Earnings summaries and quarterly performance for ENSIGN GROUP.

Executive leadership at ENSIGN GROUP.

Board of directors at ENSIGN GROUP.

Research analysts who have asked questions during ENSIGN GROUP earnings calls.

Benjamin Hendrix

RBC Capital Markets

5 questions for ENSG

Also covers: ACHC, ADUS, AHCO +25 more

Raj Kumar

Stephens

4 questions for ENSG

Also covers: ACHC, ADUS, ARDT +7 more

AR

A.J. Rice

UBS Group AG

3 questions for ENSG

Also covers: ACHC, AMED, AMN +21 more

Tao Qiu

Macquarie Group

3 questions for ENSG

Also covers: ADUS, AMED, BKD +5 more

AR

Albert Rice

UBS

2 questions for ENSG

Also covers: ACHC, AMED, AMN +20 more

CM

Clark Murphy

Truist Securities

2 questions for ENSG

DM

David Macdonald

Truist Securities

1 question for ENSG

Also covers: AVAH, GRDN, OPCH +3 more

MM

Michael Murray

RBC Capital Markets

1 question for ENSG

Also covers: ADUS, AHCO, AMED +7 more

SF

Scott Fidel

Stephens Inc.

1 question for ENSG

Also covers: ACHC, ADUS, ALHC +17 more

Recent press releases and 8-K filings for ENSG.

