Earnings summaries and quarterly performance for COMMUNITY FINANCIAL SYSTEM.

Executive leadership at COMMUNITY FINANCIAL SYSTEM.

Dimitar Karaivanov

President and Chief Executive Officer

Jeffrey Levy

Senior Vice President and Chief Banking Officer

Marya Burgio Wlos

Executive Vice President and Chief Financial Officer

Maureen Gillan-Myer

Executive Vice President and Chief Administration and Human Resources Officer

Michael Abdo

Executive Vice President and General Counsel

Board of directors at COMMUNITY FINANCIAL SYSTEM.

Eric Stickels

Chair of the Board

Jeffery Knauss

Director

John Parente

Director

John Vaccaro

Director

John Whipple Jr.

Director

Kerrie MacPherson

Director

Mark Bolus

Director

Michele Sullivan

Director

Neil Fesette

Director

Raymond Pecor III

Director

Sally Steele

Director

Savneet Singh

Director

Research analysts who have asked questions during COMMUNITY FINANCIAL SYSTEM earnings calls.

Matthew Breese

Stephens Inc.

9 questions for CBU

David Konrad

Keefe, Bruyette & Woods (KBW)

8 questions for CBU

Steve Moss

Raymond James

8 questions for CBU

Manuel Navis

D.A. Davidson

4 questions for CBU

Christopher O'Connell

Keefe, Bruyette, & Woods, Inc.

3 questions for CBU

Manuel Navas

D.A. Davidson & Co.

3 questions for CBU

Stephen Moss

Raymond James Financial, Inc.

3 questions for CBU

Frank Schiraldi

Piper Sandler

2 questions for CBU

Sharanjit Cheema

D.A. Davidson & Co.

2 questions for CBU

Tyler Cacciatori

Stephens Inc.

2 questions for CBU

Sharon Gee

D.A. Davidson & Co.

1 question for CBU

Recent press releases and 8-K filings for CBU.

