Earnings summaries and quarterly performance for Enova International.

Executive leadership at Enova International.

Board of directors at Enova International.

Research analysts who have asked questions during Enova International earnings calls.

David Scharf

Citizens Capital Markets and Advisory

6 questions for ENVA

John Hecht

Jefferies

6 questions for ENVA

Kyle Joseph

Jefferies

5 questions for ENVA

Moshe Orenbuch

TD Cowen

5 questions for ENVA

Vincent Caintic

Stephens Inc.

5 questions for ENVA

John Rowan

Janney Montgomery Scott

3 questions for ENVA

Bill Ryan

Seaport Research Partners

2 questions for ENVA

William Ryan

Seaport Research Partners

1 question for ENVA

Recent press releases and 8-K filings for ENVA.

- Dassault Systèmes reported Q4 2025 total revenue growth of 1% and full-year 2025 total revenue growth of 4% in constant currencies.

- For Q4 2025, non-IFRS operating margin increased by 90 basis points to 37.0%, and non-IFRS diluted EPS grew 9% in constant currencies. For the full year 2025, non-IFRS operating margin was 32.0%, up 40 basis points, with non-IFRS diluted EPS reaching €1.31, an increase of 7% in constant currencies.

- The company initiated its FY 2026 non-IFRS outlook, projecting total revenue growth of 3% to 5%, an operating margin between 32.2% and 32.6%, and diluted EPS of €1.30 - €1.34.

- Annual Run Rate (ARR) grew 6% year-over-year to €4.50 billion at the end of Q4 2025, reflecting the continued transition towards a subscription and Cloud-based business model.

