Earnings summaries and quarterly performance for Bloom Energy.

Executive leadership at Bloom Energy.

Board of directors at Bloom Energy.

Barbara Burger

Director

Cynthia (CJ) Warner

Director

Eddy Zervigon

Director

Gary Pinkus

Director

Jeffrey Immelt

Lead Independent Director

Jim Hagemann Snabe

Director

John T. Chambers

Director

Mary K. Bush

Director

Michael J. Boskin

Director

Research analysts who have asked questions during Bloom Energy earnings calls.

Chris Dendrinos

RBC Capital Markets

8 questions for BE

Colin Rusch

Oppenheimer & Co. Inc.

8 questions for BE

Manav Gupta

UBS Group

8 questions for BE

Sherif Elmaghrabi

BTIG

7 questions for BE

Ameet Thakkar

BMO Capital Markets

6 questions for BE

Noel Parks

Tuohy Brothers

6 questions for BE

Dushyant Ailani

Jefferies

5 questions for BE

Michael Blum

Wells Fargo & Company

5 questions for BE

Andrew Percoco

Morgan Stanley

4 questions for BE

Christopher Senyek

Wolfe Research

4 questions for BE

David Arcaro

Morgan Stanley

4 questions for BE

Henry Roberts

Truist Securities

4 questions for BE

Dimple Gosai

Bank of America

3 questions for BE

Maheep Mandloi

Mizuho Financial Group

3 questions for BE

Mark W. Strouse

J.P. Morgan Chase & Co.

3 questions for BE

Ben Kallo

Robert W. Baird & Co.

2 questions for BE

Kashy Harrison

Piper Sandler

2 questions for BE

Nick Amicucci

Evercore ISI

2 questions for BE

Brett Castelli

Morningstar

1 question for BE

Chris Senyek

Wolfe Research, LLC

1 question for BE

David Benjamin

Mizuho Securities USA LLC

1 question for BE

David Sandler

Baird

1 question for BE

Davis Sunderland

Baird

1 question for BE

Martin Malloy

Johnson Rice

1 question for BE

Michael Fairbanks

J.P. Morgan Chase & Co.

1 question for BE

Skye Landon

Rothschild & Co Redburn

1 question for BE

Tim Moore

EF Hutton

1 question for BE

Recent press releases and 8-K filings for BE.

