Earnings summaries and quarterly performance for LATAM AIRLINES GROUP.

Research analysts who have asked questions during LATAM AIRLINES GROUP earnings calls.

Gabriel Rezende

Itau BBA

7 questions for LTM

Jens Spiess

Morgan Stanley

7 questions for LTM

Guilherme Mendes

J.P. Morgan Chase & Co.

6 questions for LTM

Michael Linenberg

Deutsche Bank

6 questions for LTM

Pablo Monsivais

Barclays

3 questions for LTM

Stephen Trent

Citigroup Inc.

3 questions for LTM

Andre Ferreira

Bradesco BBI

2 questions for LTM

Ewald Stark

BICE

2 questions for LTM

Felipe Ballevona

Santander

2 questions for LTM

Felipe Vilanova

Santander

2 questions for LTM

Filipe Nielsen

Citigroup Inc.

2 questions for LTM

Julia Orsi

JPMorgan Chase & Co.

2 questions for LTM

Mike Lindenberg

Deutsche Bank

2 questions for LTM

Savi Syth

Raymond James

2 questions for LTM

Ewald Stark Bittencourt

BICE Investors

1 question for LTM

João Francisco Frizo

Goldman Sachs

1 question for LTM

Recent press releases and 8-K filings for LTM.

- A Selling Shareholder of LATAM Airlines Group S.A. proposes to sell 12,000,000 American Depositary Shares (ADSs), with each ADS representing 2,000 common shares of the company.

- J.P. Morgan Securities LLC will act as the Underwriter for the purchase of these ADSs at a price of US$61.6494 per ADS.

- The delivery and payment for the Offered ADSs are scheduled for February 11, 2026, at 9:30 a.m., New York time.

- The company's financial statements are prepared in conformity with International Financial Reporting Standards (IFRS).

- LATAM Airlines Group S.A. announced the pricing of a public secondary offering by one of its shareholders.

- The offering involves the sale of 12,000,000 American Depositary Shares (ADSs), with each ADS representing 2,000 common shares, at a price of $61.90 per ADS.

- LATAM Airlines Group S.A. will not sell any shares and will not receive any proceeds from this offering.

- The offering is expected to close on February 11, 2026.

- LATAM Airlines Group reported a net profit of U.S.$1,463.6 million for the year ended December 31, 2025, representing a 49.7% increase compared to the previous year.

- Total revenue for the year ended December 31, 2025, reached U.S.$14,265.1 million, an 11.2% increase year-over-year, with passenger revenue growing 12.3% to U.S.$12,611.5 million and cargo revenue increasing 3.4% to U.S.$1,653.5 million.

- Cost of sales rose 5.6% to U.S.$10,104.9 million for the year ended December 31, 2025, although aircraft fuel expenses decreased by 4.2% to U.S.$3,804.8 million due to lower jet fuel prices.

- The company's share capital was adjusted to ThUS$ 4,418,110 as of December 31, 2025, following a US$585,424,212 capital reduction in October 2025 related to treasury share cancellation. Additionally, LATAM issued US$800 million in secured bonds in July 2025 and is in compliance with its minimum liquidity covenants.

