Earnings summaries and quarterly performance for ESS Tech.

Executive leadership at ESS Tech.

Board of directors at ESS Tech.

Research analysts who have asked questions during ESS Tech earnings calls.

JC

Justin Clare

Roth MKM

3 questions for GWH

Also covers: AMPS, AMSC, ATKR +11 more

CR

Colin Rusch

Oppenheimer & Co. Inc.

2 questions for GWH

Also covers: AEVA, ALB, AMPX +25 more

Corinne Blanchard

Deutsche Bank

2 questions for GWH

Also covers: ARRY, CSTM, CWEN +6 more

George Gianarikas

Canaccord Genuity

2 questions for GWH

Also covers: AEVA, AIRJ, AMRC +21 more

BK

Ben Kallo

Robert W. Baird & Co.

1 question for GWH

Also covers: ALB, AMRC, ARRY +17 more

TB

Thomas Boyes

TD Cowen

1 question for GWH

Also covers: DNMR, EOSE, NRGV +2 more

Recent press releases and 8-K filings for GWH.

ESS Tech Acquires VoltStorage GmbH Intellectual Property and Assets

GWH

M&A

New Projects/Investments

- ESS Tech, Inc. acquired the intellectual property and assets of VoltStorage GmbH to advance flexible long-duration energy storage.

- The acquisition combines complementary iron-salt battery technologies to deliver a more flexible, cost-effective, and scalable long-duration energy storage solution.

- This strategic move is expected to accelerate strategic growth, expand market reach, and position ESS at the forefront of long-duration energy storage solutions, leveraging sustainable materials for superior economics and enhanced U.S. manufacturing.

