Earnings summaries and quarterly performance for Hamilton Lane.

Executive leadership at Hamilton Lane.

Board of directors at Hamilton Lane.

Research analysts who have asked questions during Hamilton Lane earnings calls.

Alexander Blostein

Goldman Sachs

6 questions for HLNE

Kenneth Worthington

JPMorgan Chase & Co.

6 questions for HLNE

Michael Cyprys

Morgan Stanley

5 questions for HLNE

Michael Brown

Wells Fargo Securities

3 questions for HLNE

Stephanie Ma

Morgan Stanley

3 questions for HLNE

Alex Bond

Keefe, Bruyette & Woods (KBW)

2 questions for HLNE

Brennan Hawken

UBS Group AG

2 questions for HLNE

Ken Worthington

JPMorgan

2 questions for HLNE

Mike Brown

UBS

2 questions for HLNE

Aidan Hall

KBW

1 question for HLNE

Alan Hall

KBW

1 question for HLNE

Anthony Allen

Goldman Sachs Group, Inc.

1 question for HLNE

Anthony on for Alex Blostein

Goldman Sachs

1 question for HLNE

Recent press releases and 8-K filings for HLNE.

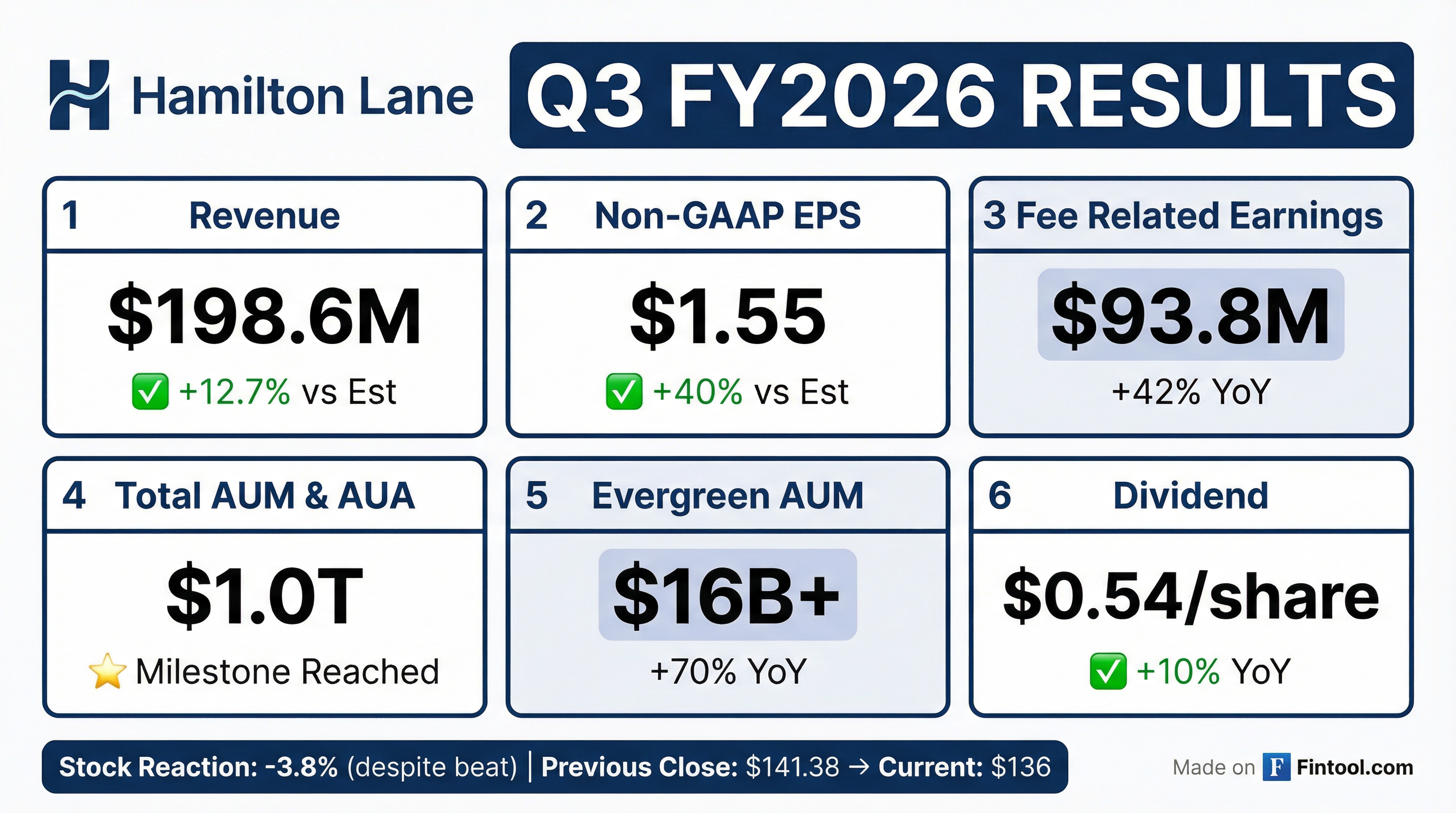

- Hamilton Lane reported a total asset footprint of over $1 trillion, an 8% increase in AUM to $146 billion, and a 6% increase in AUA to $871 billion year-over-year for Q3 Fiscal 2026.

- For the fiscal year-to-date period, total fee-related revenue grew 31% to $507 million, and Fee-Related Earnings (FRE) increased 37% to $254.6 million.

- The Evergreen Platform demonstrated strong growth, with over $1.2 billion in net inflows for the quarter ended December 31, 2025, and total Evergreen Platform AUM reaching over $16 billion, a 70% year-over-year increase.

- The company declared a quarterly dividend of $0.54 per share, on track for a 10% increase over the last fiscal year, targeting $2.16 per share for fiscal year 2026.

- A strategic partnership with Guardian was closed, under which Hamilton Lane will oversee nearly $5 billion of Guardian's existing private equity portfolio and expects additional annual commitments of approximately $500 million for at least 10 years.

- Hamilton Lane reported strong financial growth for Q3 Fiscal 2026 year-to-date, with total fee-related revenue up 31% to $507 million and fee-related earnings up 37% to $254.6 million year-over-year.

- The company's total asset footprint exceeded $1 trillion, while AUM grew 8% to $146 billion and AUA increased 6% to $871 billion year-over-year.

