Earnings summaries and quarterly performance for Regional Management.

Executive leadership at Regional Management.

Lakhbir S. Lamba

President and Chief Executive Officer

Brian J. Fisher

Executive Vice President and Chief Strategy and Development Officer

Catherine R. Atwood

Senior Vice President, General Counsel, and Secretary

Harpreet Rana

Executive Vice President and Chief Financial and Administrative Officer

Manish Parmar

Executive Vice President and Chief Credit Risk Officer

Board of directors at Regional Management.

Research analysts who have asked questions during Regional Management earnings calls.

Vincent Caintic

Stephens Inc.

5 questions for RM

Kyle Joseph

Jefferies

4 questions for RM

Alexander Villalobos-Morsink

Jefferies LLC

3 questions for RM

David Scharf

Citizens Capital Markets and Advisory

3 questions for RM

John Rowan

Janney Montgomery Scott

3 questions for RM

John Hecht

Jefferies

2 questions for RM

Zach Oster

Citizens Capital Markets

2 questions for RM

Alexander Villalobos

Jefferies

1 question for RM

Bill Dezellem

Tieton Capital Management

1 question for RM

William Dezellem

Tieton Capital Management

1 question for RM

Recent press releases and 8-K filings for RM.

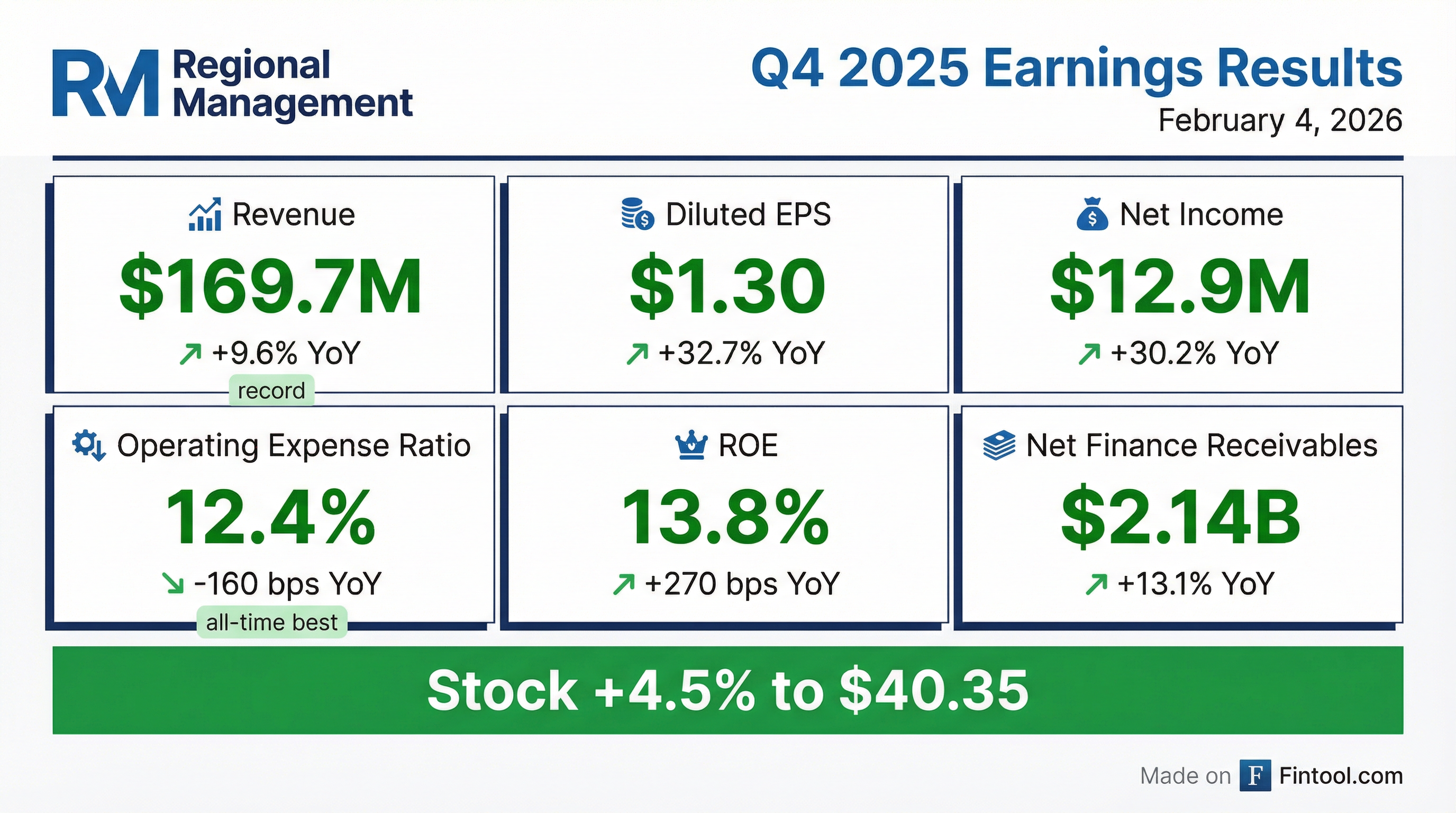

- Regional Management reported Q4 2025 net income of $12.9 million and diluted EPS of $1.30, with record quarterly revenue of $170 million.

- For the full year 2025, net income increased 8% to $44.4 million, and ending net receivables grew 13% year-over-year to $2.1 billion.

- The company achieved an all-time best annualized operating expense ratio of 12.4% in Q4 2025, an improvement of 160 basis points year-over-year, and the net credit loss rate improved by 70 basis points for the full year 2025.

- Regional Management provided full-year 2026 guidance, expecting ending net receivables growth of at least 10% and net income growth in the 20%-25% range.

- Strategic priorities include continued auto-secured portfolio growth (42% year-over-year in 2025), expansion with five new branches opened in Q4 2025, and developing a bank partnership capability.

- Regional Management (RM) reported Q4 2025 net income of $12.9 million and diluted EPS of $1.30, marking a 33% increase year-over-year, with full-year 2025 net income reaching $44.4 million, an 8% increase from 2024.

- The company's ending net receivables grew 13% year-over-year to $2.1 billion in 2025, supported by Q4 2025 total originations of $537 million.

- Credit performance improved, with the Q4 2025 30+ day delinquency rate at 7.5%, a 20 basis point year-over-year improvement, and the annualized net credit loss rate improving 30 basis points year-over-year.

