Earnings summaries and quarterly performance for HEALTHPEAK PROPERTIES.

Executive leadership at HEALTHPEAK PROPERTIES.

Scott M. Brinker

President and Chief Executive Officer

Adam G. Mabry

Chief Investment Officer

Ankit B. Patadia

Executive Vice President and Treasurer – Corporate Finance

Kelvin O. Moses

Chief Financial Officer

Lisa A. Alonso

Executive Vice President and Chief Human Resources Officer

Scott R. Bohn

Chief Development Officer and Head of Lab

Shawn G. Johnston

Executive Vice President and Chief Accounting Officer

Tracy A. Porter

Executive Vice President and General Counsel

Board of directors at HEALTHPEAK PROPERTIES.

Ava E. Lias-Booker

Independent Director

Brian G. Cartwright

Independent Director

Governor Tommy G. Thompson

Independent Director

James B. Connor

Independent Director

John T. Thomas

Vice Chair of the Board

Katherine M. Sandstrom

Independent Chair of the Board

Pamela J. Kessler

Independent Director

R. Kent Griffin, Jr.

Independent Director

Richard A. Weiss

Independent Director

Sara G. Lewis

Independent Director

Research analysts who have asked questions during HEALTHPEAK PROPERTIES earnings calls.

Austin Wurschmidt

KeyBanc Capital Markets Inc.

6 questions for DOC

Farrell Granath

Bank of America

6 questions for DOC

Juan Sanabria

BMO Capital Markets

6 questions for DOC

Vikram Malhotra

Mizuho Financial Group, Inc.

6 questions for DOC

Jamie Feldman

Wells Fargo & Company

4 questions for DOC

John Pawlowski

Green Street

4 questions for DOC

Michael Carroll

RBC Capital Markets

4 questions for DOC

Michael Stroyeck

Green Street Advisors, LLC

4 questions for DOC

Mike Mueller

JPMorgan Chase & Co.

4 questions for DOC

Nick Joseph

Citigroup Inc.

4 questions for DOC

Nick Yulico

Scotiabank

4 questions for DOC

Omotayo Okusanya

Deutsche Bank AG

4 questions for DOC

Ronald Kamdem

Morgan Stanley

4 questions for DOC

Wesley Golladay

Robert W. Baird & Co.

4 questions for DOC

Jim Kammert

Evercore

2 questions for DOC

Jon Petersen

Jefferies

2 questions for DOC

Michael Mueller

JPMorgan Chase & Co.

2 questions for DOC

Nicholas Yulico

Scotiabank

2 questions for DOC

Rich Anderson

Cantor Fitzgerald

2 questions for DOC

Richard Anderson

Wedbush Securities

2 questions for DOC

Seth Bergey

Citi

2 questions for DOC

Wes Golladay

Baird

2 questions for DOC

Recent press releases and 8-K filings for DOC.

