Earnings summaries and quarterly performance for Five Point Holdings.

Executive leadership at Five Point Holdings.

Board of directors at Five Point Holdings.

Emile Haddad

Chairman Emeritus

Gary Hunt

Director

Jonathan Foster

Director

Kathleen Brown

Director

Michael Rossi

Lead Independent Director

Michael Winer

Director

Sam Levinson

Director

Stuart Miller

Executive Chairman

William Browning

Director

Research analysts who have asked questions during Five Point Holdings earnings calls.

Alan Ratner

Zelman & Associates

5 questions for FPH

Ben Fader-Rattner

Nexus Capital Management

1 question for FPH

Benjamin Fader-Rattner

Space Summit Capital

1 question for FPH

Kenneth Zener

Seaport Research Partners

1 question for FPH

Robert Heimowitz

Concise Capital

1 question for FPH

Recent press releases and 8-K filings for FPH.

- Five Point Holdings, LLC (FPH) announced a new residential land banking investment partnership through its Hearthstone Residential Holdings platform with funds managed by Blue Owl Capital Inc. (OWL).

- This partnership is designed to support the acquisition of residential homesites and land assets in high-quality U.S. housing markets, marking a critical step in scaling Hearthstone's land banking business.

- As part of the transaction, Five Point issued warrants to Blue Owl funds, allowing the purchase of up to 1,500,000 Class A common shares at an exercise price of $7.00 per share.

- These warrants will vest upon the achievement of specified cumulative capital contribution thresholds by Blue Owl, starting at $500 million and increasing in four stages to $1.7 billion over the next five years.

- If fully vested and exercised, the warrants would result in approximately 1% dilution of Five Point's currently outstanding shares on a fully-diluted basis, with no immediate dilution occurring from the execution of the partnership.

- Five Point Holdings, LLC has established a new residential land banking investment partnership with funds managed by Blue Owl Capital Inc. through its Hearthstone Residential Holdings platform.

- This partnership is designed to facilitate the acquisition of residential homesites and land assets in high-quality U.S. housing markets.

- As part of the transaction, Five Point will issue warrants to Blue Owl funds, which, if fully vested and exercised at $7.00 per share, could result in approximately 1% dilution of Five Point's outstanding shares.

- Five Point acquired the Hearthstone platform in 2025 to expand its asset-light, fee-generating businesses.