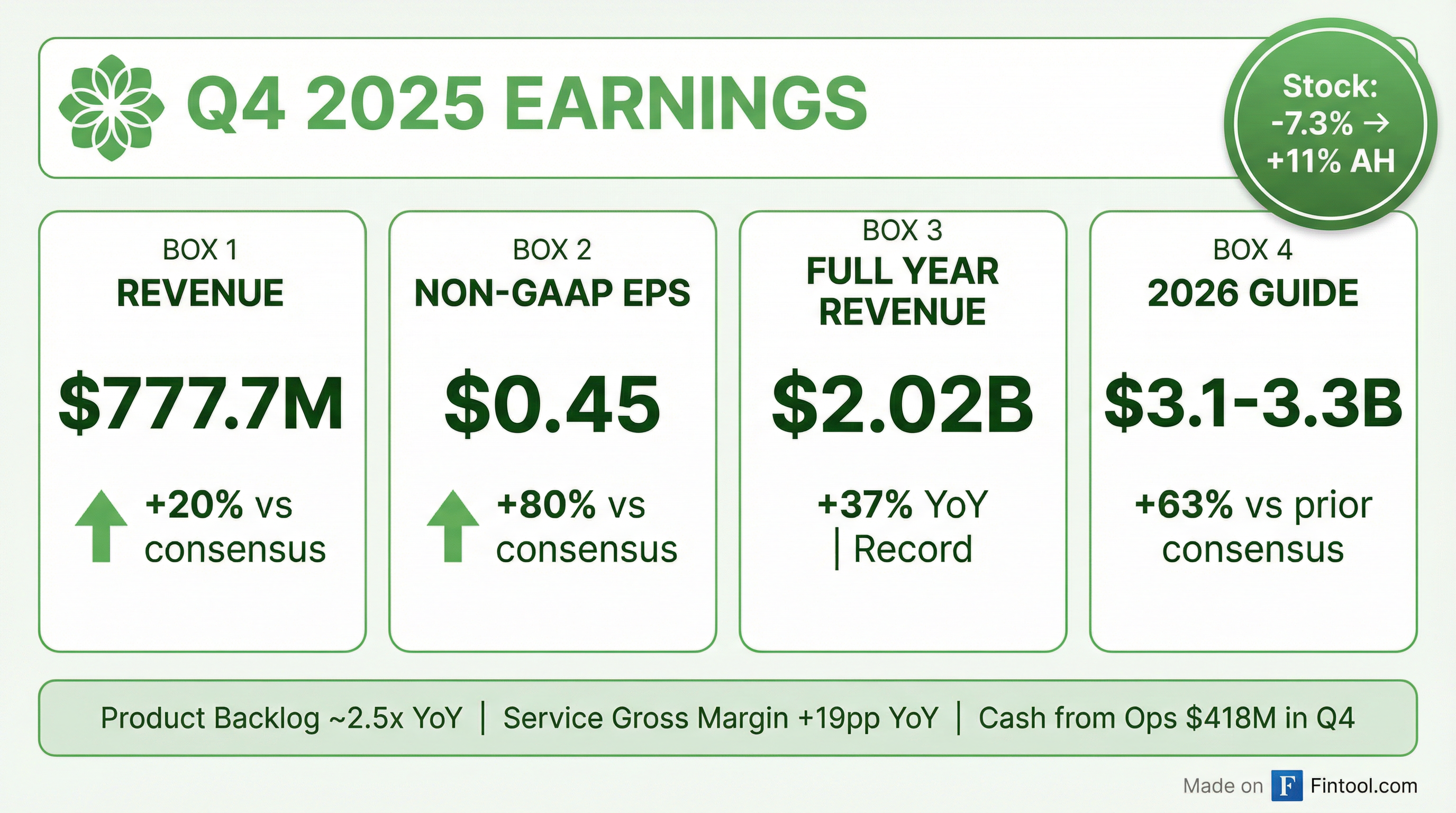

- Bloom Energy reported record annual revenue of $2.024 billion and a record annual non-GAAP gross margin of 30.3% for 2025, while also generating $114 million in positive full-year cash flow from operating activities.

- For Q4 2025, the company achieved revenue of $777.7 million, a non-GAAP gross margin of 31.9%, and non-GAAP EPS of $0.45.

- The company ended 2025 with a strong liquidity position of over $2 billion and a product backlog of approximately $6.0 billion, representing an increase of about 2.5 times from the previous year.

- Bloom Energy provided 2026 guidance, projecting total revenue between $3.1 billion and $3.3 billion, a non-GAAP gross margin of approximately 32%, and adjusted EPS ranging from $1.33 to $1.48.

- Bloom Energy reported record full-year 2025 revenue of $2 billion, a 37.3% increase from 2024, with Q4 2025 revenue reaching $777.7 million, up 35.9% year-over-year.

- The company achieved record gross margin and operating margin for the year, with non-GAAP gross margin of 30.3% and non-GAAP operating profit of $221 million in 2025.

- Bloom's product backlog surged 140% year-over-year to approximately $6 billion, complemented by an approximately $14 billion service backlog.

- For 2026, Bloom projects revenue of $3.1 billion-$3.3 billion, a non-GAAP gross margin of approximately 32%, and non-GAAP operating income of $425 million-$475 million.

- The company announced that all future Bloom servers will be 800 volts DC ready, positioning them for the evolving needs of AI data centers.

- Bloom Energy reported record full-year 2025 revenue of $2 billion, a 37.3% increase from 2024, with a non-GAAP gross margin of 30.3% and non-GAAP operating profit of $221 million. Q4 2025 revenue reached $777.7 million, up 35.9% year-over-year, and non-GAAP EPS was $0.45.

- The company's product backlog grew 140% year-over-year to approximately $6 billion, complemented by an approximately $14 billion service backlog. The CNI (commercial and industrial) backlog also increased over 135% year-over-year.

- For 2026, Bloom Energy projects revenue between $3.1 billion and $3.3 billion, a non-GAAP gross margin of approximately 32%, and non-GAAP operating income between $425 million and $475 million.

- The service business achieved approximately 20% gross margin in Q4 2025, marking its eighth consecutive profitable quarter, and all new Bloom servers will be 800 Volts DC ready to meet the demands of AI data centers.

- Bloom Energy achieved record revenue, gross margin, and operating margin for the full year 2025, with revenue reaching $2 billion, an increase of 37.3% from 2024.

- For Q4 2025, revenue was $777.7 million, up 35.9% year-over-year, and Non-GAAP EPS was $0.45. The service business achieved a 20% gross margin in Q4 2025, marking its eighth consecutive profitable quarter.

- The company provided robust 2026 guidance, projecting revenue between $3.1 billion and $3.3 billion and Non-GAAP operating income of $425 million-$475 million.

- Product backlog increased 140% year-over-year to approximately $6 billion, and the service backlog stands at around $14 billion.

- Bloom announced that all new servers shipped will be 800 Volts DC ready, natively producing this power, which is critical for future AI data centers.