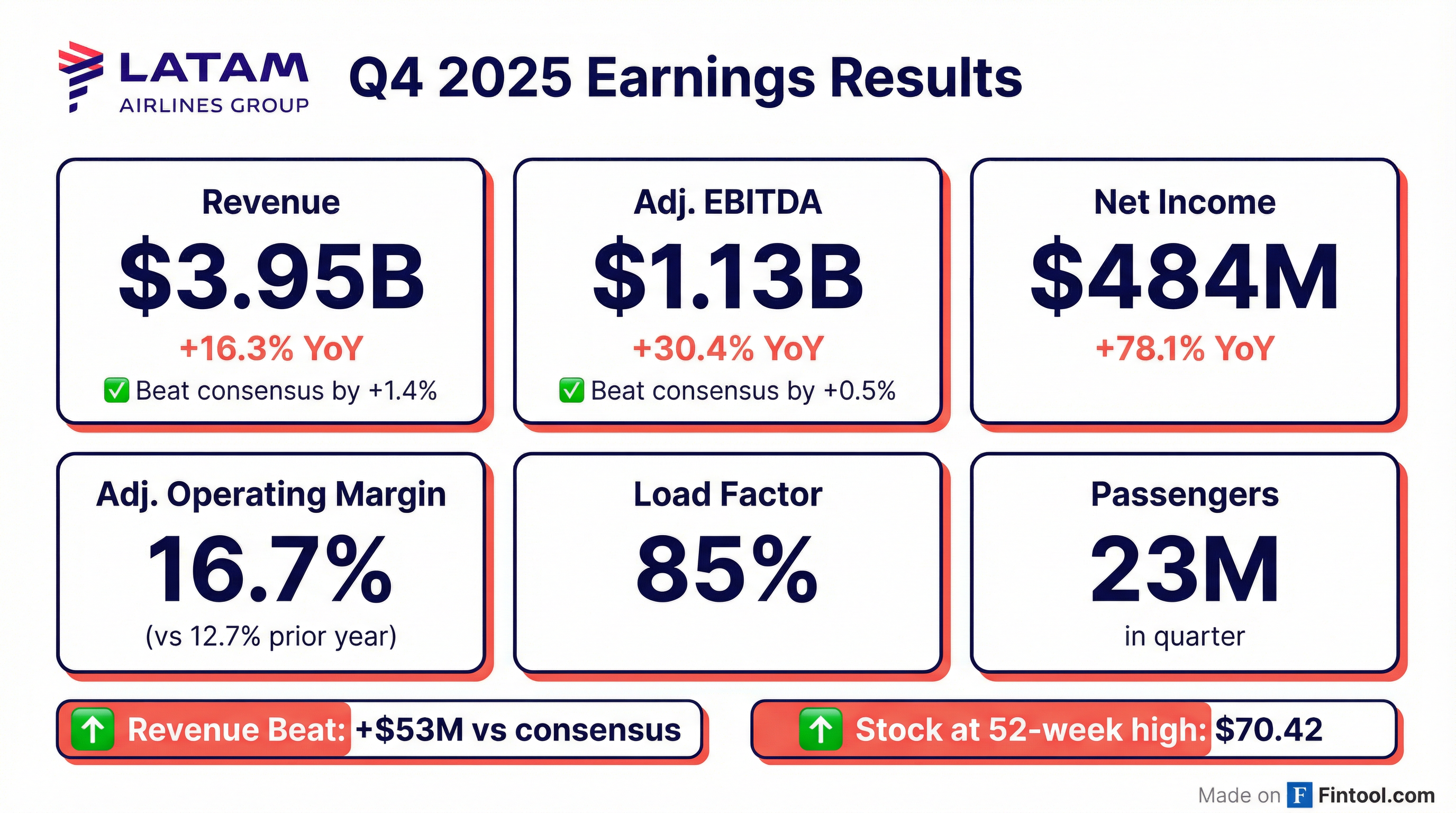

- LATAM Group reported strong financial performance for Q4 2025 and full-year 2025, with total revenues reaching almost $4 billion in Q4 and net income totaling approximately $1.5 billion for the full year. The adjusted operating margin was 16.7% in Q4 and 16.2% for the full year.

- For the full year 2025, Adjusted EBITDA came in at almost $4.1 billion, growing over 30% year-over-year , and earnings per ADS were $4.95. The group transported over 87 million passengers and increased capacity by 8.2% while maintaining a healthy load factor of 84.4%.

- The company strengthened its balance sheet, ending 2025 with $3.7 billion in liquidity and an adjusted net leverage of 1.5 times, below the maximum policy level of 2 times. The weighted average cost of debt was reduced to 6.6% from 10.7% in 2023.

- LATAM returned capital to shareholders, distributing $400 million in interim dividends in Q4 and executing two share repurchase programs totaling $585 million during the year. Total dividends for the year were close to $605 million.

- Looking ahead to 2026, LATAM projects capacity growth between 8%-10% and an adjusted operating margin between 15%-17%. Adjusted leveraged free cash flows are expected to exceed $1.7 billion, and liquidity is expected to be above $5 billion by year-end.

- LATAM Airlines Group reported strong financial performance for full-year 2025, with net income totaling approximately $1.5 billion and Adjusted EBITDA reaching almost $4.1 billion. The adjusted operating margin was 16.2%, marking a 3.5 percentage point increase year-over-year.

- For Q4 2025, the group achieved total revenues of almost $4 billion, an Adjusted EBITDA of $1.1 billion, and net income of $484 million, with an adjusted operating margin of 16.7%.

- The company generated $3.3 billion in adjusted operating cash flow in 2025, enabling the distribution of $605 million in total dividends and $585 million in share repurchases.

- LATAM ended 2025 with a strong balance sheet, reporting $3.7 billion in liquidity and an adjusted net leverage of 1.5 times, while also reducing its weighted average cost of debt to 6.6%.