- RM achieved an annualized operating expense ratio of 12.4% in Q4 2025, an improvement of 160 basis points year-over-year, reflecting strong operating efficiency.

- For 2026, RM expects ending net receivables growth of at least 10% and net income growth in the 20%-25% range, while continuing to invest in strategic initiatives such as auto-secured portfolio growth (42% year-over-year in 2025), branch expansion, and developing a bank partnership capability.

- Regional Management reported Q4 2025 net income of $12.9 million and diluted EPS of $1.30, marking a 33% year-over-year increase. For the full year 2025, net income reached $44.4 million, an 8% increase from 2024, with ending net receivables growing 13% year-over-year to $2.1 billion.

- The company projects full-year 2026 Ending Net Receivables growth of at least 10% and net income growth in the 20%-25% range.

- The annualized operating expense ratio improved to 12.4% in Q4 2025, a 160 basis point improvement year-over-year. Strategic initiatives include continued growth in the auto secured portfolio, which grew 42% year-over-year in 2025, and the development of a bank partnership capability.

- In 2025, the company generated $74 million of capital and returned $36 million to shareholders through dividends and repurchases, including 197,000 shares repurchased in Q4 2025 at a weighted average price of $38.07 per share.

- RM reported strong financial performance for Q4 2025, with net income of $12.9 million and diluted EPS of $1.30, marking increases of 30.2% and 32.7% year-over-year, respectively. For the full year 2025, net income reached $44.4 million and diluted EPS was $4.45, up 7.7% and 7.5% year-over-year.

- The company achieved record total revenue of $169.7 million in Q4 2025, a 9.6% increase year-over-year, contributing to $645.6 million for FY 2025. This growth was supported by $2.0 billion in originations (up 18.6% YoY) and 13.1% net finance receivables growth for FY 2025.

- Operating efficiency improved significantly, with the operating expense ratio reaching a historic best of 12.4% in Q4 2025, a 160 basis point improvement year-over-year. The company also reported a 13.8% Return on Equity (ROE) and 2.5% Return on Assets (ROA) in Q4 2025.

- RM returned capital to shareholders, paying $1.20 in dividends per common share for FY 2025 and repurchasing $24 million of common stock. The company maintains a robust financial position with $511 million in unused capacity and $149 million in available liquidity as of December 31, 2025.

