Earnings summaries and quarterly performance for MAXLINEAR.

Executive leadership at MAXLINEAR.

Board of directors at MAXLINEAR.

Research analysts who have asked questions during MAXLINEAR earnings calls.

David Williams

The Benchmark Company

8 questions for MXL

Christopher Rolland

Susquehanna Financial Group

7 questions for MXL

Quinn Bolton

Needham & Company, LLC

7 questions for MXL

Tim Savageaux

Northland Capital Markets

6 questions for MXL

Tore Svanberg

Stifel Financial Corp.

6 questions for MXL

Ananda Baruah

Loop Capital Markets LLC

5 questions for MXL

Karl Ackerman

BNP Paribas

5 questions for MXL

Richard Shannon

Craig-Hallum Capital Group LLC

4 questions for MXL

Ross Seymore

Deutsche Bank

4 questions for MXL

Sujeeva De Silva

Roth MKM

3 questions for MXL

Suji Desilva

ROTH MKM

3 questions for MXL

Alek Valero

Loop Capital Markets

2 questions for MXL

Joe Quatrochi

Wells Fargo

2 questions for MXL

Sam Feldman

BNP Paribas

2 questions for MXL

Torey Svanberg

Stifel

2 questions for MXL

Jeremy Kwan

Stifel

1 question for MXL

Samuel Feldman

BNP Paribas Asset Management

1 question for MXL

Recent press releases and 8-K filings for MXL.

