Earnings summaries and quarterly performance for FEDERATED HERMES.

Research analysts who have asked questions during FEDERATED HERMES earnings calls.

Patrick Davitt

Autonomous Research

7 questions for FHI

Brian Bedell

Deutsche Bank

5 questions for FHI

John Dunn

Evercore ISI

5 questions for FHI

Kenneth Worthington

JPMorgan Chase & Co.

4 questions for FHI

William Katz

TD Cowen

4 questions for FHI

Bill Katz

TD Securities

2 questions for FHI

Daniel Fannon

Jefferies Financial Group Inc.

2 questions for FHI

Ken Worthington

JPMorgan

2 questions for FHI

Brennan Hawken

UBS Group AG

1 question for FHI

Dan Fannin

Jefferies

1 question for FHI

Dan Fannon

Jefferies & Company Inc.

1 question for FHI

Kenneth Lee

RBC Capital Markets

1 question for FHI

Michael Cho

JPMorgan Chase & Co.

1 question for FHI

Robin Holby

TD Cowen

1 question for FHI

Trevor

Jefferies Financial Group Inc.

1 question for FHI

Recent press releases and 8-K filings for FHI.

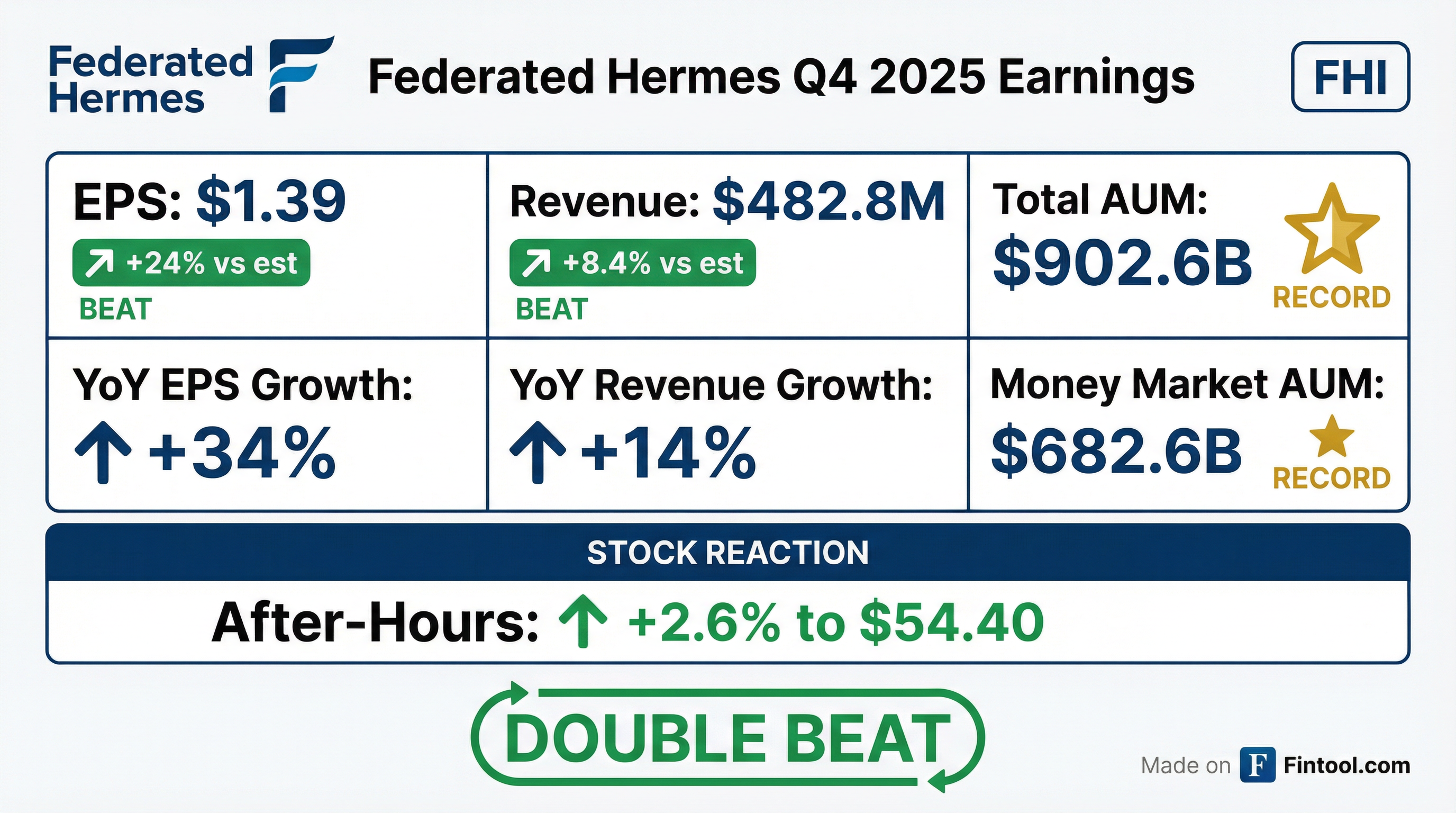

- Federated Hermes reported earnings per share of $1.39 and total revenue of $482.8 million for Q4 2025.

- Total managed assets reached $902.6 billion at the end of Q4 2025.

- The company declared a dividend of $0.34.

- Equity assets increased by 3% to $97.9 billion, and liquidity assets rose by 5% to $682.6 billion from Q3 2025. Fixed-income assets decreased by -2% to $100.1 billion.

- Federated Hermes concluded 2025 with a record $903 billion in assets under management (AUM), driven by gains in money market and equity strategies. Money market assets reached $683 billion (up $30 billion in Q4), and equity assets increased by $3.2 billion in Q4, with $1.5 billion in net sales.

- For Q4 2025, total revenue increased by $13.4 million (3%) from the prior quarter, primarily due to higher money market and equity assets. Operating expenses rose by $7.3 million (2%), mainly from increased distribution expenses.

- The company is advancing strategic initiatives, including the FCP acquisition expected to close in Q2 2026, and plans to open a Hong Kong office. FHI is also actively developing tokenization efforts for money market funds.