Feb 18, 2026, 1:31 PM

ESS Tech Provides Corporate Update and Shareholder Letter

GWH

Management Change

New Projects/Investments

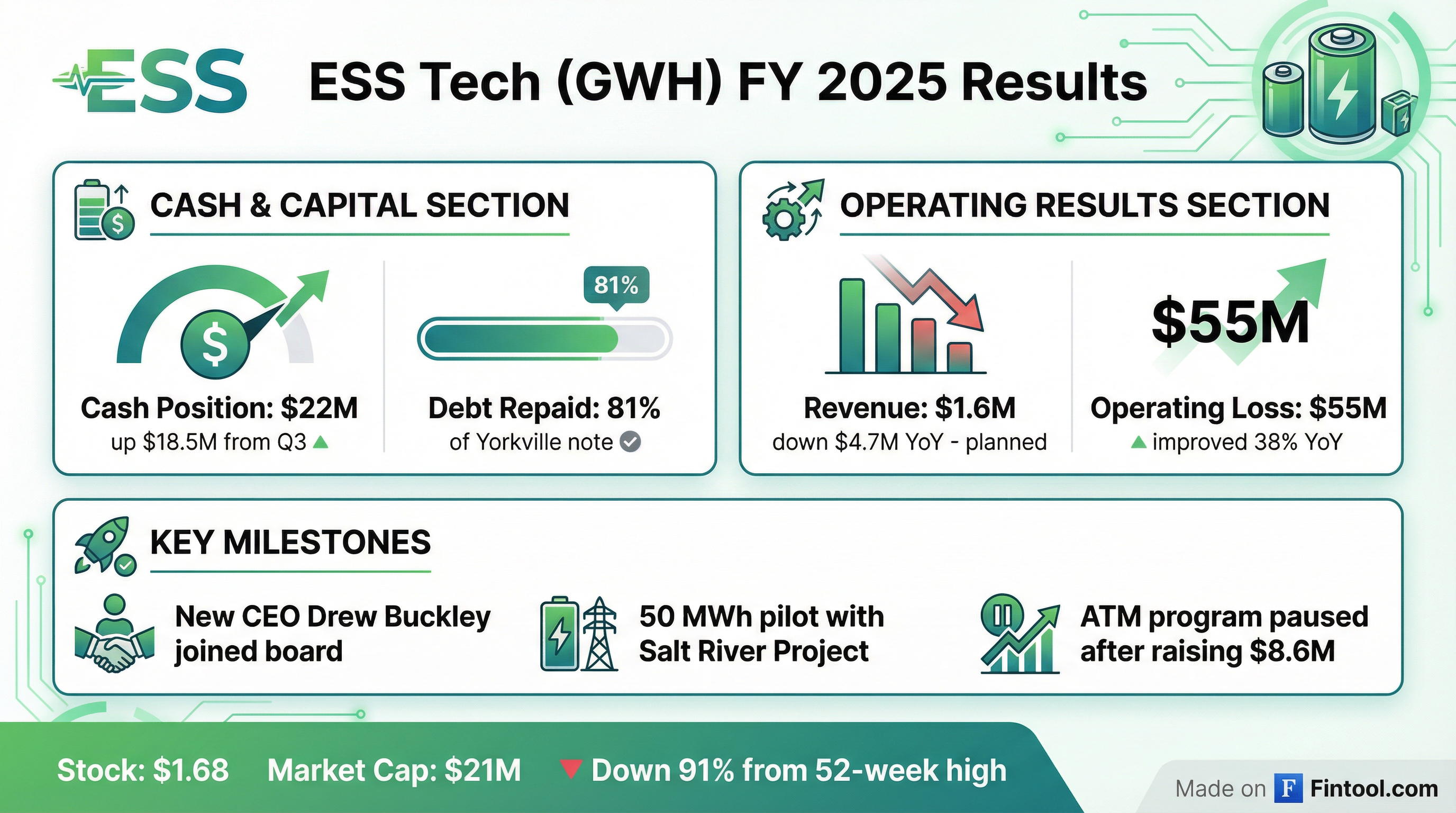

- ESS Tech announced a leadership transition, with Drew Buckley appointed Chief Executive Officer, Kelly Goodman as Chief Strategy Officer and General Counsel, and Kate Suhadolnik confirmed as Chief Financial Officer.

- The company was awarded a $9.9 million contract from Concurrent Technologies Corporation and the U.S. Air Force Research Laboratory to support the deployment of up to 27 MWh of long-duration energy storage.

- ESS Tech strengthened its balance sheet by closing a $40 million financing transaction in October, raising approximately $8.6 million from an at-the-market (ATM) equity offering in November, and completing a $15 million registered direct offering after year-end.

- As of December 31, 2025, preliminary unaudited estimates indicate cash, cash equivalents, and short-term investments are expected to be approximately $22 million, not including the post-year-end $15 million offering. The company also repaid approximately $24.4 million of a $30 million promissory note.

Feb 5, 2026, 1:31 PM

ESS Tech Closes $15 Million Registered Direct Offering

GWH

- ESS Tech, Inc. (NYSE: GWH) announced the closing of a registered direct offering on January 30, 2026, raising approximately $15 million.

- The offering involved the sale of 8,571,428 shares of Common Stock (or Pre-Funded Warrants) at a price of $1.75 per share, which was a premium to the closing price on January 28, 2026.

- The company expects to use the net proceeds from the offering for general corporate purposes and working capital.

Jan 30, 2026, 9:05 PM

ESS Tech Awarded $9.9 Million Contract

GWH

New Projects/Investments

- ESS Tech was awarded a $9.9 million contract by Concurrent Technologies Corporation (CTC) and the U.S. Air Force Research Laboratory (AFRL).

- The contract involves deploying up to 27 MWh of American-made iron flow battery (IFB) systems at the U.S. Clear Space Force Station in Alaska.

- This project is part of an AFRL initiative to demonstrate advanced energy storage and efficiency technologies, providing continuous, reliable power for mission-critical operations in demanding environments.

- ESS CEO, Drew Buckley, stated that this project is a significant validation of ESS battery technology for grid resiliency and optimized energy consumption at critical infrastructure.

