Earnings summaries and quarterly performance for HARROW.

Executive leadership at HARROW.

Board of directors at HARROW.

Research analysts who have asked questions during HARROW earnings calls.

Chase Knickerbocker

Craig-Hallum Capital Group

4 questions for HROW

Also covers: AVDL, BFLY, BVS +17 more

Mayank Mamtani

B. Riley Securities

4 questions for HROW

Also covers: AGEN, ALT, ARWR +18 more

Thomas Flaten

Lake Street Capital Markets

3 questions for HROW

Also covers: ACHV, AQST, ASRT +13 more

YC

Yi Chen

H.C. Wainwright & Co.

3 questions for HROW

Also covers: ANGO, APDN, BLFS +22 more

BO

Brooks O'Neil

Lake Street Capital Markets

1 question for HROW

Also covers: ARAY, ATEC, BBNX +11 more

LH

Lachlan Hanbury-Brown

William Blair & Company

1 question for HROW

Also covers: APLS, ARSP, EYEN +4 more

Steve Seedhouse

Cantor Fitzgerald

1 question for HROW

Also covers: BCRX, BOLD, VKTX +1 more

Thomas Shrader

BTIG

1 question for HROW

Also covers: ABOS, ALEC, ARCT +8 more

Recent press releases and 8-K filings for HROW.