- Regional Management Corp. reported net income of $12.9 million and diluted earnings per share of $1.30 for the fourth quarter of 2025, marking increases of 30% and 33% year-over-year, respectively.

- The company achieved record quarterly total revenue of $169.7 million, an increase of 9.6% from the prior-year period, primarily driven by 13.1% year-over-year portfolio growth in net finance receivables to $2.1 billion as of December 31, 2025.

- Operating efficiency reached an all-time best with an annualized operating expense ratio of 12.4% for Q4 2025, representing a 160 basis point improvement from the prior-year period.

- The Board of Directors declared a $0.30 per common share dividend for the first quarter of 2026, and the company repurchased 196,999 shares of its common stock at a weighted-average price of $38.07 per share during Q4 2025.

- Regional Management Corp. reported net income of $12.9 million and diluted earnings per share of $1.30 for the fourth quarter of 2025, representing year-over-year increases of 30% and 33%, respectively. For the full year 2025, net income was $44.4 million.

- The company achieved record quarterly total revenue of $169.7 million, an increase of 9.6% from the prior-year period, driven by 13.1% year-over-year portfolio growth in net finance receivables, which reached a record $2.1 billion as of December 31, 2025.

- An annualized operating expense ratio of 12.4% was achieved, marking an all-time best.

- The Board of Directors declared a dividend of $0.30 per common share for the first quarter of 2026.

- Regional Management Corp. reported Q3 2025 total revenue of $165.5 million, a 13.1% year-over-year increase, and diluted earnings per share of $1.42, up 86.8% year-over-year.

- The company's ending net receivables reached $2.1 billion as of September 30, 2025, growing $233 million year-over-year, with origination volume increasing 22.5% year-over-year to $522 million.

- Strategic expansion plans include opening 5 new branches before year-end 2025 and 5-10 new branches in the first half of 2026, along with entering 1 to 2 additional states in 2026.

- The company maintains a strong financial position with $400 million in unused capacity as of September 30, 2025, and 89% of its debt at a fixed rate with a weighted-average coupon of 4.7% following an October 2025 securitization.

- Regional Management (RM) reported strong Q3 2025 financial results, with net income of $14.4 million and diluted earnings per share of $1.42, alongside record total revenue of $165 million and an all-time best operating expense ratio of 12.8%.

- The company's ending net receivables reached a record $2.1 billion, surpassing the $2 billion milestone, driven by $93 million sequential portfolio growth and record originations of $522 million.

- For Q4 2025, RM projects net income of approximately $12 million and anticipates sequential growth in ending net receivables by $60 million to $70 million. The full-year 2025 net income forecast is $43.5 million.

- The Board of Directors approved an increase in the stock repurchase program from $30 million to $60 million, with $36 million remaining available as of October end, and declared a Q4 dividend of $0.30 per common share.

- Rob Beck announced his pending retirement as President and CEO, with Lockbier Lomba named as his successor.

- RM reported record total revenue of $165.5 million in Q3 2025, marking a 13.1% increase year-over-year.

- Net income for Q3 2025 was $14.4 million, representing an 87.3% increase year-over-year, with diluted earnings per share at $1.42, up 86.8% from the prior year.

- The company achieved an all-time best operating expense ratio of 12.8%, an improvement of 110 basis points year-over-year.

- The net credit loss rate improved to 10.2% in Q3 2025, a 40 basis point improvement year-over-year.

- Regional Management Corp. reported net income of $14.4 million and diluted earnings per share of $1.42 for the third quarter of 2025, marking an 87.3% and 86.8% increase year-over-year, respectively.

- The company achieved record total revenue of $165.5 million, an increase of 13.1% from the prior-year period, driven by 12.8% year-over-year portfolio growth and record total originations of $522.3 million.

- Credit quality improved with a net credit loss rate of 10.2%, a 40 basis point improvement year-over-year, and the annualized operating expense ratio reached an all-time best of 12.8%.

- The Board of Directors increased the authorization under the stock repurchase program from $30 million to $60 million and declared a Q4 2025 dividend of $0.30 per common share.

- Robert W. Beck will retire as President, Chief Executive Officer, and Director, effective November 10, 2025, and Lakhbir Lamba has been appointed as his successor.

Quarterly earnings call transcripts for Regional Management.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more