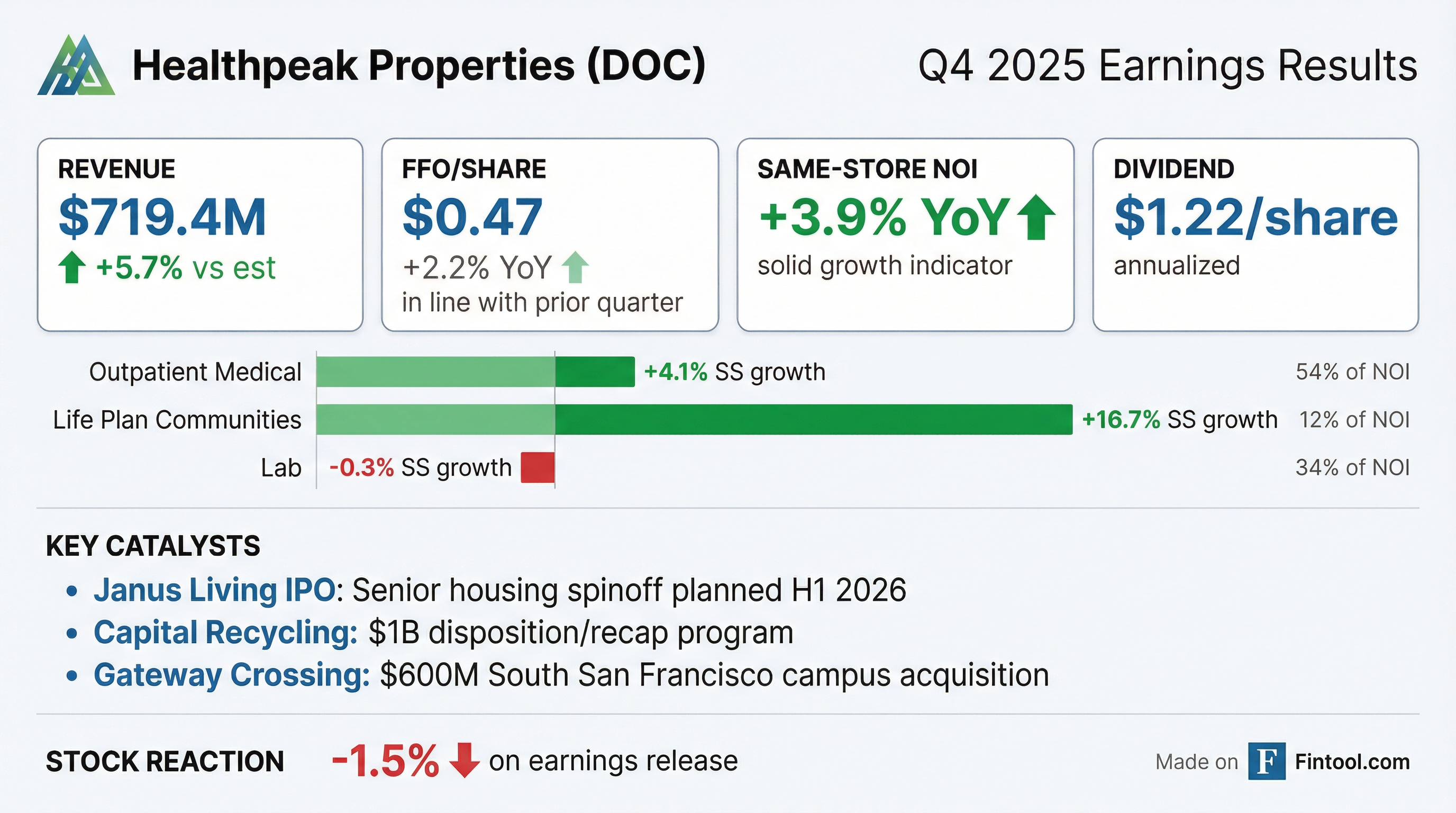

- Healthpeak reported Q4 2025 FFO as adjusted of $0.47 per share and full-year FFO as adjusted of $1.84 per share, with total portfolio same-store cash NOI growth of 3.9% in Q4 and 4% for the full year.

- For 2026, the company forecasts FFO as adjusted between $1.70 and $1.74 per share and total same-store NOI growth of -1% to +1%, with the lab segment NOI expected to decline by -5% to -10% due to lagging occupancy impacts.

- Healthpeak plans to create Janus Living, a pure-play senior housing REIT, by contributing its entire senior housing portfolio, with an IPO anticipated in the first half of 2026.

- The company strategically sold $325 million in outpatient assets in Q4 2025 and acquired the 1.4 million sq ft Gateway campus in South San Francisco in late 2025/early 2026, which has over 500,000 sq ft of vacancy.

- Healthpeak Properties reported Q4 2025 FFO as adjusted of $0.47 per share and full-year FFO as adjusted of $1.84 per share, with total portfolio same-store cash NOI growth of 3.9% for Q4 and 4% for the full year.

- For 2026, the company forecasts FFO as adjusted to range from $1.70-$1.74 per share and total same-store NOI growth between -1% and +1%.

- Strategic activities include the sale of $325 million in Outpatient Medical assets in Q4 2025, the acquisition of a 1.4 million sq ft campus in South San Francisco, and plans to contribute its Senior Housing portfolio to Janus Living for a planned IPO.

- The company completed $464 million of acquisitions in early 2026, including a $314 million buyout of a joint venture partner in its Senior Housing rental portfolio, and plans $1 billion or more in asset sales, recapitalizations, and loan repayments in 2026.

- The Lab segment ended 2025 with 1.5% same-store growth and 77% total occupancy, with the operating environment showing early signs of an inflection point due to improved capital raising and M&A in the last five months of 2025.

- Healthpeak Properties reported Q4 2025 FFO as adjusted of $0.47 per share and full-year FFO as adjusted of $1.84 per share, with total portfolio same-store cash NOI growth of 3.9% for Q4 and 4% for the full year.

- For 2026, the company forecasts FFO as adjusted to range from $1.70 to $1.74 per share and total same-store NOI growth between -1% to +1%, primarily attributing the earnings reduction to the lagging impact of occupancy loss in the lab segment.

- The outpatient medical segment delivered strong 2025 results with 4.9 million sq ft of leasing and 3.9% same-store growth, while the senior housing segment achieved 12.6% same-store growth.

- Healthpeak is preparing for the IPO of Janus Living in the first half of 2026, which will encompass all senior housing assets, and completed the Gateway acquisition to enhance its lab portfolio in South San Francisco. The company expects 2026 to be a bottom for FFO.

- Healthpeak Properties reported Net income of $0.16 per share and Nareit FFO of $0.47 per share for Q4 2025, with Total Merger-Combined Same-Store Cash (Adjusted) NOI growth of +3.9%. For the full year 2025, Net income was $0.10 per share and Nareit FFO was $1.81 per share.

- The company issued 2026 guidance, projecting diluted earnings per common share between $0.34 and $0.38 and diluted Nareit FFO per share between $1.70 and $1.74.

- Healthpeak announced the formation and planned initial public offering (IPO) of Janus Living, Inc., a REIT focused on senior housing, anticipated in H1 2026. The company also plans $1 billion in asset sales, recapitalizations, and loan repayments in 2026 as part of its capital recycling strategy.

