Earnings summaries and quarterly performance for KT.

Research analysts who have asked questions during KT earnings calls.

Joonsop Kim

KB Securities

3 questions for KT

Kim Hoi-Jae

Daishin Securities

3 questions for KT

Lee Chan-young

Eugene Investment & Securities

2 questions for KT

Shin Eun-jung

DB Securities

2 questions for KT

H.J. Kim

Daishin Securities

1 question for KT

Hoji Kim

Daishin Securities

1 question for KT

Hong-sik Kim

Hana Securities

1 question for KT

Jae-min Ahn

NH Investment & Securities

1 question for KT

Jeong Jisoo

Meritz Securities

1 question for KT

Jeon Seok Kim

KB Securities

1 question for KT

Mina Choi

Samsung Securities

1 question for KT

Min-ha Choi

Samsung Securities

1 question for KT

Won-seok Jeong

IM Securities

1 question for KT

Wonsok Jung

Shinyoung Securities

1 question for KT

Recent press releases and 8-K filings for KT.

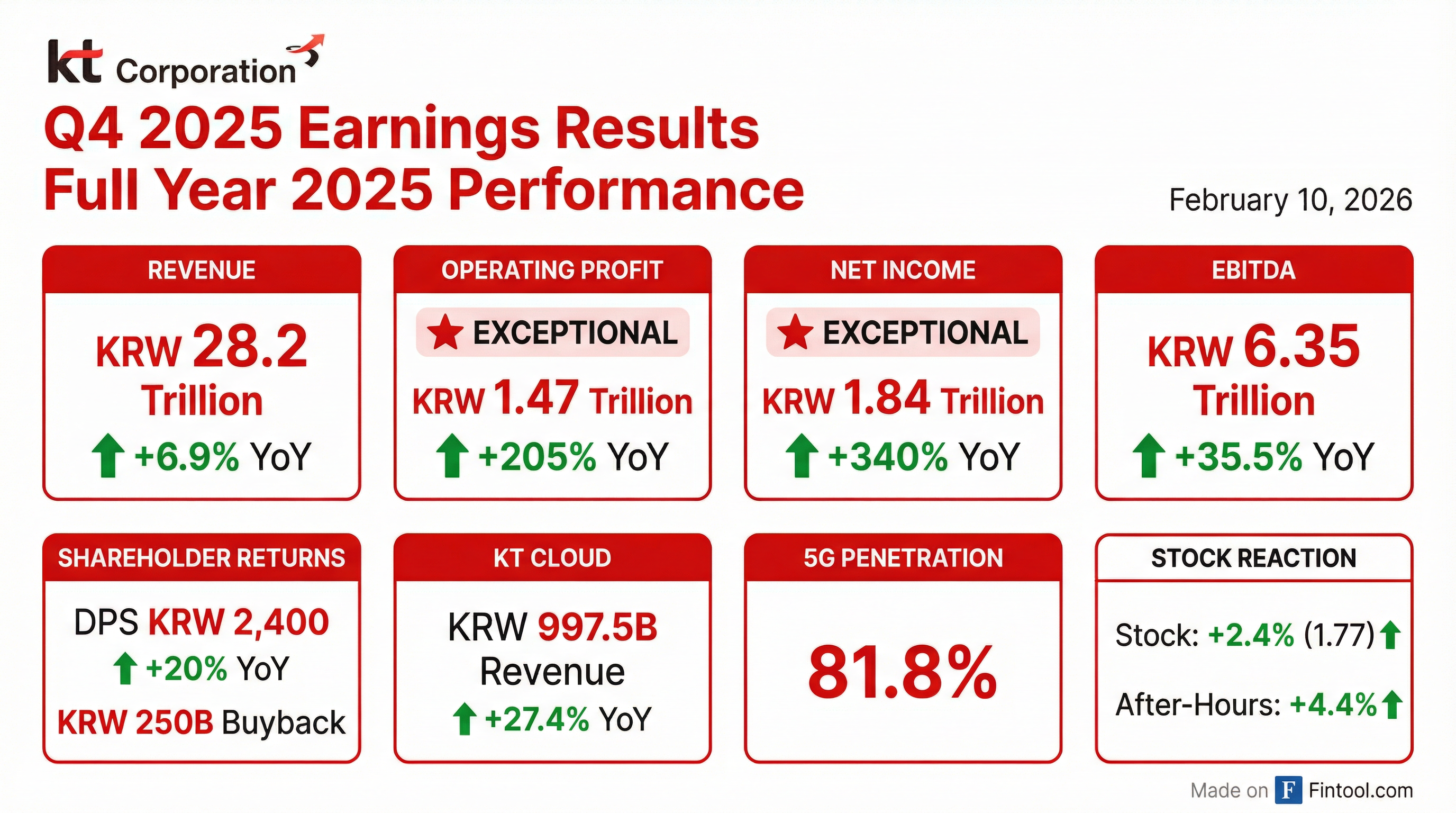

- KT reported robust financial performance for FY 2025, with operating revenue increasing 6.9% year-on-year to KRW 28,244.2 billion, operating profit surging 205% to KRW 2,469.1 billion, and net income growing 340.4% to KRW 1,836.8 billion.

- The company demonstrated a strong commitment to shareholder value, increasing its annual dividend per share (DPS) by 20% from KRW 2,000 in 2024 to KRW 2,400 in 2025, and planning a KRW 250 billion share buyback and cancellation in 2026.

- Growth was significantly driven by core businesses, including KT Cloud revenue, which increased 27.4% year-over-year to KRW 997.5 billion, and strategic investments in AI and data centers, such as the opening of the Gasan AI Data Center.

- Following a data breach incident, KT is planning a substantial KRW 1 trillion investment into security over five years to bolster its information security system and regain customer trust.

- The incoming CEO is expected to maintain the company's current shareholder return stance and growth strategy, with a positive outlook for better performance in 2026 compared to 2025.

- KT reported strong financial results for FY 2025, with operating revenue increasing 6.9% to KRW 28,244.2 billion, operating profit surging 205% to KRW 2,469.1 billion, and net income up 340.4% to KRW 1,836.8 billion.

