Earnings summaries and quarterly performance for Eagle Point Credit Co.

Executive leadership at Eagle Point Credit Co.

Board of directors at Eagle Point Credit Co.

Research analysts who have asked questions during Eagle Point Credit Co earnings calls.

Erik Zwick

Lucid Capital Markets

5 questions for ECC

Mickey Schleien

Ladenburg Thalmann

5 questions for ECC

Christopher Nolan

Ladenburg Thalmann

2 questions for ECC

Gaurav Mehta

Alliance Global Partners

2 questions for ECC

Randy Binner

B. Riley Securities

2 questions for ECC

Timothy D'Agostino

B. Riley Securities

2 questions for ECC

Gregory Kraut

KPG Funds

1 question for ECC

Matthew Howlett

B. Riley Securities

1 question for ECC

Paul Johnson

Keefe, Bruyette & Woods

1 question for ECC

Randolph Binner

B. Riley Financial, Inc.

1 question for ECC

Shalabh Mehrish

VinsonCap Advisors LP

1 question for ECC

Steven Bavaria

Inside The Income Factory

1 question for ECC

Recent press releases and 8-K filings for ECC.

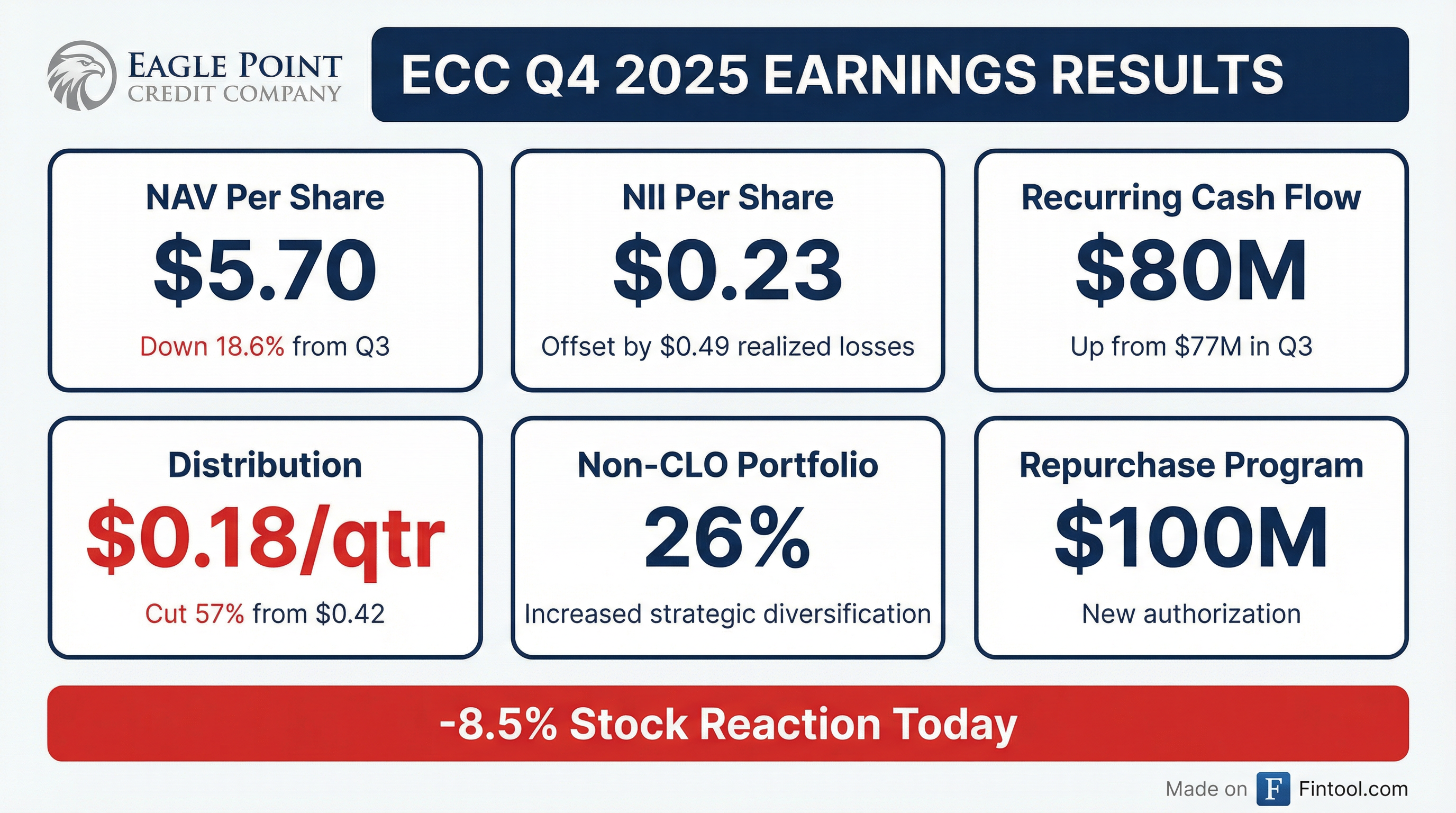

- Eagle Point Credit Co (ECC) reported a GAAP return on common equity of negative 14.6% for 2025, which was modestly better than Nomura Research's estimated median CLO equity return of negative 15% for the year.

- The company's Net Asset Value (NAV) was $5.70 per share as of December 31, 2025, a decrease from $7 per share on September 30, 2025, with Q4 2025 net investment income (NII) less realized losses at -$0.26 per share.

- ECC declared a reduced monthly distribution of $0.06 per share for the second quarter of 2026, down from $0.14 per share in the prior quarter, to retain more capital for investments.

- The company optimized its capital structure by redeeming its 8% Series F Term Preferred Stock on January 30 and issuing a total of $155 million of 7% Series AA and BB convertible perpetual preferred stock through the end of 2025.

- The board authorized a $100 million common stock repurchase program, and the company increased its allocation to credit assets beyond CLO equity, with the non-CLO portion of its portfolio reaching approximately 26% of total investments by year-end 2025.

- Eagle Point Credit Company reduced its common stock distribution to $0.06 per share for Q2 2026, down from $0.14 per share in Q4 2025 and Q1 2026, and authorized a $100 million common stock repurchase program.

- The company is intentionally increasing its allocation to credit assets other than CLO equity, which currently represents 26% of the portfolio, to maximize total return and sees the most attractive risk-adjusted returns in these areas.

