Earnings summaries and quarterly performance for CENTERSPACE.

Executive leadership at CENTERSPACE.

Board of directors at CENTERSPACE.

Research analysts who have asked questions during CENTERSPACE earnings calls.

Brad Heffern

RBC Capital Markets

6 questions for CSR

Mason P. Guell

Baird

5 questions for CSR

Ami Probandt

UBS

4 questions for CSR

Connor Mitchell

Piper Sandler & Co.

4 questions for CSR

Alexander Goldfarb

Piper Sandler

3 questions for CSR

John Kim

BMO Capital Markets

2 questions for CSR

Michael Gorman

BTG Pactual

2 questions for CSR

Robert Stevenson

Janney Montgomery Scott LLC

2 questions for CSR

Rob Stevenson

Janney Montgomery Scott

2 questions for CSR

Cooper Clark

Wells Fargo

1 question for CSR

James Feldman

Wells Fargo

1 question for CSR

Jamie Feldman

Wells Fargo & Company

1 question for CSR

Richard Anderson

Wedbush Securities

1 question for CSR

Recent press releases and 8-K filings for CSR.

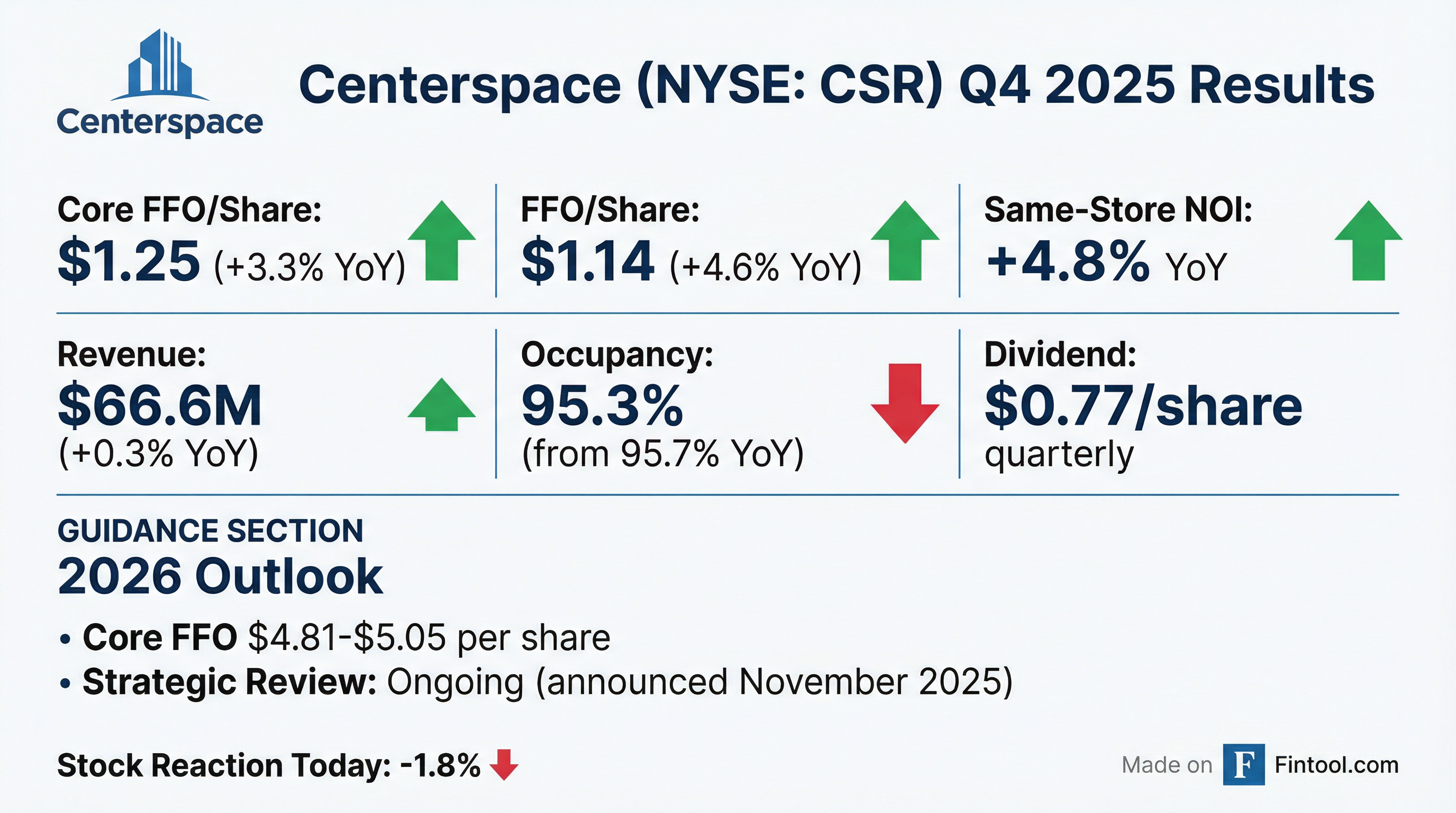

- Centerspace provided its 2026 financial outlook, projecting FFO per share between $4.61 and $4.89 and Core FFO per share between $4.81 and $5.05.

- The company reported Q4 2025 blended same-store leasing spreads of 0.1% and Q1 2026 QTD blended same-store leasing spreads of -0.5%.

- In 2025, Centerspace completed $212.1 million in strategic dispositions and $281.2 million in acquisitions to enhance its long-term portfolio.

- As of February 24, 2026, Centerspace's current trading price reflects a 20% discount to consensus Net Asset Value (NAV).

- Centerspace provided its 2026 financial outlook, projecting Core FFO per share between $4.81 and $5.05, with a midpoint of $4.93. This compares to a 2025 actual Core FFO per share of $4.93.

- In 2025, the company executed $493 million in strategic transaction activity, which included entering the Salt Lake City market and expanding in Fort Collins, while exiting St. Cloud and pruning Minneapolis holdings to enhance portfolio quality.

