Earnings summaries and quarterly performance for CNX Resources.

Executive leadership at CNX Resources.

Board of directors at CNX Resources.

Research analysts who have asked questions during CNX Resources earnings calls.

Leo Mariani

ROTH MKM

6 questions for CNX

Jacob Roberts

TPH & Co.

5 questions for CNX

Michael Scialla

Stephens Inc.

5 questions for CNX

Zach Parham

JPMorgan Chase & Co.

4 questions for CNX

Betty Jiang

Barclays

3 questions for CNX

Noah Hungness

Firm Not Mentioned in Transcript

3 questions for CNX

Bertrand Donnes

Truist Securities

2 questions for CNX

Gabriel Daoud

Cowen

2 questions for CNX

Jeff Bellman

Daniel Energy Partners

2 questions for CNX

Kalei Akamine

Bank of America

2 questions for CNX

David Deckelbaum

TD Cowen

1 question for CNX

Jake Roberts

TPH&Co.

1 question for CNX

Kevin MacCurdy

Pickering Energy Partners

1 question for CNX

Nitin Kumar

Mizuho Securities USA

1 question for CNX

Recent press releases and 8-K filings for CNX.

- CNX Resources Corporation announced the closing of a private placement of $500 million aggregate principal amount of its 5.875% senior notes due 2034 on February 26, 2026.

- The company intends to use the net proceeds from this offering to purchase and/or redeem its outstanding 6.000% senior notes due 2029.

- The new notes are guaranteed by all of CNX's restricted subsidiaries that also guarantee its revolving credit facility.

- CNX Resources Corporation announced the closing of a private placement of $500 million aggregate principal amount of its 5.875% senior notes due 2034 on February 26, 2026.

- The net proceeds from this offering are intended to purchase any and all of its outstanding 6.000% senior notes due 2029 through a tender offer and subsequent redemption.

- If the net proceeds are not sufficient to fund these obligations, CNX plans to draw on its revolving credit facility for additional funds.

- CNX Resources announced the final results of its tender offer for its $500 million aggregate principal amount of 6.000% Senior Notes due 2029.

- $420.2 million, or 84.04%, of the outstanding 2029 Notes were tendered by the February 23, 2026 expiration time.

- The company will pay a purchase price of $1,016.10 per $1,000 principal amount, plus accrued interest, for the tendered notes on the February 26, 2026 settlement date, after which all purchased notes will be retired.

- Concurrently, CNX issued a conditional notice to redeem any untendered 2029 Notes at 101.50% of the principal amount plus accrued interest by March 19, 2026, contingent on the closing of a new senior notes offering.

- CNX Resources Corporation priced $500 million of its 5.875% senior notes due 2034 at 100.0% of their face value on February 17, 2026.

- The offering is expected to close on February 26, 2026, with net proceeds intended to fund the purchase and/or redemption of outstanding 6.000% senior notes due 2029.

- The notes have credit ratings of B1 from Moody's, BB from S&P, and BB+ from Fitch.

- CNX Resources Corporation priced $500 million of 5.875% senior notes due 2034.

- The net proceeds from the sale of these notes will be used to purchase any and all outstanding 6.000% senior notes due 2029 through a tender offer and fund the redemption of any 2029 Notes not purchased.

- The offering is expected to close on February 26, 2026.

- CNX Resources Corporation announced a private offering of $500 million of senior notes due 2034.

- Concurrently, the company commenced a tender offer to purchase any and all of its outstanding 6.000% senior notes due 2029 at a purchase price of $1,016.10 per $1,000 principal amount, plus accrued interest.

- The tender offer is set to expire at 5:00 p.m. New York City Time on February 23, 2026, and a conditional notice was issued to redeem any untendered 2029 notes at 101.50% of the principal amount by March 19, 2026.

- Both the tender offer and the redemption are conditioned on the successful completion of the new notes offering.

- CNX Resources Corporation (CNX) has commenced a cash tender offer to purchase any and all of its outstanding $500,000,000 6.000% Senior Notes due 2029.

- The Purchase Price for each $1,000 principal amount of notes is $1,016.10, plus accrued and unpaid interest.

- The tender offer will expire at 5:00 p.m. New York City Time on February 23, 2026, and is conditioned on the completion of a contemporaneous new notes offering.

- Notes not purchased in the tender offer are subject to a conditional redemption at 101.50% of the principal amount, plus accrued interest, with a redemption date of March 19, 2026.

- CNX Resources Corporation intends to offer and sell $500 million of senior notes due 2034 in a private placement.

- Concurrently, the company has commenced a tender offer to purchase its 6.000% senior notes due 2029 and issued a conditional notice to redeem any remaining 2029 Notes.

- The net proceeds from the sale of the new notes are intended to fund the obligations under the tender offer and the redemption of the 2029 Notes.

- The offering of the new notes, the tender offer, and the redemption are all conditioned on the consummation of the new senior notes offering.

