Earnings summaries and quarterly performance for GEOSPACE TECHNOLOGIES.

Research analysts who have asked questions during GEOSPACE TECHNOLOGIES earnings calls.

Bill Dezellem

Tieton Capital Management

3 questions for GEOS

Also covers: ACIC, ADTN, AP +13 more

Scott Bundy

Moors & Cabot

3 questions for GEOS

Also covers: DWSN

ML

Martin Lorenzen

Private Investor

2 questions for GEOS

JF

Jeffrey Feldman

Primary Succession Capital

1 question for GEOS

JE

John Elliott

Investor

1 question for GEOS

Matthew Dhane

Tieton Capital Management

1 question for GEOS

Also covers: KTCC, SLNG

MC

Michael Cox

Investor

1 question for GEOS

SG

Sheldon Grodsky

Grodsky Associates

1 question for GEOS

Also covers: KTCC

William Dezellem

Tieton Capital Management

1 question for GEOS

Also covers: ACIC, ADTN, BGSF +15 more

Recent press releases and 8-K filings for GEOS.

Geospace Technologies Reports Q1 2026 Financial Results

GEOS

Earnings

New Projects/Investments

Demand Weakening

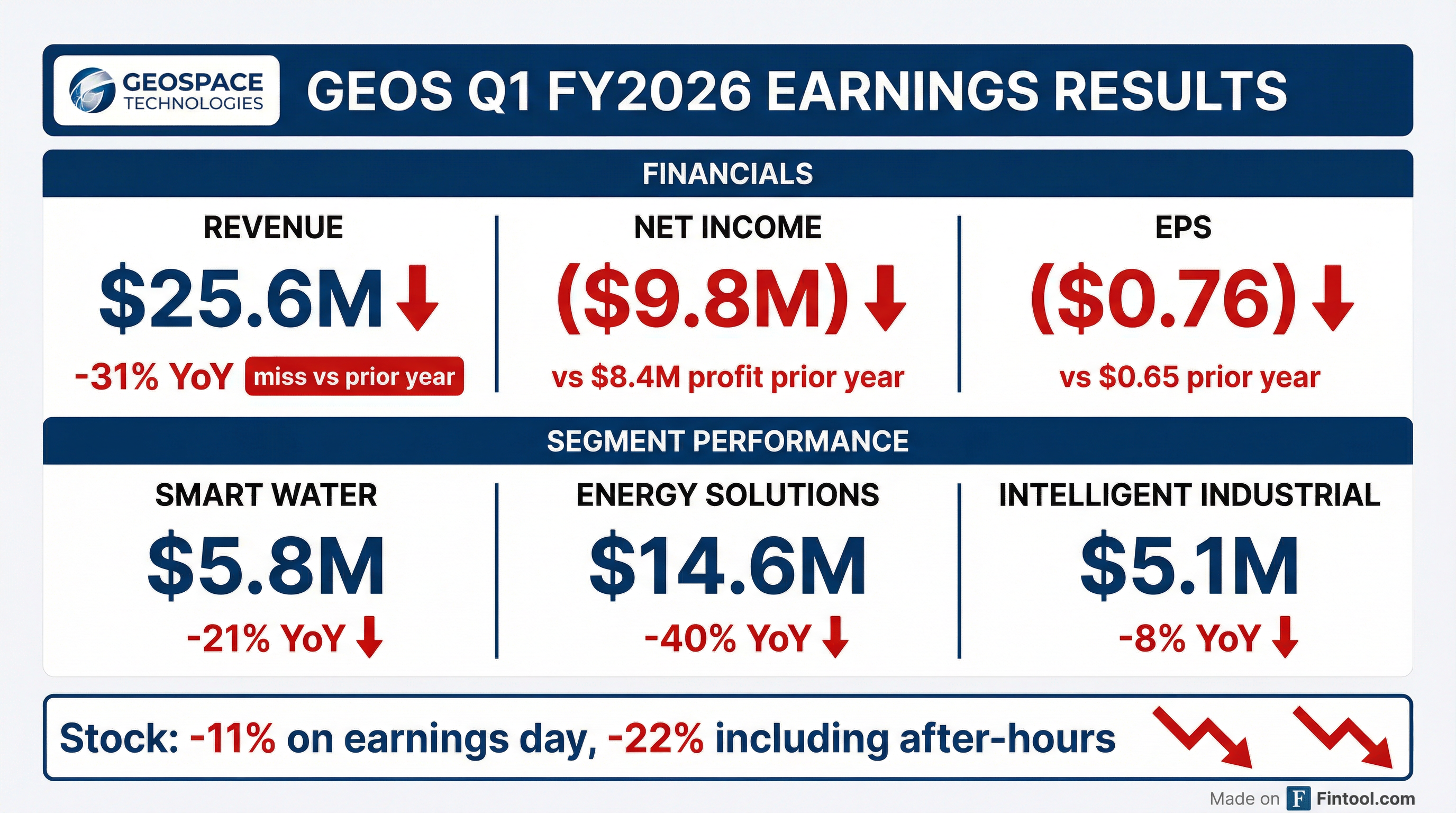

- Geospace Technologies reported Q1 2026 revenue of $25.6 million and a net loss of $9.8 million, or $0.76 per diluted share, a decrease from Q1 2025 revenue of $37.2 million and net income of $8.4 million.