Harrow Reaffirms 2025 Revenue Guidance and Appoints Chief Commercial Officer

HROW

Guidance Update

Management Change

New Projects/Investments

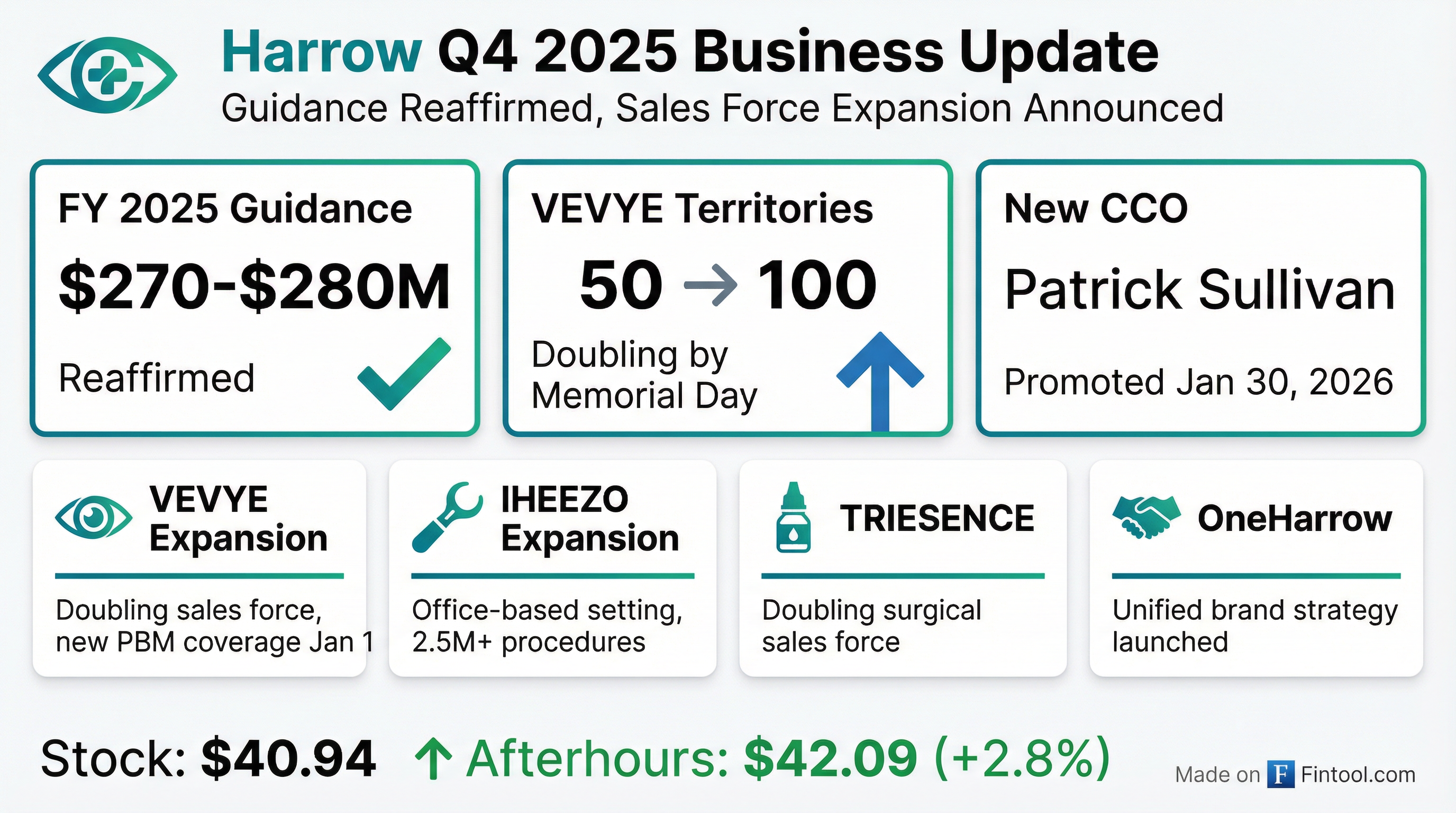

- Harrow, Inc. reaffirmed its full-year 2025 revenue guidance to be between $270 million and $280 million.

- Patrick W. Sullivan was promoted to Chief Commercial Officer effective January 30, 2026, with an annual base salary of $425,000 and 40,000 restricted stock units (RSUs), of which 25,000 RSUs will vest upon achieving $230 million in quarterly revenue.

- The company announced significant commercial expansion plans, including doubling the VEVYE sales force, expanding IHEEZO's commercial footprint to office-based settings, and doubling the TRIESENCE surgical sales force.

- Harrow launched the OneHarrow initiative to unify branding and operations and confirmed the MELT-300 New Drug Application (NDA) submission is on track for the first half of 2027.

Feb 2, 2026, 12:30 PM

Harrow Reaffirms 2025 Revenue Guidance and Details Commercial & Development Progress

HROW

Guidance Update

New Projects/Investments

Legal Proceedings

- Harrow reaffirmed its full-year 2025 revenue guidance of between $270-280 million.

- The company is executing commercial expansions, including doubling the VEVYE sales force by Memorial Day, expanding IHEEZO into the office-based setting, and doubling the surgical sales force for TRIESENCE.

- Harrow launched the OneHarrow initiative to unify branding and operations and is progressing with MELT-300 and MELT-210 programs towards New Drug Application filings, with MELT-300 NDA submission expected in the first half of 2027.

- Harrow's ImprimisRx division settled regulatory matters with the California Board of Pharmacy, resulting in an administrative fine of approximately $157,000 and a voluntary exit from the California market effective February 1, 2026, which is not financially material to Harrow.

Feb 2, 2026, 12:00 PM

Harrow Discusses Product Performance and Strategic Initiatives at Piper Sandler Conference

HROW

M&A

Product Launch

New Projects/Investments

- Harrow recently closed the Melt acquisition in mid-November, gaining MELT-300 (targeting opioid reduction in cataract surgery with broader applications) and MELT-210 (an oral dissolving tablet for anti-anxiety/sedation). The MELT-300 program has a Special Protocol Agreement with the FDA, and efficacy studies are complete.

- The dry eye disease product VEVYE has seen its market share nearly double in the last two calendar quarters, driven by a major coverage win starting January 1st with a large pharmacy benefit manager covering over 30 million lives. Harrow is doubling its sales force to support this growth.

- IHEEZO, a reimbursable topical anesthetic, is experiencing strong sales, with approximately $45 million through the first three quarters of the year and Q4 expected to be the largest quarter. The company targets 10% market share in the intravitreal injection market by the end of 2027.

