Earnings summaries and quarterly performance for ConnectOne Bancorp.

Executive leadership at ConnectOne Bancorp.

Frank Sorrentino III

Chairman and Chief Executive Officer

Elizabeth Magennis

President, ConnectOne Bank

Laura Criscione

Executive Vice President and Chief Compliance Officer

Michael O'Malley

Executive Vice President and Chief Risk Officer

Robert Schwartz

General Counsel

William Burns

Senior Executive Vice President and Chief Financial Officer

Board of directors at ConnectOne Bancorp.

Anson Moise

Director

Christopher Becker

Vice Chairman

Daniel Rifkin

Director

Edward Haye

Director

Frank Baier

Director

Frank Huttle III

Director

Katherin Nukk-Freeman

Director

Mark Sokolich

Director

Michael Kempner

Director

Nicholas Minoia

Director

Peter Quick

Director

Stephen Boswell

Lead Independent Director

Susan O'Donnell

Director

Research analysts who have asked questions during ConnectOne Bancorp earnings calls.

Daniel Tamayo

Raymond James Financial, Inc.

5 questions for CNOB

Matthew Breese

Stephens Inc.

5 questions for CNOB

Timothy Switzer

KBW

3 questions for CNOB

Feddie Strickland

Hovde Group

2 questions for CNOB

Mark Fitzgibbon

Piper Sandler & Co.

2 questions for CNOB

Tim Switzer

Keefe, Bruyette & Woods (KBW)

2 questions for CNOB

Frank Schiraldi

Piper Sandler

1 question for CNOB

Tim Delacion

Raymond James

1 question for CNOB

Tyler Cacciatori

Stephens Inc.

1 question for CNOB

Recent press releases and 8-K filings for CNOB.

- ConnectOne Bancorp (CNOB) delivered strong Q4 2025 operating earnings, up 18.6% sequentially, with operating return on assets reaching 1.24% and return on tangible common equity at 14.3%.

- The company successfully integrated its largest transaction, growing assets to $14 billion and market cap to over $1.4 billion by year-end 2025, surpassing the $10 billion asset threshold.

- Client deposits and the loan portfolio each grew by an annualized 5% in the second half of 2025. For 2026, loan portfolio growth is projected at a more modest 3%-5% due to anticipated higher payoffs.

- Net interest margin (NIM) widened significantly in Q4 2025, with 2026 guidance expecting a 5 basis point increase in Q1 and further expansion throughout the year, potentially reaching the 335-340 range by year-end.

- Operating expenses are forecast to increase 4% by Q4 2026 from the current quarter, with five branch closures planned by the end of Q1 2026 to drive efficiencies.

- ConnectOne Bancorp (CNOB) delivered strong Q4 2025 performance, with operating earnings increasing 18.6% sequentially over the third quarter, driving quarterly operating return on assets to 1.24% and return on tangible common equity to 14.3%.

- The company ended 2025 with $14 billion in assets and a market cap exceeding $1.4 billion, following the successful integration of its largest transaction.

- The net interest margin (NIM) widened significantly in Q4 2025, and ConnectOne anticipates this positive trajectory to continue throughout 2026, projecting a year-end NIM in the 335-340 basis points range, including one rate cut.

- Client deposits increased approximately 5% on an annualized basis in the second half of 2025, and the loan portfolio also grew by an annualized 5%, with a more modest loan portfolio increase of 3%-5% anticipated for 2026.

- CNOB's tangible common equity ratio steadily increased to 8.62% as of year-end 2025, with a goal to reach 9%, providing flexibility for potential dividend increases, share repurchases, and opportunistic M&A.

- ConnectOne Bancorp (CNOB) delivered strong Q4 2025 performance, with operating earnings increasing 18.6% sequentially over Q3, driving the quarterly operating return on assets to 1.24% and return on tangible common equity to 14.3%.

- The company ended 2025 with $14 billion in assets and a market capitalization exceeding $1.4 billion.