- Looking ahead to Q1 2026, seasonal factors are expected to result in approximately $10.2 million lower revenues and about $8 million higher compensation and related expenses.

- Federated Hermes concluded 2025 with a record $903 billion in assets under management, primarily driven by gains in money market and equity strategies. Money market assets alone reached a record $683 billion, with money market fund assets increasing by $16 billion (3%) in Q4 to $508 billion.

- Total revenue for Q4 2025 increased by $13.4 million (3%) from the prior quarter, largely due to higher money market and equity assets, while operating expenses rose by $7.3 million (2%). The effective tax rate for the quarter was 24.4%.

- The company is progressing with the FCP acquisition, anticipated to close in the first half of 2026, and plans to establish a Hong Kong office. Federated Hermes is also actively developing digital asset initiatives, including tokenized US money market funds through a partnership with Archax and a collaboration with BNY and Goldman Sachs.

- MDT Equity and market-neutral strategies achieved record gross sales of $4 billion and net sales exceeding $2 billion in Q4 2025, contributing to record full-year 2025 MDT gross sales of $19.1 billion and net sales of $13 billion.

- Federated Hermes (FHI) concluded 2025 with record assets under management (AUM) of $903 billion, primarily driven by gains in money market and equity strategies. As of January 28, 2026, managed assets were approximately $909 billion.

- The company reported Q4 2025 net equity sales of $1.5 billion, contributing to full-year 2025 net equity sales of $4.6 billion. MDT strategies were a significant driver, achieving record gross sales of $4 billion and net sales of over $2 billion in Q4 2025.

- Money market assets reached a record high of $683 billion at the end of 2025, with money market fund assets increasing by $16 billion (3%) to $508 billion in Q4.

- Total revenue for Q4 2025 increased by $13.4 million (3%) from the prior quarter, with higher money market assets contributing $8 million and higher equity assets adding $5.5 million. Q4 operating expenses rose by $7.3 million (2%), mainly due to $8.8 million in higher distribution expense.