Ensign Group Reports Q4 and Full-Year 2025 Results, Issues 2026 Guidance

ENSG

Earnings

Guidance Update

M&A

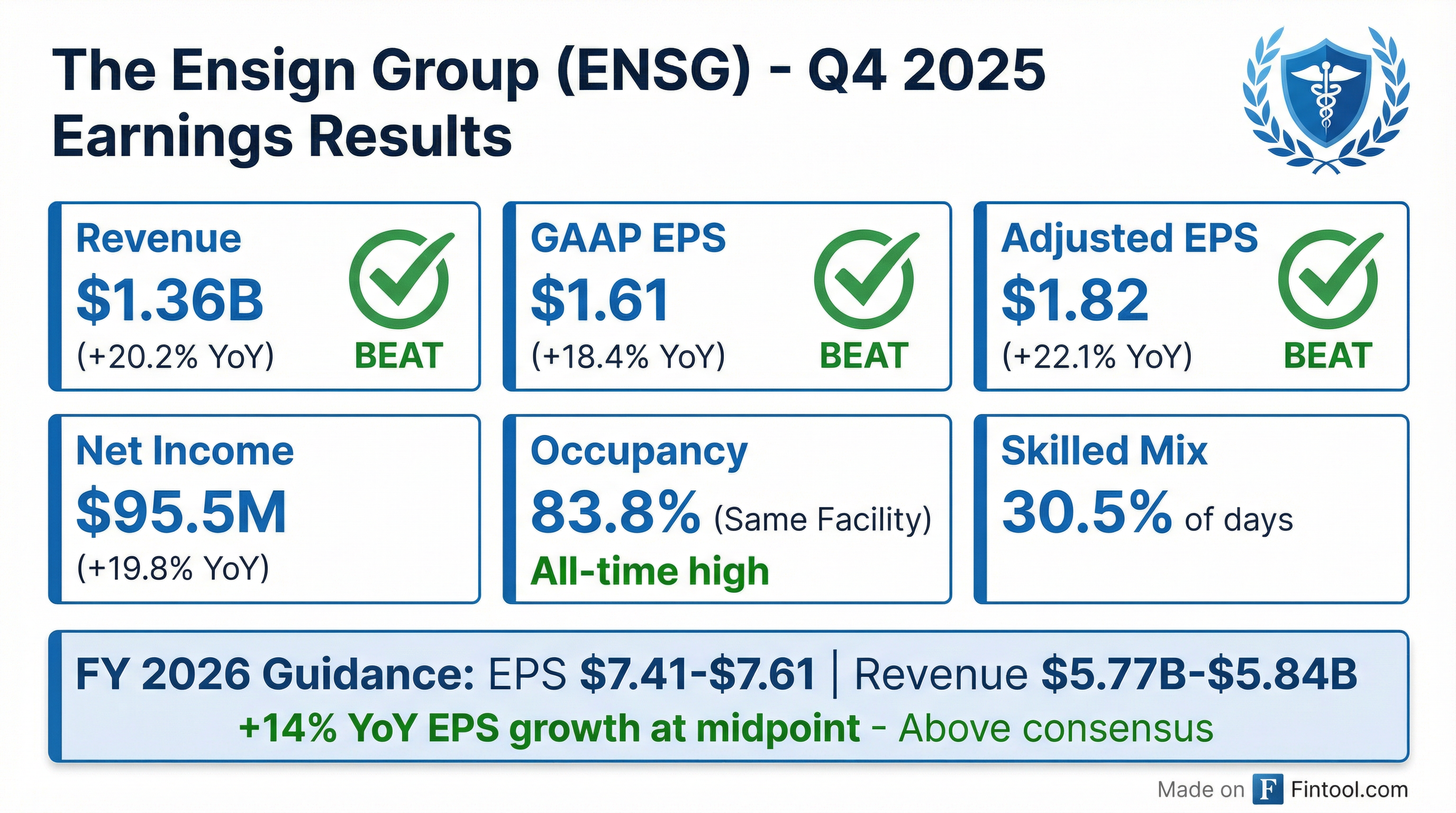

- The Ensign Group reported GAAP diluted earnings per share of $1.61 and adjusted diluted earnings per share of $1.82 for the fourth quarter ended December 31, 2025. For the full fiscal year 2025, GAAP diluted earnings per share were $5.84 and adjusted diluted earnings per share were $6.57.

- Consolidated revenue for Q4 2025 was $1.36 billion, and for the full fiscal year 2025, it was $5.06 billion.

- The company issued its 2026 annual guidance, projecting earnings of $7.41 to $7.61 per diluted share and revenue of $5.77 billion to $5.84 billion.

- Ensign expanded its portfolio by adding 17 new operations during the quarter and since, totaling 51 acquisitions in 2025, and increased its dividend for the 23rd consecutive year in December 2025.

2 days ago

Ensign Group Reports Fiscal Year and Q4 2025 Results, Issues 2026 Guidance

ENSG

Earnings

Guidance Update

Dividends

- The Ensign Group, Inc. reported GAAP diluted earnings per share of $5.84 and adjusted earnings per share of $6.57 for the fiscal year ended December 31, 2025, with consolidated revenue of $5.06 billion.

- For the fourth quarter ended December 31, 2025, the company achieved GAAP diluted earnings per share of $1.61 and adjusted earnings per share of $1.82, alongside consolidated revenue of $1.36 billion.

- Ensign issued its annual 2026 guidance, projecting earnings of $7.41 to $7.61 per diluted share and revenue between $5.77 billion and $5.84 billion.

- The company maintains strong liquidity with approximately $503.9 million of cash on hand and $591.6 million of available capacity under its line-of-credit.

- Ensign increased its quarterly cash dividend to $0.065 per share, marking the 23rd consecutive year of dividend increases.

2 days ago

ENSIGN GROUP Reports Record Q4 and Full-Year 2025 Results, Issues Strong 2026 Guidance

ENSG

Earnings

Guidance Update

M&A

- ENSIGN GROUP reported strong financial results for Q4 2025, with adjusted diluted EPS of $1.82, an increase of 22.1%, and consolidated revenue of $1.4 billion, an increase of 20.2%. For the full year 2025, adjusted diluted EPS was $6.57, up 19.5%, and consolidated revenue reached $5.1 billion, an increase of 18.7%.

