Earnings summaries and quarterly performance for First Internet Bancorp.

Executive leadership at First Internet Bancorp.

Board of directors at First Internet Bancorp.

Research analysts who have asked questions during First Internet Bancorp earnings calls.

Nathan Race

Piper Sandler & Co.

9 questions for INBK

Brett Rabatin

Hovde Group, LLC

7 questions for INBK

George Sutton

Craig-Hallum

7 questions for INBK

Timothy Switzer

KBW

3 questions for INBK

Emily Lee

Keefe, Bruyette & Woods, Inc.

2 questions for INBK

Tim Switzer

Keefe, Bruyette & Woods (KBW)

2 questions for INBK

John Rodis

Janney Montgomery Scott LLC

1 question for INBK

Logan W Lillehaug

Craig-Hallum Capital Group LLC

1 question for INBK

Recent press releases and 8-K filings for INBK.

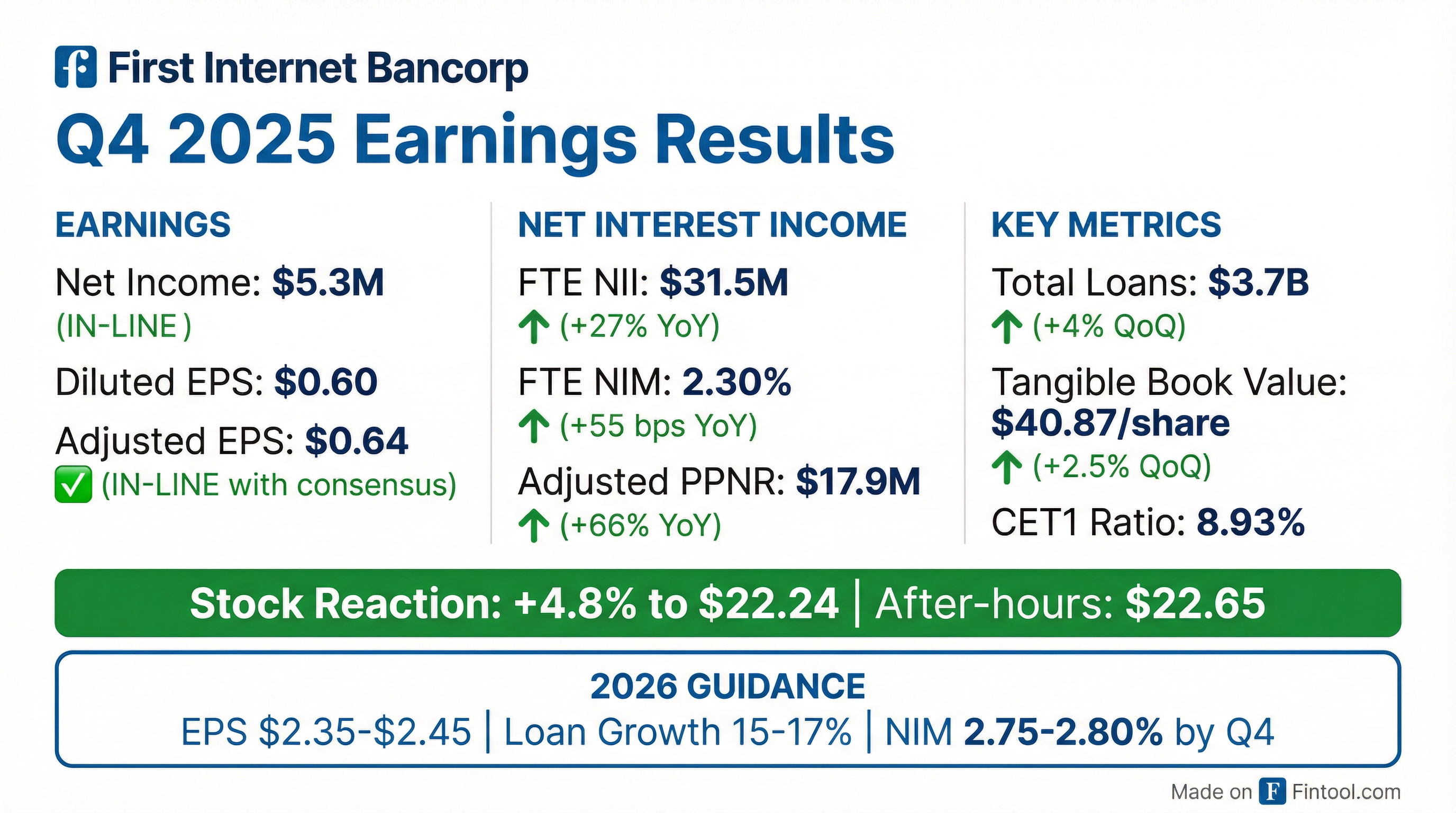

- INBK reported Q4 2025 net income of $5.3 million or $0.60 per diluted share, with adjusted total revenue increasing 21% year-over-year to $42.1 million. The company projects 2026 earnings per share of $2.35-$2.45.