- For 2026, ConnectOne anticipates Net Interest Margin (NIM) expansion, with guidance suggesting a 5 basis point increase in Q1 (to the low 330s) and further improvement from Fed rate cuts and higher loan yields, potentially reaching the 335-340 range by year-end. Loan portfolio growth is projected to be in the 3%-5% range.

- Strategic initiatives include improving the quality of its deposit base (non-interest-bearing demand now over 21% ), closing 5 branches , and aiming to increase the tangible common equity ratio from 8.62% to 9%, which would provide flexibility for dividends, share repurchases, and opportunistic M&A.

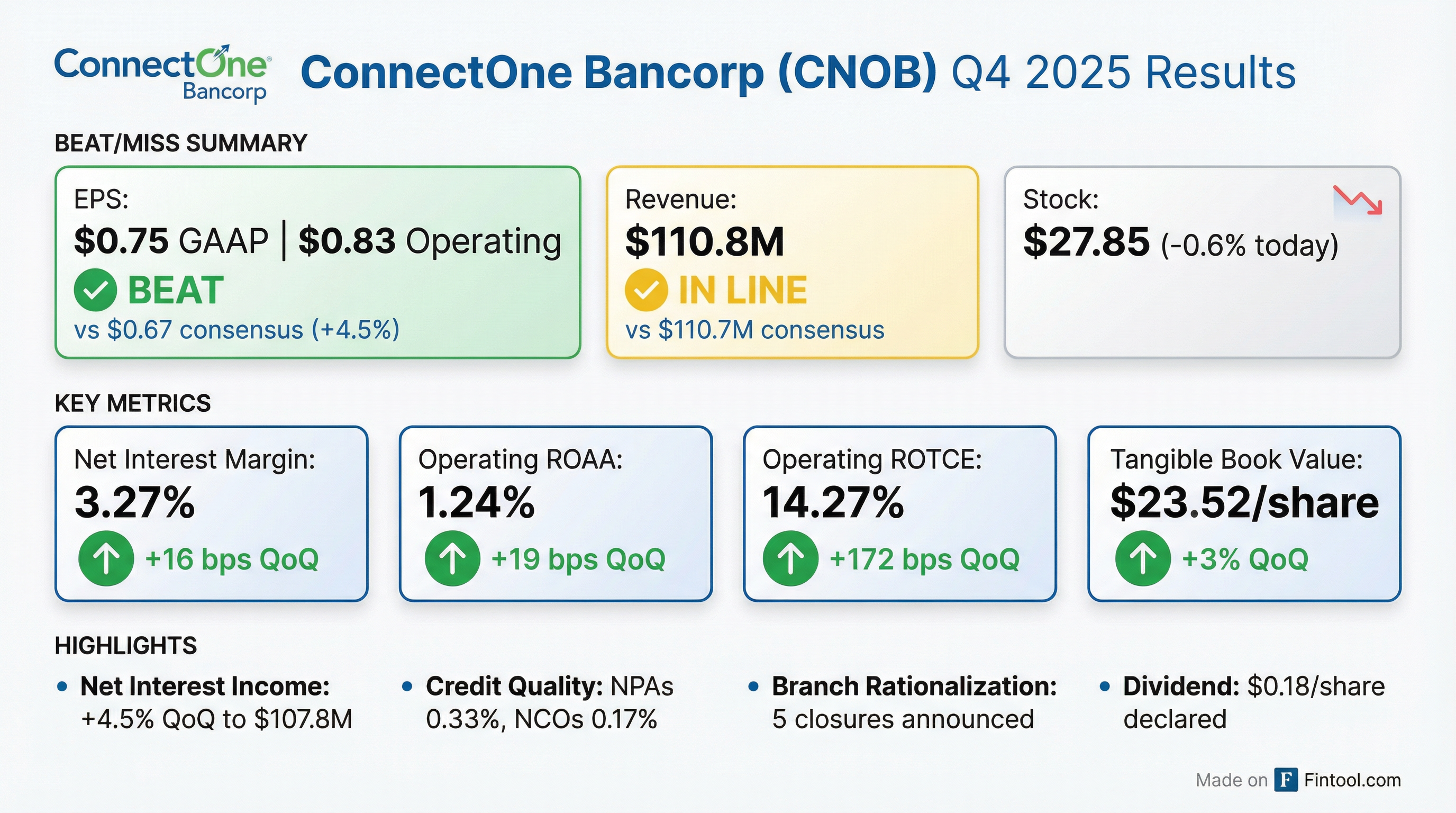

- ConnectOne Bancorp, Inc. reported net income available to common stockholders of $38.0 million and diluted earnings per share of $0.75 for the fourth quarter of 2025, with full-year 2025 net income of $74.4 million and diluted EPS of $1.63.

