Earnings summaries and quarterly performance for CONMED.

Executive leadership at CONMED.

Patrick Beyer

President and Chief Executive Officer

Andrew Moller

Vice President, Corporate Controller

Brent Lalomia

Executive Vice President, Regulatory Affairs, Quality Assurance, Clinical Affairs, and Commercial Operations

Edward Clifford

Vice President, Global Manufacturing

Hollie Foust

Executive Vice President, General Counsel and Corporate Secretary

John Ferrell

Executive Vice President, Human Resources

Johonna Pelletier

Treasurer and Vice President, Tax

Peter Shagory

Executive Vice President, Strategy and Corporate Development

Richard Glaze

Chief Information Officer

Stephan Epinette

Vice President and General Manager, International

Todd Garner

Executive Vice President, Finance and Chief Financial Officer

Board of directors at CONMED.

Research analysts who have asked questions during CONMED earnings calls.

Young Li

Jefferies

5 questions for CNMD

Robbie Marcus

JPMorgan Chase & Co.

4 questions for CNMD

Travis Steed

Bank of America

4 questions for CNMD

Mike Matson

Needham & Company, LLC

3 questions for CNMD

Vik Chopra

Wells Fargo & Company

3 questions for CNMD

Frederick Wise

Stifel

2 questions for CNMD

Matthew O'Brien

Piper Sandler

2 questions for CNMD

Michael Matson

Needham & Company

2 questions for CNMD

Robert Marcus

JPMorgan Chase & Co.

2 questions for CNMD

Kristen Stewart

CL King & Associates

1 question for CNMD

Matthew O'Brien

Piper Sandler & Co.

1 question for CNMD

Phillip Dantoin

Piper Sandler

1 question for CNMD

Vikramjeet Chopra

Wells Fargo & Company

1 question for CNMD

Recent press releases and 8-K filings for CNMD.

