Earnings summaries and quarterly performance for Bankwell Financial Group.

Executive leadership at Bankwell Financial Group.

Christopher Gruseke

Chief Executive Officer

Christine Chivily

Chief Credit Officer

Courtney Sacchetti

Chief Financial Officer

Matthew McNeill

President and Chief Banking Officer

Ryan Hildebrand

Chief Innovation Officer

Steven Brunner

Chief Risk Officer

Board of directors at Bankwell Financial Group.

Anahaita Kotval

Director

Blake Drexler

Chairman of the Board

Carl Porto

Director

Darryl Demos

Director

Eric Dale

Vice Chairman of the Board

Jeffrey Dunne

Director

Kevin Leitão

Director

Lawrence Seidman

Director

Todd Lampert

Director and Corporate Secretary

Research analysts who have asked questions during Bankwell Financial Group earnings calls.

Steve Moss

Raymond James

6 questions for BWFG

David Konrad

Keefe, Bruyette & Woods (KBW)

5 questions for BWFG

Feddie Strickland

Hovde Group

5 questions for BWFG

Christopher O'Connell

Keefe, Bruyette, & Woods, Inc.

3 questions for BWFG

David Joseph Konrad

KBW

2 questions for BWFG

Feddie Justin Strickland

Hovde Group, Inc.

2 questions for BWFG

Stephen Moss

Raymond James Financial, Inc.

2 questions for BWFG

Anira

Hovde Group

1 question for BWFG

Stephen M. Moss

Raymond James & Associates

1 question for BWFG

Recent press releases and 8-K filings for BWFG.

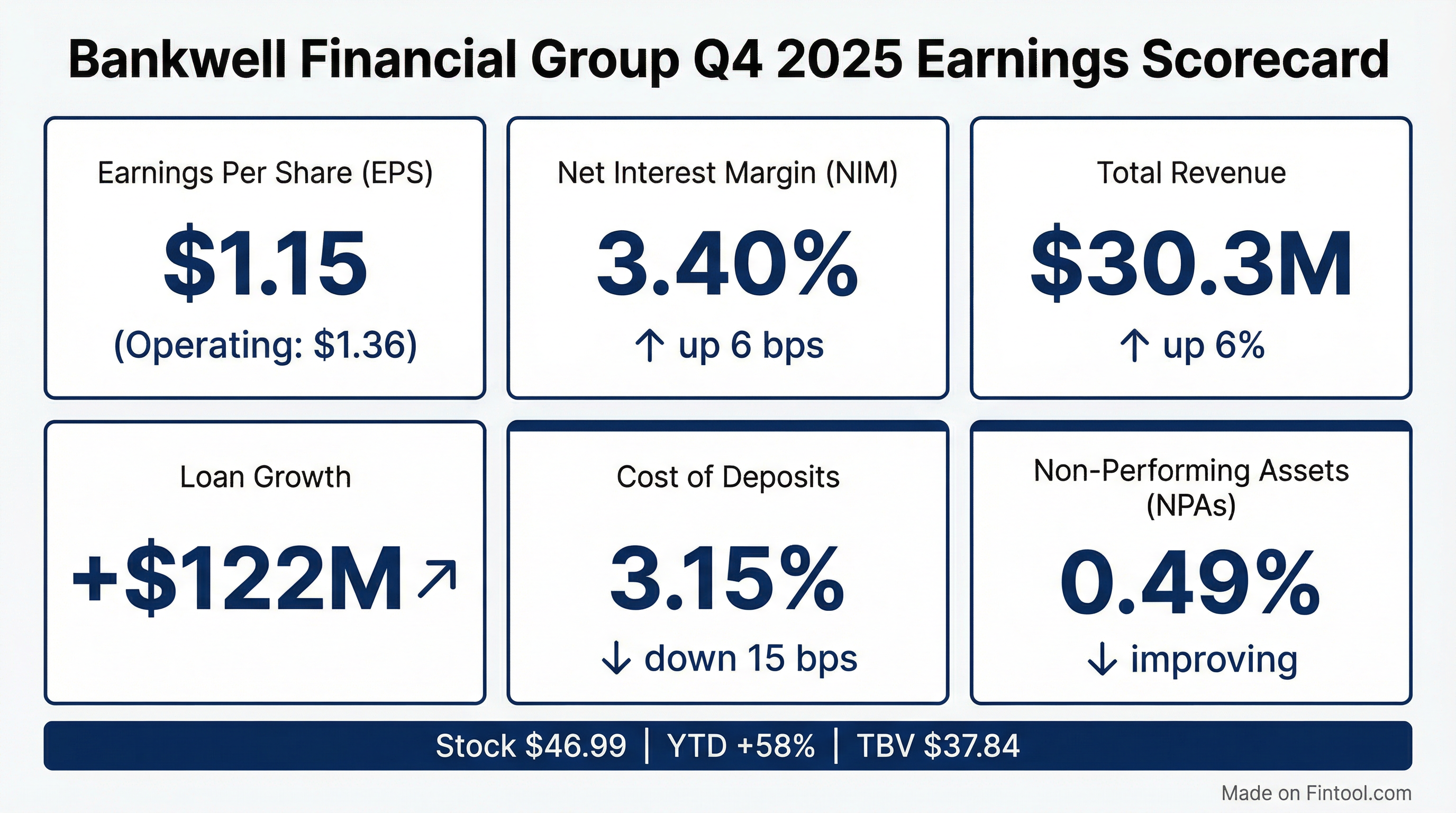

- Bankwell Financial Group (BWFG) reported Q4 2025 GAAP net income of $9.1 million, or $1.15 per share, and operating income of $10.7 million, or $1.36 per share, excluding a one-time tax adjustment.