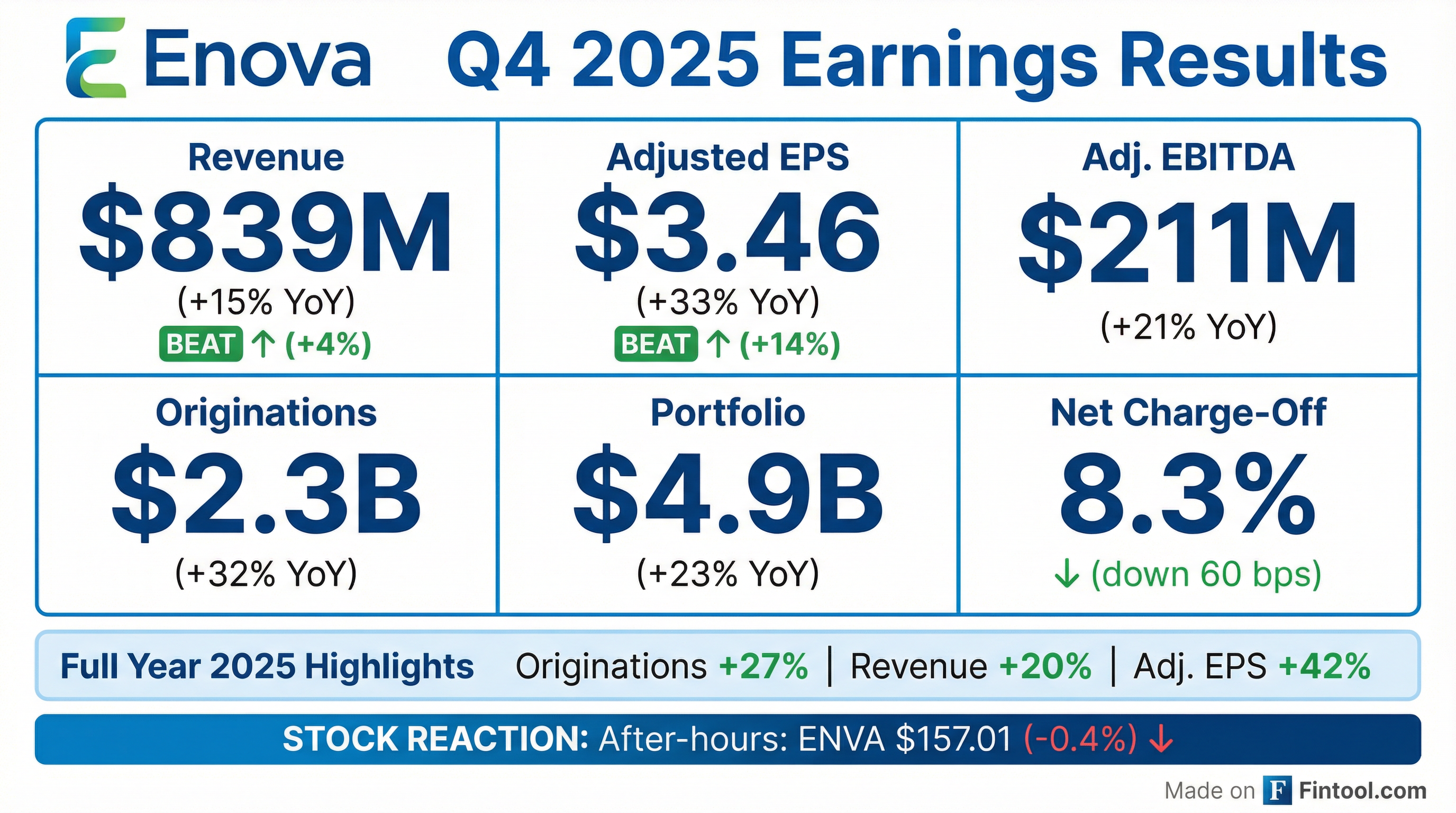

- Enova International reported strong financial results for Q4 and full year 2025, with Q4 originations increasing 32% year-over-year to $2.3 billion and full-year 2025 adjusted EPS growing 42%.

- The company announced management changes effective January 1, 2026, with Steve Cunningham becoming CEO and Scott Cornelis becoming CFO, while David Fisher transitioned to Executive Chairman.

- Enova expects to close the acquisition of Grasshopper Bank in the second half of 2026, anticipating $125 million-$220 million annually in net synergies and over 25% adjusted EPS accretion once fully realized.

- For full year 2026, the company projects originations growth of around 15% and adjusted EPS growth of at least 20%, assuming a stable macroeconomic environment.

- Enova International reported strong Q4 2025 results, with total company revenue increasing 15% year-over-year to $839 million and originations growing 32% to $2.3 billion. Adjusted EPS rose 33% to $3.46 per diluted share.

- For the full year 2025, the company achieved nearly 20% revenue growth and 42% Adjusted EPS growth, driven by 27% originations growth.

- The company provided Q1 2026 guidance, expecting revenue to be flat to slightly higher sequentially and Adjusted EPS to be 20%-25% higher than Q1 2025. For full year 2026, Enova anticipates originations growth of around 15% and Adjusted EPS growth of at least 20%, excluding the Grasshopper Bank acquisition.

- Effective January 1, 2026, Steve Cunningham became CEO and Scott Cornelis became CFO, with David Fisher transitioning to Executive Chairman. The pending acquisition of Grasshopper Bank, announced in December, is expected to close in the second half of 2026.

- Enova reported a record year in 2025, with full-year Adjusted EPS increasing 42% and revenue growing nearly 20%. For Q4 2025, revenue increased 15% year-over-year to $839 million, and Adjusted EPS grew 33% to $3.46 per diluted share.

- The company is progressing with the acquisition of Grasshopper Bank, expected to close in the second half of 2026, which is projected to increase adjusted net income by $125 million to $220 million annually and drive Adjusted EPS accretion of more than 25% once synergies are fully realized.

- For the full year 2026, Enova expects originations growth of around 15%, with resulting revenue growth similar to originations growth, and Adjusted EPS growth of at least 20%. These expectations do not include any contribution from the Grasshopper Bank acquisition.

- Effective January 1st, Steve Cunningham became CEO and Scott Cornelis became CFO, as the former CEO transitioned to the Executive Chairman role for at least two years.

- Enova International, Inc. reported total revenue of $839 million for the fourth quarter of 2025, marking a 15% increase from Q4 2024, and diluted earnings per share of $3.00, a 30% increase.

- For the full year 2025, total revenue reached $3.2 billion, up 19% from 2024, with net income of $308 million, or $11.52 per diluted share, representing a 47% increase.

