Earnings summaries and quarterly performance for Primis Financial.

Executive leadership at Primis Financial.

Dennis J. Zember, Jr.

President and Chief Executive Officer

Ann-Stanton C. Gore

Executive Vice President and Chief Marketing Officer

Marie T. Leibson

Executive Vice President and Chief Credit Officer

Matthew A. Switzer

Executive Vice President and Chief Financial Officer

Rickey A. Fulk

Executive Vice President and President of Primis Bank

Board of directors at Primis Financial.

Allen R. Jones Jr.

Director

Charles A. Kabbash

Director

Deborah B. Diaz

Director

Eric A. Johnson

Director

F.L. Garrett, III

Director

John F. Biagas

Chairman of the Board

John M. Eggemeyer

Director

Robert Y. Clagett

Director

W. Rand Cook

Vice-Chairman

Research analysts who have asked questions during Primis Financial earnings calls.

Christopher Marinac

Janney Montgomery Scott LLC

8 questions for FRST

Russell Gunther

Stephens Inc.

6 questions for FRST

Nicholas Lorenzoni

D.A. Davidson & Co.

1 question for FRST

Nick

Virtue Capital

1 question for FRST

Recent press releases and 8-K filings for FRST.

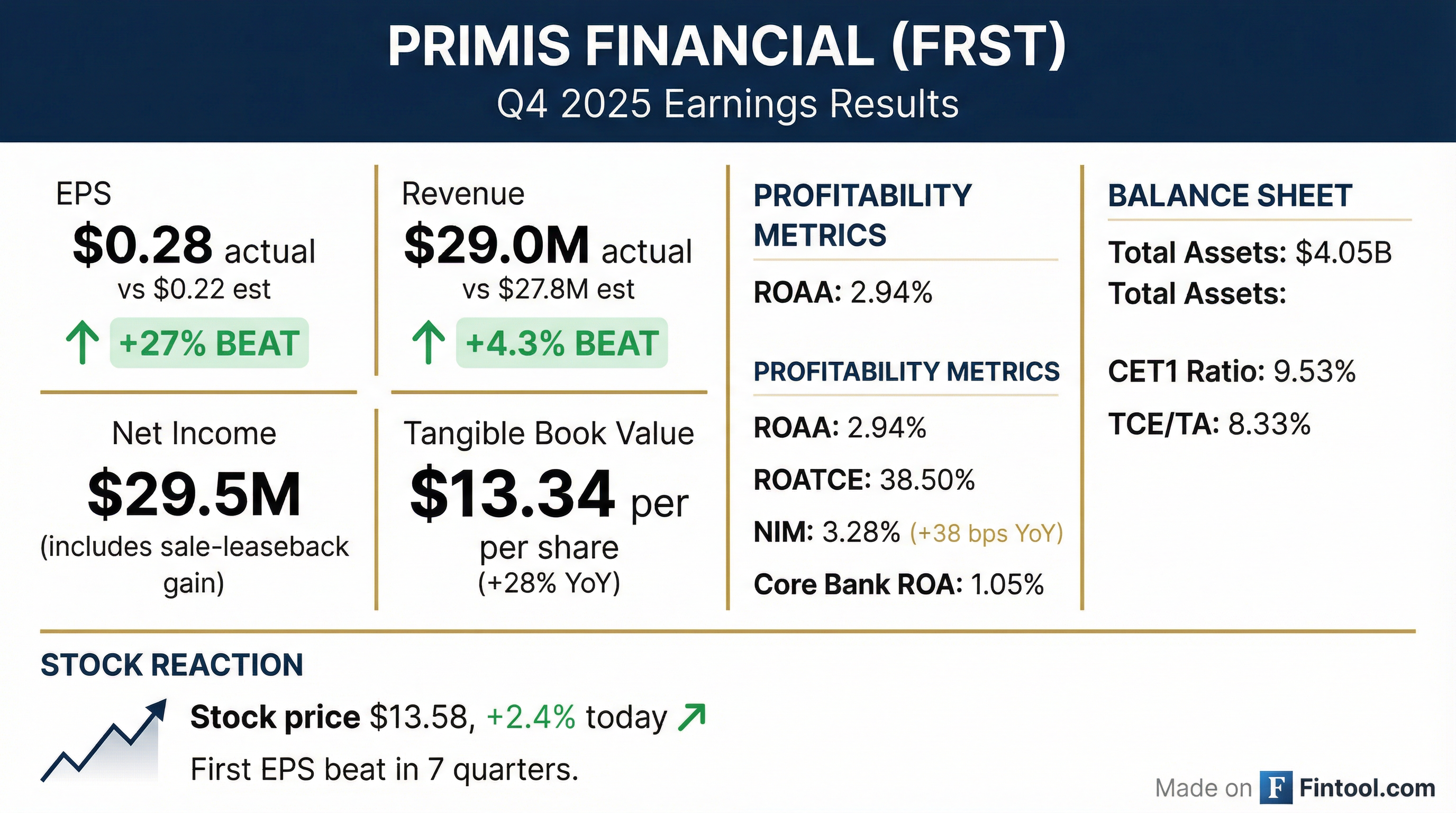

- Primis Financial Corp. reported Q4 2025 earnings of $29.5 million, or $1.20 per share, with an almost 3% ROA, although the underlying run rate earnings for the quarter were approximately $8 million, translating to an 80 basis points ROA on about $4 billion of average assets.