- Strategic initiatives include the planned FCP acquisition expected to close in the first half of 2026, with estimated additional transaction costs of $9.2 million in 2026. FHI is also expanding its global presence with a planned Hong Kong office and advancing digital asset efforts through partnerships like Archax and a BNY/Goldman Sachs initiative.

- Federated Hermes, Inc. reported record total assets under management (AUM) of $902.6 billion at December 31, 2025, an increase of 9% from December 31, 2024. This was primarily driven by record money market AUM of $682.6 billion.

- Earnings per diluted share (EPS) for Q4 2025 were $1.39, compared to $1.04 for Q4 2024, and full-year 2025 EPS reached $5.13, up from $3.23 in 2024.

- The board of directors declared a quarterly dividend of $0.34 per share.

- During Q4 2025, Federated Hermes repurchased 1,566,901 shares of Class B common stock for $78.7 million, bringing the total shares purchased in 2025 to 6,192,433 for $263.4 million.

- Federated Hermes reported Q4 2025 earnings per diluted share of $1.39 and full-year 2025 EPS of $5.13.

- The company achieved record total assets under management (AUM) of $902.6 billion at December 31, 2025, representing a 9% increase from December 31, 2024.

- Money market AUM also reached a record $682.6 billion at year-end 2025.

- The board declared a quarterly dividend of $0.34 per share.

- Total revenue increased by 14% in Q4 2025 to $482.833 million and by 10% for the full year 2025 to $1,800.663 million.

- Federated Hermes announced that R.J. Gallo, current Deputy CIO for global fixed income, will succeed Robert Ostrowski as CIO for global fixed income.

- Robert Ostrowski will retire on May 1, 2026, after 38 years with Federated Hermes.

- Ann Ferentino will become the sole head of the Municipal Bond Group.

- As of Sept. 30, 2025, Gallo will oversee $101.8 billion in global fixed-income assets, and Ferentino will oversee $7.1 billion in municipal managed assets.

- AM Best has revised the outlooks for FHM Insurance Company to stable from positive, while affirming its Financial Strength Rating of B+ (Good) and Long-Term Issuer Credit Rating of "bbb-" (Good).

- The outlook revision reflects AM Best's assessment that FHM's enterprise risk management (ERM) remains marginal, and foundational actions to improve operating performance have not fully benefited the company's financial condition.

- Despite improving loss experience in recent accident years, the expense ratio remains high due to a relatively shrinking book of business, and persistent pressure on workers' compensation premium rates has challenged profitability.

- Negative rating action could occur if FHM's risk-adjusted capitalization materially deteriorates or if operating performance continues to trend poorly and falls short of AM Best's expectations.

- Federated Hermes achieved record assets under management of $871 billion in Q3 2025, with total revenue increasing by $44.6 million (10%) from the prior quarter, largely due to growth in money market and equity assets.

- The company agreed to acquire a controlling interest in FCP, a U.S.-based real estate investment manager with $3.8 billion in AUM, aiming to enter the U.S. real estate market with the acquisition expected to close around the end of Q1 2026.

- Federated Hermes started Q4 with approximately $2.1 billion in net institutional mandates yet to fund, with about two-thirds expected to fund in Q4, and is actively pursuing digital asset opportunities, including tokenized money market funds.

- Federated Hermes reported $871.2 billion in managed assets at the end of Q3 2025, with total revenue of $469.4 million and $1.34 earnings per share for the quarter.

- The company declared a dividend of $0.34 for Q3 2025.

- Managed assets saw growth across key categories compared to Q2 2025: equity assets increased by 6% to $94.7 billion, fixed-income assets grew by 3% to $101.8 billion, and liquidity assets rose by 3% to $652.8 billion at Q3 period end.

- Year-to-date Q3 2025, Federated Hermes recorded $2,888 million in net equity sales and $(1,071) million in net fixed-income sales.

Quarterly earnings call transcripts for FEDERATED HERMES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more