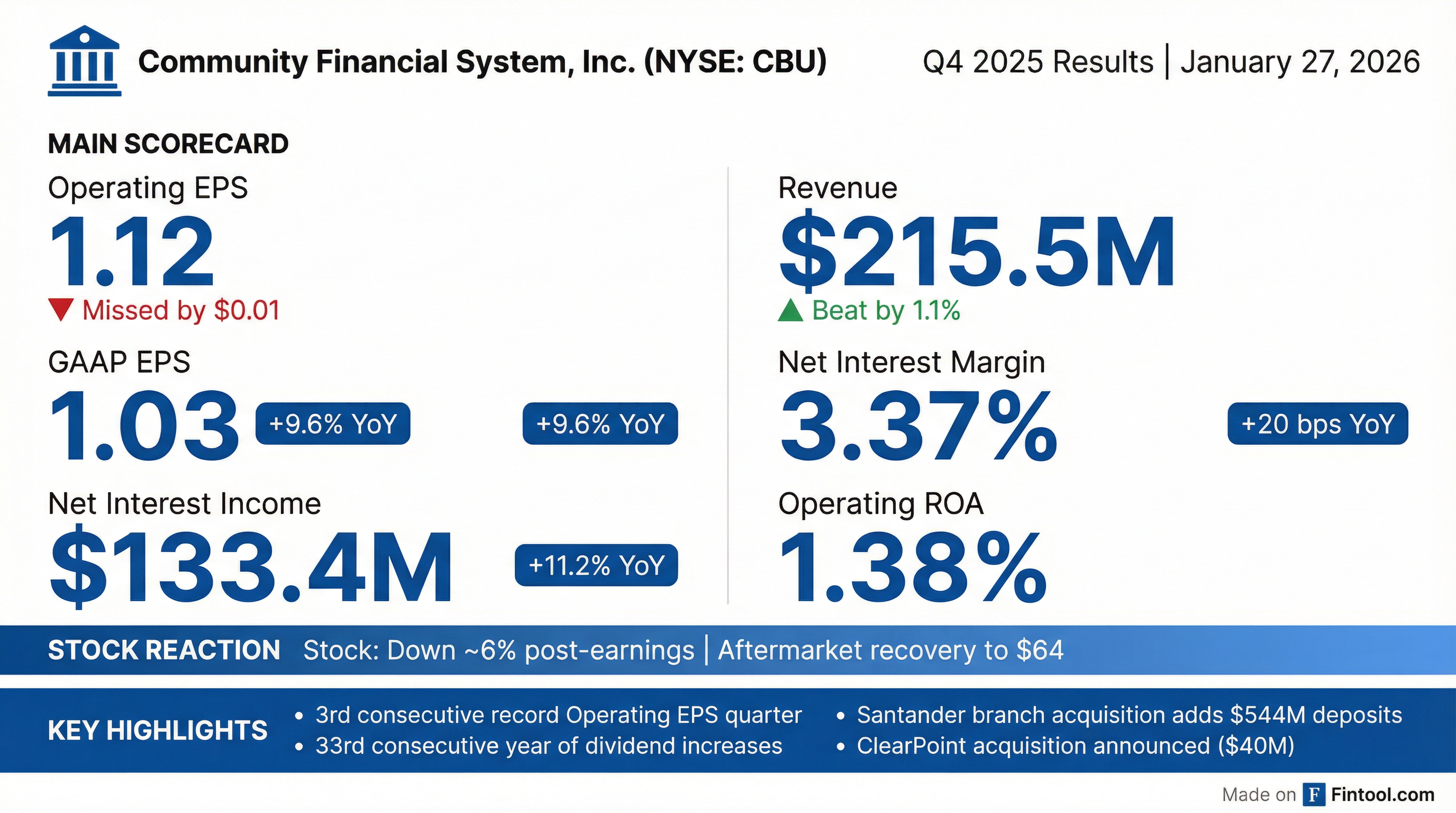

- Community Financial System (CBU) reported Q4 2025 operating earnings per share of $1.12 and achieved 16% operating earnings growth for the full year 2025. Total operating revenues reached a new quarterly high of $215.6 million in Q4 2025.

- The banking business demonstrated strong performance in 2025 with 22% operating income growth and 5% loan growth. Net interest income for Q4 2025 was $133.4 million, an 11.2% improvement over Q4 2024, and the fully tax-equivalent net interest margin expanded by six basis points to 3.39% from the linked third quarter.

- CBU continued its strategic expansion, integrating 7 former Santander branches and opening 15 new branches in 2025. The company also announced an agreement to acquire ClearPoint Federal Bank & Trust, expected to close in Q2 2026, which will significantly expand its wealth management business.

- For 2026, the company expects loan balance growth of 3.5%-6%, deposit balance growth of 2%-3%, net interest income growth of 8%-12%, and non-interest revenue growth of 4%-8%. Non-interest expenses are projected to be in the range of $535 million-$550 million.

- Community Financial System (CBU) reported 16% operating earnings growth for the full year 2025.

- In Q4 2025, the company achieved record total operating revenues of $215.6 million, driven by a 11.2% year-over-year increase in net interest income and a 6 basis point expansion in net interest margin to 3.39%.

- For 2026, CBU projects loan growth of 3.5%-6%, deposit growth of 2%-3%, net interest income growth of 8%-12%, and non-interest revenue growth of 4%-8%.

- Strategic developments include the integration of 7 former Santander branches in Q4 2025 and an agreement to acquire ClearPoint Federal Bank & Trust, expected to close in Q2 2026, to expand wealth management and trust administration services.

- The company also noted significant full-year 2025 operating income growth in its banking (22%), insurance services (42%), and wealth management services (15%) segments.

- Community Financial System (CBU) reported record operating earnings per share of $1.12 in Q4 2025, a significant increase from $1.00 in the prior year, and achieved 16% operating earnings growth for the full year 2025.

- Total operating revenues reached a new quarterly high of $215.6 million in Q4 2025, marking a 10% increase year-over-year, with strong contributions from banking (22% operating income growth) and insurance services (42% operating income growth) for the full year.

- The company's net interest income grew 11.2% year-over-year to $133.4 million in Q4 2025, and the net interest margin expanded by 6 basis points to 3.39%. Ending loans increased 5% and total deposits grew 7% year-over-year.

- For 2026, CBU projects net interest income growth of 8%-12% and non-interest revenues growth of 4%-8%, alongside expected loan growth of 3.5%-6% and deposit growth of 2%-3%. The company also announced the acquisition of ClearPoint Federal Bank & Trust, anticipated to close in Q2 2026.

- Community Financial System, Inc. reported net income of $54.4 million, or $1.03 per share, for the fourth quarter of 2025 and $210.5 million, or $3.97 per share, for full year 2025. The company also achieved a third consecutive quarter of record operating diluted earnings per share of $1.12 in Q4 2025.

- The company experienced strong revenue performance across all businesses, with total revenues reaching $215,451 thousand in Q4 2025. Net interest income increased by 11.2% compared to Q4 2024, and the net interest margin expanded to 3.37% in Q4 2025, up 20 basis points from Q4 2024.

