Earnings summaries and quarterly performance for KULICKE & SOFFA INDUSTRIES.

Executive leadership at KULICKE & SOFFA INDUSTRIES.

Fusen Chen

President and Chief Executive Officer

Chan Pin Chong

Executive Vice President & GM, K&S Products & Solutions

Lester Wong

Executive Vice President and Chief Financial Officer

Nelson Wong

Senior Vice President, Global Sales & Supply Chain

Robert Chylak

Senior Vice President, Central Engineering and Chief Technology Officer

Zi Yao Lim

Senior Director, Legal Affairs and General Counsel and Corporate Secretary

Board of directors at KULICKE & SOFFA INDUSTRIES.

Research analysts who have asked questions during KULICKE & SOFFA INDUSTRIES earnings calls.

Charles Shi

Needham & Company

8 questions for KLIC

Krish Sankar

TD Cowen

6 questions for KLIC

Craig Ellis

B. Riley Securities

5 questions for KLIC

Christian Schwab

Craig-Hallum Capital Group

4 questions for KLIC

Tom Diffely

D.A. Davidson Companies

4 questions for KLIC

Dave Duley

Steelhead Securities

3 questions for KLIC

David Duley

Steelhead Securities LLC

3 questions for KLIC

Thomas Diffely

D.A. Davidson & Co.

3 questions for KLIC

Sreekrishnan Sankarnarayanan

Wolfe Research, LLC

2 questions for KLIC

Mayor Popuri

B. Riley Securities, Inc.

1 question for KLIC

Tom Disley

D.A. Davidson

1 question for KLIC

Recent press releases and 8-K filings for KLIC.