- The company achieved significant net interest margin expansion to 3.28% in Q4 2025, up from 2.90% in Q4 2024, and expects further growth to mid-3.4s in Q1 2026 and pushing 3.5% through the year.

- Non-interest-bearing deposits grew to $554 million, representing 16% of total deposits by year-end 2025, an increase from $439 million or 14% at the end of 2024, supported by over 23% growth in checking accounts.

- Gross loans held for investment increased approximately 10% annualized in Q4 2025, with Primis Mortgage closing $1.2 billion in loans for 2025 (a 50% increase over 2024) and projecting $1.6-$2 billion in 2026. Mortgage warehouse balances are anticipated to average $500 million in 2026, up from $175 million in 2025.

- Primis Financial Corp. aims for a 1% ROA for the full year 2026, supported by disciplined expense management with normalized core non-interest expense at approximately $21 million in Q4 2025 and projected to be $23 million-$24 million quarterly in 2026.

- Primis Financial Corp. reported Q4 2025 earnings of $29.5 million, or $1.20 per share, with an ROA of almost 3%, which included a substantial gain from a sale-leaseback transaction. The run-rate earnings for Q4 2025 were approximately $8 million, translating to an 80 basis points ROA on about $4 billion of average assets.

- The net interest margin (NIM) increased to 3.28% in Q4 2025, up from 2.90% in Q4 2024, with expectations to reach the mid-3.4s in Q1 2026 and push 3.5% through the year.

- Deposits grew 10% annualized in Q4 2025, with non-interest-bearing deposits ending 2025 at $554 million (16% of total deposits). Gross loans held for investment increased approximately 10% annualized in Q4 2025.

- The company projects its mortgage warehouse division to average $500 million in 2026, significantly up from an average of $175 million in 2025, and anticipates $1.6 billion to $2 billion in Primis Mortgage production for 2026.

- Management is targeting a sustainable 1% ROA for the full year 2026, supported by improved margins and a conservative quarterly core expense range of $23 million to $24 million (excluding mortgage and Panacea).

- FRST reported strong Q4 2025 financial results, with Earnings Per Share (EPS) of $1.20 and a Return on Average Assets (ROAA) of 2.94%, significantly higher than previous periods.

- The company's Net Interest Margin (NIM) improved to 3.28% in Q4 2025, up from 3.18% in Q3 2025, attributed to repricing of earning assets and favorable deposit pricing.

- Key segments showed robust performance, with the Core Bank achieving a 1.05% ROA and Mortgage Warehouse ROAA at 2.26%. Panacea Financial also saw loans and deposits grow 25% and 39% year-over-year, respectively.

- Capital ratios remained solid, with a CET1 Ratio of 9.53% and TCE / TA of 8.33% as of Q4 2025, alongside an increase in tangible book value per share to $13.34.

- While Q4 2025 operating expenses were elevated, they are anticipated to decline in Q1 2026, and the company projects an achievable 1.0% ROAA in 2026.

- Primis Financial Corp. reported Q4 2025 earnings of $29.5 million, or $1.20 per share. The company is targeting a 1% Return on Assets (ROA) for the full year 2026.

- The net interest margin (NIM) significantly improved to 3.28% in Q4 2025 from 2.90% in the prior year period, with expectations to reach mid-3.4s in Q1 2026 and push 3.5% through the year.

- The company experienced strong growth in Q4 2025, with gross loans held for investment increasing approximately 10% annualized and deposits up 10% annualized. Non-interest-bearing deposits grew to $554 million, or 16% of total deposits, by year-end 2025.

- Primis Mortgage closed $1.2 billion in loans in 2025, a 50% increase over 2024, and projects $1.6-$2 billion in production for 2026. Mortgage warehouse balances are expected to average $500 million in 2026, up from $175 million in 2025.

- Normalized core non-interest expenses were approximately $21 million in Q4 2025, with a conservative estimate for quarterly core expenses in 2026 set at $23 million-$24 million.

- Primis Financial Corp. reported net income available to common shareholders of $30 million, or $1.20 per diluted share, for the fourth quarter of 2025, a significant improvement from a net loss of $23 million, or a loss of $0.94 per diluted share, for the same period in 2024. For the full year 2025, net income was $61 million, or $2.49 per diluted share, compared to a net loss of $16 million, or a loss of $0.66 per diluted share, in 2024.

- The company declared a quarterly cash dividend of $0.10 per share, payable on February 27, 2026, to shareholders of record as of February 13, 2026.

