Earnings summaries and quarterly performance for ENTEGRIS.

Executive leadership at ENTEGRIS.

David Reeder

President and Chief Executive Officer

Bertrand Loy

Executive Chair

Daniel Woodland

Senior Vice President and President, Materials Solutions

Joseph Colella

Senior Vice President, General Counsel, Chief Compliance Officer and Secretary

Linda LaGorga

Senior Vice President, Chief Financial Officer

Susan Rice

Senior Vice President, Global Human Resources

Board of directors at ENTEGRIS.

Research analysts who have asked questions during ENTEGRIS earnings calls.

John Ezekiel Roberts

Mizuho Securities

7 questions for ENTG

Melissa Weathers

Deutsche Bank

7 questions for ENTG

Timothy Arcuri

UBS

7 questions for ENTG

Bhavesh Lodaya

BMO Capital Markets

6 questions for ENTG

Aleksey Yefremov

KeyBanc Capital Markets

4 questions for ENTG

Charles Shi

Needham & Company

4 questions for ENTG

Christopher Parkinson

Wolfe Research

4 questions for ENTG

Atif Malik

Citigroup Inc.

3 questions for ENTG

Edward Yang

Oppenheimer & Co. Inc.

3 questions for ENTG

Elizabeth Sun

Citi

2 questions for ENTG

Harris Fein

Wolfe Research

2 questions for ENTG

Jim Schneider

Goldman Sachs

2 questions for ENTG

Michael Harrison

Seaport Research Partners

2 questions for ENTG

Mike Harrison

Seaport Research Partners

2 questions for ENTG

Toshiya Hari

Goldman Sachs Group, Inc.

2 questions for ENTG

Yu Shi

Susquehanna International Group, LLP

2 questions for ENTG

Yiling Sun

Citi

1 question for ENTG

Recent press releases and 8-K filings for ENTG.