- The company provided annual 2026 earnings guidance of $7.41-$7.61 per diluted share and annual revenue guidance of $5.77 billion-$5.84 billion. The midpoint of the 2026 earnings guidance represents a 14.3% increase over 2025 results.

- Operational highlights include record-high same-store occupancy of 83.8% and transitioning occupancy of 84.9% during the quarter. Skilled days increased by 8.5% for same-store operations and 10% for transitioning operations over the prior year quarter.

- ENSIGN GROUP added 17 new operations in Q4 2025, including 12 real estate assets, and has over $1 billion in dry powder for future investments, combining its line of credit and cash on hand. Director of Nursing turnover declined by 33% over the past few years.

3 days ago

Ensign Group Reports Record Q4 and Full-Year 2025 Results, Issues Strong 2026 Guidance

ENSG

Earnings

Guidance Update

M&A

- The Ensign Group reported strong financial results for Q4 2025, with adjusted diluted EPS of $1.82 (up 22.1%) and consolidated revenue of $1.4 billion (up 20.2%). For the full year 2025, adjusted diluted EPS was $6.57 (up 19.5%) and consolidated revenue reached $5.1 billion (up 18.7%).

- The company issued annual 2026 earnings guidance of $7.41-$7.61 per diluted share and annual revenue guidance of $5.77 billion-$5.84 billion. The midpoint of the 2026 earnings guidance represents a 14.3% increase over 2025 results.

- Operational highlights include record-high same-store occupancy of 83.8% and transitioning occupancy of 84.9%. The company also saw significant increases in skilled days and Medicare/managed care revenue across both same-store and transitioning operations.

- Strategic growth continued with the addition of 17 new operations in Q4 2025, including 1,371 new skilled nursing beds. The company maintains a strong balance sheet with over $1 billion in dry powder for future investments and increased its dividend for the 23rd consecutive year.

3 days ago

Ensign Group Reports Record Q4 and FY 2025 Results, Issues Strong 2026 Guidance

ENSG

Earnings

Guidance Update

M&A

- The Ensign Group reported strong Q4 2025 financial results, with consolidated revenue increasing 20.2% to $1.4 billion and adjusted diluted EPS growing 22.1% to $1.82. For the full year 2025, revenue reached $5.1 billion and adjusted diluted EPS was $6.57.

- The company provided annual 2026 earnings guidance of $7.41-$7.61 per diluted share and revenue guidance of $5.77 billion-$5.84 billion. The midpoint of the 2026 earnings guidance represents a 14.3% increase over 2025 results.

- Operational metrics reached record highs in Q4 2025, with same-store and transitioning occupancy at 83.8% and 84.9%, respectively. ENSG also continued its growth strategy, adding 17 new operations and 1,371 skilled nursing beds in Q4 2025, alongside new construction projects. The company maintains a robust balance sheet with $504 million in cash and over $1 billion in available capital for future investments, and increased its dividend for the 23rd consecutive year.

3 days ago

Ensign Group Expands Portfolio with Multiple Acquisitions

ENSG

M&A

New Projects/Investments

- Ensign Group completed five acquisitions of skilled nursing facilities, effective February 1, 2026.

- The acquisitions include both real estate and operations for four facilities in Texas and Wisconsin, and the operations of one facility in Arizona.

- These transactions expand Ensign's portfolio to 378 healthcare operations across 17 states, with its subsidiaries now owning 160 real estate assets.

- CEO Barry Port reaffirmed the company's active pursuit of further acquisition opportunities for real estate and operations in the healthcare sector.

4 days ago

Ensign Group Reports Strong Q3 2025 Results and Raises Full-Year Guidance

ENSG

Earnings

Guidance Update

M&A

- Ensign Group reported Q3 2025 GAAP diluted earnings per share of $1.42 and adjusted diluted earnings per share of $1.64, representing increases of 6% and 18% respectively. Consolidated GAAP and adjusted revenues were $1.3 billion, an increase of 19.8%.