- Harrow is entering the biosimilar market with planned launches of a ranibizumab biosimilar in 2026 and an aflibercept biosimilar in 2027, aiming for a "handful or so percentage points of market share" in a $1 billion segment of the AMD market.

- After a "disappointment" in the first three quarters, the Triesence product has shown a turnaround following new commercial leadership and a relaunch on October 1st. A prefilled syringe next-generation product is expected to be filed next year.

Dec 2, 2025, 8:00 PM

Harrow Discusses Recent MELT Acquisition and Growth Strategies

HROW

M&A

New Projects/Investments

Revenue Acceleration/Inflection

- Harrow recently closed the MELT acquisition in mid-November, with the lead asset MELT-300 having completed efficacy studies for its Phase III program under an FDA Special Protocol Agreement. The technology aims to reduce opioid exposure in cataract surgery and has broader applications in dental, plastics, derm, and MRI.

- The dry eye disease product VEVYE has nearly doubled its market share in the last two calendar quarters and secured a major preferred coverage win with the largest pharmacy benefit manager (over 30 million lives) starting January 1st. Harrow is doubling its sales force to approximately 100 territories by Memorial Day, anticipating improved units and net price in 2026.

- IHEEZO, a reimbursable topical anesthetic, generated $45 million in revenue through the first three quarters of the current year, with full-year projections around $50 million. The company targets 10% market share in the intravitreal injection market by the end of 2027.

- Harrow is entering the biosimilar market with planned launches of a ranibizumab biosimilar in 2026 and an aflibercept biosimilar in 2027, aiming for a 3-4% market share in the approximately $1 billion Lucentis/biosimilar segment.

Dec 2, 2025, 8:00 PM

Harrow discusses MELT acquisition, Vevye growth, IHEEZO performance, and biosimilar market entry at Piper Sandler Conference

HROW

M&A

New Projects/Investments

Revenue Acceleration/Inflection

- Harrow recently closed the MELT acquisition, a procedural sedation technology with a special protocol agreement (SPA) with the FDA for Phase III, which has applications beyond ophthalmology in areas like dental, plastics, derm, and MRI claustrophobia.

- The dry eye product, Vevye, has nearly doubled its market share in the last two calendar quarters and secured a major coverage win starting January 1st, granting preferred status with a large pharmacy benefit manager covering more than 30 million lives. Harrow is doubling its sales force in response to this growth.

- IHEEZO is on track for approximately $50 million in sales for the current year, having reached $45 million through Q3, and aims for 10% market share in the intravitreal injection market by the end of 2027.

- Harrow is entering the biosimilar market with ranibizumab (2026) and aflibercept (2027), targeting a 3-4% market share in the Lucentis/biosimilar segment, with each percentage point representing over $80 million in revenue.

Dec 2, 2025, 8:00 PM

Harrow completes acquisition of Melt Pharmaceuticals

HROW

M&A

New Projects/Investments

Product Launch

- Harrow, Inc. completed the acquisition of Melt Pharmaceuticals, Inc. on November 17, 2025, for an initial cash consideration of approximately $4.3 million.

- The acquisition adds Melt's clinical-stage, non-opioid, non-IV sedation therapies, including MELT-300, to Harrow's portfolio, targeting the multi-billion-dollar procedural sedation market.

- MELT-300, a sublingual formulation of midazolam and ketamine, has shown statistical superiority to midazolam alone in Phase 2 and Phase 3 trials.

- Harrow plans to submit the New Drug Application (NDA) for MELT-300 in H1 2027, with potential FDA approval in H1 2028, and commercial launch in H2 2028.

Nov 18, 2025, 1:00 PM

HROW Reports Q3 2025 Financial Results and Updates Full-Year Guidance

HROW

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Harrow reported Q3 2025 total revenue of $71.6 million, representing a 45% increase over the same period in 2024 and a 12% sequential increase from Q2 2025. Adjusted EBITDA for Q3 was $22.7 million, with GAAP-based net income of $1 million.

