Earnings summaries and quarterly performance for National Energy Services Reunited.

Research analysts who have asked questions during National Energy Services Reunited earnings calls.

David Anderson

Barclays PLC

5 questions for NESR

Jeff Robertson

Water Tower Research

5 questions for NESR

Derek Podhaizer

Piper Sandler Companies

4 questions for NESR

Sherif Elmaghrabi

BTIG

4 questions for NESR

John Ajay

Occam Crest Management

3 questions for NESR

Saurabh Pant

Bank of America

3 questions for NESR

Arun Jayaram

JPMorgan Chase & Co.

2 questions for NESR

Gregory Lewis

BTIG, LLC

2 questions for NESR

Jeffrey Robertson

Water Tower Research

2 questions for NESR

John Anderson

Barclays

2 questions for NESR

Josh Silverstein

UBS Group

2 questions for NESR

Tate Sullivan

Maxim Group

2 questions for NESR

Arvind Sanger

Geosphere Capital Management

1 question for NESR

Arvind Singhar

Geosphere Capital Management

1 question for NESR

Derek Potheiser

Piper Sandler

1 question for NESR

Grant Hynes

JPMorgan Chase & Co.

1 question for NESR

Greg Lewis

BTIG

1 question for NESR

J. David Anderson

Barclays

1 question for NESR

Recent press releases and 8-K filings for NESR.

