Earnings summaries and quarterly performance for MARZETTI.

Research analysts who have asked questions during MARZETTI earnings calls.

Alton Stump

Loop Capital Markets

2 questions for MZTI

Also covers: CBRL, FAT, JACK +1 more

Brian Holland

D.A. Davidson

2 questions for MZTI

Also covers: BRBR, FRPT, LANC +6 more

Jim Salera

Stephens Inc.

2 questions for MZTI

Also covers: BRBR, CAKE, CELH +21 more

Scott Mushkin

R5 Capital

2 questions for MZTI

Also covers: ACI, COST, NGVC +3 more

TB

Todd Brooks

The Benchmark Company

2 questions for MZTI

Also covers: BJRI, CBRL, CHEF +17 more

Recent press releases and 8-K filings for MZTI.

Marzetti Company Reports Q2 2026 Results and Announces Bachan's Acquisition

MZTI

Earnings

M&A

Guidance Update

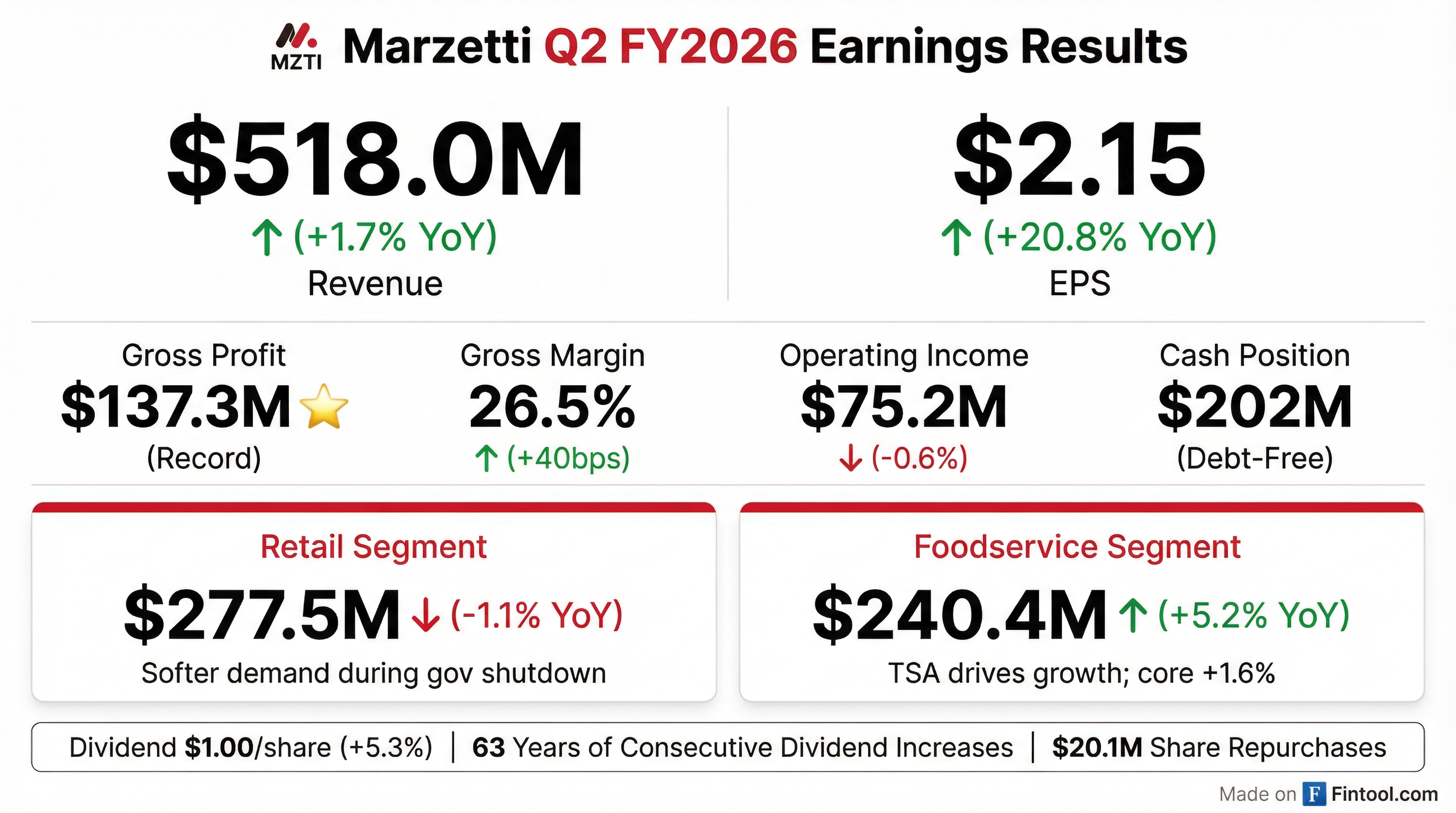

- Marzetti Company reported Q2 2026 consolidated net sales increased 1.7% to $518 million, with gross profit growing 3.4% to a record $137 million, and diluted earnings per share increasing 20.8% to $2.15.