- The strategic partnership with Guardian officially closed, expected to add nearly $5 billion to the asset footprint next quarter and secure approximately $500 million in additional annual commitments for at least 10 years.

- The Evergreen Platform continued its strong momentum, achieving over $1.2 billion in net inflows for the quarter ended December 31, 2025, and its total AUM surpassed $16 billion, growing over 70% year-over-year.

- Hamilton Lane also announced an investment in Pluto Financial Technologies to develop technology-enabled liquidity solutions for private markets.

- Hamilton Lane reported a total asset footprint exceeding $1 trillion and AUM of $146 billion for Q3 Fiscal 2026, marking year-over-year increases of 6% and 8%, respectively.

- Year-to-date, total fee-related revenue surged 31% to $507 million, while fee-related earnings grew 37% to $254.6 million.

- The Evergreen Platform AUM reached over $16 billion, reflecting over 70% year-over-year growth and driven by $1.2 billion in net inflows for the quarter ended December 31, 2025.

- The strategic partnership with Guardian has closed, expected to add nearly $5 billion to the total asset footprint next quarter and secure approximately $500 million in additional annual commitments for at least 10 years.

- Management anticipates 2026 will be a stronger exit environment than 2025, with distribution activity showing an increase.

- For the third fiscal quarter ended December 31, 2025, Hamilton Lane Incorporated reported net income attributable to Hamilton Lane Incorporated of $58.4 million and diluted earnings per share of $1.37.

- Total revenues increased by 18% to $198.6 million for the third fiscal quarter of 2026 compared to the prior year period.

- As of December 31, 2025, assets under management (AUM) reached $146.1 billion and fee-earning assets under management (FEAUM) reached $79 billion, representing increases of 8% and 11% respectively, compared to December 31, 2024.

- Hamilton Lane has declared a quarterly dividend of $0.54 per share of Class A common stock, payable on April 6, 2026, to record holders at the close of business on March 20, 2026.

- Hamilton Lane reported its third fiscal quarter results for the period ended December 31, 2025.