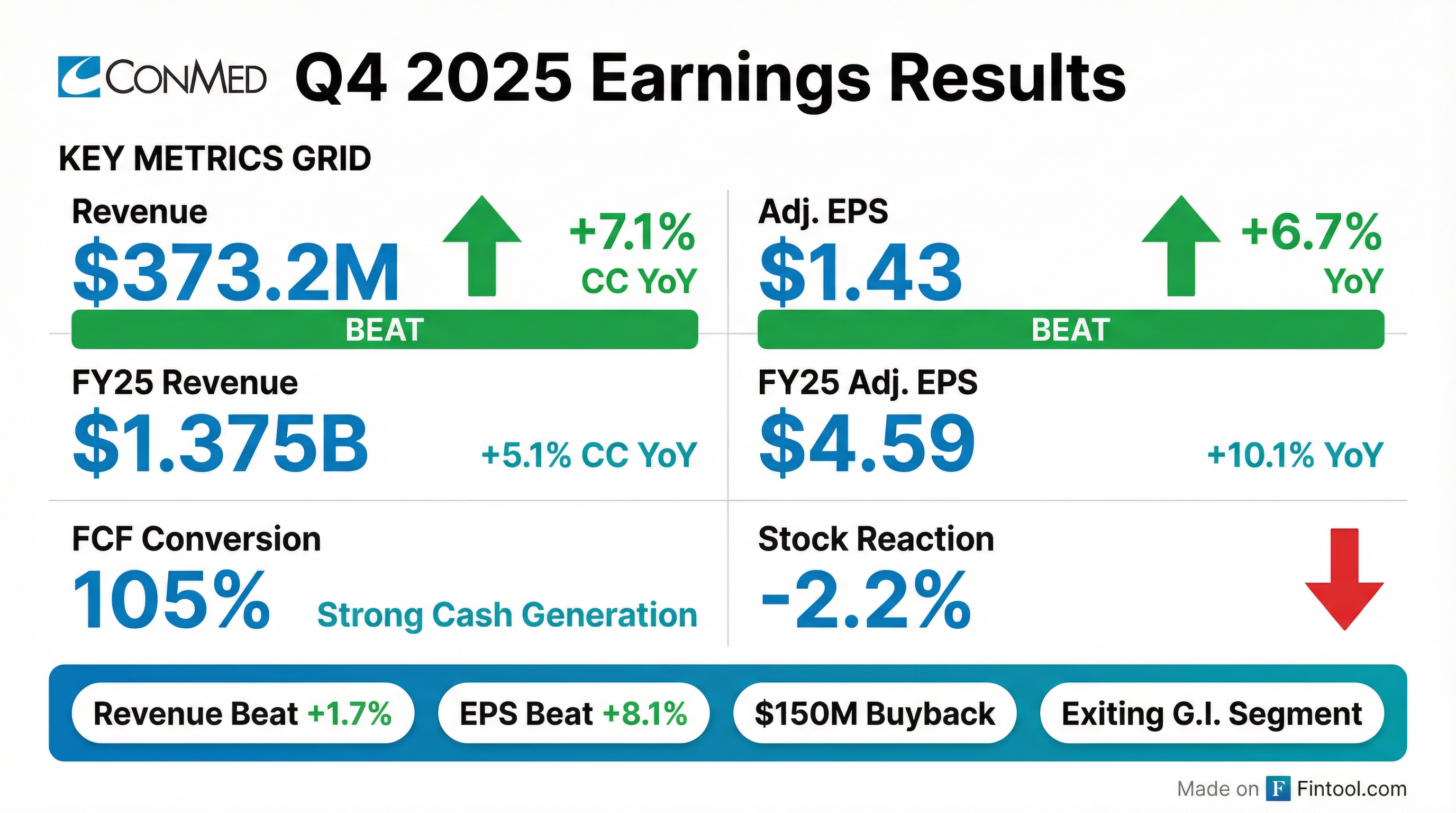

- CONMED reported Q4 2025 total sales of $373.2 million, an increase of 7.1% in constant currency, and full-year 2025 total sales of $1.375 billion, up 5.1% in constant currency.

- Adjusted diluted EPS for Q4 2025 was $1.43, a 6.7% increase, and full-year adjusted EPS was $4.59, a 10.1% increase.

- For 2026, the company guides full-year reported revenue between $1.345 billion and $1.375 billion (4.5% to 6% constant currency organic growth) and adjusted EPS between $4.30 and $4.45.

- Strategic initiatives include the decision to exit gastroenterology product lines , the suspension of its dividend, and the approval of a $150 million share repurchase authorization.

- The company also announced a CFO transition, with Todd Garner moving to an advisory role after a transition period.

- CONMED reported Q4 2025 revenue of $373.2 million and Adjusted Diluted EPS of $1.43, representing 7.9% and 6.7% growth respectively compared to Q4 2024. For the full year 2025, revenue was $1,374.7 million and Adjusted Diluted EPS was $4.59, growing 5.2% and 10.1% respectively over FY 2024.

- The company provided 2026 financial guidance, projecting Total Reported Revenue between $1,345 million and $1,375 million and Total Adjusted EPS between $4.30 and $4.45.

- CONMED announced a $150 million share buyback program and an intent to exit gastroenterology to sharpen focus on core platforms like minimally invasive surgery, smoke evacuation, and orthopedic soft tissue repair.

- CONMED reported Q4 2025 total sales of $373.2 million, an increase of 7.9% (7.1% in constant currency), and full-year 2025 sales of $1.375 billion, up 5.2% (5.1% in constant currency).

- Adjusted diluted EPS for Q4 2025 was $1.43, a 6.7% increase, and full-year 2025 adjusted diluted EPS was $4.59, a 10.1% increase.

- For 2026, the company guides reported revenue between $1.345 billion and $1.375 billion (4.5% to 6% constant currency organic growth) and adjusted EPS between $4.30 and $4.45.

- CONMED announced a strategic decision in December to exit its gastroenterology product lines, which is expected to improve the long-term consolidated growth margin profile by approximately 80 basis points.

- The company also suspended its dividend and approved a $150 million share repurchase authorization; additionally, Todd Garner will transition from CFO to an advisory role, with a search for a new CFO underway.

- CONMED reported Q4 2025 total sales of $373.2 million, a 7.9% year-over-year increase, and full-year sales of $1.375 billion, up 5.2% as reported. Adjusted diluted EPS was $1.43 for Q4 2025 (up 6.7%) and $4.59 for the full year 2025 (up 10.1%).

- The company announced a strategic decision to exit its gastroenterology product lines, which is expected to improve the long-term consolidated growth margin profile by approximately 80 basis points.

- CONMED provided 2026 full-year guidance, projecting reported revenue between $1.345 billion and $1.375 billion (representing 4.5% to 6% constant currency organic growth) and adjusted EPS between $4.30 and $4.45.

- To enhance shareholder value, the board suspended the dividend and approved a $150 million share repurchase authorization.