- The company updated its full-year revenue outlook to a range of $270-$280 million for 2025, revising from an original target of over $280 million.

- VEVYE generated $22.6 million in Q3 revenue, a 22% increase from Q2 2025, and by the end of Q3, captured 10.5% of the total dry eye market. Starting January 2026, VEVYE will be listed on multiple new formularies with preferred product status, including the largest U.S. pharmacy benefit manager, which is expected to significantly improve average selling price (ASP) and drive volume.

- IHEEZO revenue for Q3 was $21.9 million, up 20% from Q2 2025, and the TRIESENCE and broader specialty branded portfolio generated $6.9 million, a 33% sequential increase, with TRIESENCE officially launched into the ocular inflammation market.

- Harrow is also concluding the acquisition of Melt Pharmaceuticals and approaching the launch of the Samsung Bioepis biosimilar portfolio, with four new product launches scheduled over the next two years.

Nov 11, 2025, 1:00 PM

Harrow Announces Third Quarter 2025 Financial Results

HROW

Earnings

Guidance Update

M&A

- Harrow reported total revenues of $71.6 million for the third quarter of 2025, representing a 45% increase over the prior-year period, with GAAP net income of $1.0 million and Adjusted EBITDA of $22.7 million.

- Key products VEVYE and IHEEZO showed strong performance in Q3 2025, with VEVYE revenue increasing 22% quarter-over-quarter to $22.6 million and IHEEZO revenue growing 70% year-over-year to $21.9 million.

- The company updated its full-year revenue outlook to a range of $270 million to $280 million.

- Strategic initiatives in Q3 2025 included an agreement to acquire Melt Pharmaceuticals, Inc. and the launch of the Harrow Access for All (HAFA) program.

Nov 10, 2025, 10:09 PM

Harrow Outlines Strategic Vision, Product Pipeline, and Financial Targets

HROW

M&A

Product Launch

Guidance Update

- Harrow aims to become the next great U.S. ophthalmic company, leveraging its founder-led approach and active M&A strategy to build the largest and most diversified portfolio of prescription ophthalmic products in North America.

- The company announced the acquisition of Melt, a patented technology for procedural sedation, with an anticipated NDA filing in 2027 and launch in 2028. Melt 300 is expected to become a $100 million-plus high-margin annual revenue product.

- Harrow anticipates over $280 million in revenue for 2025 and has a medium-term goal of achieving over $250 million in quarterly revenue by Q4 2027.

- Key product developments include the expansion of TRIESENCE into the ocular inflammation market in Q4 of this year, the launch of BICLOVI in Q1 next year, and the planned launches of biosimilars BioViz (mid-2026) and Opuviz (second half of 2027).

- VEVYE reached a 7.8% market share in Q2 2025, surpassing CEQUA to become the second most prescribed cyclosporin-based dry eye therapy, with continued momentum in Q3.

Sep 26, 2025, 3:30 PM

Harrow Provides 2025 Revenue Guidance and Highlights Recent Acquisitions and Product Performance

HROW

Guidance Update

Product Launch

M&A

- Harrow expects 2025 revenue to exceed $280 million , with consolidated revenues for H1 2025 reported at $111,574 thousand and Adjusted EBITDA at $15,021 thousand.

- The company made several strategic moves in 2025, including acquiring exclusive U.S. commercial rights for BYQLOVI in June and the exclusive U.S. rights to Samsung Bioepis' ophthalmology biosimilars pipeline, including BYOOVIZ and OPUVIZ, in July.

- Key growth drivers such as VEVYE saw 66% Q/o/Q Rx volume growth and reached 7.8% market share in Q2 2025 , while IHEEZO experienced 25% growth in unit demand in Q2 2025.

- As of June 30, 2025, Harrow held $52,963 thousand in cash and cash equivalents.

Sep 26, 2025, 1:43 PM

Quarterly earnings call transcripts for HARROW.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more