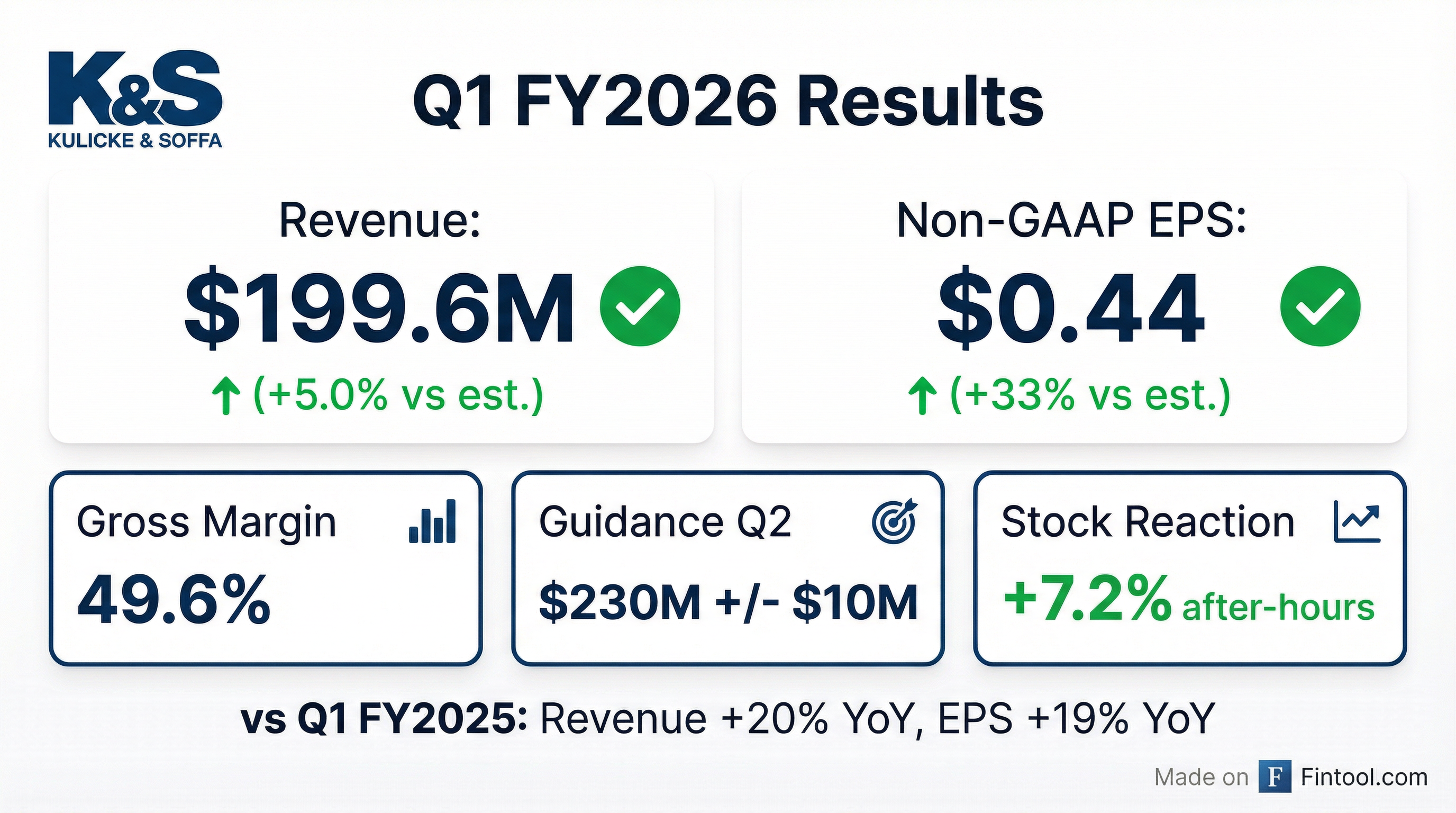

- Kulicke & Soffa reported Q1 2026 revenue and earnings above expectations, with GAAP earnings of $0.32 and non-GAAP earnings of $0.44, and gross margins of 49.6%.

- For Q2 2026, the company expects revenue to increase 15% sequentially to $230 million, with non-GAAP earnings per share of $0.67 and gross margins of 49%.

- Demand is improving faster and stronger than previously expected, with general semiconductor and memory markets showing robust demand and high utilization rates. Management anticipates the second half of fiscal year 2026 to be 15%-20% better than the first half.

- The company expects advanced packaging TCB revenue to exceed $100 million for FY 2026 and is expanding its fluxless thermal compression production capacity by 3x.

- Kulicke & Soffa (KLIC) reported Q1F26 revenue of $199.6 million and Non-GAAP diluted EPS of $0.44 for the quarter ended January 3, 2026.

- The company experienced demand growth faster and stronger than expected, primarily led by General Semiconductor and Memory, with the data center identified as a critical driver for the incremental outlook.

- For Q2F26, Kulicke & Soffa projects revenue of $230 million (+/- $10 million) and Non-GAAP diluted EPS of $0.67 (+/- 10%).

- KLIC is focused on an operational production ramp and advancing multiple parallel technology transitions, including Advanced Dispense, Power Semiconductor, and Advanced Packaging.

- Kulicke & Soffa reported Q1 2026 revenue and earnings above expectations, with GAAP earnings of $0.32 and non-GAAP earnings of $0.44.

- For the March quarter (Q2 2026), the company expects revenue to increase by 15% sequentially to $230 million, with targeted GAAP EPS of $0.53 and non-GAAP EPS of $0.67.

- The second half of fiscal year 2026 is anticipated to be 15%-20% better than the first half, driven by improving demand and high utilization rates in general semiconductor and memory markets.

- Advanced packaging solutions, particularly Thermal Compression Bonding (TCB), are expected to generate over $100 million in revenue for fiscal year 2026.

- Kulicke & Soffa reported net revenue of $199.6 million for its first fiscal quarter ended January 3, 2026.

- GAAP diluted EPS for the quarter was $0.32, and non-GAAP diluted EPS was $0.44.

- During the quarter, the Company repurchased 0.2 million shares of common stock at a cost of $6.7 million.

- For the second fiscal quarter of 2026, Kulicke & Soffa anticipates net revenue of approximately $230 million +/- $10 million, GAAP diluted EPS of approximately $0.53 +/- 10%, and non-GAAP diluted EPS of approximately $0.67 +/- 10%.

- Kulicke & Soffa reported net revenue of $199.6 million, net income of $16.8 million, GAAP EPS of $0.32, and non-GAAP EPS of $0.44 for the first fiscal quarter ended January 3, 2026.

- For the second fiscal quarter ending April 4, 2026, the company anticipates net revenue of approximately $230 million +/- $10 million, GAAP diluted EPS of approximately $0.53 +/- 10%, and non-GAAP diluted EPS of approximately $0.67 +/- 10%.

- During the first fiscal quarter, the company repurchased 0.2 million shares of common stock at a cost of $6.7 million.