- The company entered into a definitive agreement to acquire Bachan’s, a Japanese-American barbecue sauce brand, for approximately $400 million in cash. This acquisition is expected to be accretive to both top line growth and gross margins beginning in year one.

- Bachan's demonstrated strong growth, with net revenue compound annual growth of approximately 48% from 2022 to 2025, and recorded $87 million in sales.

- For fiscal year 2026, Marzetti Company forecasts total capital expenditures between $75 million and $85 million.

4 days ago

Marzetti Company Announces Bachan's Acquisition and Q2 2026 Results

MZTI

M&A

Earnings

Dividends

- The Marzetti Company entered into a definitive agreement to acquire Bachan’s, a rapidly growing Japanese-American barbecue sauce brand, for approximately $400 million in cash, anticipating it to be accretive to both top line growth and gross margins starting in year one.

- For the second quarter of fiscal year 2026, consolidated net sales increased 1.7% to $518 million, and diluted earnings per share grew 20.8% to $2.15.

- Gross profit increased 3.4% to $137 million, and the company raised its quarterly cash dividend by 5% to $1 per share, marking 63 consecutive years of increases.

- MZTI repurchased $20.1 million in common stock in Q2 and maintains a debt-free balance sheet with over $201 million in cash before the acquisition.

4 days ago

Marzetti Company Reports Q2 2026 Results and Announces Bachan's Acquisition

MZTI

Earnings

M&A

Share Buyback

- The Marzetti Company's consolidated net sales increased 1.7% to $518 million in the second fiscal quarter of 2026, with adjusted net sales growing 0.1% to $510 million. Gross profit rose 3.4% to a record $137 million, and diluted earnings per share increased 20.8% to $2.15.

- The company announced a definitive agreement to acquire Bachan’s, a Japanese-American barbecue sauce brand, for approximately $400 million in cash. This acquisition is expected to be accretive to both top-line growth and gross margins starting in year one.

- MZTI returned funds to shareholders, paying a quarterly cash dividend of $1 per share, representing a 5% increase from the prior year, and repurchasing $20.1 million in common stock during the quarter.

- The company plans to leverage its strong balance sheet to invest for further growth, focusing on accelerating core business growth, simplifying its supply chain, and expanding its core through M&A and strategic licensing.

4 days ago

Marzetti Company Announces Q2 2026 Results

MZTI

Earnings

Dividends

Share Buyback

- The Marzetti Company reported consolidated net sales of $518.0 million for Q2 2026, an increase of 1.7%, with Adjusted Consolidated Net Sales rising 0.1% to $509.8 million.

- Gross Profit improved 3.4% to a second-quarter record of $137.3 million, while Operating Income declined 0.6% to $75.2 million, impacted by $1.7 million in restructuring and impairment charges.

- Diluted EPS increased by $0.37 to $2.15. The company also returned a $1.00 cash dividend per share, a 5.3% increase over the prior year, and repurchased $20.1 million of common stock in the quarter.

- MZTI maintains a strong financial position, being debt-free with $202 million in cash as of FY26 Q2, and anticipates FY26 capital expenditures between $75 and $85 million.

4 days ago

Marzetti Reports Q2 2026 Results and Announces Bachan's Acquisition

MZTI

Earnings

M&A

Dividends

- The Marzetti Company reported net sales of $518.0 million for the second quarter ended December 31, 2025, an increase of 1.7% compared to the prior year, with diluted net income per share of $2.15.

- The company announced a definitive agreement to acquire Bachan’s, Inc., a Japanese Barbecue Sauce brand, for a purchase price of $400 million. Bachan's net sales for the twelve months ended December 31, 2025, were approximately $87 million.

- Marzetti increased its regular cash dividend for the 63rd consecutive year and, during the quarter, paid $27.6 million in cash dividends and repurchased $20.1 million of common stock.

4 days ago

Marzetti Co. Increases Dividend and Announces Shareholder Meeting Results

MZTI

Dividends

Executive Compensation

Proxy Vote Outcomes

- The Marzetti Company's Board of Directors declared a quarterly cash dividend of $1.00 per common share, payable on December 31, 2025, to shareholders of record on December 5, 2025. This marks 63 consecutive years of increasing regular cash dividends, with an indicated annual payout of $3.95 per share for the fiscal year ending June 30, 2026.

