3 clinical trial for infigratinib in children with achondroplasia.

- The trial met its primary endpoint, demonstrating a mean difference of +2.1 centimeters per year in annualized height velocity (AHV) against placebo, and an LS mean difference of +1.74 centimeters per year (p < 0.0001).

- Infigratinib also showed significant improvements in key secondary endpoints, including an LS mean change of +0.32 standard deviation score in height Z-score and a statistically significant improvement in body proportions in children aged 3 to 8 years.

- The drug exhibited a well-tolerated safety profile with no serious adverse events related to the study drug and no adverse events associated with FGFR1 or FGFR2 inhibition, offering an oral therapeutic option.

- BridgeBio plans to submit a New Drug Application (NDA) to the FDA and a Marketing Authorization Application (MAA) for the EMA in the second half of 2026, targeting a skeletal dysplasia market estimated at $5 billion.

Quarterly earnings call transcripts for BridgeBio Pharma.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more