Earnings summaries and quarterly performance for BANK OF HAWAII.

Executive leadership at BANK OF HAWAII.

Peter S. Ho

Chairman and Chief Executive Officer

Bradley S. Satenberg

Vice Chair and Chief Financial Officer

James C. Polk

President and Chief Banking Officer

Jeanne M. Dressel

Principal Accounting Officer (Senior Vice President and Controller)

Marco A. Abbruzzese

Vice Chair and Senior Executive Director of Wealth Management

Matthew K.M. Emerson

Chief Retail Banking Officer

Patrick M. McGuirk

Vice Chair and Chief Administrative Officer

S. Bradley Shairson

Vice Chair and Chief Risk Officer

Taryn L. Salmon

Vice Chair and Chief Information and Operations Officer

Board of directors at BANK OF HAWAII.

Alicia E. Moy

Director

Dana M. Tokioka

Director

Elliot K. Mills

Director

John C. Erickson

Director

Joshua D. Feldman

Director

Kent T. Lucien

Director

Michelle E. Hulst

Director

Raymond P. Vara, Jr.

Lead Independent Director

Robert W. Wo

Director

Suzanne P. Vares-Lum

Director

Victor K. Nichols

Director

Research analysts who have asked questions during BANK OF HAWAII earnings calls.

Jeff Rulis

D.A. Davidson & Co.

9 questions for BOH

Kelly Motta

Keefe, Bruyette & Woods

9 questions for BOH

Jared Shaw

Barclays

8 questions for BOH

Andrew Terrell

Stephens Inc.

5 questions for BOH

Matthew Clark

Piper Sandler

4 questions for BOH

Andrew Liesch

Piper Sandler

3 questions for BOH

Jared David Shaw

Barclays Capital

1 question for BOH

Recent press releases and 8-K filings for BOH.

- Peter S. Ho, Chairman and CEO of Bank of Hawai'i, will retire effective March 31, 2026, concluding a 33-year career with the company, with 16 years as Chairman and CEO.

- James C. Polk, current President and Chief Banking Officer, will succeed Ho as President and Chief Executive Officer, effective April 1, 2026, and will also join the Board of Directors.

- Mr. Polk's annual base salary will be $825,000, effective April 1, 2026.

- Raymond P. Vara, Jr., current Lead Independent Director, will assume the new role of Non-Executive Chairman of the Board on April 1, 2026.