- Operational improvements include significant progress in resolving sports medicine supply chain constraints, with backorder value and SKUs at a three-year low by the end of 2025.

- CONMED Corporation reported sales of $373.2 million for Q4 2025, an increase of 7.9% year-over-year, and full-year 2025 sales of $1,374.7 million, up 5.2% year-over-year.

- For Q4 2025, adjusted diluted net earnings per share were $1.43, compared to $1.34 in Q4 2024. For the full-year 2025, adjusted diluted net earnings per share were $4.59, compared to $4.17 in 2024.

- The company expects full-year 2026 reported revenue to be between $1.345 billion and $1.375 billion, and full-year 2026 adjusted diluted net earnings per share in the range of $4.30 to $4.45.

- CONMED Corporation reported fourth quarter 2025 sales of $373.2 million, an increase of 7.9% year-over-year, with adjusted diluted net earnings per share of $1.43.

- For the full-year 2025, sales reached $1,374.7 million, a 5.2% increase year-over-year, and adjusted diluted net earnings per share were $4.59.

- The company provided full-year 2026 guidance, projecting reported revenue between $1.345 billion and $1.375 billion and adjusted diluted net earnings per share in the range of $4.30 to $4.45.

- CONMED provided preliminary 2026 guidance, projecting revenue between $1.345 billion and $1.375 billion and adjusted EPS between $4.25 and $4.45. This guidance reflects the exit of the GI business in December 2025, which reduces revenue by $78-$82 million and EPS by $0.50, along with an incremental tariff impact of $0.30-$0.35.

- The company is strategically focusing on its high-growth, high-margin platforms: AirSeal, Buffalo Filter (smoke evacuation), and BioBrace (orthopedic soft tissue repair). The GI business divestiture was undertaken to align resources with these core growth drivers.

- CONMED achieved its target of lowering leverage to below three by the end of Q3 2025. The company suspended its dividend in 2025 and announced a shift to share repurchases, contributing $0.07 to the 2026 EPS guidance.

- Key growth drivers include AirSeal, which is expanding into the laparoscopy market where it holds 6%-7% market share, and Buffalo Filter, whose market is projected to grow from $300-$350 million to over $1 billion due to increasing legislation and clinical validation. BioBrace, an FDA-approved tissue repair technology, launched a new delivery device in 2025 and anticipates clinical data publication in 2027.

- CONMED presented its preliminary financial guidance for Full Year 2026 at the J.P. Morgan 44th Annual Healthcare Conference on January 12, 2026.

- For FY 2026, the company anticipates Total Reported Revenue to be between $1,345M and $1,375M, with Organic Constant Currency growth of ~4% to ~6%.

- Total Adjusted EPS for FY 2026 is projected to be between $4.25 and $4.45.

- CONMED announced a $150M share buyback program and is optimizing its portfolio by exiting gastroenterology to focus on minimally invasive surgery, smoke evacuation, and orthopedic soft tissue repair.

- The company is leveraging growth drivers such as high-growth, high-margin products including AirSeal, Buffalo Filter, and BioBrace.

- CONMED provided preliminary guidance for 2026, projecting revenue between $1.345 billion and $1.375 billion and adjusted EPS between $4.25 and $4.45.

- The company announced its exit from the GI business, which is expected to reduce the top line by $78-$82 million and impact EPS by $0.50.

- CONMED achieved its leverage goal of below three by the end of Q3 2025 and is suspending its dividend to allocate $25 million towards share repurchases, contributing a $0.07 EPS tailwind for 2026.

- The company is focusing on high-growth, high-margin platforms including AirSeal, Buffalo Filter, and BioBrace, and anticipates midterm growth in the 4%-9% range.

- CONMED provided preliminary 2026 guidance, projecting revenue between $1.345 billion and $1.375 billion and adjusted EPS between $4.25 and $4.45.

- The company exited its GI business in December 2025, which is expected to reduce 2026 revenue by $78-$82 million and impact EPS by $0.50.

- CONMED suspended its dividend in 2025 and will reallocate the $25 million to share repurchases, contributing a $0.07 tailwind to 2026 EPS.

- The company achieved its goal of reducing leverage to below three by Q3 2025, one quarter earlier than planned.

- Key growth drivers, including AirSeal and direct smoke evacuation (Buffalo Filter), are expected to achieve high single-digit to double-digit growth.

Quarterly earnings call transcripts for CONMED.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more