Earnings summaries and quarterly performance for KFORCE.

Executive leadership at KFORCE.

Board of directors at KFORCE.

Ann E. Dunwoody

Director

Catherine H. Cloudman

Director

David L. Dunkel

Chairman of the Board

Derrick D. Brooks

Director

Elaine D. Rosen

Lead Independent Director

Mark F. Furlong

Director

N. John Simmons

Director

Randall A. Mehl

Director

Research analysts who have asked questions during KFORCE earnings calls.

Mark Marcon

Baird

6 questions for KFRC

Trevor Romeo

William Blair

6 questions for KFRC

Kartik Mehta

Northcoast Research

5 questions for KFRC

Joshua Chan

UBS Group AG

4 questions for KFRC

Marc Riddick

Sidoti & Company, LLC

3 questions for KFRC

Tobey Sommer

Truist Securities, Inc.

3 questions for KFRC

Josh Chan

UBS

2 questions for KFRC

Tyler Barishaw

Truist Securities

2 questions for KFRC

Jasper Bibb

Truist Securities

1 question for KFRC

Recent press releases and 8-K filings for KFRC.

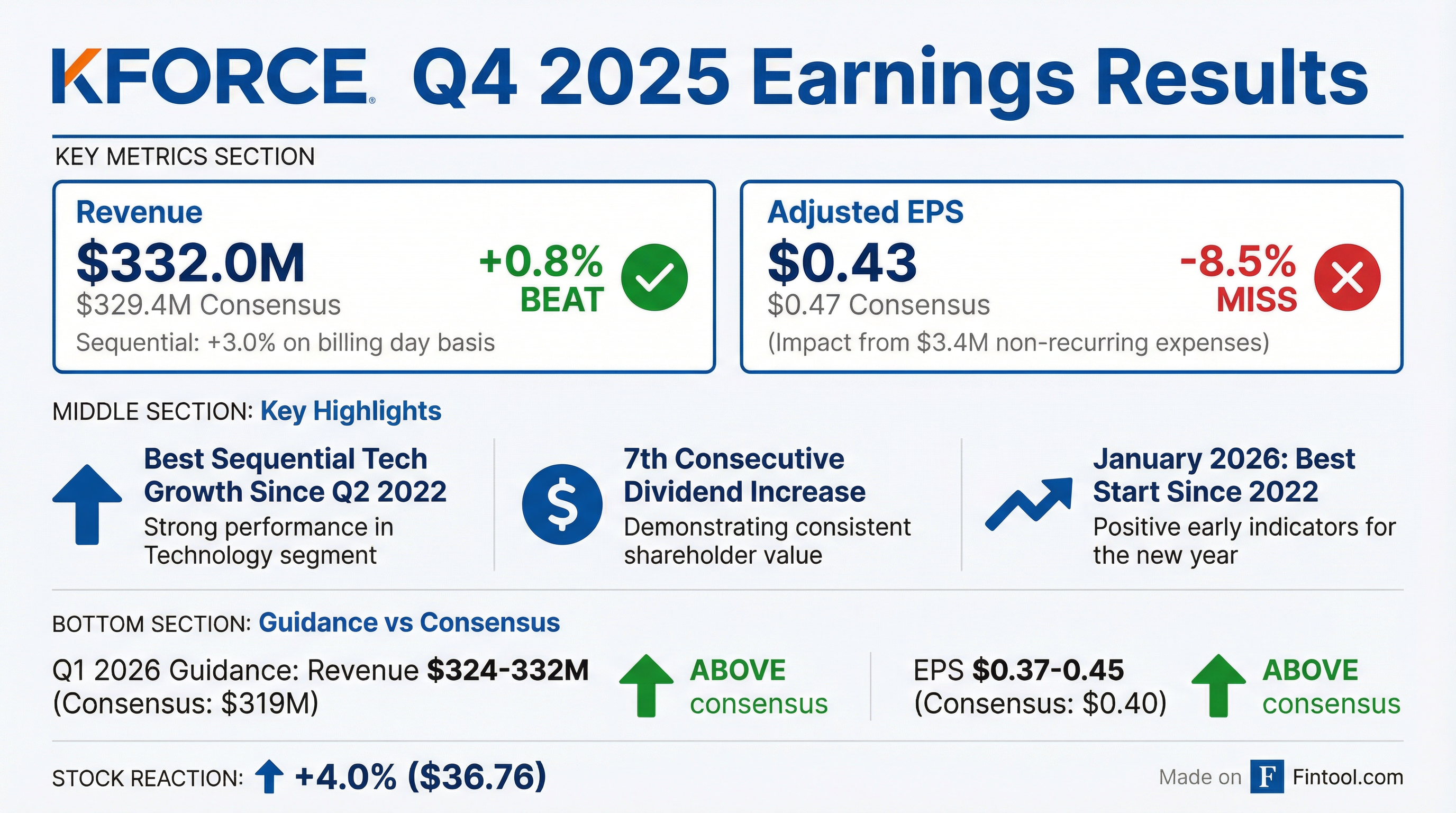

- Kforce (KFRC) reported Q4 2025 revenues of $332 million, surpassing expectations, with GAAP EPS of $0.30 and adjusted EPS of $0.43.

