Earnings summaries and quarterly performance for DIGI INTERNATIONAL.

Research analysts who have asked questions during DIGI INTERNATIONAL earnings calls.

Josh Nichols

B. Riley Financial

4 questions for DGII

Scott Searle

ROTH MKM

4 questions for DGII

James Fish

Piper Sandler Companies

3 questions for DGII

Thomas Moll

Stephens Inc.

3 questions for DGII

Anthony Stoss

Craig-Hallum Capital Group LLC

2 questions for DGII

Caden Dahl

Piper Sandler & Co.

2 questions for DGII

Tommy Moll

Stephens Inc.

2 questions for DGII

Matthew Maus

Nichols

1 question for DGII

Quinton Gabrielli

Piper Sandler

1 question for DGII

Tommy Mall

Stephens

1 question for DGII

Recent press releases and 8-K filings for DGII.

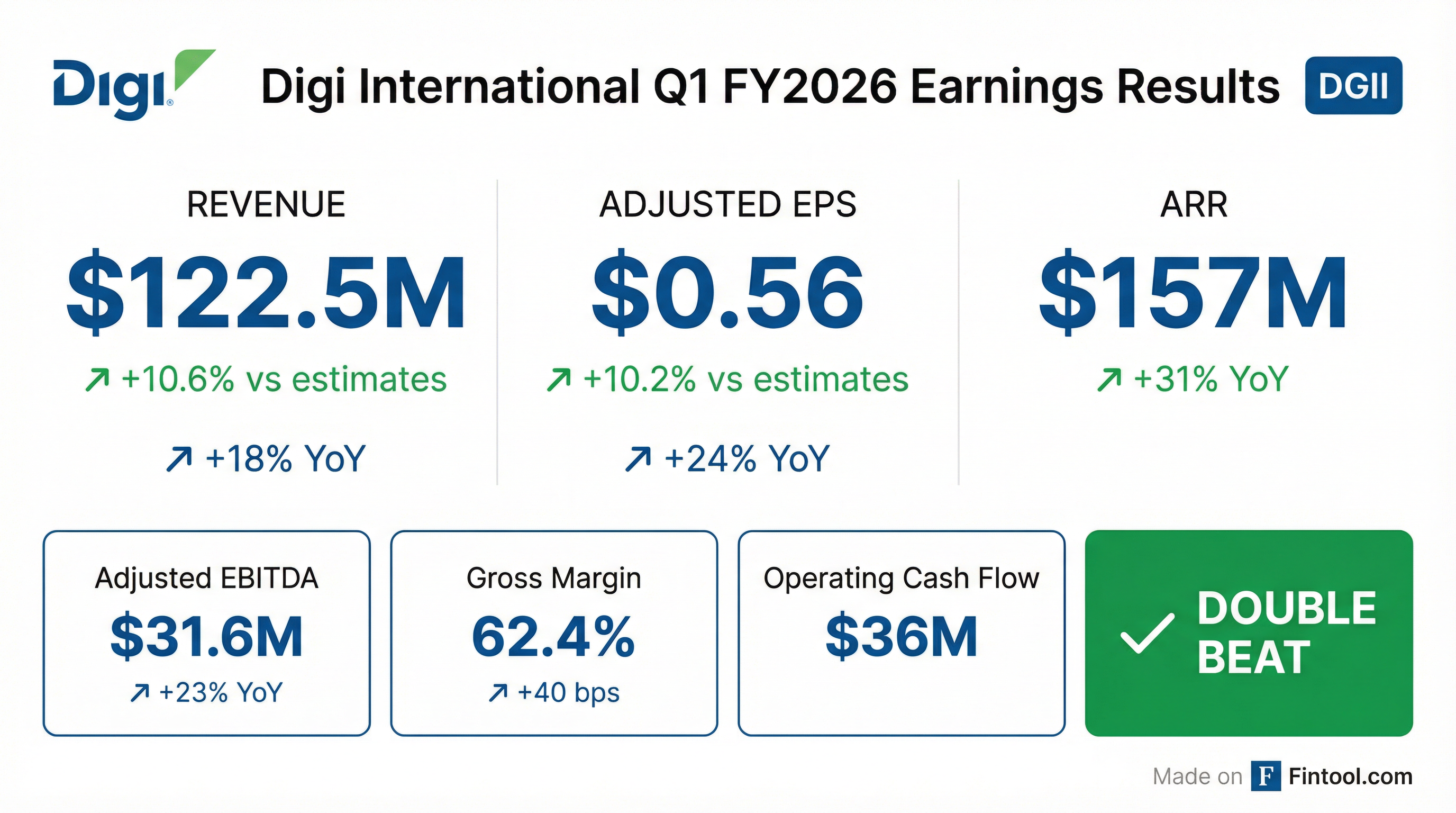

- Digi International (DGII) reported strong Q1 2026 results, with quarterly revenues of $122 million, an 18% year-over-year increase, and Annualized Recurring Revenue (ARR) reaching $157 million, up 31% year-over-year.

- The company achieved a new quarterly record adjusted EBITDA margin of 25.8%, with quarterly adjusted EBITDA of $32 million, representing a 23% year-over-year increase.

- DGII announced the acquisition of Particle on January 27th, which is projected to add $20 million in ARR and contribute $13 million-$14 million in revenue and $1 million-$2 million in adjusted EBITDA to fiscal 2026 guidance.

- For fiscal 2026, the company anticipates 23% ARR growth, 14%-18% revenue growth, and 17%-21% adjusted EBITDA growth.

- Acquisitions remain a top capital deployment priority, with a goal to achieve $200 million of ARR and $200 million of adjusted EBITDA by the end of fiscal 2028.

- Digi International reported strong Q1 2026 results, with revenue increasing 18% to $122 million and Annualized Recurring Revenue (ARR) growing 31% to $157 million. Adjusted EBITDA also saw a 23% increase to $32 million.

- The company provided FY26 guidance, forecasting revenue growth of 14% to 18%, ARR growth of 23%, and Adjusted EBITDA growth of 17% to 21%.

- Digi's top priority is growing ARR, which now represents 35% of total revenue. The recent acquisition of Particle for $50 million in cash on January 27, 2026, added $20 million in ARR and is expected to contribute $5 million in incremental A-EBITDA in fiscal 2027.