- Community Financial System, Inc. completed the acquisition of seven branch locations from Santander Bank, N.A. in November 2025, adding $543.7 million of customer deposits. The company also announced an agreement to acquire ClearPoint Federal Bank & Trust in January 2026, which is expected to significantly expand its wealth management services. Additionally, the company declared a quarterly cash dividend of $0.47 per share, marking the 33rd consecutive year of dividend increases, and approved a new stock repurchase program for up to 2.63 million shares.

- Community Financial System, Inc. (CBU) announced on January 15, 2026, that its banking subsidiary, Community Bank, N.A., will acquire ClearPoint Federal Bank & Trust in an all-cash transaction valued at $40 million.

- ClearPoint is a national leader in trust administration with over $1.5 billion in assets under management and a 3-year revenue CAGR of 8.8%.

- The acquisition is expected to significantly expand CBU's wealth management services, increasing Nottingham Financial Group's revenue by 20% and its contribution to CBU by 1.0%.

- The transaction is anticipated to be slightly accretive to earnings per share with a double-digit return on capital and is expected to close in the second quarter of 2026.

- Community Financial System, Inc. (CFSI) announced an agreement to acquire ClearPoint Federal Bank & Trust in an all-cash transaction valued at $40 million.

- This acquisition is expected to significantly expand CFSI's wealth management services through its Nottingham Financial Group (NFG).

- ClearPoint is a national leader in trust administration for the death care industry, with over $1.5 billion of assets under management and a 3-year revenue CAGR of 8.8%.

- The transaction is anticipated to close in the second quarter of 2026, subject to shareholder and regulatory approvals.

- Community Financial System, Inc. (CBU), through its wholly-owned banking subsidiary Community Bank, N.A., completed the acquisition of seven branches in the Allentown, Pennsylvania area from Santander Bank, N.A. on November 7, 2025.

- As part of the transaction, Community Bank acquired approximately $553.0 million of deposits and approximately $31.9 million of performing loans.

- This strategic acquisition accelerates Community Bank’s expansion in the Greater Lehigh Valley, complementing its existing presence and securing a Top 5 market position with a total of 12 retail locations in the region.

- Community Bank, N.A., a subsidiary of Community Financial System, Inc. (CBU), has completed the acquisition of seven former Santander Bank, N.A. branches in the Allentown, Pennsylvania area.

- This acquisition adds approximately $553.0 million in customer deposit accounts.

- With this acquisition, Community Bank will operate a total of 12 retail locations in the Greater Lehigh Valley, securing a Top 5 market position in the region.

- Community Financial System, Inc. (CBU) reported strong Q3 2025 results, with record operating earnings per share of $1.09, a 23.9% increase year-over-year, and total operating revenues of $206.8 million, up 9.4% from the prior year.

- The company highlighted diversified revenue growth, with pre-tax tangible returns for the quarter at 63% for insurance services and 62% for employee benefit services, and has deployed approximately $100 million in cash capital for strategic transactions year-to-date.

- Strategic initiatives include the upcoming acquisition of seven Santander branches in the Lehigh Valley market and a minority investment in Leap Holdings Inc. to enhance its insurance services business.

- CBU's balance sheet remains robust, with ending loans increasing 4.9% and total deposits growing 4.3% year-over-year, alongside a strong Tier-one leverage ratio of 9.46% and stable asset quality metrics.

- The company maintains its 4% to 5% loan growth guidance for the year and anticipates continued net interest margin expansion in Q4 2025.

- Community Financial Systems, Inc. (CBU) reported record operating earnings per share of $1.09 in Q3 2025, a 23.9% increase year-over-year, driven by record total operating revenues of $206.8 million.

- The company demonstrated strong financial health with net interest income of $128.2 million, a 15.07% improvement year-over-year, and a net interest margin of 3.33%.

- CBU saw significant balance sheet growth, with ending loans increasing by 4.9% year-over-year and total deposits growing by 4.3% year-over-year, while maintaining a strong Tier one leverage ratio of 9.46%.

- Strategic capital deployment included approximately $100 million in cash capital for transactions aligning with strategic priorities and the buyback of approximately 206,000 shares.

- Looking ahead, CBU anticipates closing the acquisition of seven Santander branches on November 7 and made a minority investment in Leap Holdings, Inc., expecting continued loan growth of 4% to 5% for the year.

Quarterly earnings call transcripts for COMMUNITY FINANCIAL SYSTEM.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more