Earnings summaries and quarterly performance for GERDAU.

Research analysts who have asked questions during GERDAU earnings calls.

Caio Ribeiro

Bank of America

5 questions for GGB

Carlos de Alba

Morgan Stanley

5 questions for GGB

Daniel Sasson

Itaú BBA

5 questions for GGB

Caio Greiner

BTG Pactual

3 questions for GGB

Igor Guedes

Genial Investimentos

3 questions for GGB

Ricardo Monegaglia Neto

Safra

3 questions for GGB

Emerson Vieira

Goldman Sachs

2 questions for GGB

Lucas Laghi

XP Inc.

2 questions for GGB

Marcio Farid Filho

Goldman Sachs

2 questions for GGB

Rafael Barcellos

Bradesco BBI

2 questions for GGB

Raphael Bastos Bezerra

Bradesco

2 questions for GGB

Ricardo

Banco Safra

2 questions for GGB

Rodolfo De Angele

JPMorgan Chase & Co.

2 questions for GGB

Yuri Pereira

Santander Bank

2 questions for GGB

Camilla Analyst

Banco Bradesco S.A.

1 question for GGB

Daniel Sassoon

Itau BBA

1 question for GGB

Gabriel Baja

Citigroup

1 question for GGB

Leo Koheja

BTG Pactual

1 question for GGB

Leonardo Correa

BTG Pactual

1 question for GGB

Lukas Lage

XP Inc.

1 question for GGB

Rafael Marcellus

Bradesco BBI

1 question for GGB

Recent press releases and 8-K filings for GGB.