- ECC optimized its capital structure by redeeming its 8% Series F Term Preferred Stock on January 30 and issuing a total of $155 million of 7% Series AA and BB convertible perpetual preferred stock through the end of 2025.

- Management expects the credit environment in 2026 to be similar to 2025, with continued loan spread compression and a robust pipeline for CLO refinancings and resets.

- Eagle Point Credit Company reported a GAAP return on common equity of negative 14.6% for 2025 and a NAV of $5.70 per share as of December 31, 2025, a decrease from $7 per share on September 30.

- For Q4 2025, the company recorded net investment income less realized losses of -$0.26 per share, while recurring cash flows from the portfolio increased to $0.61 per share.

- The company is strategically increasing its exposure to credit assets beyond CLO Equity, with the non-CLO portion of its portfolio reaching approximately 26% at year-end 2025, a strategy that helped mitigate market headwinds.

- To optimize its capital structure, ECC redeemed its 8% Series F Term Preferred Stock and issued $155 million of 7% Series AA and BB convertible perpetual preferred stock through the end of 2025. The board also authorized a $100 million common stock repurchase program.

- The company declared monthly distributions of $0.06 per share for Q2 2026, a reduction from Q1 2026's $0.14 per share, to retain more capital for investments.

- Eagle Point Credit Company Inc. reported a Net Asset Value (NAV) per common share of $5.70 as of December 31, 2025, compared to $7.00 as of September 30, 2025, and a GAAP net loss attributable to common stock of $109.9 million for the fourth quarter of 2025.

- The company declared monthly common distributions of $0.06 per share for the second quarter of 2026, a revised rate aligned with the company's near-term earnings potential.

- A common stock repurchase program of up to $100 million was authorized by the board of directors.

- During the fourth quarter of 2025, the company deployed $183.7 million in gross capital into new investments, with approximately $147 million allocated to credit asset classes beyond CLO equity, indicating an intentional decision to increase exposure to these assets over time.

- Eagle Point Credit Company (ECC) reported Q3 2025 recurring cash flows of $77 million or $0.59 per share, a decrease from the prior quarter. Net investment income less realized losses was $0.16 per share, with net investment income at $0.24 per share.

- The company's Net Asset Value (NAV) stood at $7 per share as of September 30th, a 4.2% decrease from June 30th. Management's unaudited estimate for NAV as of October month-end was between $6.69 and $6.79 per share.