- Key financial metrics showed significant year-over-year improvement in Q4 2025, with Total Assets increasing 10% to $4,047 million, Gross Loans HFI up 14% to $3,284 million, Total Deposits rising 7% to $3,396 million, and Tangible Book Value per Share growing 28% to $13.34. Net Interest Income increased 18% to $30,852 million, and Net Interest Margin improved to 3.28% from 2.90% in Q4 2024.

- Strategic divisions contributed to growth, with Primis Mortgage closed volume up 84% to $378 million and Mortgage warehouse outstanding loan balances up 398% to $318 million year-over-year in Q4 2025. Panacea Financial loans also grew 25% to $544 million compared to the end of 2024.

- Primis Financial Corp. reported net income available to common shareholders of $30 million, or $1.20 per diluted share, for the three months ended December 31, 2025, compared to a net loss of $23 million, or $0.94 per diluted share, for the same period in 2024. For the full year ended December 31, 2025, net income available to common shareholders was $61 million, or $2.49 per diluted share, compared to a net loss of $16 million, or $0.66 per diluted share, for 2024.

- The company's Board of Directors declared a quarterly cash dividend of $0.10 per share.

- As of December 31, 2025, total assets were $4.047 billion, total deposits were $3.396 billion, and tangible book value per share increased to $13.34.

- Net interest income for Q4 2025 was $30.852 million, an 18% increase from Q4 2024, with a net interest margin of 3.28%. Noninterest income for the quarter was $50 million, which included a $51 million gain from a sale leaseback transaction.

- Primis Bank, a wholly-owned subsidiary of Primis Financial Corp. (FRST), completed a sale-leaseback transaction for 18 branch properties on December 5, 2025, for an aggregate purchase price of approximately $58 million.

- The transaction is expected to generate a pre-tax gain of $50 million and an after-tax gain of $38 million or $1.54 per share.

- The company anticipates the transaction to be accretive to tangible book value (TBV) by 13.2% and recurring earnings by 15.0%.

- Primis Bank will lease back the properties for an initial term of 20 years at an initial annual base rent of $4.7 million, which will increase by 2% per annum.

- Primis Financial Corp. reported net earnings of $6.8 million and $0.28 per share for Q3 2025, with a reported Return on Assets (ROA) of 70 basis points and an adjusted ROA of approximately 90 basis points.

- The company's Net Interest Margin (NIM) improved to 3.18% in Q3 2025, up from 2.86% in the prior quarter, driven by a 16% year-over-year growth in non-interest-bearing checking accounts and a nearly 20% reduction in the cost of deposits.

- Gross loans held for investment increased almost 9% annualized, or approximately 15% annualized including reclassified Panacea loans, while average earning assets grew 10% annualized in Q3 2025.

- Key growth drivers include the Mortgage Warehouse division, with average balances of $210 million and $1.6 million in pre-tax earnings, and the Panacea Financial Division, which saw loan balances rise to $530 million and deposits increase 50% year-over-year to $132 million.

- Management aims for a 1% ROA and expects the net interest margin to reach 3.30% by early 2026, with a medium-term goal of non-interest-bearing deposits comprising 20% of total deposits.

- Primis Financial Corp. reported net earnings of $6.8 million and $0.28 per share for Q3 2025, with a reported Return on Assets (ROA) of 70 basis points, which would be approximately 90 basis points on an adjusted basis.

- The net interest margin improved to 3.18% in Q3 2025, up from 2.86% in the prior quarter, supported by a 16% year-over-year growth in non-interest-bearing checking accounts and a core bank cost of deposits at 173 basis points.

- Gross loans held for investment increased almost 9% annualized in Q3 2025, or approximately 15% annualized including Panacea loans reclassified to held for sale, while average earning assets grew 10% annualized.

- The Mortgage division achieved $1.9 million in pre-tax earnings (excluding legal fees), and the Panacea Financial Division saw loan balances average $530 million and deposits reach $132 million with a cost of deposits at 1.37%.

- Management anticipates reaching a 1% ROA goal with pre-tax earnings over $13 million in the near term, projecting the net interest margin to approach 3.30% by early 2026 and targeting 10% to 12% loan growth for the next year.

- Premise Financial Corp. reported net earnings of $6.8 million or $0.28 per share for Q3 2025, a substantial increase from the prior year, with ROA improving to 70 basis points and an adjusted core ROA closer to 90 basis points.

- The Net Interest Margin (NIM) expanded to 3.18% in Q3 2025, up from 2.86% in Q2 2025, driven by new loan yields near 7% and a lower cost of deposits, with management expecting to reach 3.3% by Q1 2026.

- The company saw robust balance sheet growth, with gross loans held for investment increasing almost 9% annualized and non-interest bearing deposits growing 10% annualized in Q3 2025.

- Strategic segments contributed significantly, with the mortgage division generating $1.9 million in pretax earnings and the mortgage warehouse group adding $1.6 million in pretax earnings. Panacea's loan balances grew to $530 million and deposits to $132 million, with a cost of deposits at 1.37%.

Quarterly earnings call transcripts for Primis Financial.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more