- For 2026, the company projects capacity growth between 8%-10%, an adjusted operating margin between 15%-17%, and expects adjusted leveraged free cash flows to exceed $1.7 billion, with year-end liquidity above $5 billion.

- For the full year 2025, LATAM Airlines Group achieved an adjusted operating margin of 16.2%, Adjusted EBITDA of almost $4.1 billion, and net income totaling approximately $1.5 billion, resulting in earnings per ADS of $4.95. Net income increased by 50% versus 2024.

- In Q4 2025, total revenues reached almost $4 billion, a 16.3% year-over-year increase, driven by a 20.3% rise in the passenger segment. The quarter saw an Adjusted EBITDA of $1.1 billion, up 30.4% versus Q4 2024, and net income of $484 million, increasing 78.1%.

- Operationally, the group transported over 87 million passengers in 2025, with 23 million in Q4, and increased capacity by 8.2% for the full year. The fleet expanded to 371 aircraft by year-end 2025, a 7% increase.

- The company's balance sheet showed strong liquidity of $3.7 billion and adjusted net leverage of 1.5 times by the end of 2025. LATAM distributed $400 million in interim dividends in Q4 2025, contributing to $605 million in total dividends for the year, and executed $585 million in share repurchase programs.

- For 2026, LATAM projects capacity growth between 8%-10% and an adjusted operating margin of 15%-17%. Adjusted leveraged free cash flow is expected to exceed $1.7 billion, and liquidity is anticipated to be above $5 billion.

- LATAM Airlines Group reported a net income of US$1.5 billion for the full year 2025, a 49.4% increase compared to 2024, with diluted earnings per ADS of US$4.95.

- Total revenues for FY 2025 reached US$14.5 billion, up 11.2% year-over-year, driven by an 8.2% increase in capacity and 87.4 million passengers transported.

- For the fourth quarter of 2025, total operating revenues increased 16.3% to US$3,949 million, and net income attributable to owners of the parent company rose 78.1% to US$484 million.

- The company generated US$4.1 billion in adjusted EBITDAR for 2025, a 31.6% increase from 2024, achieving an adjusted EBITDAR margin of 28.2%.

- Strong cash generation of US$1.4 billion in 2025 allowed for US$585 million in share repurchases and US$693 million in total dividends. Adjusted net leverage improved to 1.5x at year-end 2025.

- For the year ended December 31, 2025, LATAM Airlines Group S.A. reported a net income of ThUS$1,463,561 and net cash inflow from operating activities of ThUS$3,737,096.

- The company reduced its share capital by US$585,424,212 through the cancellation of 30,221,893,878 treasury shares in October 2025. This followed the approval of a new share repurchase program in June 2025 for up to 3.4% of outstanding shares.

- Total Property, plant and equipment increased to ThUS$11,947,014 as of December 31, 2025. Concurrently, total obligations with financial institutions rose to ThUS$8,088,526 by the same date.

- The company paid dividends totaling ThUS$605,181 for the year ended December 31, 2025.

- LATAM Airlines Group S.A. recognized losses of US$19.1 million from fuel hedging activities, net of premiums, in the costs of sales for the year ended December 31, 2025.

- LATAM group transported 87.4 million passengers in 2025, marking a 6.6% increase compared to 2024.

- In December 2025, consolidated capacity (ASK) increased by 10.9%, and consolidated traffic (RPK) grew by 10.5%, leading to a consolidated load factor of 84.5%.

- This December growth was primarily driven by a 13.9% increase in international operations and an 11.9% growth in LATAM Airlines Brazil's domestic capacity.

- During 2025, the group launched eight new destinations, expanding its network to 160 passenger destinations across 27 countries.

- LATAM Airlines provided 2026 guidance, projecting 8% to 10% capacity growth, an adjusted operating margin between 15% and 17%, cash generation above $1.7 billion, liquidity above $5 billion, and net leverage at or below 1.4 times.

- The company forecasts $14.5 billion in revenues for 2025, outpacing capacity growth with a 2% increase in revenue per ASK.

- A key strategic focus is digitalization and premium revenue growth, with 60% of revenues now coming from LATAM Pass members and premium revenues growing 14% in 2025.

- LATAM is committed to cost efficiency, projecting almost flat unit costs for 2025 and 2026, and plans to fund profitable growth with a $1.5 billion CapEx plan in 2025.

- Shareholder returns are prioritized, with a commitment to minimum 30% dividends and $400 million in interim dividends approved for 2025, alongside share buyback programs.

Quarterly earnings call transcripts for LATAM AIRLINES GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more