Earnings summaries and quarterly performance for FIRST NORTHERN COMMUNITY BANCORP.

Executive leadership at FIRST NORTHERN COMMUNITY BANCORP.

Board of directors at FIRST NORTHERN COMMUNITY BANCORP.

BH

Barbara Hayes

Detailed

Director

GD

Gregory DuPratt

Detailed

Director

JC

John Carbahal

Detailed

Director

LW

Louise Walker

Detailed

Director

MS

Mark Schulze

Detailed

Director

PB

Patrick Brady

Detailed

Director

RB

Richard Bedoya

Detailed

Director

RM

Richard Martinez

Detailed

Vice Chairman of the Board

SQ

Sean Quinn

Detailed

Chairman of the Board

Research analysts covering FIRST NORTHERN COMMUNITY BANCORP.

Recent press releases and 8-K filings for FNRN.

First Northern Community Bancorp Reports Q4 and Full-Year 2025 Financial Results

FNRN

Earnings

Dividends

Revenue Acceleration/Inflection

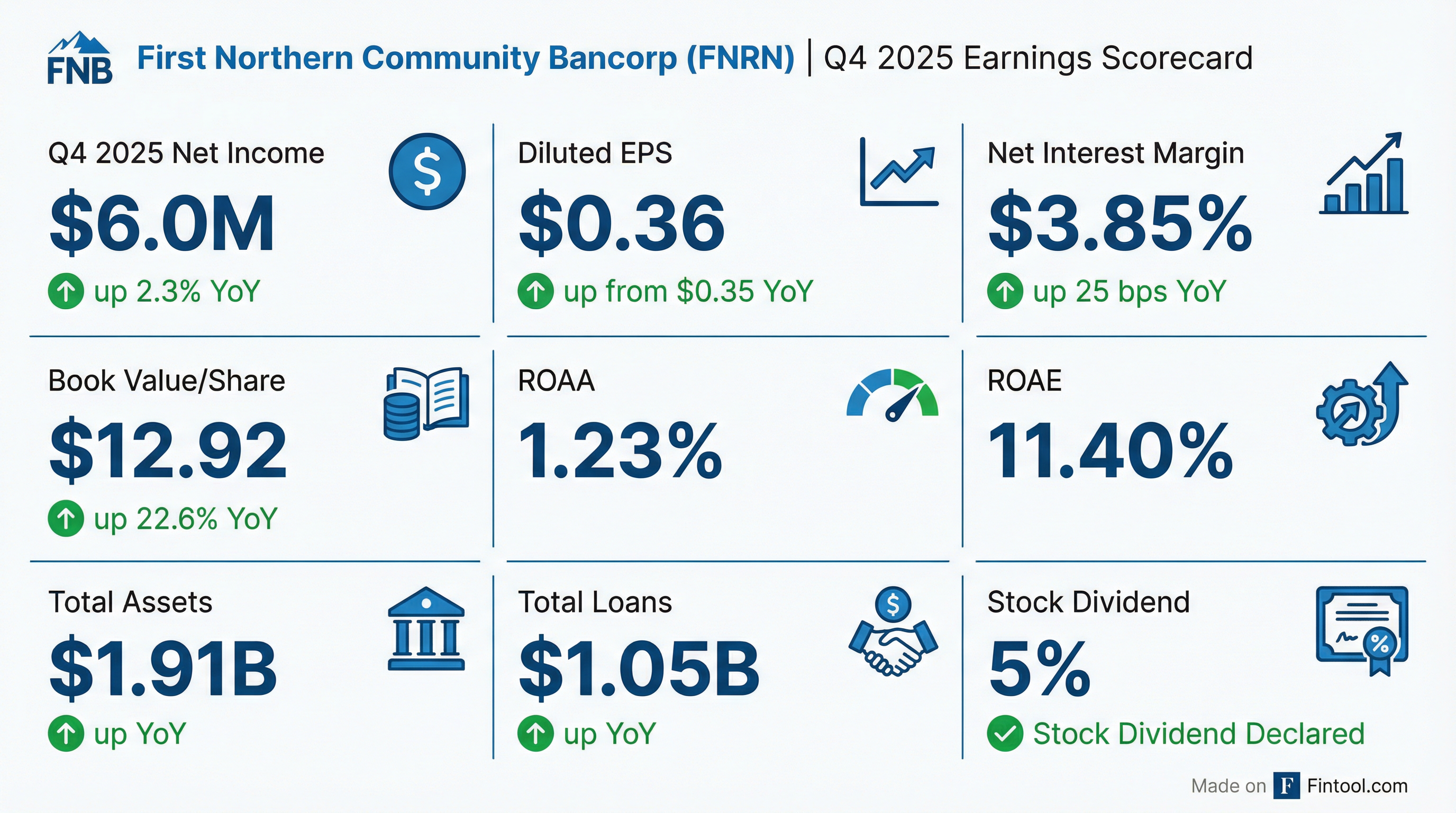

- First Northern Community Bancorp reported net income of $6.0 million, or $0.36 per diluted share, for the fourth quarter ended December 31, 2025, representing a 2.3% increase compared to the same period in 2024.

- For the full year ended December 31, 2025, net income was $21.1 million, or $1.27 per diluted share, up 5.5% from the previous year.

- Total assets increased by 1.0% to $1.91 billion as of December 31, 2025, while total deposits decreased by 1.2% to $1.68 billion compared to December 31, 2024.

- Shareholders' equity grew by 20.2% to $212.0 million, and book value per share increased by 22.6% to $12.92 as of December 31, 2025.

- The company's net interest margin improved by 25 basis points to 3.85% for the three months ended December 31, 2025, compared to the same quarter one year prior. Additionally, the Board of Directors approved a 5% stock dividend payable March 25, 2026.

Jan 30, 2026, 12:47 AM

First Northern Community Bancorp Reports Q4 and Full-Year 2025 Financial Results

FNRN

Earnings

Dividends

- First Northern Community Bancorp reported net income of $6.0 million ($0.36 per diluted share) for the fourth quarter ended December 31, 2025, and $21.1 million ($1.27 per diluted share) for the full year 2025.

- As of December 31, 2025, total assets were $1.91 billion (up 1.0% year-over-year), and total deposits were $1.68 billion (down 1.2% year-over-year).