- All three segments experienced revenue declines in Q1 2026: Smart Water decreased 21% to $5.8 million, Energy Solutions decreased 40% to $14.6 million, and Intelligent Industrial decreased 8% to $5.1 million.

- The company anticipates recognizing revenue from the $90 million Petrobras contract starting in Q3 2026, with the goods portion expected to be completed by Q1 2027.

- Geospace began shipping its Geovox Security Heartbeat Detector units in Q1 2026, with an expectation of deploying a couple hundred units this year and a potential market of over 1,000 units for CBP at border crossings.

- As of December 31, 2025, the company maintained $10 million in cash and cash equivalents and $52.2 million in working capital, with a fiscal year 2026 capital expenditure budget of $5 million.

Feb 5, 2026, 3:00 PM

Geospace Technologies Reports Q1 2026 Financial Results and Provides Business Updates

GEOS

Earnings

New Projects/Investments

Demand Weakening

- Geospace Technologies reported Q1 2026 revenue of $25.6 million and a net loss of $9.8 million, or $0.76 per diluted share, compared to revenue of $37.2 million and net income of $8.4 million in Q1 2025.

- Segment revenues for Q1 2026 were $5.8 million for Smart Water (down 21%), $14.6 million for Energy Solutions (down 40%), and $5.1 million for Intelligent Industrial (down 8%).

- Revenue recognition for the $90 million-range Petrobras contract is anticipated to begin in Q3 2026 and continue through Q1 2027 for the goods portion, with a smaller services portion extending into Q4 2027.

- The company began shipping Geovox Security's Heartbeat Detector units in Q1 2026, with a couple hundred units anticipated this year and a potential market of 1,000+ units for U.S. border crossings.

- As of December 31, 2025, the company held $10 million in cash and cash equivalents and $52.2 million in working capital, with a fiscal year 2026 capital expenditure budget of $5 million.

Feb 5, 2026, 3:00 PM

Geospace Technologies Reports Q1 2026 Financial Results

GEOS

Earnings

Demand Weakening

New Projects/Investments

- For the first quarter of fiscal year 2026, Geospace Technologies reported revenue of $25.6 million and a net loss of $9.8 million, or $0.76 per diluted share. This compares to revenue of $37.2 million and net income of $8.4 million, or $0.65 per diluted share, in the prior year's first quarter.

- The Energy Solutions segment revenue decreased by 40% to $14.6 million for the three months ended December 31, 2025, primarily due to lower utilization of the OBX rental fleet and the absence of a $17 million OBX marine wireless product sale from the prior year, despite including $10.6 million from Pioneer equipment sales.

- The Smart Water segment revenue decreased by 21% to $5.8 million, attributed to lower demand for Hydroconn cable and connector products, while the Intelligent Industrial segment revenue decreased by 8% to $5.1 million, mainly due to lower demand for industrial sensor products.

- As of December 31, 2025, the company had $10 million in cash and cash equivalents and $52.2 million in working capital. Management anticipates a capital expenditure budget of $5 million for fiscal year 2026.

- Revenue recognition for the Petrobras contract is expected to begin in Q3 2026 and continue through Q1 2027 for the goods portion, with a smaller services portion extending into Q4 2027. The company also started shipping Geovox Security units this quarter, with revenue recognition expected in the next quarter.

Feb 5, 2026, 3:00 PM

Geospace Technologies Reports Q1 2026 Results

GEOS

Earnings

Demand Weakening

- For the first quarter ended December 31, 2025, Geospace Technologies reported revenue of $25.6 million, a decrease from $37.2 million in the comparable prior-year quarter, and a net loss of $9.8 million, or $(0.76) per diluted share, compared to net income of $8.4 million, or $0.65 per diluted share, for the quarter ended December 31, 2024.

- Revenue decreased across all segments for the three months ended December 31, 2025, with Energy Solutions revenue at $14.6 million (down 40% from $24.3 million), Smart Water revenue at $5.8 million (down 21% from $7.3 million), and Intelligent Industrial revenue at $5.1 million (down 8% from $5.6 million).

- As of December 31, 2025, the company had $10.6 million in cash and cash equivalents and working capital of $52.2 million.

- Management commented on operating in an environment shaped by economic uncertainty, inflation, tariffs, and supply chain challenges, while focusing on strategic initiatives and leveraging innovative technology to diversify the business.

Feb 4, 2026, 10:15 PM

Geospace Technologies Reports First Quarter Fiscal Year 2026 Results

GEOS

Earnings

Demand Weakening

New Projects/Investments

- Geospace Technologies reported a net loss of $9.8 million, or $(0.76) per diluted share, for the first quarter ended December 31, 2025, compared to net income of $8.4 million, or $0.65 per diluted share, for the same period in the prior year.

