Earnings summaries and quarterly performance for NEW JERSEY RESOURCES.

Research analysts who have asked questions during NEW JERSEY RESOURCES earnings calls.

Travis Miller

Morningstar

8 questions for NJR

Jamieson Ward

Jefferies

5 questions for NJR

Chris Ellinghaus

Siebert Williams Shank

3 questions for NJR

Eli Jossen

JPMorgan Chase & Co.

3 questions for NJR

Gabriel Moreen

Mizuho Financial Group, Inc.

3 questions for NJR

Richard Sunderland

JPMorgan Securities LLC

3 questions for NJR

Gabe Maureen

Mizuho

2 questions for NJR

Robert Mosca

Mizuho Securities Co., Ltd.

2 questions for NJR

Christopher Ellinghaus

Siebert Williams Shank & Co., LLC

1 question for NJR

Eli Josen

JPMorgan

1 question for NJR

Robert Moskow

TD Cowen

1 question for NJR

Shahriar Pourreza

Guggenheim Partners

1 question for NJR

Recent press releases and 8-K filings for NJR.

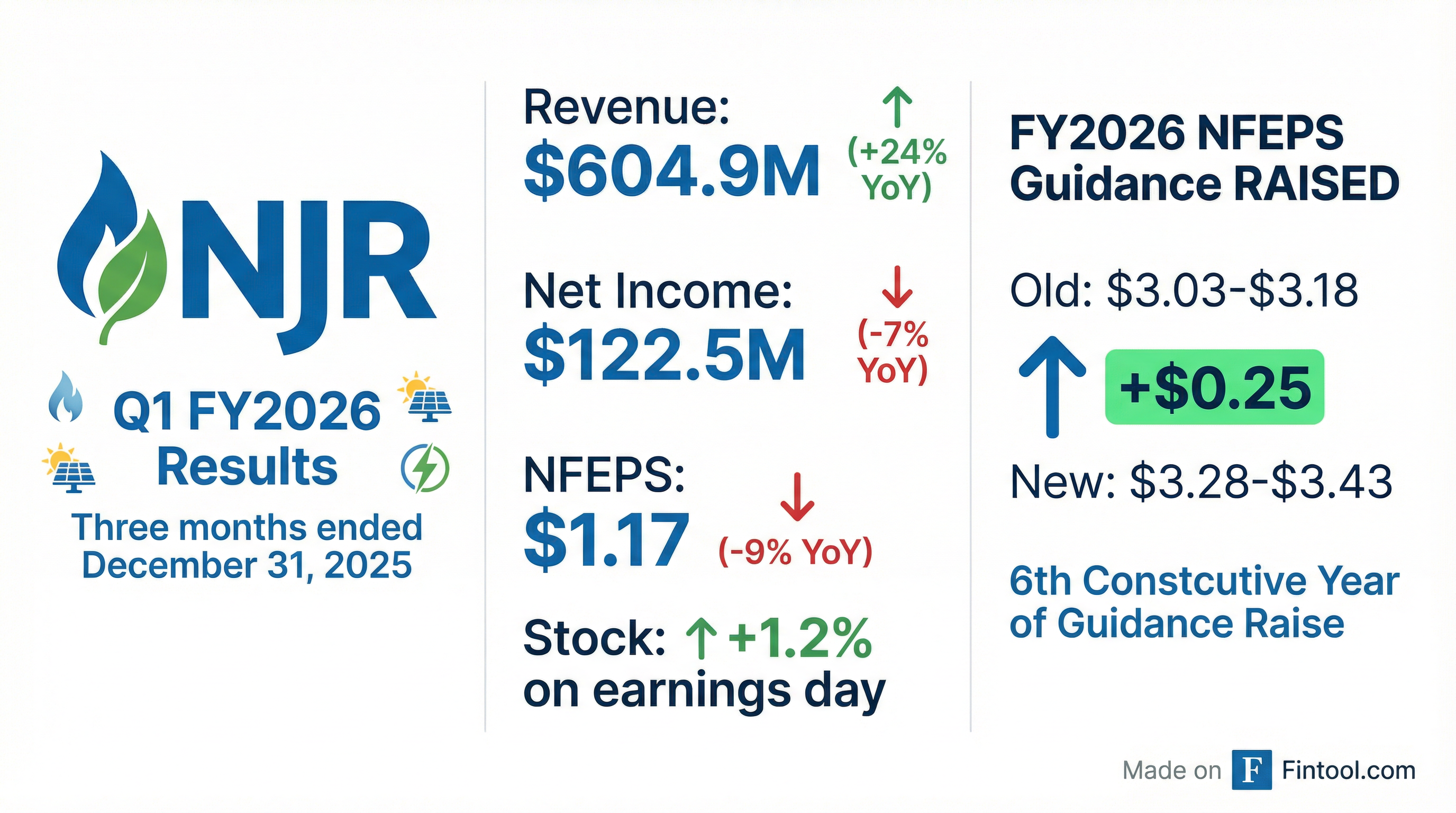

- New Jersey Resources (NJR) reported Net Financial Earnings (NFE) of $118.2 million or $1.17 per share for Q1 2026.