- Centerspace maintains a flexible balance sheet with $2.4 billion in total capitalization, a weighted average interest rate of 3.6%, and a weighted average debt maturity of 6.9 years. The company also repurchased $3.5 million of shares in 2025 at an average price of $54.86 per share.

- From Q1 2020 to Q4 2025, Centerspace demonstrated higher average year-over-year same-store NOI growth of 5.3% compared to a peer average of 4.1%, and lower volatility (3.7% vs. 7.0%).

- Centerspace reported Q4 2025 Core FFO of $1.25 per diluted share and a 4.8% year-over-year increase in same-store NOI, driven by a 1% increase in same-store revenues and a 5.1% decrease in same-store expenses.

- For 2026, the company expects full-year Core FFO per share of $4.93 at the midpoint, with same-store NOI increasing by 75 basis points, same-store revenues by 88 basis points, and same-store expenses by 150 basis points.

- The board's formal evaluation of strategic alternatives to maximize shareholder value remains ongoing, and the company cannot repurchase stock during this process.

- In 2025, Centerspace executed $493 million of transaction activity to reshape its portfolio, including entering Salt Lake City and expanding in Fort Collins, and repurchased 3.5 million common shares.

- Market-wise, North Dakota led with 4.5% blended increases in Q4 2025, while Denver experienced downward pressure on rents (down 4.3%) due to supply, though normalization is expected in 2026-2027.

- Centerspace reported Q4 2025 Core FFO of $1.25 per diluted share and achieved 3.5% same-store NOI growth for the full year 2025, outpacing peers.

- The company issued 2026 guidance for Core FFO per diluted share of $4.93 at the midpoint, with same-store NOI expected to increase by 75 basis points and same-store revenues by 88 basis points.

- A formal evaluation of strategic alternatives to maximize shareholder value, initiated in November, remains ongoing, and the company executed $493 million of transaction activity in 2025 to reshape its portfolio.

- Value-add capital expenditures for 2026 are projected to be lower and have a wider range ($2.5 million-$12.5 million) due to the higher cost of capital and the ongoing strategic review.