- Shareholder's equity increased by 20.2% to $212.0 million, with book value per share rising 22.6% to $12.92 as of December 31, 2025.

- The company's net interest margin improved to 3.85% for the three months ended December 31, 2025, compared to 3.60% for the same quarter one year prior.

- The Board of Directors approved a 5% stock dividend, payable March 25, 2026, to shareholders of record as of February 27, 2026.

Jan 30, 2026, 12:15 AM

First Northern Community Bancorp Reports Third Quarter 2025 Results

FNRN

Earnings

Revenue Acceleration/Inflection

- First Northern Community Bancorp reported net income of $6.0 million, or $0.38 per diluted share, for the third quarter ended September 30, 2025, marking a 9.6% increase compared to the same quarter in 2024.

- For the nine months ended September 30, 2025, net income reached $15.2 million, or $0.96 per diluted share, representing a 6.8% increase over the same period in 2024.

- The company's net interest margin expanded to 3.75% for the third quarter of 2025, an increase of 10 basis points from 3.65% in the third quarter of 2024.

- As of September 30, 2025, total assets were $1.91 billion, a 1.2% decrease compared to September 30, 2024, and total deposits were $1.69 billion, a 2.6% decrease over the same period.

- Book value per share increased to $13.02 as of September 30, 2025, up 5.7% from $12.32 at the end of the prior quarter.

Oct 29, 2025, 11:32 PM

First Northern Community Bancorp Reports Q3 2025 Financial Results

FNRN

Earnings

Revenue Acceleration/Inflection

- First Northern Community Bancorp reported net income of $6.0 million, or $0.38 per diluted share, for the third quarter ended September 30, 2025, representing a 9.6% increase in net income compared to the same quarter last year.

- For the nine months ended September 30, 2025, net income was $15.2 million, or $0.96 per diluted share, an increase of 6.8% over the prior year.

- As of September 30, 2025, total assets were $1.91 billion, total net loans were $1.06 billion, and total deposits were $1.69 billion.

- The company's net interest margin expanded to 3.75% in Q3 2025, up 10 basis points from Q3 2024, and its book value per share increased to $13.02 as of September 30, 2025. A tax planning strategy also significantly reduced the effective tax rate for the quarter.

Oct 29, 2025, 11:22 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more