- Bloom Energy reported record full year 2025 revenue of $2.02 billion, an increase of 37.3% compared to 2024, driven by significant growth from the AI data center industry and continued strong demand from the C&I business.

- The company achieved a Non-GAAP gross margin of 30.3% for full year 2025, an increase of 1.6 percentage points year-over-year, and Non-GAAP operating income of $221.0 million.

- Bloom Energy generated $113.9 million in cash flow from operating activities for the full year 2025, marking the second consecutive year of positive cash flow from operations.

- Product backlog grew approximately 2.5x year-over-year to ~$6 billion, contributing to a total current backlog of approximately $20 billion.

- For full year 2026, Bloom Energy provided guidance including revenue of $3.1 billion to $3.3 billion, a Non-GAAP gross margin of ~32%, Non-GAAP operating income of $425 million to $475 million, and Non-GAAP EPS of $1.33 to $1.48.

- Bloom Energy reported record full year revenues of $2.02 billion for 2025, a 37.3% increase compared to 2024, driven by the AI data center industry and C&I business.

- The company achieved a full year gross margin of 29.0% and operating income of $72.8 million in 2025, representing increases of 1.6 percentage points and $49.9 million, respectively, over 2024.

- Bloom Energy generated $113.9 million in cash flow from operating activities in 2025, marking its second consecutive year of positive free cash flow.

- The current product backlog grew approximately 2.5 times year-over-year to ~$6 billion.

- For the full year 2026, the company projects revenue between $3.1 billion and $3.3 billion, with a Non-GAAP Gross Margin of approximately 32% and Non-GAAP Operating Income between $425 million and $475 million.

- Bloom Energy's 2026 Data Center Power Report indicates a significant shift towards reducing reliance on utility grids, with one-third of data centers projected to be fully off-grid by 2030.

- The report highlights a geographic redistribution of data center development, driven by power availability, with Texas' data center load expected to more than double to 30% of total U.S. demand by 2028.

- In contrast, legacy data center markets like California and Oregon are anticipated to lose over 50% of their relative market share.

- Furthermore, 45% of respondents expect to adopt direct-current (DC) distribution architectures in their new data centers by 2028 to manage denser loads and accelerate build schedules.

- Bloom Energy Corporation secured a new $600 million senior secured multicurrency revolving credit facility on December 19, 2025.

- The facility matures on December 19, 2030, and its proceeds are designated for financing working capital, capital expenditures, permitted acquisitions, and other general corporate purposes.

- Loans under the facility will bear interest at an annual rate of Term SOFR plus an applicable margin ranging from 1.50% to 2.25% or an adjusted base rate plus a margin from 0.50% to 1.25%, based on the Company's Total Leverage Ratio.

- The Credit Agreement includes financial covenants requiring a maximum Secured Leverage Ratio of 3.25 to 1.00 and a minimum Consolidated Interest Coverage Ratio of 3.00 to 1.00, both to be tested quarterly starting from the fiscal quarter ending December 31, 2025.

- Bloom Energy Corporation priced an upsized offering of $2.2 billion aggregate principal amount of 0% convertible senior notes due 2030 on October 30, 2025, which was increased from the previously announced $1.75 billion. The offering settled on November 4, 2025, with a total of $2.5 billion principal amount of notes issued, including the full exercise of an option for additional notes.

- The notes have an initial conversion rate of 5.1290 shares of Class A common stock per $1,000 principal amount, equating to an initial conversion price of approximately $194.97 per share. This represents a premium of approximately 52.50% over the last reported sale price of $127.85 per share on October 30, 2025.

- Bloom Energy estimates net proceeds of approximately $2.16 billion (or approximately $2.45 billion if the initial purchasers' option is fully exercised).

- Approximately $988.4 million of the net proceeds will be used to fund the cash portion of concurrent exchange transactions for existing convertible notes. These transactions involve exchanging $532.8 million principal amount of 2028 Notes and $443.1 million principal amount of 2029 Notes for cash and Class A common stock. The remaining net proceeds are intended for general corporate purposes.

- GTT reported revenue of 599.6 million euros for the first nine months of 2025, representing a 29.0% increase compared to the same period in 2024.

- The company revised its 2025 objectives upwards, now expecting revenue in the range of 790–820 million euros and EBITDA between 530–550 million euros.

- The acquisition of Danelec was completed on July 31, 2025, contributing to an 83.4% growth in the digital business revenue, which reached 19.9 million euros for the first nine months of 2025.

- GTT secured significant new orders during the first nine months of 2025, including 19 LNG carriers, 7 ethane carriers, 1 FLNG, and 18 LNG-powered container ships.

Fintool News

In-depth analysis and coverage of Bloom Energy.

Quarterly earnings call transcripts for Bloom Energy.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more