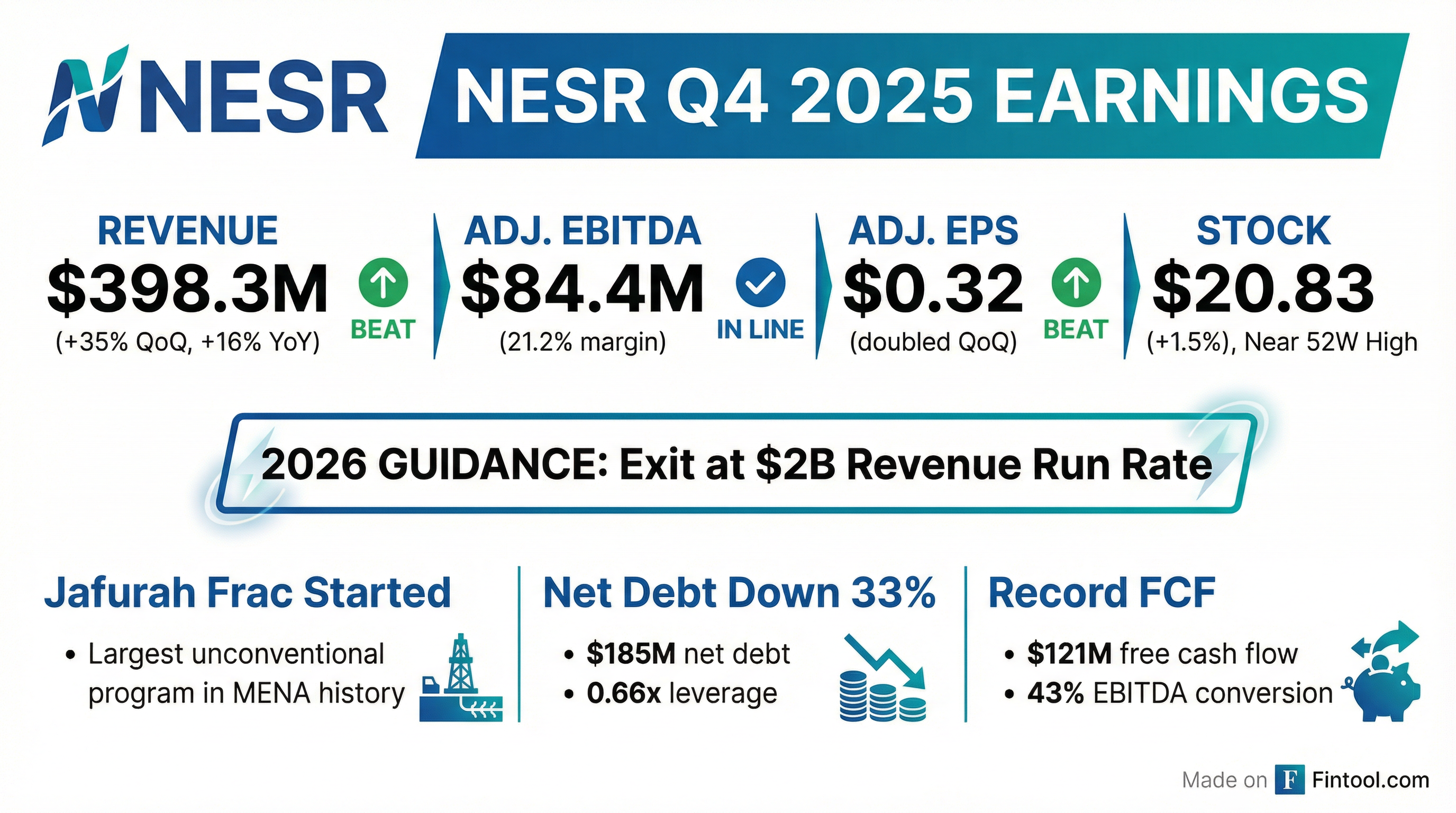

- NESR reported record fourth quarter 2025 revenue of $398.3 million, an increase of 34.9% sequentially and 15.9% year-over-year, driven by the Jafurah contract mobilization and strong activity in North Africa. For the full year 2025, revenue totaled $1.324 billion, with adjusted diluted earnings per share of $0.81.

- The company anticipates exiting 2026 at an annualized revenue run rate of approximately $2 billion, with full-year EBITDA margins expected to remain broadly consistent with 2025.

- NESR aims to double the size of the company over the next couple of years, supported by $2 billion-$3 billion in regional tenders expected to be awarded in 2026, with contracts typically lasting 5-7 years.

- Capital expenditures for 2026 are projected to be approximately $165 million, and free cash flow conversion is expected to be 35%-40% from adjusted EBITDA.

- As of December 31, 2025, NESR maintained a strong balance sheet with net debt of $185.3 million and a net debt to adjusted EBITDA ratio of 0.66x.

- National Energy Services Reunited (NESR) reported record Q4 2025 revenue of $398.3 million, a 34.9% sequential increase, and full-year 2025 revenue of $1.324 billion. Adjusted diluted EPS for Q4 2025 was $0.32 and for the full year 2025 was $0.81.

- NESR anticipates 2026 to be its "best growth year ever", aiming for an annualized revenue run rate of approximately $2 billion by the end of 2026 and a goal to double the company's size by 2027. Full year 2026 EBITDA margins are expected to remain consistent with 2025.

- The company concluded 2025 with net debt of $185.3 million, resulting in a net debt to adjusted EBITDA ratio of 0.66. Full year 2025 free cash flow was $120.8 million, with 2026 free cash flow conversion projected at 35%-40% of adjusted EBITDA.

- Growth is fueled by the Jafurah contract mobilization, robust activity in North Africa and Kuwait, and substantial investment plans across the Middle East, including new contract wins and tenders. NESR is also engaged in critical minerals development in Saudi Arabia.

- An update on NESR's formal capital allocation and shareholder return framework, potentially including dividends and stock buybacks, is expected in the next earnings call.

- National Energy Services Reunited (NESR) reported record Q4 2025 revenue of $398.3 million, marking a 34.9% sequential increase and 15.9% year-over-year growth, contributing to a full year 2025 revenue of $1.324 billion.

- The company achieved $120.8 million in free cash flow for full year 2025 and maintained a low net debt to adjusted EBITDA ratio of 0.66x as of December 31, 2025.

- NESR anticipates 2026 to be its "best growth year ever", targeting an annualized revenue run rate of approximately $2 billion by the end of the year, with full year EBITDA margins expected to remain consistent with 2025.

- The company is actively pursuing significant growth opportunities, including the successful kickoff of the largest unconventional frack program in sector history (Jafurah contract) and plans to double its size over the next couple of years through new contract wins from an estimated $2-$3 billion in regional tenders.

- Regional upstream spending commitments, such as Kuwait's $8 billion-$10 billion annually through 2030 and Abu Dhabi's $150 billion investment plan for 2026-2030, are expected to drive continued activity and growth for NESR.

- National Energy Services Reunited Corp. reported revenue of $398.3 million for the fourth quarter ended December 31, 2025, representing a 34.9% sequential increase and a 15.9% year-over-year increase.

- Adjusted net income for Q4 2025 was $31.9 million, showing a 106.6% sequential increase, and Adjusted EBITDA grew 32.0% sequentially to $84.4 million.

- For the full year ended December 31, 2025, the company generated operating cash flow of $264.2 million, an increase of 15.2% year-over-year, and free cash flow of $120.8 million.

- The company's Net Debt decreased to $185.3 million as of December 31, 2025, down from $274.9 million at December 31, 2024, driven by scheduled long-term debt repayments and free cash flow generation.