- Net loan growth for Q4 2025 was $122 million, contributing to a full-year 2025 net loan growth of $134 million, or 5%.

- The company's net interest margin expanded to 340 basis points, up 6 basis points from the prior quarter, driven by a 15 basis point reduction in deposit costs to 3.15%.

- Non-interest income increased to $3.4 million in Q4 2025, primarily due to $2.2 million in SBA gain on sale income.

- For 2026, BWFG expects loan growth of 4%-5%, net interest income between $111 million-$112 million, non-interest income of $11 million-$12 million, and total non-interest expense of $64 million-$65 million.

- BWFG reported Q4 2025 GAAP net income of $9.1 million, or $1.15 per share, and operating income of $10.7 million, or $1.36 per share.

- The company achieved a net interest margin of 340 basis points and an efficiency ratio of 50.8% in Q4 2025, with non-performing assets as a percentage of total assets falling to 49 basis points.

- Net loan growth for Q4 2025 was $122 million, contributing to 5% annual loan growth for 2025, and SBA gain on sale income increased to $2.2 million for the quarter.

- For 2026, BWFG expects loan growth of 4%-5%, net interest income in the range of $111 million-$112 million, non-interest income of $11 million-$12 million, and total non-interest expense of $64 million-$65 million. SBA originations are anticipated to be around $100 million.

- Bankwell Financial Group (BWFG) reported fully diluted EPS of $1.15, or $1.36 on an operating basis, for Q4 2025.

- The company achieved $122 million in net loan growth during Q4 2025, contributing to an annual loan growth of 5.0%.

- Net Interest Margin (NIM) expanded by 6 basis points quarter-over-quarter to 3.40%, driven by a 15 basis point reduction in total deposit costs to 3.15%.

- Non-interest income increased by $0.9 million quarter-over-quarter, primarily due to $2.2 million in gains realized on SBA Loan sales.

- Tangible book value per share rose by $1.00 quarter-over-quarter to $37.84.

- BWFG reported Q4 2025 GAAP net income of $9.1 million or $1.15 per share, and operating net income of $10.7 million or $1.36 per share (excluding a one-time tax adjustment).

- The company achieved a net interest margin of 340 basis points in Q4 2025, an increase of 6 basis points from the prior quarter, driven by a 15 basis point reduction in deposit costs.

- Net loan growth for Q4 2025 was $122 million, contributing to 5% annual loan growth for the full year, and non-performing assets decreased to 49 basis points of total assets.

- For 2026, BWFG provided guidance including loan growth of 4%-5%, net interest income between $111 million and $112 million, non-interest income of $11 million-$12 million, and total non-interest expense of $64 million-$65 million.

- Bankwell Financial Group reported GAAP net income of $9.1 million, or $1.15 per share, and operating net income of $10.7 million, or $1.36 per share, for the fourth quarter of 2025.

- The company's Board of Directors declared a $0.20 per share cash dividend, payable February 20, 2026, to shareholders of record on February 10, 2026.

- For 2026, the company expects loan growth of 4 to 5 percent, net interest income in the range of $111 to $112 million, non-interest income of $11 to $12 million, and total non-interest expense of $64 to $65 million, with an anticipated efficiency ratio of approximately 51% to 53%.

- Nonperforming assets as a percentage of total assets improved to 0.49% as of December 31, 2025, down from 0.56% as of September 30, 2025.

- Bankwell Financial Group reported GAAP net income of $9.1 million, or $1.15 per share, and operating net income of $10.7 million, or $1.36 per share, for the fourth quarter of 2025.

- The company's Board of Directors declared a $0.20 per share cash dividend, payable February 20, 2026.

- For 2026, the company expects loan growth of 4 to 5 percent, net interest income between $111 million and $112 million, and non-interest income of approximately $11 million to $12 million.

- Total non-interest expense for 2026 is estimated at $64 million to $65 million, projecting an efficiency ratio of approximately 51% to 53%.

- As of December 31, 2025, total assets were $3.4 billion, with total loans increasing 5.0% year-over-year to $2.8 billion. The Net Interest Margin for Q4 2025 was 3.40% and the efficiency ratio was 50.8%.

- Bankwell Financial Group reported GAAP net income of $10.1 million, or $1.27 per share, for Q3 2025, an increase from the previous quarter.

- The company's Net Interest Margin (NIM) expanded to 3.34%, up 24 basis points over the prior quarter, and its efficiency ratio improved to 51.4%.

- Credit quality improved, with non-performing assets as a percentage of total assets falling to 56 basis points.

- While loan fundings were strong at $220 million for the quarter, the full-year loan growth guidance was revised to flat due to elevated payoffs. The company affirmed its full-year guidance for non-interest income at $7 million-$8 million, net interest income at $97 million-$98 million, and non-interest expense at $58 million-$59 million.

- Bankwell Financial Group reported GAAP net income of $10.1 million, or $1.27 per share, for Q3 2025, an increase from $9.1 million, or $1.15 per share, last quarter.

- The company's net interest margin expanded to 3.34%, up 24 basis points over the prior quarter, and the efficiency ratio improved to 51.4%.

- Non-performing assets as a percentage of total assets fell to 56 basis points in Q3 2025, down from 78 basis points last quarter, reflecting continued positive credit trends.

- Loan originations remained strong at $220 million for the quarter, bringing year-to-date fundings to $500 million, though full-year loan growth guidance was revised to flat due to elevated payoffs.

- The company affirmed its full-year guidance for non-interest income at $7 million to $8 million, net interest income at $97 million to $98 million, and non-interest expense at $58 million to $59 million.

Quarterly earnings call transcripts for Bankwell Financial Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more