Earnings summaries and quarterly performance for NorthEast Community Bancorp, Inc./MD/.

Executive leadership at NorthEast Community Bancorp, Inc./MD/.

Board of directors at NorthEast Community Bancorp, Inc./MD/.

Research analysts covering NorthEast Community Bancorp, Inc./MD/.

Recent press releases and 8-K filings for NECB.

NorthEast Community Bancorp, Inc. Reports Q4 and Full Year 2025 Results

NECB

Earnings

Share Buyback

Board Change

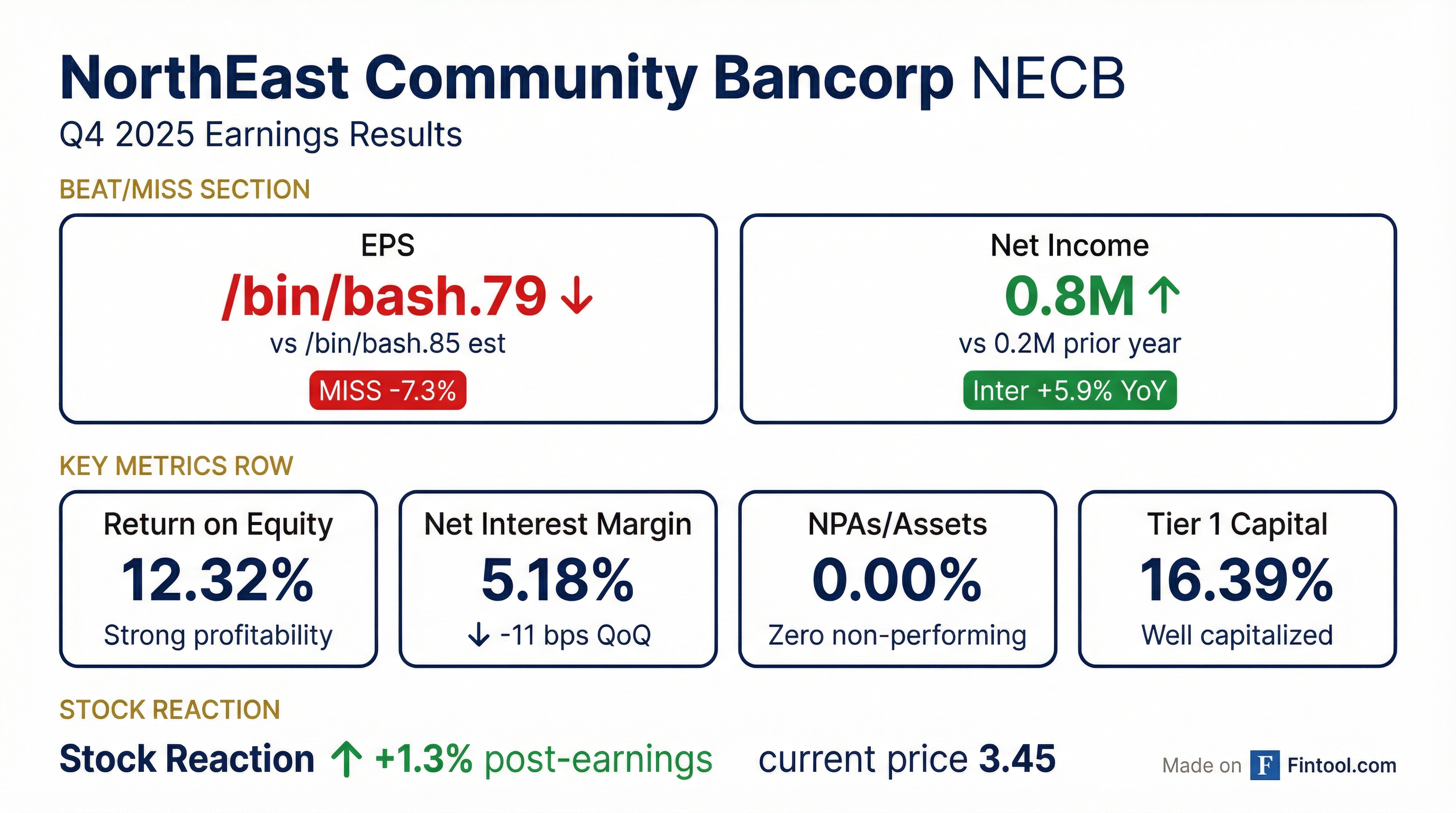

- NorthEast Community Bancorp, Inc. reported net income of $10.8 million for the quarter ended December 31, 2025, or $0.81 per basic share, and $44.4 million for the full year 2025, or $3.35 per basic share.