- National Energy Services Reunited (NESR) reported Q4 2025 revenue of $398.3 million, up 34.9% sequentially and 15.9% year-over-year, with adjusted EBITDA rising 32% sequentially to $84.4 million.

- The company generated $264.2 million in operating cash flow and $120.8 million in free cash flow for 2025, significantly reducing net debt to $185.3 million.

- Management highlighted record revenues and major contract awards, including work on Saudi Arabia’s Jafurah development and an enhanced partnership with Aramco, as drivers for multi-year growth.

- For Q3 2025, NESR reported revenue of $295.3 million, a 9.8% sequential and 12.2% year-over-year decline primarily due to a contract transition in Saudi Arabia, while Adjusted EBITDA remained steady at $64 million (21.7% margin) and Adjusted EPS was $0.16.

- The company projects full year 2025 revenues to be broadly in line with 2024 levels, with Q4 2025 expected to be a record performance. Full year 2025 free cash flow is projected at $70 million-$80 million, with CapEx anticipated to be $140-$150 million.

- NESR forecasts ending full year 2026 with a revenue run rate of approximately $2 billion, with a 99% confidence level in achieving this target due to awarded and signed contracts. The EBITDA margin for 2026 is expected to be similar to 2025, between 21%-22%.

- The company's net debt was $263.3 million as of September 30, 2025, with a net debt-to-adjusted EBITDA ratio of 0.93. NESR plans to deploy all excess cash flow towards debt reduction through the first half of 2026 and is on track to refinance its debt facility by year-end 2025 or early January 2026.

- NESR reported Q3 2025 revenue of $295.3 million, a 9.8% sequential and 12.2% year-over-year decrease, with Adjusted EBITDA of $64 million (21.7% margin) and Adjusted EPS of $0.16.

- The company secured the multi-year, multi-billion dollar Jafurah frac tender, which is the largest single-service contract in sector history and is expected to drive significant future growth.

- NESR forecasts full year 2025 revenues to be in line with 2024, with a record Q4 2025 revenue performance and an anticipated $2 billion revenue run rate by the end of 2026.

- Management expects EBITDA margins for 2025 and 2026 to be between 21%-22% and plans to deploy all excess cash flow towards debt reduction through the first half of 2026 while refinancing its debt facility.

- NESR reported Q3 2025 revenue of $295.3 million, a decrease of 9.8% sequentially and 12.2% year-over-year, with Adjusted EBITDA of $64 million (21.7% margin) and Adjusted EPS of $0.16.

- The company secured a multi-year, multi-billion dollar frac tender in Jafurah, which commenced on November 1st, 2025, and is expected to be a cornerstone for future growth.

- Management forecasts full year 2025 revenue to be broadly in line with full year 2024 levels, implying a record Q4 2025 performance, and anticipates achieving a $2 billion revenue run rate by the end of 2026.

- NESR plans to deploy all excess cash flow towards debt reduction through the first half of 2026, maintaining a net debt-to-Adjusted EBITDA ratio of 0.93 as of September 30, 2025.

- National Energy Services Reunited Corp. (NESR) reported a decrease in revenue and net income for both the three-month and nine-month periods ended September 30, 2025, compared to the same periods in the prior year.

- For the three months ended September 30, 2025, revenue was $295.3 million, down from $336.2 million in the prior year, and net income was $17.7 million, compared to $20.6 million in the prior year.

- Diluted earnings per share for Q3 2025 was $0.18, a decrease from $0.22 in Q3 2024.

- Cash flows provided by operating activities for the nine-month period ended September 30, 2025, significantly decreased to $125.7 million from $183.1 million in the prior year, primarily due to growth in accounts receivable.

- The company recorded an income tax benefit of $5.5 million for Q3 2025, primarily reflecting non-recurring adjustments to uncertain tax positions and unrecognized tax benefits.

- National Energy Services Reunited Corp. reported revenue of $295.3 million for the third quarter ended September 30, 2025.

- Net income for Q3 2025 was $17.7 million, an increase of 16.7% on a sequential quarter basis, with diluted EPS of $0.18, up 15.6% sequentially.

- Adjusted EBITDA for the quarter ended September 30, 2025, was $64.0 million.

- For the nine months ended September 30, 2025, operating cash flow was $125.7 million and free cash flow was $25.0 million.

- As of September 30, 2025, the company held $69.7 million in cash and cash equivalents, with total debt of $332.9 million, resulting in Net Debt of $263.3 million.

Quarterly earnings call transcripts for National Energy Services Reunited.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more