- Total revenue for the quarter ended December 31, 2025, was $25.6 million, a decrease from $37.2 million in the comparable year-ago quarter.

- The Energy Solutions segment revenue decreased 40% to $14.6 million, primarily due to lower utilization of the OBX rental fleet and comparison to a $17 million OBX marine wireless product sale in the prior year.

- The Smart Water segment revenue declined 21% to $5.8 million, influenced by seasonal deployment schedules and the timing of municipal government budget cycles.

- As of December 31, 2025, the company had $10.6 million in cash and cash equivalents.

Feb 4, 2026, 9:45 PM

GEOLOG Acquires Quad Ltd and QO Inc.

GEOS

M&A

New Projects/Investments

- GEOLOG has successfully acquired Quad Ltd and QO Inc. (collectively "Quad").

- This strategic acquisition aims to strengthen GEOLOG's global wellsite geology and pore pressure services capabilities.

- Quad is a long-standing provider of wellsite and operations geology services, known for its advanced pore pressure and fracture gradient analysis services.

- The acquisition is expected to enrich GEOLOG's advanced subsurface geology and drilling support services portfolio, solidify its global business presence, and offer customers an expanded talent pool, strengthened risk management, and integrated service delivery.

- The financial terms of the transaction were not disclosed.

Jan 8, 2026, 10:00 AM

GEOLOG acquires Quad Ltd and QO Inc.

GEOS

M&A

New Projects/Investments

- GEOLOG International B.V. has successfully acquired Quad Ltd and QO Inc. (Quad).

- This strategic acquisition aims to enhance GEOLOG's global well geology and pore pressure services, deepen technical expertise, and expand service delivery worldwide.

- Quad is a provider of well and operations geologists and advanced pore pressure and fracture gradient analysis services.

- The acquisition will expand GEOLOG's advanced drilling and subsurface support service portfolio and consolidate its global operational presence.

- The terms of the transaction were not disclosed.

Jan 8, 2026, 10:00 AM

Geospace Technologies Reports Q4 and Full Year 2025 Results

GEOS

Earnings

Demand Weakening

New Projects/Investments

- Geospace Technologies reported a net loss of $9.1 million on $30.7 million in revenue for Q4 2025, and a net loss of $9.7 million on $110.8 million in revenue for the full fiscal year 2025.

- The Smart Water segment achieved 10% revenue growth for FY 2025, reaching $35.8 million, while the Energy Solutions segment's revenue declined by 35% to $50.7 million for the full year due to reduced utilization of marine ocean bottom nodes.

- The company secured a major permanent reservoir monitoring contract with Petrobras and sold its Pioneer land nodes, but faced higher material costs due to tariffs and uncertainty in the short-term exploration market.

- As of September 30, 2025, the company maintained $26.3 million in cash and $8 million in additional available liquidity.

Nov 21, 2025, 3:00 PM

Geospace Technologies Reports Fiscal Year 2025 Results

GEOS

Earnings

Product Launch

Demand Weakening

- Geospace Technologies reported a fiscal year 2025 revenue decline of 18.3% to $110.8 million and a widened net loss of $9.7 million, primarily due to decreased product revenue in its Energy Solutions segment.

- The company's gross profit decreased by 37.4% year-over-year to $32.9 million, mainly attributed to lower ocean bottom nodes product revenue and reduced utilization of the rental fleet.

- Despite these challenges, the Smart Water segment experienced growth, and a significant contract with Petrobras helped narrow net losses in Q4 2025.

- Geospace also launched new products, including the Pioneer™ wireless sensor and Mariner® ocean bottom seismic systems, aimed at enhancing efficiency and reducing environmental impact.

Nov 21, 2025, 6:07 AM

Geospace Technologies Corporation Reports Fourth Quarter and Fiscal Year 2025 Results

GEOS

Earnings

Demand Weakening

New Projects/Investments

- Geospace Technologies Corporation reported a net loss of $9.1 million (or $(0.71) per diluted share) on $30.7 million in revenue for the fourth quarter ended September 30, 2025. For the full fiscal year 2025, the company posted a net loss of $9.7 million (or $(0.76) per diluted share) on $110.8 million in revenue.

- The Smart Water segment delivered 10% revenue growth for fiscal year 2025, totaling $35.8 million, driven by increased demand for Hydroconn connectors.

- The Energy Solutions segment experienced a 35% decrease in fiscal year 2025 revenue, totaling $50.7 million, primarily due to lower utilization and sales of its marine ocean bottom node rental fleet.

- As of September 30, 2025, the company held $26.3 million in cash and cash equivalents and maintained $64.1 million in working capital. For fiscal year 2025, $22.2 million in cash was used in operating activities, while $42.7 million was generated from investing activities.

Nov 20, 2025, 9:56 PM

Quarterly earnings call transcripts for GEOSPACE TECHNOLOGIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more