- Following the Particle acquisition, total ARR now exceeds $177 million, accelerating the path towards the company's goal of $200 million in ARR and $200 million in A-EBITDA by FY28.

- Digi International Inc. (DGII) reported record Q1 2026 financial results, including $122 million in quarterly revenues (up 18% year-over-year), $157 million in annualized recurring revenue (ARR) (up 31% year-over-year), and $32 million in quarterly adjusted EBITDA (up 23% year-over-year).

- The company announced the acquisition of Particle, an IoT solution provider, on January 27th, which is expected to add $20 million in ARR to the IoT product and services segment and strengthen its edge-to-cloud capabilities.

- For fiscal year 2026, updated guidance includes anticipated ARR growth of 23%, revenue growth of 14%-18%, and adjusted EBITDA growth of 17%-21%. Particle is projected to contribute $13 million-$14 million in revenue and $1 million-$2 million in adjusted EBITDA to this guidance.

- For Q2 2026, revenues are estimated to be between $124 million-$128 million, with adjusted EBITDA between $31.5 million and $33.0 million. Digi International also reiterated its long-term goal of achieving $200 million in ARR and adjusted EBITDA by the end of fiscal 2028.

- Digi International reported a strong start to fiscal 2026 with $122 million in quarterly revenues, an 18% year-over-year increase, and $157 million in annualized recurring revenue (ARR), up 31% year-over-year.

- The company achieved $32 million in quarterly adjusted EBITDA, a 23% year-over-year increase, and a record 25.8% adjusted EBITDA margin, alongside $36 million in quarterly cash generation.

- Digi International announced the acquisition of Particle on January 27th, which is expected to contribute $20 million-$22 million in ARR and $13 million-$14 million in revenue to the fiscal 2026 guidance.

- For fiscal 2026, the company anticipates 23% ARR growth, 14%-18% revenue growth, and 17%-21% adjusted EBITDA growth. Q2 2026 guidance projects revenues between $124 million-$128 million and adjusted EBITDA between $31.5 million-$33.0 million.

- The demand environment is improving, with strength noted in mass transit, utility, retail digital signage, and data center segments, partly driven by the AI infrastructure buildout.