- The company's net interest margin widened by 16 basis points to 3.27% in Q4 2025, while operating return on average assets advanced to 1.24% and tangible book value per share increased to $23.52.

- Noninterest income for Q4 2025 was $6.0 million, a decrease from Q3 2025 primarily due to nonrecurring benefits in the prior quarter, including a $6.6 million employee retention tax credit and a $3.5 million defined benefit pension plan curtailment gain.

- Asset quality remained solid with nonperforming assets at 0.33% of total assets and annualized net charge-offs at 0.17% for Q4 2025. Total assets grew to $14.0 billion as of December 31, 2025, largely due to the merger with First of Long Island Corporation.

- The Board of Directors declared a common stock cash dividend of $0.18 per share payable on March 2, 2026, and announced five branch closures as part of rationalization efforts.

- ConnectOne Bancorp reported net income available to common stockholders of $38.0 million and diluted earnings per share of $0.75 for the fourth quarter of 2025, with full-year 2025 figures at $74.4 million and $1.63, respectively.

- Operating net income available to common stockholders was $42.0 million and operating diluted earnings per share were $0.83 for the fourth quarter of 2025. The net interest margin widened by 16 basis points to 3.27% during the quarter.

- As of December 31, 2025, total assets reached $14.0 billion, loans receivable $11.5 billion, and total deposits $11.2 billion, primarily driven by the merger with The First of Long Island Corporation (FLIC).

- The company declared a common stock dividend of $0.18 per share and reported a tangible book value per share of $23.52 as of December 31, 2025.

- ConnectOne Bancorp reported strong Q3 2025 financial performance, with operating return on assets increasing by over 30 basis points to 1.05% and net interest margin expanding to 3.11%. The company also saw robust sequential client deposit growth of approximately 4% annualized, matching loan growth and maintaining a loan-to-deposit ratio below 100%.

- Credit quality remains solid, with non-performing assets at 0.28% and annualized net charge-offs below 0.25% for Q3 2025.

- The company received two non-recurring items that boosted pre-tax income by over $10 million in Q3 2025, including a $6.6 million employee retention tax credit and a $3.5 million pension curtailment gain.

- ConnectOne Bancorp provided an optimistic outlook, expecting Q4 2025 net interest margin to be 3.25% or above and projecting 2026 loan growth in the 5% plus range. Profitability targets for 2026 include a 1.2% ROA by Q2 and approaching 1.3% by year-end.

- ConnectOne Bancorp, Inc. reported net income available to common stockholders of $39.5 million and diluted earnings per share of $0.78 for the third quarter of 2025, a significant increase from $(21.8) million net income and $(0.52) diluted EPS in Q2 2025.

- The third quarter of 2025 results included nonrecurring items such as a $6.6 million Employee Retention Tax Credit and a $3.5 million defined benefit pension plan curtailment gain, partially offset by $2.9 million in merger and restructuring expenses.

- As of September 30, 2025, total assets were $14.0 billion, loans receivable $11.3 billion, and total deposits $11.4 billion, with these increases primarily attributable to the merger with The First of Long Island Corporation completed on June 1, 2025.

- The company's net interest margin expanded five basis points sequentially to 3.11% in Q3 2025, and nonperforming assets were $39.7 million, representing 0.28% of total assets.

- A cash dividend of $0.18 per share on common stock and $0.328125 per depositary share on preferred stock was declared, both payable on December 1, 2025.

Quarterly earnings call transcripts for ConnectOne Bancorp.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more