- Centerspace reported Q4 2025 Core FFO of $1.25 per diluted share and same-store NOI growth of 4.8% year-over-year, driven by a 1% increase in same-store revenues and a 5.1% decrease in same-store expenses.

- For 2026, the company expects Core FFO per diluted share of $4.93 at the midpoint, projecting same-store NOI to increase by 75 basis points and same-store revenues by 88 basis points, with blended leasing spreads in the mid-1% range.

- In 2025, Centerspace completed $493 million of transaction activity to reshape its portfolio and repurchased 3.5 million common shares. The board is also conducting an ongoing formal evaluation of strategic alternatives to maximize shareholder value.

- The company's leverage profile improved to 7.5x net debt to EBITDA, supported by strong liquidity of nearly $268 million in cash and line of credit availability.

- Centerspace reported Net Income of $1.02 per diluted share and Core FFO of $4.93 per diluted share for the year ended December 31, 2025.

- The company provided its 2026 financial outlook, projecting diluted Net Income (loss) per share between $(0.49) and $(0.19), FFO per diluted share between $4.61 and $4.89, and Core FFO per diluted share between $4.81 and $5.05.

- For the year ended December 31, 2025, Centerspace acquired two apartment communities for $281.2 million and sold twelve non-core apartment communities and one office building for $215.5 million. The Board also announced a quarterly distribution of $0.77 per share/unit payable on April 14, 2026.

- Centerspace's Board is currently undertaking an ongoing review of strategic alternatives to maximize shareholder value.

- Centerspace reported a Net Income of $1.02 per diluted share for the year ended December 31, 2025, compared to a Net Loss of $1.27 per diluted share in 2024, and Core FFO increased to $4.93 per diluted share from $4.88.

- The company's same-store Net Operating Income (NOI) grew by 3.5% year-over-year, supported by a 2.4% increase in same-store revenue for the year ended December 31, 2025.

- For 2026, Centerspace provided guidance for Core FFO per diluted share between $4.81 and $5.05.

- During 2025, Centerspace acquired two apartment communities for $281.2 million and sold twelve non-core apartment communities and one corporate office building for $215.5 million.

- The Board is conducting a strategic review of alternatives to maximize shareholder value, with no definitive timetable.

- Centerspace's Board of Trustees initiated a review of strategic alternatives earlier this fall, considering options such as a sale, merger, or other business combinations, alongside continuing its independent business strategy.

- BMO Capital Markets Corp. is acting as Centerspace's financial advisor, and Wachtell, Lipton, Rosen & Katz is serving as legal counsel for this review.

- The company has not set a timetable for the review process and has not made any decisions regarding potential strategic alternatives at this time.

- Centerspace (CSR) has initiated a strategic review process to explore potential options including a sale, merger, or other business combinations, engaging BMO Capital Markets and Wachtell, Lipton, Rosen & Katz as advisors.

- The company faces financial challenges, highlighted by a debt-to-equity ratio of 1.52, liquidity ratios of 0.53, and an Altman Z-Score indicating financial distress.

- Despite these financial struggles, Centerspace reported a strong EBITDA margin of over 71%, an operating margin of 9.2%, and a net margin of 11.35%.

- Following the announcement, Centerspace's stock price reacted positively, increasing by 6.4% in afternoon trading.

- Centerspace (CSR) provided its 2025 financial outlook, projecting diluted FFO per share between $4.73 and $4.82 and Core FFO per share between $4.88 and $4.96 for the 12 months ended December 31, 2025.

- In 2025, the company completed $212.1 million in strategic dispositions in St. Cloud, MN, and Minneapolis, MN, and $281.2 million in acquisitions in Salt Lake City, UT, and Fort Collins, CO, enhancing its long-term portfolio returns and market exposures.

- For Q3 2025, same-store blended leasing spreads were 1.0%, with year-to-date blended spreads reaching 3.0% through November 3, 2025.

- Centerspace expanded its line of credit by $150 million to $400 million and reported a proforma Net Debt / Adjusted EBITDA of 7.3x.

Quarterly earnings call transcripts for CENTERSPACE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more