- The company increased its annual dividend per share by 20% to KRW 2,400 for 2025 and announced a KRW 250 billion share buyback and cancellation plan for 2026.

- Following a data breach incident, KT is committing KRW 1 trillion to security investments over five years and confirmed Park Yoon-young as the next CEO, who is expected to maintain the company's strategic focus on AX-driven innovation and B2B growth.

- Key growth drivers included KT Cloud revenue, which rose 27.4% to KRW 997.5 billion, and overall B2B service revenue, which saw a 6% year-over-year growth when combined with KT Cloud.

- KT reported strong financial results for FY 2025, with revenue increasing 6.9% to KRW 28,244.2 billion, operating profit surging 205% to KRW 2,469.1 billion, and net income up 340.4% to KRW 1,836.8 billion.

- The company announced a 2025 year-end dividend of KRW 2,400 per share, a 20% increase from 2024, and plans for a KRW 250 billion share buyback and cancellation in 2026.

- Growth was driven by core businesses including data center, cloud, and B2B services, with KT Cloud revenue increasing 27.4% year-over-year to KRW 997.5 billion.

- Following a data breach incident, KT is investing KRW 1 trillion in security over five years and has appointed Park Yoon-young as the new CEO, who is expected to maintain the company's strategic direction.

- For 2026, KT anticipates better overall performance than 2025, with continued focus on operational efficiency in wireless and sustained high growth in AI and cloud businesses.

- KT Corp. reported significant financial growth for FY 2025, with consolidated operating revenue reaching 28,244.2 billion KRW (YoY +6.9%) and operating profit soaring to 2,469.1 billion KRW (YoY +205.0%).

- The company announced enhanced shareholder returns, including a FY25 dividend per share of KRW 2,400 (YoY +20%) and a KRW 250 billion share buyback/cancellation program.

- Yoon-young Park was nominated as the new CEO, pending approval at the 2026 Annual General Meeting.

- Strategic initiatives for AX growth and AI/IT business expansion were highlighted, including new partnerships with Microsoft and Palantir, and the opening of the 'Gasan' AI Data Center.

- In response to recent incidents, KT Corp. is implementing measures to rebuild customer trust and enhance cybersecurity, backed by a KRW 1 trillion investment over five years.