- Lester Wong, Interim Chief Executive Officer and Chief Financial Officer, noted the company's continued preparation to support customers' higher near-term capacity requirements and its strategic positioning in Power Semiconductor, Advanced Dispense, and Advanced Packaging to expand market access long-term.

- Kulicke and Soffa (KLIC) reported its fiscal fourth quarter 2025 results and provided guidance for the first fiscal quarter of 2026, ending December 2025.

- Lester Wong has been appointed Interim CEO due to Fusen Chen's retirement, while continuing his role as Chief Financial Officer. A search for a permanent successor is ongoing.

- The company is optimistic about fiscal year 2026, expecting half of its incremental growth from technology transitions and new market share gains, and the other half from ongoing cyclical recovery, with general semiconductor and memory utilization rates exceeding 80%.

- KLIC is preparing for a production ramp through fiscal 2026 for fluxless thermal compression (FTC) and expects to ship its first HBM system in the current December quarter. The company also anticipates vertical wire market production to shift to high-volume by the end of fiscal 2026, with an estimated $10 million in revenue for FY2026 from this segment.

| Metric | Q4 2025 | Q1 2026 (Guidance) |

|---|---|---|

| Revenue ($USD Millions) | $177.6 | $190 |

| GAAP EPS ($USD) | $0.12 | $0.18 |

| Non-GAAP EPS ($USD) | $0.28 | $0.33 |

| Gross Margin (%) | 45.7% | 47% |

| Non-GAAP Operating Expense ($USD Millions) | < $70 | $71 |

- Kulicke & Soffa (KLIC) reported Q4F25 revenue of $177.6 million, a 19.6% sequential increase, with Non-GAAP Net Income of $14.9 million and Non-GAAP EPS of $0.28.

- For Q1F26, the company anticipates revenue of $190 million +/- $10 million and Non-GAAP diluted EPS of $0.33 +/- 10%.

- The company noted improving end market dynamics, with General Semi & Memory orders improving and Automotive/Industrial anticipated to improve sequentially into Q1F26.

- A CEO transition occurred, with the management team prepared to continue driving organizational strategy.

- Kulicke and Soffa (K&S) reported Q4 2025 revenue of $177.6 million, with GAAP earnings per share of $0.12 and non-GAAP earnings per share of $0.28.

- For Q1 2026, K&S expects revenue to increase approximately 7% sequentially to $190 million, targeting GAAP earnings per share of $0.18 and non-GAAP earnings per share of $0.33.

- Lester Wong has been appointed Interim CEO following Fusen Chen's retirement, while continuing his existing duties as Chief Financial Officer.

- The company noted improved order activity and favorable utilization trends in general semiconductor and memory end markets, with general semiconductor revenue increasing 24% sequentially and memory-related revenue up nearly 60% sequentially to $24.4 million in Q4 2025.

- K&S repurchased 464,000 shares for $16.7 million during the September quarter, contributing to a fiscal year 2025 total of 2.4 million shares for $96.5 million.

- Kulicke & Soffa reported Q4 2025 revenue of $177.6 million, GAAP earnings per share of $0.12, and non-GAAP earnings per share of $0.28.

- For the December quarter (Q1 2026), the company expects revenue to increase by approximately 7% sequentially to $190 million, with gross margins at 47%, and non-GAAP earnings per share of $0.33.

- Lester Wong has been appointed Interim CEO while retaining his role as Chief Financial Officer, following Fusen Chen's retirement.

- The company notes improved order activity and utilization rates over 80% in general semiconductor and memory markets, with anticipated sequential improvement in automotive and industrial markets in the December quarter.

- During Q4 2025, the company repurchased 464,000 shares for $16.7 million, contributing to a fiscal year 2025 total of 2.4 million shares repurchased for $96.5 million.

- Kulicke & Soffa (KLIC) reported net revenue of $177.6 million and GAAP diluted EPS of $0.12 for the fourth fiscal quarter ended October 4, 2025.

- For the full fiscal year 2025, the company's net revenue was $654.1 million and GAAP diluted EPS was $0.004.

- The company repurchased 2.4 million shares of common stock at a cost of $96.5 million during fiscal year 2025, and held $510.7 million in cash, cash equivalents, and short-term investments as of October 4, 2025.

- Kulicke & Soffa expects first fiscal quarter 2026 net revenue to be approximately $190 million +/- $10 million, with non-GAAP diluted EPS of approximately $0.33 +/- 10%.

Quarterly earnings call transcripts for KULICKE & SOFFA INDUSTRIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more