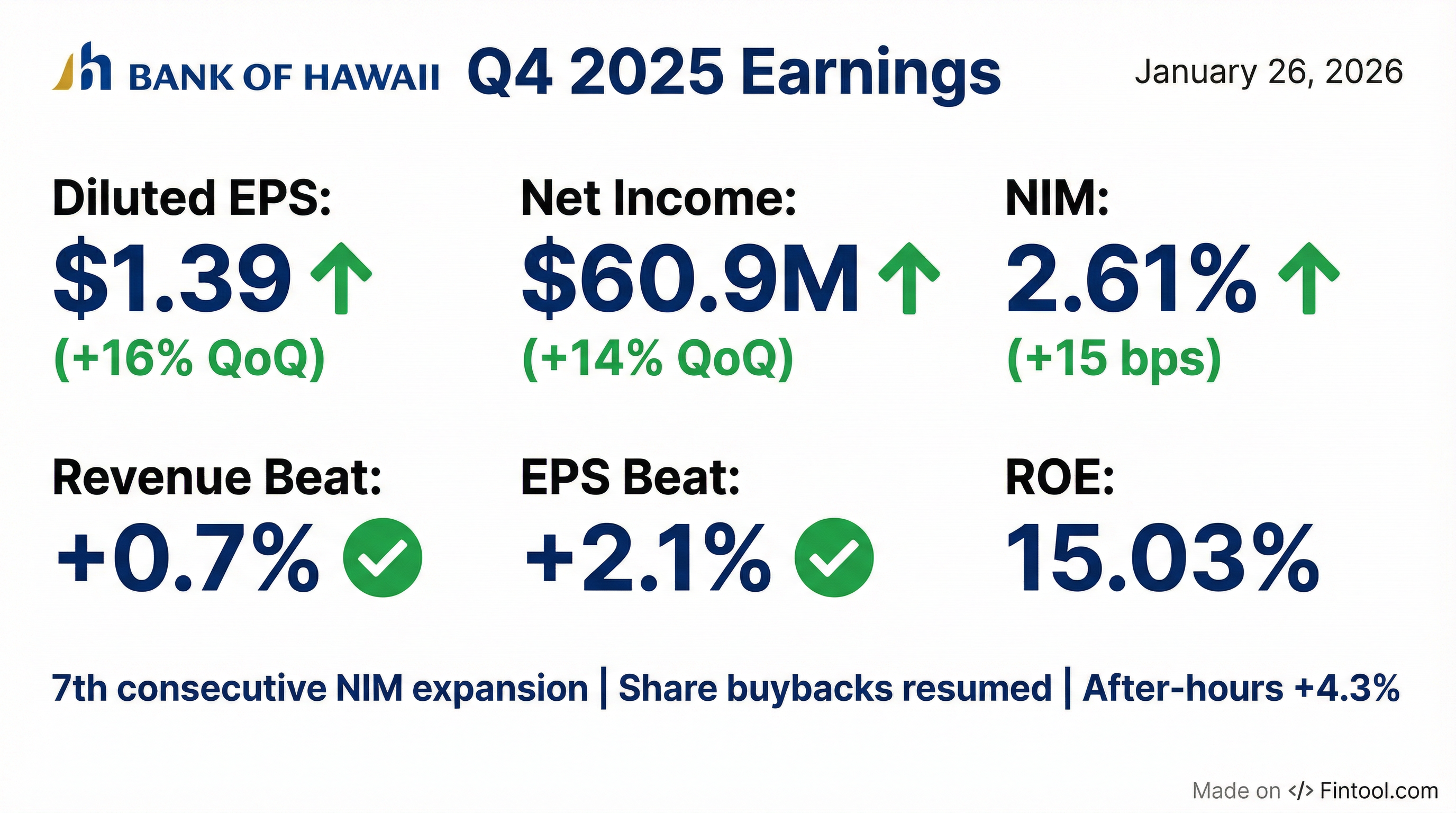

- Bank of Hawaii reported strong Q4 2025 results, with fully diluted earnings per share of $1.39, a 63% increase year-over-year, and net interest margin (NIM) expanding for the seventh consecutive quarter to 2.61%.

- The company anticipates NIM to reach near the 2.90% range by the end of 2026, driven by fixed asset repricing, deposit remix, and rate cuts.

- Credit quality remained pristine, with non-performing assets declining to 10 basis points and the allowance for credit losses (ACL) to outstandings at 1.04%. Non-interest-bearing demand deposits grew 6.6% on a linked basis, and the company expects mid-single-digit loan growth for 2026.

- Bank of Hawaii resumed its stock repurchase program, buying $5 million in Q4 2025, and plans to increase repurchases to $15 million-$20 million per quarter moving forward, with $121 million remaining under the current plan.

- Bank of Hawai'i Corporation reported diluted earnings per common share of $1.39 and net income of $60.9 million for the fourth quarter of 2025.

- The company achieved its seventh consecutive quarter of Net Interest Margin (NIM) expansion, reaching 2.61%, and saw Net Interest Income (NII) rise to $145.4 million.

- The average cost of total deposits decreased to 1.43% from 1.59% in the linked quarter, with noninterest-bearing demand increasing by 6.6%.

- Credit quality remained strong, with a net charge-off rate of 0.12% and non-performing assets at 0.10%.

- Bank of Hawai'i Corporation resumed share buybacks in Q4 2025, supported by a Tier 1 capital ratio of 14.49% and a total capital ratio of 15.54%.

- Bank of Hawaii Corporation (BOH) reported fully diluted earnings per share of $1.39 for Q4 2025, representing a 63% increase year-over-year and a 16% rise from the previous quarter.

- The Net Interest Margin (NIM) expanded by 15 basis points to 2.61% in Q4 2025, marking the seventh consecutive quarter of improvement, with a projection to reach near 2.90% by the end of 2026.

- Credit quality remained strong, with Net Charge-Offs totaling $4.1 million (12 basis points annualized) and Non-Performing Assets declining to 10 basis points.

- The company resumed its share repurchase program in Q4 2025, purchasing approximately $5 million of common shares, and plans to increase quarterly repurchases to $15 million-$20 million moving forward.

- Management anticipates mid-single-digit loan growth for 2026 and forecasts 2026 noninterest expense to increase by 3% to 3.5% from 2025 normalized expenses.

- Bank of Hawaii Corporation reported fully diluted earnings per share of $1.39 for Q4 2025, marking a 63% increase from a year ago and 16% higher than the previous quarter.

- The Net Interest Margin (NIM) improved for the seventh consecutive quarter, rising 15 basis points to 2.61% in Q4 2025, with an expectation to reach near 2.90% by the end of 2026.

- Credit quality remained strong, with Net Charge-Offs totaling $4.1 million (12 basis points annualized) and Non-Performing Assets declining to 10 basis points. The Allowance for Credit Losses (ACL) stood at $146.8 million, representing 1.04% of outstandings.