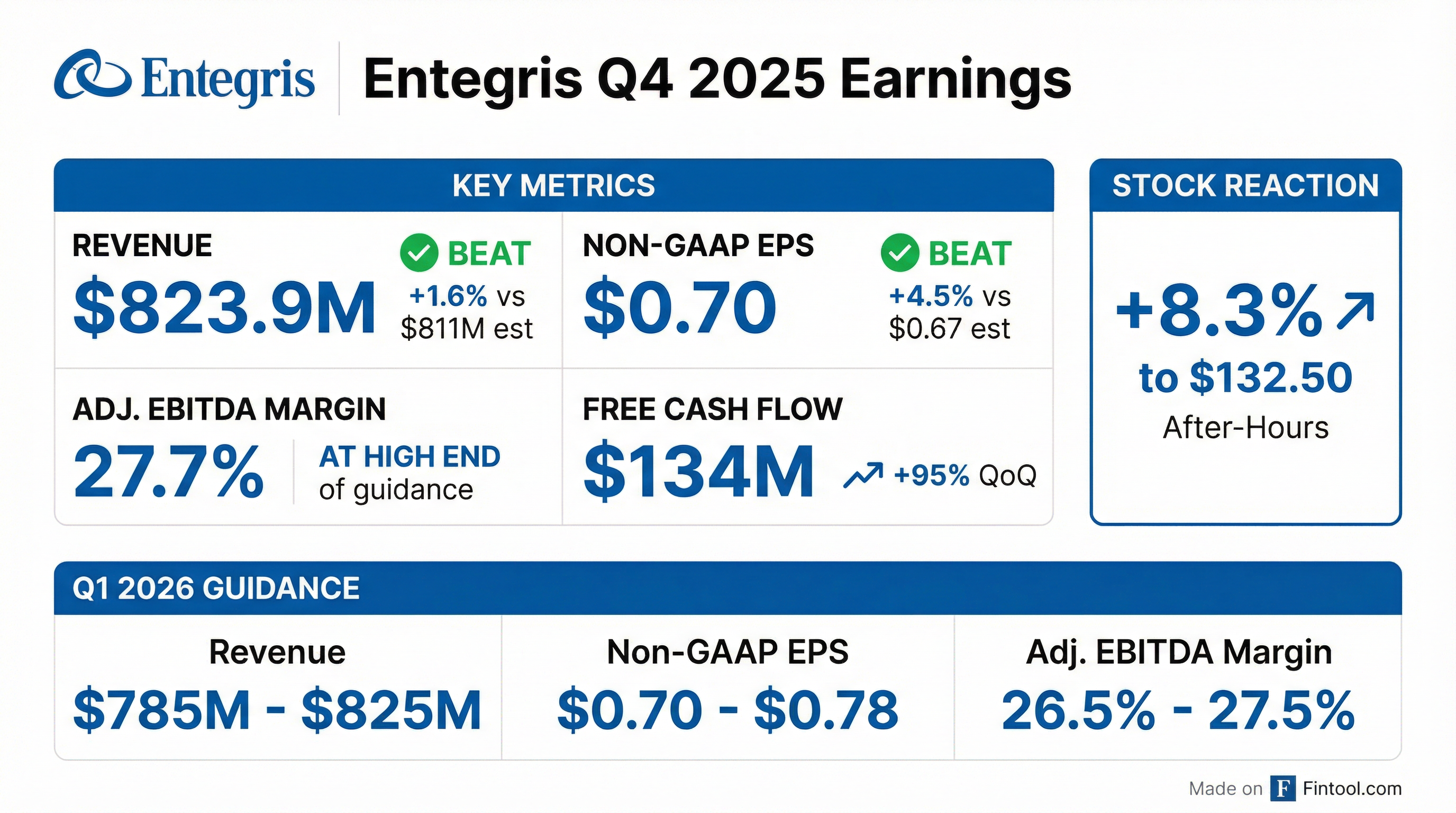

- Entegris reported Q4 2025 sales of $824 million and non-GAAP EPS of $0.70 per share, both at or above guidance.

- For the full year 2025, total revenue was approximately flat compared to 2024 (excluding divestitures), with free cash flow reaching $404 million and a 12.7% free cash flow margin.

- The company provided Q1 2026 sales guidance of $785 million to $825 million and non-GAAP EPS guidance of $0.70 to $0.78 per share.

- Entegris expects 2026 CapEx to decline to $250 million and targets reducing net leverage to below 3.5 times by the end of 2026.

- The company anticipates a more constructive industry backdrop in 2026, driven by node transitions in logic and memory, expected mid-single-digit industry MSI growth, and growth in fab construction spending.

- Entegris reported strong Q4 2025 results, with sales of $824 million, non-GAAP gross margin of 44%, adjusted EBITDA of 27.7% of revenue, and non-GAAP EPS of 70 cents per share, all at or above guidance.

- For the full year 2025, total revenue was approximately flat compared to 2024 (excluding divestitures), with unit-driven revenue growing approximately 2% and CapEx-driven revenue declining 7%. The company achieved a free cash flow margin of 12.7% and reduced net leverage to 3.8 times.

- Looking to 2026, Entegris anticipates a more constructive industry backdrop, expecting mid-single-digit industry MSI growth, growth in fab construction spending, and strong WFE growth. The company projects Q1 2026 sales between $785 million and $825 million and expects CapEx to decline to $250 million for the year, targeting net leverage below 3.5 times by year-end.

- Strategic priorities for 2026 include deepening customer intimacy, improving utilization by ramping new facilities and rationalizing existing ones, improving free cash flow, and increasing local-for-local manufacturing, particularly for China, where approximately 85% of Q1 revenue is expected to be supplied by Asia facilities.

- Entegris reported Q4 2025 revenue of $824 million and non-GAAP EPS of $0.70 per share, both at the high end or above guidance.

- For the full year 2025, total revenue was approximately flat compared to 2024 (excluding divestitures), and free cash flow margin improved to 12.7%.

- The company provided Q1 2026 sales guidance of $785 million to $825 million and expects 2026 CapEx to decline to $250 million.

- Entegris anticipates mid-single-digit industry MSI growth in 2026, along with growth in fab construction spending and WFE, and aims to reduce net leverage to below 3.5 times by the end of 2026.

- ENTEGRIS reported Q4 2025 GAAP Net Sales of $823.9 million, with Net Income of $49.4 million and Diluted Earnings Per Common Share of $0.32. On a non-GAAP basis, Net Sales were $823.9 million, Non-GAAP Net Income was $106.5 million, and Diluted Non-GAAP Earnings Per Common Share was $0.70.

- Compared to Q4 2024, GAAP Net Income decreased 51.7% and Diluted EPS decreased 52.2%. Non-GAAP Net Income decreased 16.5% and Diluted Non-GAAP EPS decreased 16.7%.

- In Q4 2025, Materials Solutions (MS) Net Sales were $361.8 million, while Advanced Purity Solutions (APS) Net Sales were $464.5 million. APS sales decreased 5.4% year-over-year, primarily due to fluid handling and FOUPs.

- Cash provided by operating activities for Q4 2025 was $192.0 million, and Free Cash Flow was $134.0 million. The company ended the quarter with $360.4 million in Cash and Cash Equivalents.