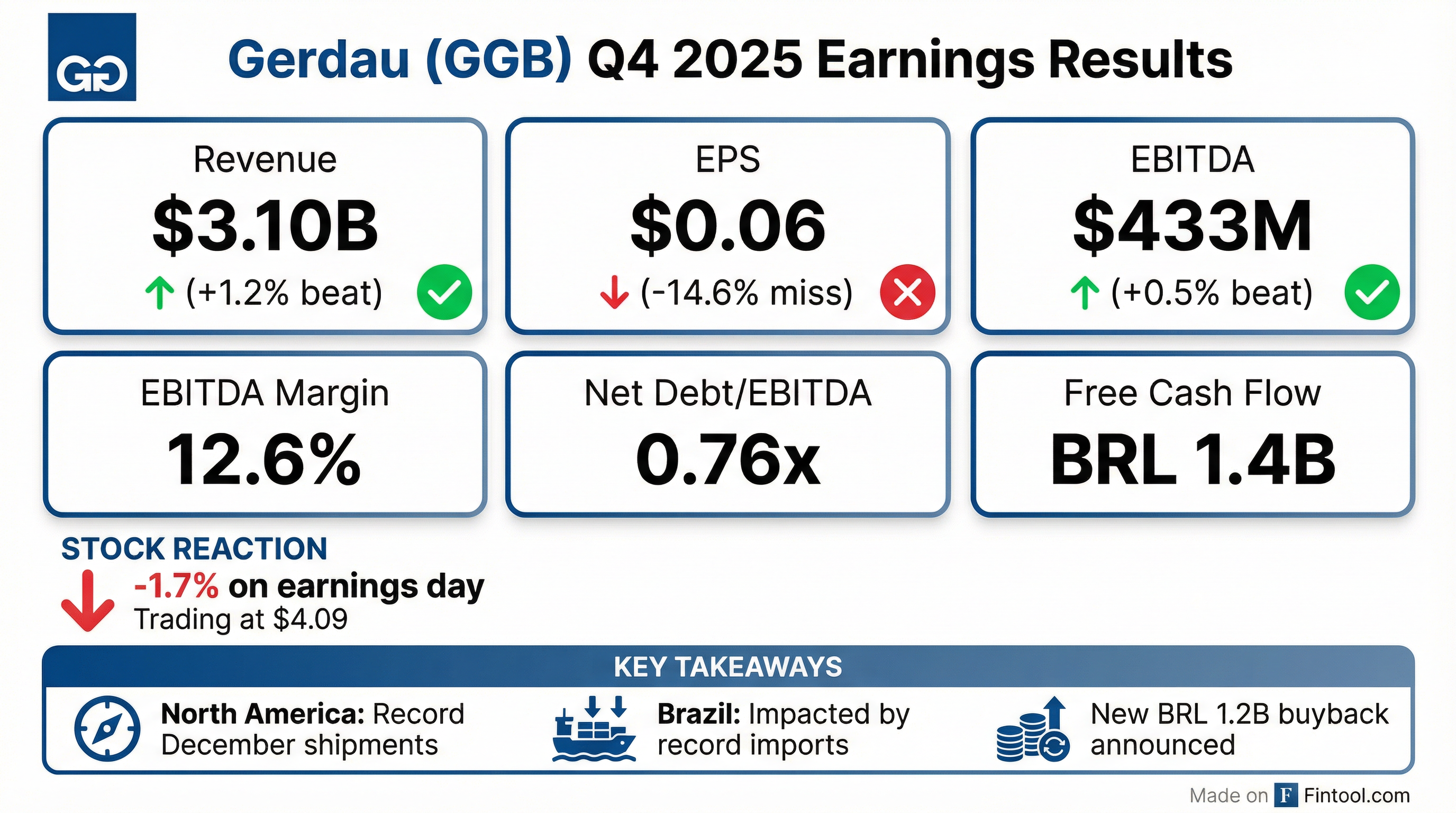

- Gerdau reported Q4 2025 EBITDA of BRL 10.1 billion, a 7% decrease from 2024, and adjusted net income of BRL 3.4 billion for 2025, down 21% year-over-year, impacted by BRL 2 billion in non-recurring impairment losses in Brazil units.

- The company generated BRL 1.4 billion in free cash flow in Q4 2025, resulting in a positive annual cash flow generation of BRL 394 million for 2025, and ended the year with a leverage of 0.76 times net debt over EBITDA.

- CapEx for 2025 was BRL 6.1 billion, with a guidance of BRL 4.7 billion for 2026, representing a BRL 1.4 billion reduction.

- Gerdau paid out BRL 2.4 billion in dividends and share buybacks throughout 2025 and announced a new share buyback program for approximately 2.9% of outstanding shares, equivalent to BRL 1.2 billion.

- The outlook for North America remains positive with stable steel consumption and strong order backlogs, while Brazil faces a challenging environment with increased competition, though moderate demand growth is expected and a double-digit EBITDA margin for the full year 2026 is considered achievable with the Miguel Burnier project ramp-up.

- Gerdau's Q4 2025 results showed solid performance in North America, including record shipments in December 2025, driven by strong steel consumption and reduced imports. Conversely, the Brazilian market was impacted by a record 7.5% increase in steel imports in 2025, affecting profitability.

- For Q1 2026, Brazil faces challenges with lower volumes and cost pressures from increased coal prices. However, the new Miguel Burnier sustainable mining platform is expected to begin operations soon, significantly reducing production costs at the Ouro Branco unit and contributing to improved competitiveness in Brazil.

- The company anticipates continued solid profitability in North America in the coming quarters, supported by a strong order book and expectations of stable scrap prices.

- Gerdau's CapEx for 2026 is BRL 4.7 billion, primarily focused on improving competitiveness and reducing costs in Brazil, rather than significant capacity expansion.

- While the company is internally exploring options for unlocking value, including a potential listing of its North American operations, there are no tangible studies or action plans currently being executed.

- Gerdau reported BRL 10.1 billion in EBITDA for 2025, a 7% decrease from 2024, and an adjusted net income of BRL 3.4 billion, down 21% year-over-year, partly due to BRL 2 billion in non-cash impairment losses in Brazil.

- The company generated BRL 1.4 billion in free cash flow in Q4 2025, resulting in a positive annual cash flow generation of BRL 394 million for 2025, and maintained a strong balance sheet with 0.76 times net debt over EBITDA.

- Gerdau provided a 2026 CapEx guidance of BRL 4.7 billion, a BRL 1.4 billion reduction from 2025, and announced a new share buyback program for approximately 2.9% of outstanding shares, valued at BRL 1.2 billion.

- North American operations demonstrated resilience with strong steel consumption and a positive outlook, contrasting with the Brazilian market which was impacted by record steel imports in 2025, though trade defense measures are advancing.

- The Miguel Burnier mining project is nearing operation, anticipated to significantly reduce production costs at the Ouro Branco unit and potentially contribute to double-digit EBITDA margins for Brazil in 2026.

- Gerdau S.A. reported Net Income of R$3.4 billion for 2025, a 21% reduction from 2024, and Adjusted EBITDA of R$10.1 billion.