- The company declared a quarterly dividend of $0.54 per share of Class A common stock, payable on April 6, 2026, to record holders as of March 20, 2026.

- The target full-year dividend of $2.16 represents a 10% increase from the prior fiscal year dividend.

- As of December 31, 2025, Hamilton Lane had $1.0 trillion in assets under management and supervision, composed of $146.1 billion in discretionary assets and $871.5 billion in non-discretionary assets.

- Hamilton Lane announced the final closing of its Infrastructure Opportunities Fund II (IOF II) and related vehicles, securing nearly $2 billion in total capital commitments.

- The fund significantly exceeded its $1.25 billion target and is more than three times larger than its predecessor, IOF I.

- IOF II maintains a focus on a globally diversified middle-market strategy, aiming to capitalize on direct co-investment and secondary opportunities to deliver attractive income and total returns.

- The fund has already committed approximately 40% of its capital across 14 deals and attracted over 30 new investors globally.

- Hamilton Lane and Slate Asset Management announced the acquisition of a majority equity stake in Cold-Link Logistics, one of the ten largest privately-held cold storage platforms in North America.

- Cold-Link Logistics, founded in 2016, owns and operates nine state-of-the-art cold storage facilities across the Central, Northeastern, and Southeastern US, with the majority of its current operated pallet volume concentrated in assets constructed in 2022 or later.

- This investment enhances Slate's position in essential real estate and infrastructure, increasing its exposure to assets vital to food logistics, and represents a unique opportunity in the infrastructure space for Hamilton Lane.

- Cold-Link's founders, Michael and Nick Mandich, and other management team members will maintain a meaningful stake in the company and continue leading the business.

- Hamilton Lane's total asset footprint exceeded $1 trillion for the first time, marking a 6% increase year over year, with AUM growing 11% to $145 billion and AUA increasing 5% to $860 billion.

- For the fiscal year to date, total fee related revenue grew 23% to $321.6 million, and fee related earnings increased 34% to $160.7 million, resulting in GAAP EPS of $2.98 and non-GAAP EPS of $2.86.

- A significant strategic partnership was announced with Guardian Life Insurance Company of America, involving the management of Guardian's existing $5 billion private equity portfolio and a commitment to invest approximately $500 million per year for the next ten years.

- The Evergreen platform achieved its largest quarter ever with over $1.6 billion in net inflows, bringing total Evergreen AUM to $14.3 billion.

- Strategic technology initiatives include a partnership with Bloomberg to provide access to Hamilton Lane's private market indices and the anticipated public listing of Securitize, where Hamilton Lane expects a return of more than two times its initial investment.

- Hamilton Lane reported strong Q2 Fiscal 2026 year-to-date results, with GAAP EPS of $2.98 and non-GAAP EPS of $2.86, driven by a 23% year-over-year increase in total fee-related revenue to $321.6 million.

- The firm's total asset footprint exceeded $1 trillion for the first time, marking a 6% year-over-year increase, while Assets Under Management (AUM) grew 11% to $145 billion and Assets Under Advisement (AUA) rose 5% to $860 billion.

- A significant strategic partnership was announced with Guardian Life Insurance Company of America, under which Hamilton Lane will manage Guardian's existing private equity portfolio of nearly $5 billion and receive commitments of approximately $500 million per year for the next 10 years.

- The Evergreen platform experienced substantial growth, with over $1.6 billion in net inflows for the quarter ending September 30, 2025, bringing total Evergreen AUM to $14.3 billion and expanding the product suite from three to eleven funds.

- Key technology developments include a partnership with Bloomberg for private market indices, Securitize's planned public listing (expected to yield more than two times Hamilton Lane's initial investment), and Novata's strategic acquisition of Atlas Metrics.

- Hamilton Lane reported its second fiscal quarter results for the period ended September 30, 2025.

- The company declared a quarterly dividend of $0.54 per share of Class A common stock, payable on January 7, 2026, to shareholders of record on December 19, 2025. The target full-year dividend of $2.16 represents a 10% increase from the prior fiscal year dividend.

- As of September 30, 2025, Hamilton Lane had $1.0 trillion in assets under management and supervision, consisting of $145.4 billion in discretionary assets and $859.8 billion in non-discretionary assets.

Quarterly earnings call transcripts for Hamilton Lane.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more