- KT Corporation's Board of Directors resolved to pay a quarterly cash dividend of 600 KRW per share for common stock, with a record date of February 25, 2026.

- The total dividend payment is 144,657,867,600 KRW, representing a dividend yield of 1.1%.

- This dividend is for Q4 FY2025, following similar 600 KRW per share quarterly dividends already paid for Q1, Q2, and Q3 of FY2025.

- The stated dividend per share is subject to change based on external audit results and the general shareholders' meeting.

- KT Corporation's Board of Directors resolved on February 10, 2026, to cancel an estimated 4,215,851 common shares.

- The estimated total amount of cancellation is KRW 250,000,000,000.

- The buyback period for these shares is scheduled from March 10, 2026, to September 9, 2026, through a trust contract.

- This action aims to enhance corporate value by acquiring and canceling treasury shares within the limit of earnings available for dividends, in line with the 'Corporate Value-Up Plan' announced on November 11, 2025.

- KT Corporation has decided to enter a trust contract to acquire treasury shares with a contract amount of 250,000,000,000 KRW.

- The purpose of this contract is the implementation of the 'KT Corporate Value-Up Plan', involving a share buyback and cancellation of all acquired shares to enhance corporate value.

- The contract period for the acquisition is from March 10, 2026, to September 9, 2026.

- The company expects to acquire approximately 4,215,851 shares at an estimated price of 59,300 KRW per share.

- Operating revenue for KT Corporation for the three-month period ended September 30, 2025, increased by 7.10% to W 7,126,734 million from W 6,654,615 million in the same period of 2024. For the nine-month period, operating revenue grew by 7.77% to W 21,399,188 million from W 19,855,588 million.

- Operating profit saw a significant increase of 15.96% to W 538,181 million for the three-month period ended September 30, 2025, compared to W 464,110 million in the prior year. The nine-month operating profit surged by 53.07% to W 2,241,770 million from W 1,464,596 million.

- Profit attributable to Owners of the Controlling Company rose by 9.57% to W 391,542 million for the three-month period and by 43.82% to W 1,619,322 million for the nine-month period ended September 30, 2025. Basic earnings per share also increased by 11.56% to W 1,621 for the three-month period and by 45.20% to W 6,643 for the nine-month period.

- As of September 30, 2025, total assets stood at W 43,012,753 million, an increase from W 41,879,957 million at December 31, 2024. Total liabilities slightly decreased to W 23,752,817 million from W 23,883,408 million, while total equity increased to W 19,259,936 million from W 17,996,549 million over the same period.

- KT Corporation's Corporate Value-Up Plan targets a consolidated ROE of 9% to 10% and a consolidated operating profit margin of 9% by FY2028, alongside increasing AI/IT revenue share to 19% of service revenue.

- The plan includes an additional KRW 1 trillion share buyback/cancellation program by FY2028, with a KRW 250 billion share buyback specifically planned for 2025.

- For the nine months ended September 30, 2025 (3Q25), KT reported consolidated revenue of KRW 25.30 trillion, operating profit of KRW 1.09 trillion (excluding one-off costs), and net profit of KRW 0.35 trillion.

- Progress on the plan includes liquidating non-core assets, generating KRW 82.4 billion in profit and KRW 275.7 billion in cash, and streamlining low-profit businesses to improve operating profit by KRW 50 billion in 2025.

- KT Corporation reported Q3 2025 consolidated operating revenue of KRW 7,126.7 billion, a 7.1% increase year-over-year, and operating profit of KRW 538.2 billion, up 16.0% year-over-year, driven by real estate projects, CT, and group portfolio growth.

- The company declared a Q3 2025 dividend per share (DPS) of KRW 600, bringing the year-to-date DPS to KRW 1,800, with payment scheduled for November 20, 2025.

- As part of its FY2028 financial targets, KT plans a KRW 1 trillion share buyback and has already executed a KRW 250 billion share buyback in 2025.

- Wireless service revenue grew 4.7% year-over-year in Q3 2025, fueled by an increase in 5G subscribers, achieving 80.7% 5G penetration.

- The consolidated net debt-to-equity ratio decreased by 2.3 percentage points quarter-over-quarter to 34.5% in Q3 2025, primarily due to lower borrowings.

Quarterly earnings call transcripts for KT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more