- The company's leverage (Net Debt/Adjusted EBITDA) stood at 0.76x in Q4 2025, which is below its financial policy of 1.5x.

- Steel shipments grew 5.9% to 11.6 Mt in 2025, with strong performance in North America.

- CAPEX guidance for 2026 is R$4.7 billion, representing a 24% decrease compared to the R$6.1 billion realized in 2025.

- Gerdau announced Q4 2025 dividends for Gerdau S.A. of R$0.10 per share and Metalúrgica S.A. of R$0.05 per share, payable March 18, 2026, and initiated a new share buyback program for 2026.

- Gerdau S.A. and Metalúrgica Gerdau S.A. approved dividend payments as an anticipation for fiscal year 2025, with Gerdau S.A. paying R$ 0.10 per share on March 18, 2026.

- The company approved the cancellation of 418,800 common shares and 7,700,000 preferred shares, resulting in a revised capital stock of 717,363,819 common shares and 1,275,397,330 preferred shares.

- A new share buyback program was approved, allowing the acquisition of up to 55,000,000 preferred shares (approximately 4.4% of outstanding) and 1,441,120 common shares (approximately 10% of outstanding) from February 24, 2026, until August 24, 2027.

- Gerdau S.A. reported Net sales of R$17.0 billion and Adjusted EBITDA of R$2.4 billion for 4Q25, representing declines of 5.6% and 13.3% respectively from 3Q25. For the full year 2025, Net sales reached R$69.9 billion and Adjusted EBITDA was R$10.1 billion.

- The company approved R$197.5 million (R$0.10 per share) in dividends for 4Q25, to be paid on March 18, 2026, and approved a new share buyback program for up to 56.4 million shares.

- CAPEX for 2025 totaled R$6.1 billion, with an estimated CAPEX plan of R$4.7 billion for 2026. The Net debt/Adjusted EBITDA ratio stood at 0.76x at the end of 2025.

- North America operations were a key driver, contributing 73% of Consolidated EBITDA in 4Q25, mitigating seasonal effects in Brazil.

- GERDAU S.A. concluded its 2025 Share Buyback Program on December 19, 2025.

- The company acquired 1,500,000 common shares (GGBR3) at an average price of R$15.65 per share.

- Additionally, 63,000,000 preferred shares (GGBR4 and/or ADRs GGB) were acquired at an average price of R$16.27 per share.

- This completion represents 100% of the program.

- GERDAU S.A. announced that its subsidiary, GUSAP III LP, completed the financial settlement for the prepayment of all its issued Bonds on December 2, 2025.

- The Bonds had a principal amount of US$ 500,000,000.00, an interest rate of 4.25%, and a maturity date in 2030.

- The total amount paid for the redemption, including accrued interest, was US$ 509,710,576.46.

- Gerdau S.A. reported Adjusted EBITDA of R$2.7 billion and Earnings per share of R$0.54 in Q3 2025, with Net sales totaling R$18.0 billion.

- The North America segment was a key driver, contributing 65% of the consolidated EBITDA in Q3 2025, supported by demand resilience and metal spread expansion.

- The company approved dividends of R$0.28 per share for Gerdau S.A. and has repurchased 88% of its 2025 Share Buyback Program, representing 2.9% of outstanding shares.

- Gerdau maintained a healthy leverage level with a Net debt/Adjusted EBITDA ratio of 0.81x at the end of Q3 2025.

- The 2026 CAPEX guidance was set at R$4.7 billion, a 22% reduction compared to the 2025 estimate, with strategic projects like the Miguel Burnier Mining platform being 90% physically complete and expected to start up in 4Q25.

- Gerdau reported Q3 2025 EBITDA of BRL 2.7 billion, a 7% increase quarter-on-quarter, and generated BRL 1 billion in free cash flow, reducing its net debt/EBITDA ratio to 0.81 times.

- The North America segment delivered a solid performance, accounting for 65% of consolidated EBITDA and seeing over 10% increase in total shipments, while the Brazilian market continued to be negatively impacted by a 29% steel import penetration rate.

- The sustainable mining project in Miguel Burnier reached 90% physical completion and is scheduled for integrated operation in early 2026, with an anticipated BRL 400 million benefit in year one.

- The company invested BRL 1.7 billion in CapEx during Q3 2025 and announced a 2026 CapEx guidance of BRL 4.7 billion, representing a 22% reduction from the 2025 forecast.

Quarterly earnings call transcripts for GERDAU.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more