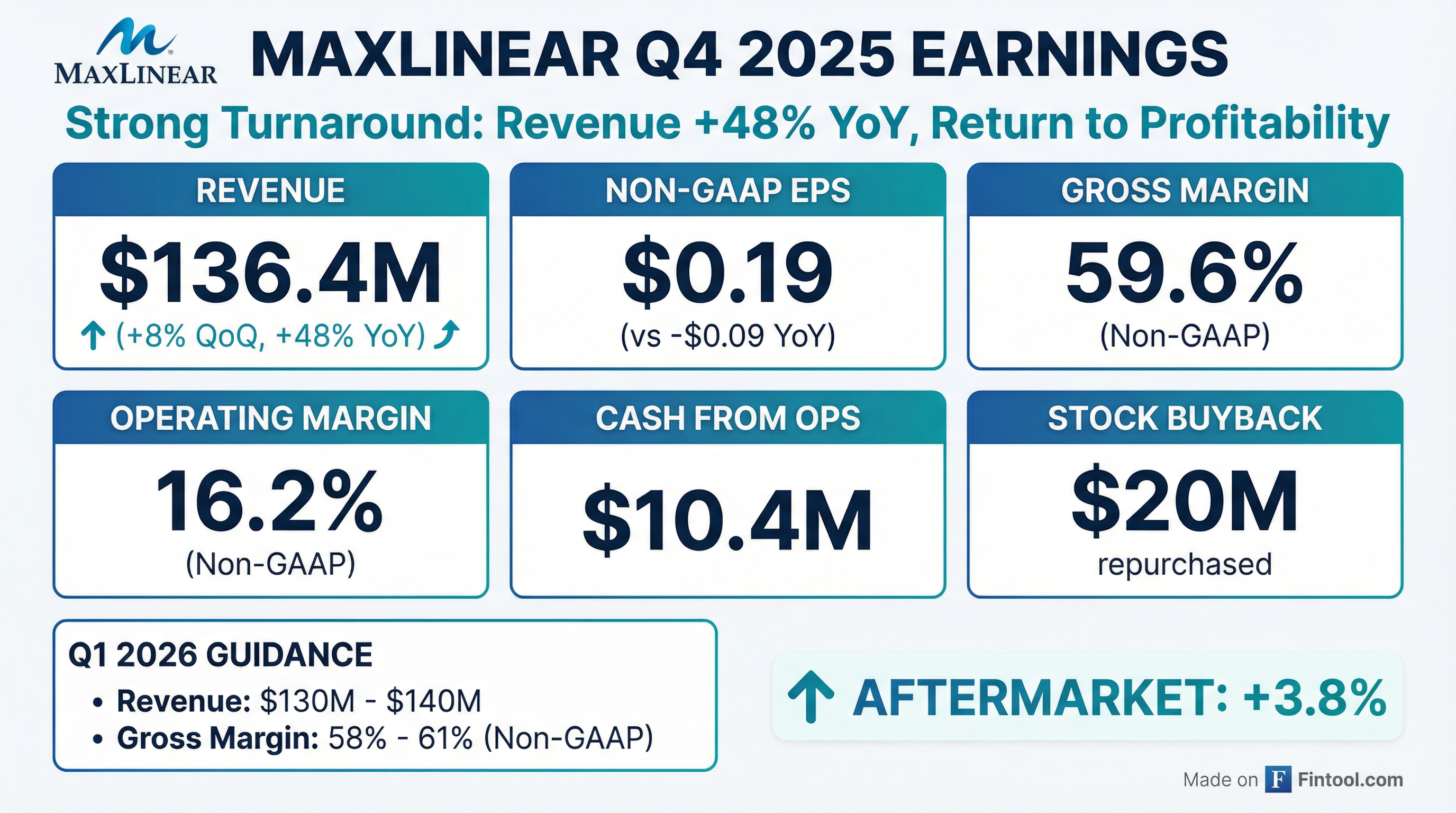

- MaxLinear reported Q4 2025 revenue of $136.4 million, an 8% sequential increase and 48% year-over-year growth from Q4 2024, contributing to 30% revenue growth for the full year 2025.

- The company provided Q1 2026 revenue guidance between $130 million and $140 million.

- Infrastructure revenue grew 76% year-over-year in Q4 2025 and is expected to become the single largest contributor to overall revenues in 2026. The Keystone PAM4 DSP family is projected to generate $100-$130 million in revenue in 2026.

- MaxLinear repurchased $20 million of common stock in Q4 2025 and ended the quarter with $101.4 million in cash, following a $75 million buyback authorization.

- The company anticipates solid overall growth in 2026, driven by new design wins, though broadband revenue is expected to decline due to the DOCSIS 4.0 transition.

- MaxLinear reported Q4 2025 revenue of $136.4 million, marking a 48% increase from Q4 2024 and contributing to 30% revenue growth for the full year 2025.

- The company issued Q1 2026 revenue guidance between $130 million and $140 million, anticipating growth in infrastructure but seasonal declines in broadband, connectivity, and industrial multi-market.

- The infrastructure category is projected to be the single largest contributor to overall revenues in 2026, with the Keystone PAM4 DSP family alone expected to generate $100-$130 million and Panther Hardware Storage Accelerator revenue anticipated to at least double compared to 2025.

- MaxLinear repurchased $20 million of its common stock in Q4 2025, as part of a $75 million authorized buyback, reflecting confidence in sustained growth and cash flow improvement.

- MaxLinear reported Q4 2025 revenue of $136.4 million, an increase of 48.0% from Q4 2024, with full-year 2025 revenue reaching $467.6 million, up 29.7% from FY 2024.

- For Q4 2025, GAAP diluted loss per share was $(0.17) and non-GAAP diluted earnings per share was $0.19.

- The company generated $10.4 million in cash from operations in Q4 2025 and repurchased $20.0 million of common stock.

- Infrastructure revenue grew 79% in Q4 2025 and 30% in FY 2025, driven by strong growth in optical and wireless infrastructure.

- MaxLinear provided Q1 2026 revenue guidance between $130 million and $140 million.

- MaxLinear reported Q4 2025 revenue of $136.4 million, an 8% increase sequentially and a 48% increase year-over-year. For the full year 2025, the company achieved 30% revenue growth.

- The company provided Q1 2026 revenue guidance between $130 million and $140 million.

- Infrastructure revenue grew 76% year-over-year in Q4 2025 and is projected to become the single largest contributor to overall revenues in 2026. The Keystone PAM4 DSP family is expected to generate $100-$130 million in revenue in 2026, and storage accelerator revenue is anticipated to at least double in 2026 versus 2025.

- MaxLinear repurchased $20 million of its common stock in Q4 2025, following the board's authorization of a $75 million share buyback.

- MaxLinear, Inc. reported Q4 2025 net revenue of $136.4 million, an 8% sequential increase and 48% year-over-year increase, and fiscal year 2025 net revenue of $467.6 million, up 30% over fiscal year 2024.