- For 1Q26, ENTEGRIS expects GAAP Net Sales between $785 million and $825 million, GAAP Net Income between $65 million and $77 million, and Diluted Earnings Per Common Share between $0.43 and $0.51. Non-GAAP guidance for 1Q26 includes Net Sales between $785 million and $825 million, Non-GAAP Net Income between $106 million and $118 million, and Diluted non-GAAP Earnings Per Common Share between $0.70 and $0.78.

- Entegris reported Q4 2025 revenue of $823.9 million and non-GAAP EPS of $0.70, with full-year 2025 sales reaching $3.20 billion and net income of $235.6 million.

- The company provided Q1 2026 guidance projecting net sales between $785 million and $825 million and diluted EPS between $0.43 and $0.51, which was met with an uneven reaction from analysts.

- In 2025, unit-driven revenue grew approximately 2%, while CapEx-driven revenue declined about 7%; however, management anticipates benefits in 2026 from logic node transitions and NAND layer migrations.

- An upcoming CFO transition and elevated valuation amidst softer near-term guidance were identified as execution risks.

- Entegris reported net sales of $823.9 million for the fourth quarter ended December 31, 2025.

- GAAP diluted EPS was $0.32 and Non-GAAP diluted EPS was $0.70 for the same period.

- For the first quarter ending March 28, 2026, the company expects sales between $785 million and $825 million and diluted non-GAAP earnings per common share between $0.70 and $0.78.

- CEO Dave Reeder highlighted solid performance in Q4 2025 with revenue, adjusted EBITDA margin, and non-GAAP EPS near or above guidance, and anticipates continued improvement in cash generation in 2026.

- Entegris reported net sales of $824 million and non-GAAP diluted EPS of $0.70 for the fourth quarter ended December 31, 2025.

- For the full year 2025, the company achieved unit-driven growth in liquid filtration, selective etch, and CMP consumables, alongside improved free cash flow.

- For the first quarter ending March 28, 2026, Entegris expects sales between $785 million and $825 million and non-GAAP diluted EPS between $0.70 and $0.78.

- The company anticipates solid momentum entering 2026, driven by customer adoption of complex device architectures and the rapid growth of AI, which is expected to accelerate growth and enhance its financial profile.

- Entegris reported flat revenue of approximately $807 million and adjusted earnings per share of $0.72 for Q3 2025, slightly surpassing revenue expectations and meeting EPS forecasts.

- Despite meeting Q3 expectations, the company experienced declining gross margins year-over-year and projected weaker guidance for Q4 2025, with expected adjusted earnings and revenue falling below analyst estimates.

- This weak guidance led to a significant stock price decline, reflecting investor concerns over profitability challenges and competitive industry conditions.

- The Advanced Purity Solutions (APS) segment showed stronger sequential sales growth and margin improvement in Q3 2025, and inventory days outstanding improved to 129 days from 144 days in the prior quarter.

- Entegris reported Q3 2025 revenue of $807 million, which was flat year-over-year and up 2% sequentially, in line with guidance. Non-GAAP EPS was $0.72 per share, also in line with guidance, while the non-GAAP gross margin of 43.6% was below guidance due to manufacturing asset underutilization.

- The company generated $191 million in free cash flow in Q3 2025, its highest in six years, and paid down $150 million of its term loan. The single capital allocation priority remains reducing gross leverage to below 4x.

- CEO Dave Reeder, in his first earnings call, outlined three initial priorities: enhancing customer intimacy, accelerating the qualification and ramp of new facilities in Taiwan (volume increase in 2026) and Colorado (qualifications in 2026, ramp late 2026/2027), and improving free cash flow.

- For Q4 2025, Entegris expects sales to range from $790 million to $830 million and non-GAAP EPS between $0.62 and $0.69 per share. Capital expenditures are anticipated to materially decrease year-over-year after Q3 2025.

- The company noted strong AI-driven growth in advanced logic and memory, with renewed optimism for 3D NAND, but industry facilities-related spending is down approximately 10% year-over-year.

- Entegris reported Net Sales of $807.1 million for Q3 2025.

- GAAP Diluted Earnings Per Common Share was $0.46, while Non-GAAP Diluted Earnings Per Common Share reached $0.72 in Q3 2025.

- The company generated $249.5 million in cash from operating activities and $191.0 million in Free Cash Flow during Q3 2025.

- For Q4 2025, Entegris projects Net Sales to be between $790 million and $830 million, with Diluted Non-GAAP Earnings Per Common Share expected to range from $0.62 to $0.69.

Quarterly earnings call transcripts for ENTEGRIS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more