- ECC deployed almost $200 million into new investments during Q3 2025, achieving a weighted average effective yield of 16.9% on new CLO equity investments. The company also completed 16 refinancings and 11 resets of existing portfolio investments.

- The company issued $26 million of common stock at a premium to NAV and approximately $13 million of 7% Series AA and AB convertible perpetual preferred stock. Debt and preferred securities outstanding were 42% of total assets less current liabilities, exceeding the target range of 27.5%-37.5%. The Series F preferred stock is callable on January 18, 2026.

- ECC reported Q3 2025 recurring cash flows of $77 million or $0.59 per share, a decrease from Q2, and net investment income less realized losses of $0.16 per share.

- The company's Net Asset Value (NAV) as of September 30th stood at $7 per share, representing a 4.2% decline from June 30th, with the largest component of this move attributed to distributions exceeding net investment income.

- During Q3, ECC deployed nearly $200 million into new investments, with CLO equity investments having a 16.9% weighted average effective yield, and proactively completed 16 refinancings and 11 resets to strengthen its portfolio's earning power.

- ECC issued $26 million of common stock at a premium to NAV through its at-the-market program, resulting in $0.02-$0.03 accretion to NAV, and approximately $13 million of 7% Series AA and AB convertible perpetual preferred stock.

- The company declared monthly distributions of $0.14 per share for Q1 2026, maintaining the prior quarter's level, and noted that its Series F preferred stock becomes callable on January 18, 2026.

- For Q3 2025, Eagle Point Credit Company (ECC) reported Total Gross Income of $52.02 million and Total Portfolio Cash Distributions Received of $79.36 million.

- The company's Portfolio Cash Distributions Received per Common Share was $0.61 and GAAP Net Investment Income and Realized Gain/(Loss) per Common Share was $0.16 for Q3 2025.

- As of Q3 2025, ECC's Total Market Capitalization was $1,408.8 million, and it offers a monthly distribution of $0.14 per share of common stock, equating to a 27.1% distribution rate starting January 2025.

- At the end of Q3 2025, ECC's common stock traded at a -5.6% discount to Net Asset Value, with a market price of $6.61 per share and a Net Asset Value of $7.00 per share.

- Since its IPO on October 7, 2014, through October 31, 2025, ECC has generated a total return of 87.88%, with an annualized net total return of 5.86%.

- For Q3 2025, Eagle Point Credit Company (ECC) reported net investment income less realized losses from investments of $0.16 per share, with GAAP net income at $0.12 per share. Recurring cash flows for the quarter were $77 million or $0.59 per share, a decrease from $85 million or $0.69 per share in Q2 2025.

- The company's NAV as of September 30th, 2025, stood at $7 per share, a 4.2% decline from $7.31 per share at June 30th, 2025. The largest factor for this NAV decline was the excess of distributions over net investment income.

- ECC deployed almost $200 million into new investments during Q3 2025, with new CLO equity investments having a weighted average effective yield of 16.9%. The company also completed 16 refinancings and 11 resets.

- The company issued $26 million of common stock through its at-the-market program and approximately $13 million of its 7% Series AA and AB convertible perpetual preferred stock.

- As of September 30th, 2025, debt and preferred securities outstanding totaled 42% of the company's total assets less current liabilities, which is above its target range of 27.5%-37.5%.

- Eagle Point Credit Company Inc. reported a Net Asset Value (NAV) per common share of $7.00 as of September 30, 2025, a decrease from $7.31 as of June 30, 2025. The company also announced Net Investment Income (NII) of $0.24 per weighted average common share and GAAP net income of $15.5 million, or $0.12 per weighted average common share for the third quarter of 2025.

- During Q3 2025, ECC deployed $199.4 million in gross capital into CLO equity, CLO debt, loan accumulation facilities, and other investments. The weighted average effective yield of its CLO equity portfolio was 12.41% as of September 30, 2025.

- The company declared monthly common stock distributions of $0.14 per share for January, February, and March 2026. Additionally, distributions were declared for various preferred stock series, including $0.135417 per share for Series C, $0.140625 per share for Series D, $0.166667 per share for Series F, and $0.145834 per share for 7.00% Series AA/AB Convertible Perpetual Preferred Stock for the same period.

- Management's estimate for the range of the Company's NAV per common share is between $6.69 and $6.79 as of October 31, 2025.

Quarterly earnings call transcripts for Eagle Point Credit Co.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more