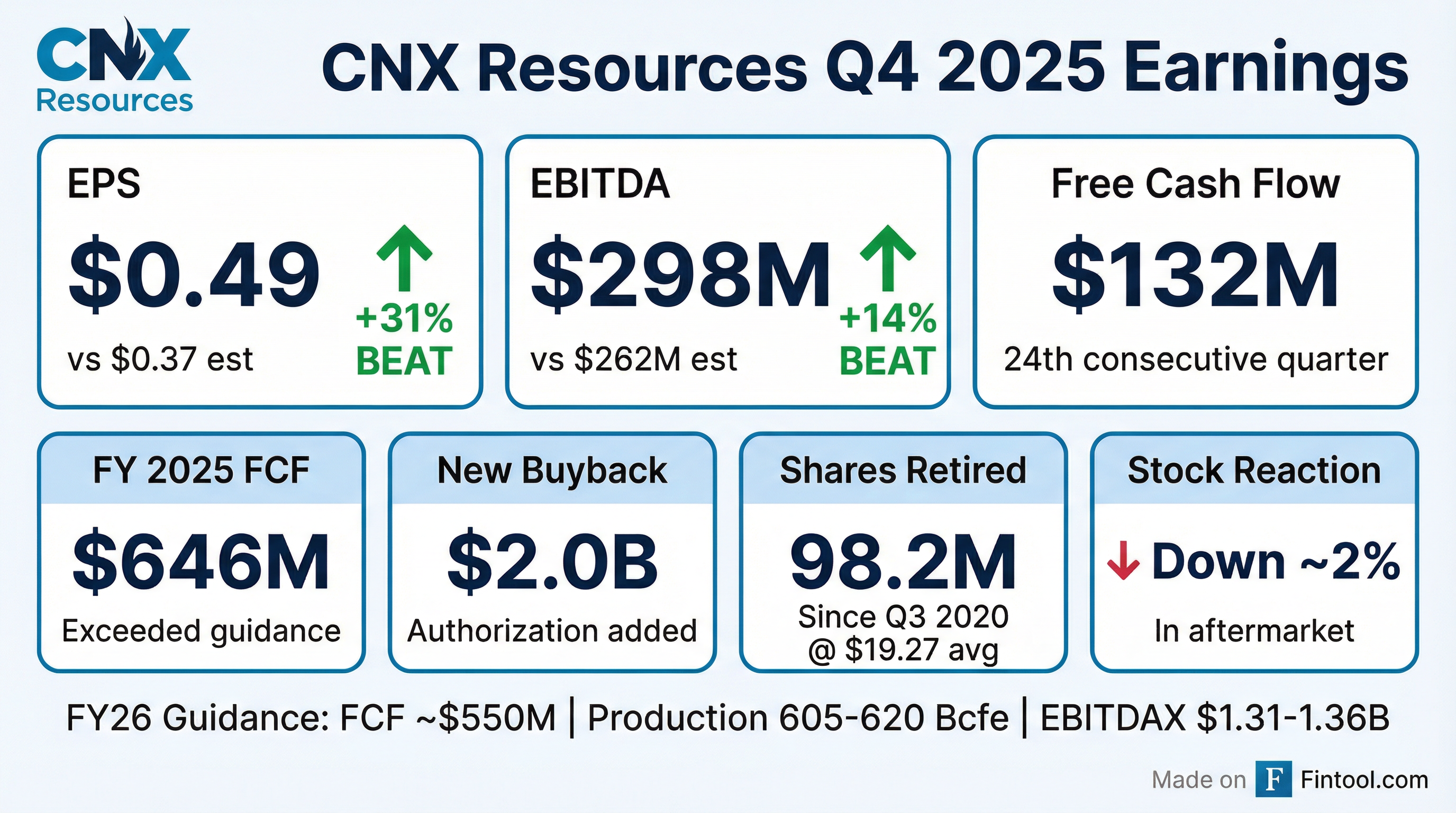

- CNX reported Q4 2025 free cash flow of $132 million and full year 2025 free cash flow of $646 million, exceeding annual guidance.

- The company announced an additional $2 billion share repurchase authorization, with no expiration, increasing its total authorized capacity to $2.4 billion. In Q4 2025, CNX repurchased 2.9 million shares for $100 million.

- CNX reduced debt by $122 million by exchanging a portion of convertible notes for common stock.

- For 2026, the company projects Free Cash Flow of ~$550 million and Total Capital Expenditures between $556 million and $586 million.

- CNX Resources anticipates first-half 2026 capital expenditures to be approximately 60% of the year's total, providing flexibility to potentially accelerate frac activity in the second half, while expecting a flat production profile throughout the year.

- The company's RNG business projects approximately $30 million annually from 45Z based on current production levels and initial proposed guidance.

- For 2027, CNX aims to be approximately 80% hedged at a weighted average NYMEX price of about $4, with over 60% already hedged.

- The deep Utica program is progressing, with five laterals expected to be completed in 2026 at an average drilling cost of about $1,700 per foot, and well performance is in line with expectations.

Quarterly earnings call transcripts for CNX Resources.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more