- For Q4 2025, the company reported a GAAP diluted loss per share of $0.17 and non-GAAP diluted earnings per share of $0.19. For the full fiscal year 2025, the GAAP diluted loss per share was $1.58 and non-GAAP diluted earnings per share was $0.31.

- MaxLinear provided Q1 2026 net revenue guidance of approximately $130 million to $140 million.

- During Q4 2025, the company repurchased $20 million of its common stock.

- MaxLinear reported Q4 2025 net revenue of $136.4 million, an increase of 48% year over year, and fiscal year 2025 net revenue of $467.6 million, up 30% over fiscal year 2024.

- For Q4 2025, non-GAAP diluted earnings per share was $0.19, compared to a loss per share of $0.09 in the year-ago quarter, and fiscal year 2025 non-GAAP diluted earnings per share was $0.31, up from a loss of $0.90 in fiscal 2024.

- The company provided first quarter 2026 net revenue guidance of $130 million to $140 million.

- MaxLinear repurchased $20 million of its common stock during the fourth quarter of 2025.

- Net cash flow provided by operating activities for fiscal year 2025 was $19.6 million, a significant improvement from net cash flow used in operations of $45.3 million in fiscal 2024.

- MaxLinear's data center DSP business is projected to reach $60-70 million in calendar 2025 and over $100 million in 2026, driven by products like the new Keystone for 800G.

- The broadband business is expected to recover in 2026, with DOCSIS 4.0 shipments increasing in 2026 and 2027 (offering 40%+ higher ASPs than DOCSIS 3.1) and a significant PON gateway win ramping in late Q1/Q2 2026.

- The company anticipates gross margins to improve, aiming to end 2026 starting with a six instead of a five, and plans to grow operating expenses at about half the rate of top-line revenue to achieve operating leverage.

- MaxLinear announced a $75 million share buyback in November (presumably 2025) and expects a resolution to the Silicon Motion arbitration mid-year 2026.

- MaxLinear anticipates significant growth in its data center business, with DSP revenues projected to exceed $100 million in 2026 and the market having the potential to continue doubling.

- The company expects a recovery in its broadband business, driven by the ramp of DOCSIS 4.0 in 2026 and 2027, which offers a 40-plus% increase in ASPs over DOCSIS 3.1, and a new PON gateway win with a major North American Tier 1 vendor expected to ramp in late Q1/Q2 2026.

- MaxLinear announced a $75 million share buyback in November due to an improved revenue outlook, expected profit increases, and a stronger cash position.

- The arbitration regarding Silicon Motion, which began in Q4 (October), is expected to reach a resolution by mid-year 2026.

- The company aims to improve its gross margin, expecting it to start with a "six" instead of a "five" by the end of 2026, and plans to manage operating expenses to grow at approximately half the rate of top-line growth.

- MaxLinear anticipates significant growth in its data center business, driven by the Keystone product for 800G, with DSP revenues projected to exceed $100 million in 2026 and potential for continued doubling.

- The company expects a recovery and growth in its broadband segment, with DOCSIS 4.0 shipments ramping in 2026 and 2027 at 40-plus% higher ASPs than DOCSIS 3.1, alongside new PON gateway wins starting in late Q1 or Q2.

- After a challenging 2025, the industrial and multi-market segment is projected to return to mid-single digit growth (4-5%) in 2026.

- MaxLinear expects improved financial performance, with infrastructure driving higher gross margins (aiming for 60%+) and OpEx growth at approximately half the rate of top-line growth.

- The board authorized a $75 million share buyback in November due to an improved revenue outlook and expected profit increases, with resolution for the Silicon Motion arbitration anticipated mid-year.

- MaxLinear's board has authorized a $75 million share repurchase program, effective until November 20, 2028, signaling management's confidence in the company's long-term growth and belief that shares are undervalued.

- The company recently reported better-than-expected Q3 earnings, with Non-GAAP EPS of $0.14 and revenues of $126.5 million, despite a 24% year-to-date share price fall and a negative net margin of 42.43%.

- Analyst opinions are mixed, with a consensus hold rating, and the stock is currently trading below analyst price targets near $19.85 compared to a recent close around $14.79.

Quarterly earnings call transcripts for MAXLINEAR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more