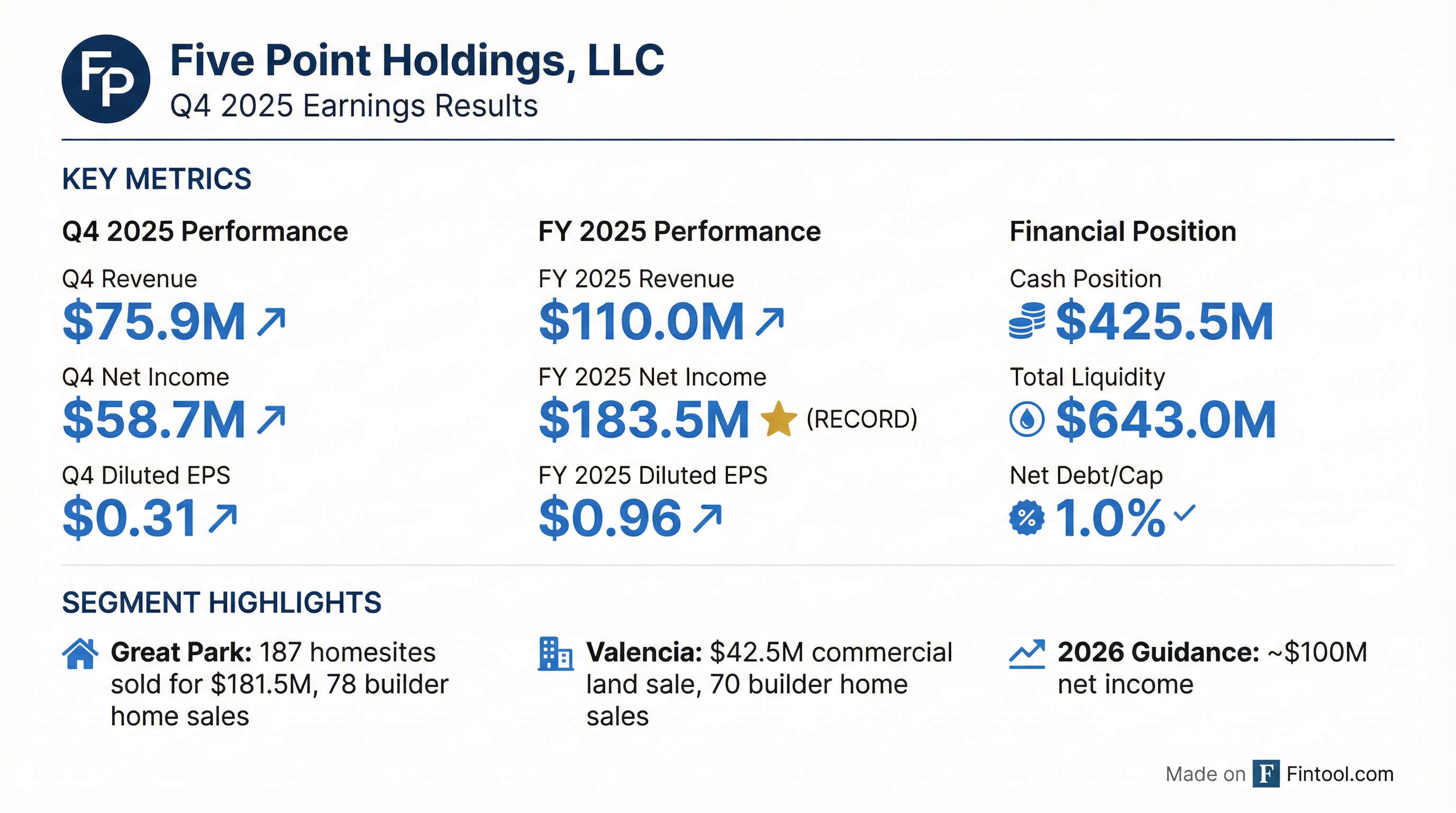

- Five Point Holdings reported a record annual consolidated net income of $183.5 million for 2025, surpassing its 2024 record and exceeding revised guidance.

- The company significantly strengthened its financial position, ending 2025 with $425.5 million in cash and $643 million in total liquidity, after reducing senior notes by $75 million to a balance of $450 million.

- Operational highlights in Q4 2025 included an industrial land sale in Valencia for $42.5 million and the Great Park Venture closing sales for 187 home sites for $181.5 million.

- Critical entitlement approvals were secured, converting approximately 100 acres of commercial land to residential at The Great Park and approving Entrata South and Valencia Commerce Center at Valencia, enhancing future development.

- For 2026, Five Point Holdings projects consolidated net income of approximately $100 million, with the majority of income expected in the second half of the year.

- Five Point Holdings reported a record annual consolidated net income of $183.5 million for 2025, surpassing its previous record set in 2024 and exceeding its revised guidance by approximately $6 million. The net income for the fourth quarter of 2025 was $58.7 million.

- The company significantly strengthened its balance sheet in 2025, ending the year with $425 million in cash and $643 million in total liquidity. Debt was reduced by an additional $75 million to a balance of $450 million, and senior notes were refinanced, which is expected to reduce annual interest expense by approximately $20 million.

- Key operational achievements included securing critical entitlement approvals at Valencia and The Great Park, with the latter converting approximately 100 acres of commercial land into additional market-rate home sites. The Hearthstone land banking platform, acquired in Q3 2025, contributed $11.8 million in management fee revenue and $3.5 million in net income for its five months of activity in 2025, growing assets under management to $3.4 billion.

- For 2026, Five Point Holdings expects consolidated net income to be approximately $100 million, with earnings anticipated to be weighted more heavily towards the second half of the year due to planned land sales. The company projects selling 20 acres of land in Valencia and 50 acres of land in the Great Park during 2026.

- Five Point Holdings reported a record annual consolidated net income of $183.5 million for fiscal year 2025, exceeding its prior record set in 2024 and revised guidance by approximately $6 million. Net income for Q4 2025 was $58.7 million.

- The company provided 2026 guidance, expecting consolidated net income of approximately $100 million, with earnings weighted towards the second half of the year and a small loss anticipated in Q1 2026 due to no planned land sales.

- FPH significantly strengthened its balance sheet in 2025 by refinancing senior notes, issuing $400 million of 8% notes due October 2030, repaying $75 million of debt, and expanding its revolving credit facility. The company ended the year with $425 million in cash and $643 million in total liquidity.

- The acquisition of the Hearthstone Land Banking platform in Q3 2025 contributed $11.8 million in management fee revenue and $3.5 million in net income to Five Point's consolidated results for 2025, with Hearthstone's assets under management growing to approximately $3.4 billion and expected to exceed $4 billion by the end of 2026.