- At the annual meeting on November 19, 2025, shareholders reelected four incumbent directors for three-year terms expiring at the 2028 Annual Meeting.

- Shareholders approved The Marzetti Company 2025 Omnibus Incentive Plan with 24,398,832 votes For. This plan provides for various equity awards, including restricted stock units for directors and employees/consultants.

- The non-binding vote on the compensation of named executive officers was approved with 24,572,731 votes For.

Nov 20, 2025, 7:28 PM

Marzetti Company Reports Strong Q1 2026 Results with Record Sales and Profit

MZTI

Earnings

Dividends

New Projects/Investments

- For Q1 FY2026, Marzetti Company reported a 5.8% increase in consolidated net sales to $493 million, with adjusted net sales (excluding a temporary supply agreement) up 3.5% to $483 million. The company achieved record gross profit of $119 million (up 7.2%) and operating income of $59 million, while diluted EPS increased 5.6% to $1.71.

- The retail segment's net sales grew 3.5%, significantly boosted by New York Bakery frozen garlic bread and licensing programs, including Chick-fil-A sauces which saw 9.6% growth driven by expanded club channel distribution. The food service segment also saw adjusted net sales growth of 3.5%.

- Marzetti maintains a strong financial position with a debt-free balance sheet and over $182 million in cash. The company generated $69.5 million in operating cash flow and increased its quarterly cash dividend by 6% to $0.95 per share, marking its 62nd consecutive year of increases.

- The company incurred $1.1 million in restructuring impairment charges related to the planned closure of its Milpitas, California facility, part of an ongoing manufacturing network optimization. Capital expenditures for FY2026 are forecasted to be between $75 million and $85 million.

Nov 4, 2025, 3:00 PM

MZTI announces Q1 2026 financial results

MZTI

Earnings

Dividends

Revenue Acceleration/Inflection

- The Marzetti Company reported record high Net Sales, Gross Profit, and Operating Income for Q1 2026.

- Consolidated Net Sales increased 5.8% to $493.5 million, with Adjusted Net Sales (excluding $10.7 million from a temporary supply agreement) growing 3.5% to $482.8 million.

- Gross Profit improved 7.2% to $118.8 million and Operating Income increased 6.1% to $59.3 million, despite $1.1 million in restructuring and impairment charges.

- Diluted EPS improved $0.09 to $1.71.

- The company remains debt-free with $182 million in cash and increased its cash dividend per share by 5.6% to $0.95, marking 62 consecutive years of annual dividend increases.

Nov 4, 2025, 3:00 PM

Marzetti Company Reports Record Q1 FY2026 Sales and Profit

MZTI

Earnings

Dividends

Revenue Acceleration/Inflection

- Marzetti Company reported record consolidated net sales of $493 million, a 5.8% increase, and adjusted net sales of $483 million, up 3.5% excluding a temporary supply agreement, for Q1 Fiscal Year 2026.

- The company achieved record gross profit of $119 million, a 7.2% increase, and record operating income of $59 million, with diluted earnings per share increasing 5.6% to $1.71.

- Both the retail and food service segments saw 3.5% adjusted net sales growth, driven by strong performance from brands like New York Bakery and Chick-fil-A sauces.

- MZTI maintains a debt-free balance sheet with over $182 million in cash and increased its quarterly cash dividend by 6% to $0.95 per share, extending its streak of annual dividend increases to 62 years.

Nov 4, 2025, 3:00 PM

Marzetti Company Reports Record Q1 2026 Sales and Profit Growth

MZTI

Earnings

Dividends

New Projects/Investments

- Consolidated net sales for Q1 2026 increased 5.8% to a record $493,000,000, with diluted earnings per share (EPS) growing 5.6% to $1.71.

- The Retail segment saw net sales increase 3.5%, driven by strong performance in New York Bakery frozen garlic bread and licensing programs, including a 9.6% growth in Chick-fil-A sauces sales due to expanded club channel distribution.

- The company reported a debt-free balance sheet with over $182,000,000 in cash and generated $69,500,000 in operating cash flow during the quarter.

- Marzetti increased its quarterly cash dividend by 6% to $0.95 per share, extending its streak of annual dividend increases to 62 years, and recorded $1,100,000 in restructuring impairment charges related to the planned closure of its Milpitas facility.

Nov 4, 2025, 3:00 PM

Quarterly earnings call transcripts for MARZETTI.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more