- Digi International reported record quarterly revenue of $122 million for the first fiscal quarter ended December 31, 2025, marking an 18% increase compared to the same period in the prior fiscal year.

- Annualized Recurring Revenue (ARR) increased by 31% to $157 million at quarter end, with the recent acquisition of Particle expected to add approximately $20 million of ARR to the IoT Products & Services segment.

- The company generated $36 million in cash flow from operations during the first fiscal quarter of 2026 and reduced its outstanding debt to $135 million, resulting in net debt of $104 million.

- For the second fiscal quarter of 2026, Digi International estimates revenues to be between $124 million and $128 million, with Adjusted EBITDA projected between $31.5 million and $33.0 million.

- Effective in the first fiscal quarter 2026, the company updated its calculation of adjusted net income and adjusted net income per share to include interest expense.

- Digi International reported record quarterly revenue of $122 million, an 18% increase compared to the first fiscal quarter of 2025, with Annualized Recurring Revenue (ARR) reaching $157 million, up 31% for the quarter ended December 31, 2025.

- For the first fiscal quarter of 2026, the company achieved Adjusted EBITDA of $32 million, a 23% increase, and Adjusted net income per diluted share of $0.56, up 24%.

- Cash flow from operations was $36 million for the quarter, and the company reduced its outstanding debt by $24 million, resulting in a net debt of $104 million.

- For the second fiscal quarter of 2026, Digi International estimates revenues between $124 million and $128 million and Adjusted EBITDA between $31.5 million and $33.0 million.

- The acquisition of Particle, announced in January 2026, is expected to add approximately $20 million of ARR to the IoT Products & Services segment.

- Digi International (DGII) has acquired Particle Industries, Inc. for $50 million in cash to accelerate Annual Recurring Revenue (ARR) growth and strengthen its Embedded-as-a-Service offering.

- Particle currently generates approximately $20 million in ARR, growing double-digits annually. This acquisition is expected to increase ARR for Digi’s IoT Product and Solutions segment by over 60% from its $32 million as of September 30, 2025.

- Digi International plans to provide updated full-year fiscal 2026 guidance, including the acquisition's impact, on February 4, 2026.

- Digi International Inc. entered into a First Amendment to Revolving Credit Agreement on December 23, 2025.

- The agreement is with BMO Bank, N.A. as the administrative and collateral agent, along with other lenders.

- The proceeds from the Revolving Loans are designated for purposes including refinancing existing obligations, financing permitted acquisitions, covering related fees and expenses, and for general corporate purposes.

- Digi International reported record Q4 2025 revenue of $114 million, an increase of 9% year-over-year, and record Annual Recurring Revenue (ARR) of $152 million, marking a 31% year-over-year increase which includes the August 2025 acquisition of Jolt Software.

- For fiscal year 2025, the company generated $430 million in revenue (up 1% year-over-year), $108 million in adjusted EBITDA (up 11% year-over-year), and $105 million in free cash flow.

- The company expects double-digit growth for ARR, revenue, and adjusted EBITDA in fiscal year 2026.

- Digi reiterated its long-term goal to reach $200 million of ARR and $200 million in adjusted EBITDA by the end of fiscal 2028, with strategic acquisitions potentially accelerating this timeline.

- Acquisitions remain a top capital deployment priority, with Jolt Software contributing over $20 million in annualized recurring revenue at the time of acquisition and expected to reach an $11 million run rate EBITDA by the end of calendar 2026.

- Digi International reported record quarterly revenue of $114 million for Q4 fiscal 2025, an increase of 9% compared to the prior year, contributing to full-year fiscal 2025 revenue of $430 million, up 1%.

- For fiscal year 2025, net income increased by 81% to $41 million, with diluted net income per share rising 77% to $1.08.

- The company's Annualized Recurring Revenue (ARR) reached a record $152 million at the end of Q4 fiscal 2025, marking a 31% increase from the prior fiscal year.

- In the fourth fiscal quarter, Digi International completed the acquisition of Jolt Software Inc. for $145.7 million, with Jolt's results included in fiscal 2025.

- For Q1 fiscal 2026, the company estimates revenues between $114 million and $118 million, and projects full-year fiscal 2026 revenue growth of 10-15%.

Fintool News

In-depth analysis and coverage of DIGI INTERNATIONAL.

Quarterly earnings call transcripts for DIGI INTERNATIONAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more