- The company resumed its stock repurchase program in Q4 2025, purchasing approximately $5 million of common shares, and plans to increase repurchases to $15 million-$20 million per quarter moving forward.

- Noninterest expense for Q4 2025 was $109.5 million, with a forecast for 2026 expenses to increase by 3% to 3.5% from 2025 normalized expenses.

- Bank of Hawai'i Corporation reported diluted earnings per common share of $1.39 for the fourth quarter of 2025 and $4.63 for the full year 2025, with net income of $60.9 million for Q4 2025 and $205.9 million for the full year.

- The company's Net Interest Margin (NIM) expanded for the seventh consecutive quarter to 2.61% in the fourth quarter of 2025, a 15 basis point improvement from the linked quarter, and the average cost of total deposits decreased to 1.43%.

- Share repurchases resumed in Q4 2025, with 76.5 thousand shares repurchased for $5.0 million, and a quarterly cash dividend of $0.70 per share was declared.

- Capital ratios remained strong, with a Tier 1 Capital Ratio of 14.49% and a Total Capital Ratio of 15.54% at December 31, 2025.

- Bank of Hawai'i Corporation reported diluted earnings per common share of $1.39 for the fourth quarter of 2025 and $4.63 for the full year 2025.

- Net income for the fourth quarter of 2025 was $60.9 million, and $205.9 million for the full year 2025.

- The net interest margin increased to 2.61% in the fourth quarter of 2025, marking a 15 basis point improvement from the linked quarter.

- The company resumed share repurchases during the fourth quarter of 2025, buying back 76.5 thousand shares at a total cost of $5.0 million, with $121.0 million remaining under the share repurchase program.

- A quarterly cash dividend of $0.70 per share on common shares was declared.

- Bank of Hawaii Corporation reported strong third quarter 2025 results, with fully diluted earnings per share of $1.20, marking a 29% increase from a year ago and a 13% increase from the previous quarter. Net income for the quarter was $53.3 million.

- The net interest margin (NIM) improved for the sixth consecutive quarter, increasing by seven basis points to 2.46%. The company anticipates further NIM expansion, projecting a 25 basis point pickup per year.

- Credit quality remained pristine, with net charge-offs at $2.6 million (seven basis points annualized) and non-performing assets at 12 basis points. The allowance for credit losses (ACL) stood at $148.8 million, with the ratio to outstandings remaining flat at 1.06%.

- The company declared a dividend of $0.70 per common share and indicated plans to engage in share repurchases, with $126 million remaining available under the current program.

- Strategic actions included the sale of its merchant services business, which resulted in an $18 million gain, and the repositioning of its AFS securities portfolio, expected to increase quarterly net interest income by approximately $1.7 million.

- Bank of Hawaii Corporation reported strong Q3 2025 results, with fully diluted earnings per share of $1.20, a 29% increase year-over-year and 13% quarter-over-quarter.

- The net interest margin (NIM) improved for the sixth consecutive quarter, increasing by seven basis points to 2.46%, with further expansion anticipated.

- Credit quality remained strong, with net charge-offs at $2.6 million (seven basis points annualized) and non-performing assets at 12 basis points.

- Management expects low single-digit loan growth for Q4 2025 and 2026, and anticipates 2026 expenses to increase in the 3+% range. The board declared a $0.70 per common share dividend for Q4 2025, and $126 million remains available for share repurchases, with activity likely in Q4 and next year.

- Bank of Hawaii (BOH) reported fully diluted earnings per share of $1.2 for Q3 2025, a 13% increase from the previous quarter. The net interest margin (NIM) improved to 2.46%, marking the sixth consecutive quarter of expansion, and is anticipated to expand further.

- The company maintained strong credit quality with net charge-offs at $2.6 million (seven basis points annualized) and nonperforming assets at 12 basis points. The loan portfolio is 93% Hawaii-based and diversified.

- BOH advanced its number one deposit market share position in Hawaii by 40 basis points as of June 30, 2025. Strategic actions included remixing $594 million in fixed-rate assets and investments to a higher roll-on rate.

- The sale of the merchant services business, combined with securities repositioning, is expected to result in a $1 million or $0.02 per share improvement to quarterly pretax earnings. The company is also investing in its wealth management initiative and plans to add talent.

- BOH indicated a likelihood of share buyback activity in the current quarter and into next year, with $126 million remaining under the current repurchase program. The outlook for 2026 expense growth is projected to be in the 3% to 4% range, likely closer to 3.5%.

Fintool News

In-depth analysis and coverage of BANK OF HAWAII.

Quarterly earnings call transcripts for BANK OF HAWAII.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more