- The company provided Q1 2026 revenue guidance between $324 million and $332 million and EPS guidance between $0.37 and $0.45.

- Kforce experienced sequential revenue growth in its technology (3%) and F&A (5.7%) businesses in Q4 2025, with January 2026 representing its best start since 2022.

- Management implemented refinements in organizational structure and other operating cost reductions in Q4 2025, expecting an annualized benefit of approximately $7 million or $0.30 per share.

- In Q4 2025, Kforce returned $14.1 million to shareholders through $6.7 million in dividends and $7.4 million in share repurchases, and the board approved a dividend increase.

- Kforce reported Q4 2025 revenues of $332 million, which exceeded expectations, and GAAP earnings per share of $0.30, with adjusted earnings per share of $0.43.

- For fiscal year 2025, total revenues were approximately $1.33 billion, representing a 5% decrease year-over-year, and adjusted earnings per share was $2.09, a decline of approximately 22% year-over-year.

- The company provided Q1 2026 revenue guidance in the range of $324 million to $332 million and earnings per share guidance between $0.37 and $0.45.

- Kforce implemented refinements in its internal headcount and organizational structure, along with other operating cost reductions in Q4 2025, expecting an annualized benefit of approximately $7 million or $0.30 per share.

- In Q4 2025, the company returned $14.1 million to shareholders, comprising $6.7 million in dividends and $7.4 million in share repurchases, and the board approved a dividend increase for the seventh consecutive year.

- Kforce reported Q4 2025 revenues of $332 million and GAAP earnings per share of $0.30, with adjusted EPS of $0.43. For fiscal 2025, revenues were approximately $1.33 billion, a decrease of roughly 5% year-over-year, and adjusted EPS was $2.09.

- The company provided Q1 2026 revenue guidance between $324 million and $332 million and EPS guidance between $0.37 and $0.45.

- Kforce experienced sequential flex revenue growth in its technology business (the highest since Q2 2022) and F&A business (5.7% sequential growth) in Q4 2025, with January 2026 showing the best start since 2022.

- The company implemented refinements in headcount and organizational structure in Q4 2025, expecting an annualized benefit of approximately $7 million or $0.30 per share.

- Kforce aims for approximately 8% operating margin when annual revenues return to $1.7 billion and expects operating margins to improve in 2026 even without revenue improvement.

- Kforce reported Q4 2025 revenue of $332.0 million and diluted earnings per share of $0.30, with adjusted diluted earnings per share at $0.43.

- For the full year 2025, revenue was $1.33 billion and diluted earnings per share were $1.96, with adjusted diluted earnings per share at $2.09.

- The company's Board of Directors approved an increase in the quarterly dividend to $0.40 per share, marking the seventh consecutive annual increase.

- Kforce provided Q1 2026 guidance for revenue between $324 million and $332 million and earnings per share between $0.37 and $0.45.

- Kforce reported fourth quarter 2025 revenue of $332.0 million and diluted earnings per share of $0.30. Adjusted diluted earnings per share for the quarter was $0.43.

- For the full year 2025, revenue was $1.33 billion , and diluted earnings per share were $1.96. Adjusted diluted earnings per share for the year was $2.09.

- The company provided first quarter 2026 guidance, projecting revenue between $324 million and $332 million and earnings per share between $0.37 and $0.45.

- The Board of Directors approved a seventh consecutive annual increase in the quarterly dividend to $1.60 per share annually, with the first quarter cash dividend of $0.40 per share payable on March 20, 2026. The company returned $76.0 million in capital to shareholders in 2025.

- Kforce reported Q3 2025 revenues of $332.6 million and earnings per share of $0.63, both surpassing the high end of guidance.

- For Q4 2025, the company expects revenues to be in the range of $326 million to $334 million and earnings per share between $0.43 and $0.51.

- The technology business saw a 1.1% sequential decline in revenue, while the finance and accounting (FA) business grew approximately 7% sequentially in Q3 2025. The company expects sequential billing day growth in Q4 for both segments.

- Consultants on assignment grew roughly 4% from early Q3 lows, with consulting-led engagements contributing positively to results and typically yielding 400-600 basis points higher margins than traditional staff augmentation.

- Kforce returned $16.2 million to shareholders in Q3 2025 through dividends and share repurchases, and the board approved an increase to its share authorization to $100 million in October 2025.

- Kforce Inc. reported revenue of $332.6 million for the third quarter ended September 30, 2025, which was a 0.5% sequential decrease and a 5.9% year-over-year decrease.

- Diluted earnings per share for Q3 2025 was $0.63, an increase of 6.8% sequentially but a decrease of 16.0% year over year.

- The Board of Directors approved an increase in the stock repurchase authorization to $100.0 million in October 2025.

- A fourth quarter cash dividend of $0.39 per share was approved, payable on December 19, 2025, to shareholders of record as of December 5, 2025.

- For the fourth quarter of 2025, Kforce Inc. anticipates revenue to be between $326 million and $334 million and earnings per share to be between $0.43 and $0.51.

Quarterly earnings call transcripts for KFORCE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more