- As of December 31, 2025, total assets increased by 2.7% to $2.1 billion, and total stockholders' equity increased by 10.5% to $351.7 million. The company also reported no non-performing assets, a decrease from $5.1 million at December 31, 2024.

- The company commenced its third stock repurchase program on December 10, 2025, to repurchase 1,400,435 shares, and had repurchased 40,924 shares for $938,000 by December 31, 2025. Loan demand remains robust, with outstanding unfunded commitments exceeding $680 million at December 31, 2025.

Jan 30, 2026, 12:00 AM

NorthEast Community Bancorp, Inc. Reports Q4 and Full Year 2025 Results

NECB

Earnings

Board Change

- NorthEast Community Bancorp, Inc. reported net income of $10.8 million for the quarter ended December 31, 2025, and $44.4 million for the full year ended December 31, 2025.

- Diluted earnings per share were $0.79 for the fourth quarter of 2025 and $3.25 for the full year 2025.

- The company maintained strong asset quality with no non-performing assets at December 31, 2025, a decrease from $5.1 million at December 31, 2024.

- Total assets increased 2.7% to $2.1 billion and total stockholders' equity increased 10.5% to $351.7 million as of December 31, 2025.

- Loan demand remains strong, with outstanding unfunded commitments exceeding $680 million at December 31, 2025.

Jan 28, 2026, 9:00 PM

NorthEast Community Bancorp, Inc. Announces Third Stock Repurchase Program

NECB

Share Buyback

- NorthEast Community Bancorp, Inc. (NECB) announced on December 8, 2025, that its Board of Directors authorized a third stock repurchase program.

- The new program allows for the repurchase of up to 1,400,435 shares, representing 10% of the company's currently issued and outstanding common stock.

- Shares may be repurchased through open market transactions, privately negotiated transactions, or pursuant to a Rule 10b5-1 trading plan.

- Under the preceding second stock repurchase program, 1,091,174 shares were repurchased at an average cost of $15.78 per share.

Dec 9, 2025, 2:16 PM

NorthEast Community Bancorp, Inc. Announces Third Stock Repurchase Program

NECB

Share Buyback

- NorthEast Community Bancorp, Inc. (NECB) has authorized a third stock repurchase program to acquire up to 1,400,435 shares, which represents 10% of the Company's currently issued and outstanding common stock.

- The previous second stock repurchase program, announced on May 30, 2023, authorized the purchase of up to 1,509,218 shares.

- Under the second program, the Company repurchased 1,091,174 shares at an average cost of $15.78 per share, and no shares currently remain available for repurchase under that program.

- The new program permits shares to be repurchased in open market transactions, privately negotiated transactions, or pursuant to a Rule 10b5-1 trading plan.

Dec 8, 2025, 8:30 PM

NorthEast Community Bancorp, Inc. Reports Q3 2025 Results

NECB

Earnings

Share Buyback

Asset Quality

- NorthEast Community Bancorp, Inc. reported net income of $11.9 million, or $0.90 per basic share, for the three months ended September 30, 2025, compared to $12.7 million, or $0.97 per basic share, for the same period in 2024. For the nine months ended September 30, 2025, net income was $33.6 million, or $2.54 per basic share, compared to $36.9 million, or $2.81 per basic share, for the nine months ended September 30, 2024.

- Total assets increased by 2.3% to $2.1 billion at September 30, 2025, from $2.0 billion at December 31, 2024, primarily due to increases in net loans.

- Total stockholders' equity increased by 8.1% to $344.0 million as of September 30, 2025, from $318.3 million as of December 31, 2024.

- Asset quality metrics remained strong, with non-performing assets decreasing to $545,000 at September 30, 2025, from $5.1 million at December 31, 2024, and the non-performing assets to total assets ratio was 0.03% at September 30, 2025.

- As of September 30, 2025, the Company had repurchased 1,091,174 shares of common stock under its second repurchase program at a cost of $17.2 million.

Oct 24, 2025, 7:36 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more