Earnings summaries and quarterly performance for LESAKA TECHNOLOGIES.

Executive leadership at LESAKA TECHNOLOGIES.

Board of directors at LESAKA TECHNOLOGIES.

Research analysts who have asked questions during LESAKA TECHNOLOGIES earnings calls.

Ross Krige

Investec

7 questions for LSAK

Theodore O'Neill

Litchfield Hills Research

4 questions for LSAK

Frank Geng

Briarwood Chase Management

3 questions for LSAK

Jarred Houston

All Weather Capital

3 questions for LSAK

Craig Smith

Anchor Securities

2 questions for LSAK

Mike Steere

Avior Capital Markets

2 questions for LSAK

Prashendran

36ONE

2 questions for LSAK

Sven Thordsen

Anchor Securities

2 questions for LSAK

Theo-Neil

R2R

2 questions for LSAK

Theo O'Neill

LHR Research

2 questions for LSAK

Frank

Not specified

1 question for LSAK

Jared Houston

All Weather

1 question for LSAK

Michael Steere

Avior Capital Markets

1 question for LSAK

Rajiv Sharma

B. Riley Securities

1 question for LSAK

Ross

Not specified

1 question for LSAK

Sven

Not specified

1 question for LSAK

Vera Capiso

RMB Morgan Stanley

1 question for LSAK

Viwe Kupiso

RMB Morgan Stanley

1 question for LSAK

Recent press releases and 8-K filings for LSAK.

- Lesaka Technologies reported strong Q2 2026 financial performance, with net revenue of ZAR 1.6 billion (up 16% year-on-year) and group-adjusted EBITDA of ZAR 304 million (up 47% year-on-year). Adjusted earnings per share significantly increased more than sixfold to ZAR 1.34.

- The company achieved key strategic milestones, including Competition Tribunal approval for the Bank Zero combination and the launch of the "One Lesaka" brand consolidation. Q2 results also benefited from one-off contributions totaling ZAR 115 million from the Cell C stake exit and legacy CPS contract resolution.

- The Consumer division demonstrated robust growth, with net revenue rising 38% year-on-year to ZAR 567 million and its active customer base growing 21% to over 2 million. Loan originations surged 88% to approximately ZAR 1.2 billion.

- Management reaffirmed its full-year FY 2026 guidance, projecting net revenue between ZAR 6.4 billion and ZAR 6.9 billion and group-adjusted EBITDA between ZAR 1.25 billion and ZAR 1.45 billion.

- Lesaka Technologies reported a 16% year-on-year increase in net revenue to ZAR 1.6 billion and a 47% year-on-year increase in group-adjusted EBITDA to ZAR 304 million for Q2 2026. Adjusted earnings per share grew more than sixfold to ZAR 1.34.

- The company received Competition Tribunal approval for the combination with Bank Zero and commenced the consolidation of all operating brands under "One Lesaka".

- The Consumer division's net revenue rose 38% year-on-year to ZAR 567 million, with its active customer base exceeding 2 million (up 21% year-on-year) and lending originations increasing 88% to ZAR 1.2 billion.

- Lesaka reaffirmed its full-year FY26 guidance, expecting net revenue between ZAR 6.4 billion and ZAR 6.9 billion and group-adjusted EBITDA between ZAR 1.25 billion and ZAR 1.45 billion.

- Lesaka Technologies reported strong financial results for Q2 2026, with net revenue reaching ZAR 1.6 billion, a 16% year-on-year increase, and group-adjusted EBITDA growing 47% year-on-year to ZAR 304 million. Adjusted earnings increased more than sixfold to ZAR 111 million, with adjusted earnings per share rising from 0.21 to 1.34.

- The company achieved a significant strategic milestone by receiving Competition Tribunal approval for the combination with Bank Zero and is awaiting approval from South Africa's Prudential Authority.

- Lesaka initiated the consolidation of all its operating brands under "One Lesaka", aiming to create a single, strong challenger brand and improve collaboration and efficiency.

- Strategic simplification efforts included the exit of its Cell C stake, receiving ZAR 50 million, and the release of ZAR 65 million in accruals related to the legacy CPS contract, both positively impacting Q2 results.

- The Consumer division delivered a record quarter, with net revenue up 38% year-on-year to ZAR 567 million, an active customer base exceeding 2 million (up 21%), and loan originations increasing 88% to ZAR 1.2 billion. The Merchant division is undergoing transformation, with net revenue pulling back 2% but active merchants growing 8% to over 130,000.

- Lesaka reported Q2 FY26 Net Revenue of R1.60 billion ($93.403 million ) and Adjusted Earnings per Share of R1.34 ($0.08 ).

- Group Adjusted EBITDA for Q2 FY26 was R304 million ($17.777 million ), reflecting a 47% year-over-year growth.