Jan 29, 2026, 1:40 PM

ESS Tech Announces $15 Million Registered Direct Offering

GWH

- ESS Tech, Inc. (GWH) has entered into definitive agreements for a registered direct offering with institutional investors.

- The offering is for approximately $15 million of shares of Common Stock and pre-funded warrants.

- The shares are priced at $1.75 per share, which is a premium to the closing price on January 28, 2026.

- The company expects to use the net proceeds for general corporate purposes and working capital.

- The transaction is anticipated to close on or about January 30, 2026.

Jan 29, 2026, 1:30 PM

GWH Announces Q3 2025 Results, New Product Launch, and Financing Activities

GWH

Earnings

Product Launch

Debt Issuance

- GWH reported a Q3 2025 revenue of $0.2 million, a 40% decrease from Q3 2024, but significantly reduced its net loss to ($10.4 million) and Adjusted EBITDA to ($7.1 million), reflecting cost reduction efforts and a 53% reduction in operating cash burn rate from Q2 2025.

- The company launched The Energy Base M, a new product featuring the Iron Core for scalable, long-duration energy storage capable of up to 22 hours, designed to meet the needs of data centers and other utility-scale applications.

- GWH is expanding its manufacturing capacity with a second automated battery manufacturing line ("Line 2") expected online in H2 2026, which will contribute to a combined 1,000+ MWh capacity with Line 1, and a maximum plant capacity of 6,000+ MWh at Wilsonville.

- To support its operations and growth, GWH raised $3.6 million during Q3 2025 from a $25 million Standby Equity Purchase Agreement (SEPA), completed a $40 million financing with Yorkville in October, and initiated a $75 million at-the-market program on November 13th.

Nov 13, 2025, 10:00 PM

ESS Reports Q3 2025 Financial Results and Secures New Financing

GWH

Earnings

Debt Issuance

New Projects/Investments

- ESS reported revenue of $200,000 for the third quarter of fiscal year 2025, compared to $2.4 million in the second quarter, with a net loss of $10.4 million and $0.73 earnings per share.

- The company ended the quarter with $3.5 million in cash, cash equivalents, and short-term investments, which did not include $30 million in proceeds from a $40 million financing with Yorkville Advisors that closed after quarter-end. As of the call date, ESS has approximately $30 million in cash on hand after repaying $15 million of the drawn amount.

- ESS is launching a $75 million at-the-market (ATM) equity program to provide efficient access to capital for growth and execution.

- The company's strategic focus is on its Energy Base platform, with the first commercial-scale deployment being a 50 MWh pilot project with Salt River Project (SRP).

Nov 13, 2025, 10:00 PM

ESS Tech, Inc. Announces Q3 2025 Financial Results and Strategic Capital Initiatives

GWH

Earnings

Debt Issuance

New Projects/Investments

- ESS Tech, Inc. reported total revenue of $214 thousand and a net loss of $(10,375) thousand for the third quarter ended September 30, 2025.

- The company strengthened its capital position by closing $40 million in financing with Yorkville Advisors Global, repaying $15 million of a promissory note, and completing a $25 million Standby Equity Purchase Agreement (SEPA).

- ESS also announced plans to launch a $75 million at-the-market (ATM) program and secured a 50 MWh long-duration storage pilot project with Salt River Project (SRP), with broader commercialization of its Energy Base platform expected to commence in 2026.

Nov 13, 2025, 9:31 PM

ESS Tech Closes $40 Million Financing Transaction

GWH

Debt Issuance

New Projects/Investments

- ESS Tech, Inc. (GWH) has closed a $40 million financing transaction with YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, L.P.

- The transaction provides $30 million of immediate capital, with an additional $10 million available upon execution of an at-the-market sales agreement.

- Structured as a one-year promissory note, this financing strengthens the company's cash position and supports its strategic pivot to the U.S.-manufactured Energy Base.

- This funding follows recent milestones, including securing landmark customer agreements such as the 50 MWh New Horizon project for Salt River Project.

Oct 14, 2025, 1:05 PM

Quarterly earnings call transcripts for ESS Tech.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more