- For 2025, the company achieved 30% net interest income growth and saw its Banking-as-a-Service (BaaS) initiatives generate over $1.3 billion in new deposits. Looking ahead to 2026, INBK anticipates loan growth of 15%-17% and expects Net Interest Margin (NIM) to reach 2.75%-2.80% by Q4.

- INBK addressed credit challenges in its SBA and franchise finance portfolios, guiding to a higher provision for credit losses of $50 million-$53 million for 2026, with expected improvement in the second half of the year. The company also returned $2.7 million to shareholders through dividends and share repurchases in 2025.

- First Internet Bancorp reported Q4 2025 net income of $5.3 million or $0.60 per diluted share, with adjusted total revenue increasing 21% over Q4 2024 to $42.1 million and net interest margin improving to 2.22%.

- Key accomplishments in 2025 included 30% net interest income growth, the strategic sale of approximately $850 million in single-tenant lease financing loans, and significant growth in Banking-as-a-Service (BaaS) initiatives, generating over $1.3 billion in new deposits and processing over $165 billion in payments volume.

- The company is addressing isolated credit issues in its SBA and franchise finance portfolios, anticipating a higher provision for credit losses of $50 million-$53 million for full year 2026, with expected improvement in the second half of the year.

- For 2026, First Internet Bancorp projects loan growth of 15%-17%, net interest margin reaching 2.75%-2.80% by Q4, and diluted earnings per share guidance of $2.35-$2.45.

- First Internet Bancorp reported Q4 2025 net income of $5.3 million or $0.60 per diluted share, with adjusted total revenue increasing 21% over the prior year period to $42.1 million. Net interest income grew 29% year-over-year to $30.3 million, and net interest margin improved by 55 basis points year-over-year to 2.22%.

- The company's Banking-as-a-Service (BaaS) initiatives generated over $1.3 billion in new deposits and processed over $165 billion in payments volume in 2025, an increase of over 225% from 2024.

- Credit challenges are isolated to the SBA and franchise finance portfolios, leading to a $12 million provision for credit losses in Q4 2025 and an increase in non-performing loans to $58.5 million. The company expects a higher provision for credit losses in 2026, estimated at $50 million-$53 million for the full year, with improvement anticipated in the second half of the year.

- For the full year 2026, First Internet Bancorp projects loan growth of 15%-17%, net interest margin expanding to 2.75%-2.80% by Q4 2026, and earnings per share in the range of $2.35-$2.45.

- The company returned $2.7 million to shareholders through dividends and share repurchases in 2025, including purchasing 27,998 shares at an average price of $18.64 per share in Q4 2025.

- First Internet Bancorp reported net income of $5.3 million and diluted earnings per share of $0.60 for the fourth quarter ended December 31, 2025. Adjusted total revenue for the quarter increased 21% year-over-year to $42.1 million.

- The provision for credit losses for Q4 2025 was $12.0 million, a 66% decrease from the third quarter of 2025. Total loan balances reached $3.7 billion, up 4% from Q3 2025, driven by strong commercial loan production.

- For the full year 2026, the company expects diluted earnings per share to be in the range of $2.35 to $2.45. It also anticipates continued loan growth of 15% to 17% and FTE net interest margin expansion to 2.75% to 2.80% by the fourth quarter of 2026.

- First Internet Bancorp reported net income of $5.3 million and diluted earnings per share of $0.60 for the fourth quarter of 2025, with adjusted total revenue growing 21% year-over-year to $42.1 million.

- The company experienced strong commercial loan production, increasing total loan balances by 4% from the prior quarter to $3.7 billion, and repurchased 27,998 shares at an average price of $18.64 per share.

- For the full year 2026, First Internet Bancorp projects diluted earnings per share of $2.35 to $2.45, loan growth between 15% and 17%, and an FTE net interest margin expanding to 2.75% to 2.80% by the fourth quarter.

- The provision for credit losses in Q4 2025 decreased 66% from the third quarter to $12.0 million, though it is anticipated to remain elevated in the first half of 2026.

- First Internet Bank (INBK) has partnered with Parlay Finance to implement its AI-native Loan Intelligence System (LIS) for Small Business Administration (SBA) lending operations.

- The partnership aims to eliminate manual tasks and gain deeper insights for loan decisioning, enabling the bank to process significantly higher application volumes with its existing team.

- First Internet Bank anticipates up to a 50% increase in efficiencies throughout the lending process due to the implementation of Parlay's LIS.

- As of June 30, 2025, First Internet Bank reported $6.1 Billion in assets.

Quarterly earnings call transcripts for First Internet Bancorp.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more