- Key operational achievements included obtaining critical entitlement approvals at Valencia and The Great Park, and closing significant land sales, such as a $42.5 million industrial land sale in Valencia and $181.5 million in home site sales at The Great Park.

- Five Point Holdings, LLC reported consolidated net income of $58.7 million for the fourth quarter of 2025 and $183.5 million for the full year 2025, with consolidated revenues of $75.9 million for Q4 2025 and $110.0 million for the full year 2025.

- As of December 31, 2025, the company had cash and cash equivalents totaling $425.5 million and total liquidity of $643.0 million, with a debt to total capitalization ratio of 16.3%.

- During Q4 2025, Valencia closed the sale of 13.8 acres of commercial land for $42.5 million, and Great Park Venture sold 187 homesites for $181.5 million, with distributions and incentive compensation payments to the Company from Great Park Venture totaling $73.6 million.

- In 2025, the company issued $450.0 million in new 8.000% Senior Notes due October 2030 and acquired a 75% interest in Hearthstone Residential Holdings, LLC for $57.6 million.

- Five Point Holdings, LLC expects consolidated annual net income for 2026 of approximately $100 million.

- Five Point Holdings, LLC reported record consolidated net income of $183.5 million for the full year 2025, exceeding its revised guidance, with $58.7 million in consolidated net income for Q4 2025.

- The company ended 2025 with a strong financial position, including $425.5 million in cash and cash equivalents and $643.0 million in total liquidity, alongside a debt to total capitalization ratio of 16.3% as of December 31, 2025.

- Key operational achievements in 2025 included the Great Park Venture selling 920 homesites on 75.6 acres for $781.7 million and providing $319.9 million in distributions and incentive compensation to the Company.

- Strategic financial actions in 2025 involved issuing $450.0 million in new 8.000% Senior Notes to redeem existing higher-rate notes, increasing its revolving credit facility to $217.5 million, and acquiring a 75% interest in Hearthstone Residential Holdings, LLC for $57.6 million.

- For 2026, the company anticipates consolidated annual net income of approximately $100 million.

- Five Point Holdings reported a consolidated net income of $55.7 million for Q3 2025, primarily driven by the Great Park Venture's sale of 326 home sites on 26.6 acres for an aggregate base purchase price of $257.7 million, resulting in Five Point's share of earnings being $69.5 million.

- The company successfully refinanced its debt by issuing $450 million in new 8% senior notes due 2030 to repurchase and redeem $523.5 million of its prior 10.5% senior notes due 2028, which is expected to benefit future cash flows by saving over $20 million a year. Moody's upgraded the corporate credit rating and senior notes rating to B2 with a stable outlook.

- Five Point closed the acquisition of a 75% ownership interest in the Hearthstone Residential Holdings Land Banking Venture for $57.6 million in July 2025, expanding its national platform for capital solutions to home builders and growing Hearthstone's assets under management to approximately $3 billion.

- Management reiterated its guidance to end 2025 with net income consistent with 2024 earnings of $176.3 million, supported by expected land sales in Q4 and continuing management services revenues.

- Five Point Holdings, LLC reported consolidated net income of $55.7 million and net income attributable to the Company of $21.1 million for the third quarter of 2025, with consolidated revenues of $13.5 million.

- The Great Park Venture sold 326 homesites on 26.6 acres of land for an aggregate base purchase price of $257.7 million during Q3 2025.

- The company enhanced its capital structure by issuing $450.0 million in new 8.000% Senior Notes due October 2030 and purchasing or redeeming $523.5 million 10.500% Senior Notes due January 2028.

- As of September 30, 2025, Five Point Holdings, LLC maintained cash and cash equivalents of $351.1 million and total liquidity of $476.1 million.

- The company expects full-year 2025 consolidated net income to be in line with its 2024 results.

- Five Point Holdings, LLC reported consolidated net income of $55.7 million and consolidated revenues of $13.5 million for the third quarter of 2025.

- As of September 30, 2025, the company maintained total liquidity of $476.1 million, which included $351.1 million in cash and cash equivalents.

- During the quarter, the Great Park Venture sold 326 homesites for an aggregate base purchase price of $257.7 million, and Five Point Holdings acquired a 75% interest in Hearthstone Residential Holdings, LLC for $57.6 million.

- The company also issued $450.0 million in new 8.000% Senior Notes due October 2030, and its senior notes and corporate ratings were upgraded or affirmed by Moody's, S&P Global Ratings, and Fitch Ratings in September 2025.

Quarterly earnings call transcripts for Five Point Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more