- The company maintained strong consolidated credit performance in Q4 2025, with a net charge-off ratio of 8.3% and a net revenue margin of 60%.

- Enova announced the acquisition of Grasshopper Bancorp, Inc. and its wholly-owned subsidiary Grasshopper Bank, which is expected to close during the second half of 2026.

- During the fourth quarter of 2025, Enova repurchased $35 million of common stock under its share repurchase program.

- For the fourth quarter ended December 31, 2025, Enova International reported total revenue of $839 million, a 15% increase from Q4 2024, and diluted earnings per share of $3.00, up 24% from Q4 2024.

- For the full year ended December 31, 2025, the company achieved total revenue of $3.2 billion, an 19% increase from 2024, and diluted earnings per share of $11.52, a 47% increase from 2024.

- Originations rose 32% and total company combined loans and finance receivables increased 23% to a record $4.9 billion by the end of Q4 2025.

- The company repurchased $35 million of common stock during the fourth quarter of 2025.

- Enova announced the acquisition of Grasshopper Bancorp, Inc. and its subsidiary Grasshopper Bank, expected to close in the second half of 2026, aiming to expand service capabilities under a national bank charter.

- Enova International, Inc. and Grasshopper Bancorp, Inc. amended their Merger Agreement on December 18, 2025, to simplify the consideration procedures.

- Under the revised terms, Grasshopper stockholders will no longer elect between cash or stock; instead, they will receive both, with the consideration split as 50% cash and 50% stock.

- The aggregate consideration payable by Enova in the Merger remains unchanged.

- Outstanding Grasshopper stock options will be fully vested and converted into a cash payment, calculated as the product of the number of shares subject to the option and the positive difference between the Per Share Cash Amount and the option's exercise price.

- Enova International has signed a definitive agreement to acquire Grasshopper Bancorp and its subsidiary, Grasshopper Bank, N.A., for $369 million. The payment will be approximately 50% cash and 50% newly issued Enova shares.

- The transaction is expected to close in the second half of 2026 and will result in Enova becoming a bank-holding company, with Grasshopper as its bank subsidiary.

- The acquisition is projected to generate annual revenue synergies of $175 million to $230 million and funding synergies of $50 million to $100 million within the first two years post-closing.

- These synergies are anticipated to increase Adjusted Net Income by $125 million-$220 million annually and drive Adjusted EPS accretion of more than 25% once fully realized.

- Strategic benefits include expanding product offerings, lowering funding costs, and enabling geographic expansion for Enova's existing near-prime consumer products.

- Enova International, Inc. announced its plan to acquire Grasshopper Bank for an aggregate purchase value of approximately $369 million , aiming to create a leading digital bank.

- The consideration for the acquisition will be approximately 50% paid in cash and 50% in newly issued ENVA shares. Post-acquisition, Enova stockholders are expected to own ~94.7% and Grasshopper stockholders ~5.3% of the combined company.

- The transaction is anticipated to close in the second half of 2026 , pending regulatory approvals from the OCC and the Federal Reserve.

- The acquisition is expected to generate adjusted earnings per share accretion of more than 15% within the first year and more than 25% once synergies are fully realized.

- Financial benefits include expected revenue synergies of $175 million to $230 million within the first two years post-closing and an opportunity to lower the cost of funds by over 200 basis points annually , as Grasshopper's deposit costs are 300 to 400 basis points lower than Enova's securitizations.

- Enova International has signed a definitive agreement to acquire Grasshopper Bancorp and its wholly-owned subsidiary, Grasshopper Bank, N.A., in a $369 million cash and stock transaction.

- The transaction, expected to close in the second half of 2026, will establish Enova as a bank-holding company with Grasshopper as its bank subsidiary.

- Enova anticipates significant financial benefits, including annual revenue synergies of $175 million to $230 million and funding synergies of $50 million to $100 million within the first two years post-closing.

- These synergies are projected to increase Adjusted Net Income by $125 million-$220 million annually, driving Adjusted EPS accretion of more than 25% once fully realized.

Quarterly earnings call transcripts for Enova International.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more