- The Board of Directors declared a monthly common stock cash dividend of $0.10167 per share for January, February, and March of 2026, totaling $0.305 per share for the first quarter.

- Healthpeak Properties reported Q4 2025 Net income of $0.16 per share and Nareit FFO of $0.47 per share, with Total Merger-Combined Same-Store Cash (Adjusted) NOI growth of +3.9%. For the full year 2025, Net income was $0.10 per share and Nareit FFO was $1.81 per share, with Total Merger-Combined Same-Store Cash (Adjusted) NOI growth of +4.0%.

- The company announced the formation and planned initial public offering (IPO) of Janus Living, Inc., a REIT dedicated to senior housing, expected in the first half of 2026 to unlock value.

- Strategic capital recycling includes $1 billion of asset sales, recapitalizations, and loan repayments targeted for 2026 , following $511 million in asset sales and loan repayments in 2025. Recent transactions include the acquisition of a 1.4 million square foot campus in South San Francisco for $600 million and $325 million in outpatient medical dispositions in Q4 2025.

- Healthpeak declared a monthly common stock cash dividend of $0.10167 per share for Q1 2026, representing an annualized dividend of $1.22 per share.

- For full year 2026, guidance includes Diluted earnings per common share from $0.34 – $0.38 and Diluted Nareit FFO per share of $1.70 – $1.74, with Total Merger-Combined Same-Store Cash (Adjusted) NOI growth of (1%) – 1%.

- Healthpeak Properties announced $925 million in recent transaction activity, including the $600 million acquisition of a 1.4-million square foot campus in South San Francisco and $325 million in outpatient medical dispositions during Q4 2025.

- The acquired South San Francisco campus, closed in December 2025 and January 2026, is approximately 60% occupied and expands Healthpeak's presence in the submarket to 6.5 million square feet.

- The company is pursuing additional outpatient medical sales, recapitalizations, and loan repayments that could generate $700 million or more in proceeds, supporting its strategy to reinvest into strategic life science assets.

- Healthpeak Properties (DOC) announced the formation and planned initial public offering (IPO) of Janus Living, Inc., a pure-play, RIDEA-structured senior housing REIT.

- Healthpeak will contribute its 34-community, 10,422-unit senior housing portfolio to Janus Living and will retain a substantial majority interest immediately following the IPO.

- The IPO is expected to be completed in the first half of 2026, subject to market and regulatory conditions.

- Healthpeak will serve as Janus Living's external manager, receiving an annual management fee of $10 million.

- Healthpeak intends to use the net proceeds from the IPO for pending acquisitions, debt repayment, and general corporate purposes, aiming to strengthen its balance sheet.

- Healthpeak Properties (DOC) has confidentially submitted a draft registration statement for the initial public offering (IPO) of Janus Living, Inc.

- Janus Living will be a newly formed company intending to elect and qualify as a real estate investment trust, focused on owning, acquiring, and developing senior housing properties under a RIDEA structure.

- The IPO will comprise 34 senior housing assets from Healthpeak, with the net proceeds expected to be used for pending acquisitions, debt repayment, and general corporate purposes.

- Healthpeak anticipates completing the IPO in the first half of 2026, subject to various conditions, and intends to maintain control of Janus Living post-offering.

- Healthpeak Properties reported FFO as adjusted of $0.46 per share and AFFO of $0.42 per share for Q3 2025, with year-to-date portfolio same-store growth at 3.8%.

- The company plans to generate $1 billion or more from outpatient medical asset sales, with $204 million already under purchase and sale agreement, intending to recycle these proceeds into higher-return lab opportunities (targeting double-digit unlevered IRRs) and outpatient development (average yield 7+%).

- Outpatient medical leasing was strong in Q3 2025, with 1.2 million square feet executed, achieving positive cash releasing spreads of 5.4% and ending the quarter with 91% occupancy.

- In the lab sector, the leasing pipeline has doubled to 1.8 million square feet since Q1 2025; however, occupancy is expected to decline to the high 70% range over the next couple of quarters before recovering, with earnings benefits starting in late 2026 and thereafter.

- The company reaffirmed its FFO as adjusted and same-store expectations within its original guidance range and reduced interest expense and G&A guidance by $10 million.

- Healthpeak Properties reported Q3 2025 FFO as adjusted of $0.46 per share and AFFO of $0.42 per share, with year-to-date portfolio same-store growth of 3.8%.

- The company plans to generate $1 billion or more from outpatient medical asset sales, with $130 million already under signed contract, to recycle into higher-return lab opportunities and outpatient development. This strategy is expected to create meaningful accretion.

- Leading indicators in the lab sector are positive, with the leasing pipeline doubling since the start of the year. However, lab occupancy is projected to decline to the high 70% range over the next few months before an anticipated recovery.

- Healthpeak has internalized property management on 39 million sq ft and is implementing technology initiatives to enhance operations.

Quarterly earnings call transcripts for HEALTHPEAK PROPERTIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more