- The company raised its 2025 annual earnings guidance to between $6.48 and $6.54 per diluted share and its annual revenue guidance to between $5.05 billion and $5.07 billion. The new midpoint for earnings guidance represents an 18.4% increase over 2024 results.

- During Q3 2025, Ensign Group added 22 new operations, including 10 real estate assets, bringing the total acquisitions for 2025 to 45. These additions included 1,857 new skilled nursing beds and 109 senior living units across six states.

- Standard Bearer Healthcare REIT generated $32.6 million in rental revenue for the quarter, with $19.3 million in FFO, and maintained an EBITDA to rent coverage ratio of 2.5 times.

Nov 4, 2025, 6:00 PM

Ensign Group Reports Strong Q3 2025 Results and Raises Full-Year Guidance

ENSG

Earnings

Guidance Update

M&A

- Ensign Group reported strong Q3 2025 financial results, with adjusted diluted earnings per share increasing 18% to $1.64 and consolidated revenues rising 19.8% to $1.3 billion.

- The company raised its full-year 2025 guidance, with annual earnings now projected between $6.48-$6.54 per diluted share and annual revenue between $5.05 billion-$5.07 billion.

- Operational performance saw Same-Store and transitioning occupancy reach all-time highs of 83% and 84.4%, respectively, driven by increases in skilled days and Medicare/managed care revenues.

- During Q3 2025, Ensign Group accelerated growth by adding 22 new operations, bringing the total acquisitions for 2025 to 45, and its Standard Bearer real estate portfolio grew to 149 owned properties.

Nov 4, 2025, 6:00 PM

Ensign Group Reports Strong Q3 2025 Results and Raises Full-Year Guidance

ENSG

Earnings

Guidance Update

M&A

- The Ensign Group reported strong financial results for Q3 2025, with GAAP diluted earnings per share of $1.42, an increase of 6%, and adjusted diluted earnings per share of $1.64, up 18%. Consolidated GAAP and adjusted revenues both reached $1.3 billion, marking a 19.8% increase.

- The company raised its annual 2025 earnings guidance to between $6.48-$6.54 per diluted share and its annual revenue guidance to between $5.05 billion and $5.07 billion.

- Operational highlights include Same-Store and transitioning occupancy reaching all-time highs of 83% and 84.4%, respectively. Skilled days increased by 5.1% for Same-Store and 10.9% for transitioning operations over the prior year quarter.

- During Q3 2025, Ensign accelerated its growth by adding 22 new operations, including 10 real estate assets, totaling 1,857 new skilled nursing beds and 109 senior living units across six states, bringing the total acquisitions for 2025 to 45.

- The company maintains a strong financial position with $443.7 million in cash and cash equivalents and $593 million of available capacity under its line of credit as of September 30, 2025, providing over $1 billion in dry powder for future investments.

Nov 4, 2025, 6:00 PM

Ensign Group Reports Strong Q3 2025 Results and Raises Full-Year Guidance

ENSG

Earnings

Guidance Update

M&A

- The Ensign Group reported GAAP diluted earnings per share of $1.42 and adjusted diluted earnings per share of $1.64 for the third quarter ended September 30, 2025.

- Consolidated GAAP and adjusted revenue for Q3 2025 was $1.30 billion, an increase of 19.8% over the prior year quarter.

- The company raised its annual 2025 earnings guidance to between $6.48 to $6.54 per diluted share and annual revenue guidance to $5.05 billion to $5.07 billion.

- Same Facilities occupancy for the quarter was 83.0%, and Transitioning Facilities occupancy was 84.4%, representing increases of 2.1% and 3.6% respectively over the prior year quarter.

- As of September 30, 2025, the company maintained strong liquidity with approximately $443.7 million of cash on hand and $592.6 million of available capacity under its line-of-credit.

Nov 3, 2025, 9:18 PM

Quarterly earnings call transcripts for ENSIGN GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more