- The company provided Q3 FY26 guidance for Net Revenue between R1.65 billion and R1.80 billion and Group Adjusted EBITDA between R300 million and R340 million.

- For FY26, Lesaka projects Net Revenue between R6.4 billion and R6.9 billion, Adjusted EPS greater than R4.60, and anticipates Net Income Attributable to Lesaka to be positive.

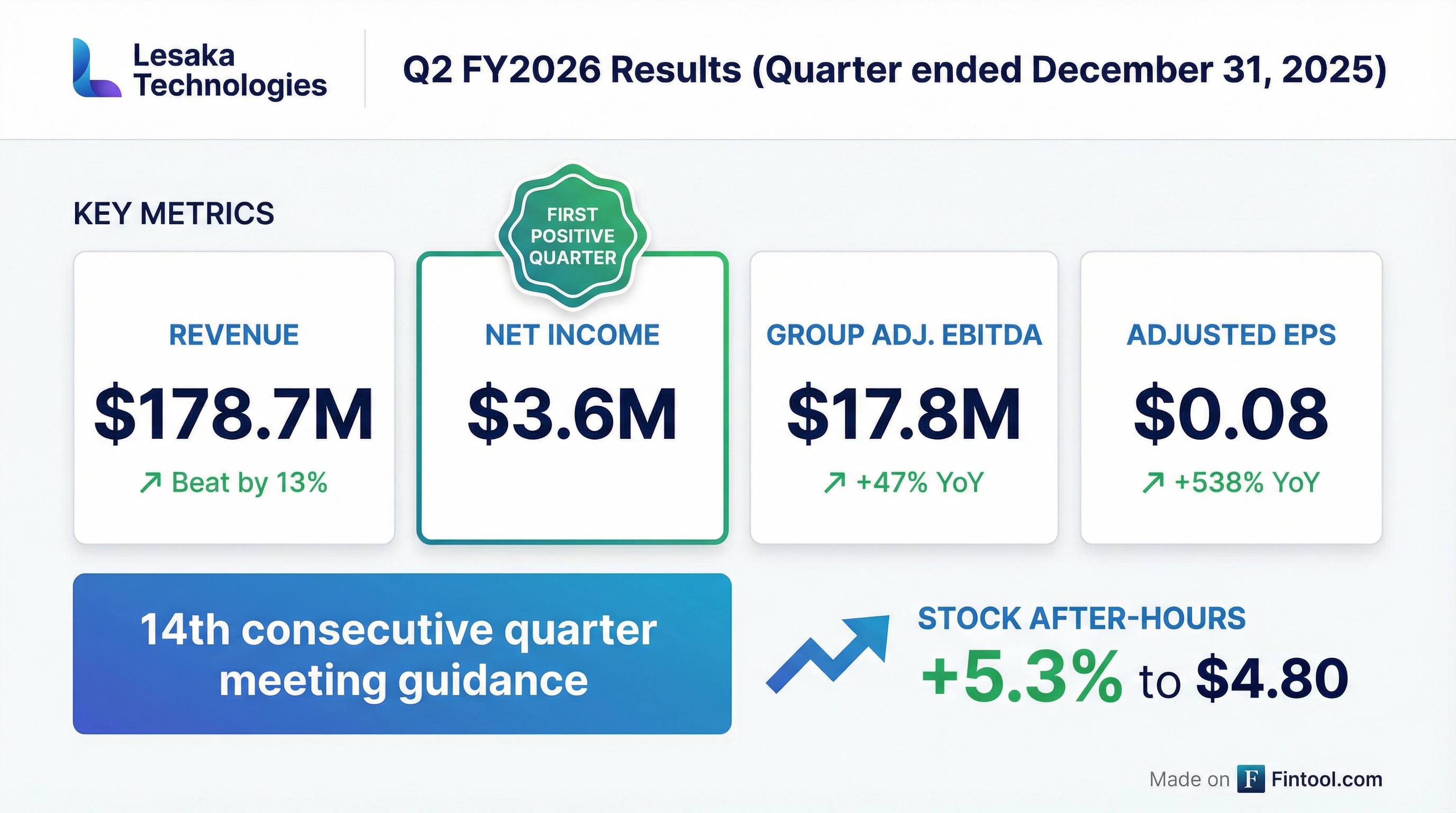

- Lesaka Technologies, Inc. reported positive Net Income for the first time since its creation in 2022, achieving the mid-point of its profitability guidance and meeting guidance for the 14th consecutive quarter for Q2 FY2026.

- For Q2 FY2026, the company reported Net Income of $3,645 thousand and Adjusted Earnings per Share of $0.08.

- The company's Group Adjusted EBITDA increased by 47% year-over-year to $17,777 thousand in Q2 FY2026, with Adjusted Earnings per Share growing 538% year-over-year.

- Lesaka Technologies reaffirmed its full-year FY2026 guidance, expecting Net Revenue between ZAR 6.4 billion and ZAR 6.9 billion and Group Adjusted EBITDA between ZAR 1.25 billion and ZAR 1.45 billion.

- The FY2026 guidance also projects positive Net Income Attributable to Lesaka and Adjusted earnings per share of at least ZAR 4.60, implying over 100% year-on-year growth, and excludes the impact of the announced Bank Zero acquisition.

- Lesaka (LSAK) reported Net Revenue of R1.53 billion, a 45% year-over-year increase, and Group Adjusted EBITDA of R271 million, a 61% year-over-year increase for Q1 FY26.

- Adjusted Earnings per Share for Q1 FY26 increased by 97% year-over-year to R1.07.

- The company provided Q2 FY26 Net Revenue guidance between R1.575 billion and R1.725 billion and Group Adjusted EBITDA guidance between R280 million and R320 million.

- Key operational metrics showed strong growth, including Merchant Card TPV of R9.2 billion in Q1 FY26 (up from R4.2 billion in Q1 FY25) and Consumer Active Consumers reaching 1.93 million (up from 1.56 million in Q1 FY25).

- Lesaka Technologies reported strong Q1 2026 financial results, with net revenue increasing 45% year-on-year to ZAR 1.53 billion and group adjusted EBITDA growing 61% to ZAR 271 million.

- Adjusted earnings surged 150% to ZAR 87 million, leading to adjusted earnings per share of ZAR 1.07, nearly double the prior year.

- The company's net debt to adjusted EBITDA ratio improved to 2.5 times from 2.9 times in the previous quarter, moving closer to its medium-term target of 2 times or less.

- Strategic progress includes the Bank Zero acquisition remaining on track for completion by the end of FY 2026, and an agreement to monetize its Cell C equity position with a ZAR 50 million underpin.

- Lesaka met its guidance for the 13th consecutive quarter and reiterated its full-year EBITDA guidance, expressing conviction in its organic growth strategies.

- Lesaka Technologies reported Q1 2026 net revenue of ZAR 1.53 billion, a 45% year-over-year increase, and group adjusted EBITDA of ZAR 271 million, up 61%.

- Adjusted earnings per share nearly doubled year-on-year to ZAR 1.07 , and the net debt to adjusted EBITDA ratio improved to 2.5 times from 2.9 times last quarter.

- The company provided Q2 2026 guidance for net revenue between ZAR 1.575 billion and ZAR 1.725 billion and group adjusted EBITDA between ZAR 280 million and ZAR 320 million.

- Key strategic updates include the Bank Zero acquisition remaining on track for completion by the end of FY 2026 and an agreement to monetize its Cell C equity position with a ZAR 50 million underpin.

- Lesaka reported net revenue of ZAR 1.53 billion for Q1 2026, a 45% increase year-on-year, and group adjusted EBITDA of ZAR 271 million, representing 61% year-on-year growth.

- Adjusted earnings grew by 150% to ZAR 87 million, with adjusted earnings per share reaching ZAR 1.07, nearly doubling year-on-year.

- The company's net debt to adjusted EBITDA ratio improved to 2.5x from 2.9x in the previous quarter, moving closer to its medium-term target of 2.0x or less.

- Lesaka reaffirmed its FY 2026 annual guidance and provided Q2 2026 guidance, projecting net revenue between ZAR 1.575 billion and ZAR 1.725 billion and group adjusted EBITDA between ZAR 280 million and ZAR 320 million.

- Strategic progress includes the ongoing Bank Zero acquisition, anticipated to close by the end of FY 2026, and efforts to simplify the business through office consolidation and divesting non-core assets.

- Lesaka Technologies, Inc. (LSAK) achieved its Q1 FY2026 guidance and reaffirmed its full fiscal year 2026 outlook on November 5, 2025.

- For Q1 FY2026, the company reported revenue of $171.5 million and Net Revenue of $86.6 million, representing a 45% increase year-on-year in ZAR.

- Group Adjusted EBITDA grew by 61% year-on-year in ZAR to $15.3 million, and Adjusted earnings per share increased by 97% year-on-year in ZAR to $0.06 (ZAR 1.07).

- Lesaka expects Q2 FY2026 Net Revenue between ZAR 1.575 billion and ZAR 1.725 billion and Group Adjusted EBITDA between ZAR 280 million and ZAR 320 million.

- The company reaffirmed its FY2026 guidance for Net Revenue between ZAR 6.4 billion and ZAR 6.9 billion, Group Adjusted EBITDA between ZAR 1.25 billion and ZAR 1.45 billion, and Adjusted earnings per share of at least ZAR 4.60.

Quarterly earnings call transcripts for LESAKA TECHNOLOGIES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more