- The company raised its fiscal 2026 NFEPS guidance by $0.25 per share to a new range of $3.28-$3.43 per share, primarily due to outperformance from energy services.

- NJR plans to invest $4.8-$5.2 billion in capital expenditures through fiscal 2030, a 40% increase over the prior five years, with over 60% allocated to its utility, New Jersey Natural Gas.

- Key growth drivers include New Jersey Natural Gas's expected high single-digit rate-based growth through 2030, Storage and Transportation's projected doubling of NFE by 2027, and Clean Energy Ventures' plan to expand capacity by over 50% in the next two years.

- The company maintains a strong balance sheet, requiring no block equity issuance for its capital plan and projecting an adjusted FFO to adjusted debt ratio of around 20% for the next five years.

- NJR reported Net Financial Earnings Per Share (NFEPS) of $1.17 for Q1 2026.

- The company raised its fiscal 2026 NFEPS guidance by $0.25 per share to a new range of $3.28-$3.43 per share, primarily due to outperformance from energy services.

- NJR reaffirmed its five-year capital expenditure outlook of $4.8-$5.2 billion through fiscal 2030, representing a 40% increase over the previous five years, with over 60% allocated to its utility, New Jersey Natural Gas.

- Key growth initiatives include Storage and Transportation (S&T) expecting to more than double net financial earnings by 2027 and Clean Energy Ventures (CEV) planning to expand capacity by over 50% in the next two years.

- The company maintains a strong balance sheet and requires no block equity issuance to execute its capital plan.

- New Jersey Resources (NJR) reported Net Financial Earnings (NFE) of $118.2 million or $1.17 per share for the first quarter of fiscal 2026.

- The company raised its fiscal 2026 NFEPS guidance to $3.28-$3.43 per share, up from the initial range of $3.03-$3.18 per share, primarily due to outperformance from Energy Services.

- NJR plans to invest approximately $5 billion in capital expenditures over the next five years through fiscal 2030, with over 60% allocated to its utility, New Jersey Natural Gas, and expects to achieve a long-term NFEPS growth rate of 7%-9% without requiring block equity issuance.

- Key growth drivers include New Jersey Natural Gas's high single-digit rate-based growth through 2030, Storage and Transportation's expected doubling of NFE by 2027, and Clean Energy Ventures' planned capacity expansion of over 50% in the next two years.

- New Jersey Resources reported fiscal 2026 first-quarter consolidated net financial earnings (NFE) of $118.2 million, or $1.17 per share, for the period ended December 31, 2025, compared with $128.9 million, or $1.29 per share, in the first quarter of fiscal 2025.

- The company increased its fiscal 2026 net financial earnings per share (NFEPS) guidance to a range of $3.28 to $3.43, a $0.25 increase from the previous range, primarily due to the strong performance of Energy Services in January 2026.

- The decrease in first-quarter NFE was mainly attributed to a gain on sale of Clean Energy Ventures' (CEV) residential solar portfolio assets recognized in the prior-year period. This was partially offset by higher NFE from New Jersey Natural Gas (NJNG), Storage and Transportation (S&T), and Energy Services (ES), with ES's NFE increasing to $16.3 million from $7.8 million due to natural gas price volatility.

- NJR expects to deploy between $4.8 billion and $5.2 billion in capital expenditures through 2030, with over 60% of this investment allocated to utility spending at NJNG.

- New Jersey Resources (NJR) reported fiscal 2026 first-quarter consolidated net financial earnings (NFE) of $118.2 million, or $1.17 per share, compared with $128.9 million, or $1.29 per share, in the first quarter of fiscal 2025.

- The company increased its fiscal 2026 net financial earnings per share (NFEPS) guidance by $0.25 to a new range of $3.28 to $3.43, primarily due to strong performance from Energy Services in January 2026.

- NJR maintains its long-term NFEPS growth target of 7% to 9%, starting from a fiscal 2025 base of $2.83 per share.

- Capital expenditures for the first quarter of fiscal 2026 were $163.6 million, and the company anticipates deploying between $4.8 billion and $5.2 billion in capital expenditures through 2030.

- The Board of Directors re-elected five directors for a three-year term expiring in 2029, approved the non-binding advisory resolution on executive compensation, and ratified Deloitte and Touche LLP as the independent registered public accounting firm for the fiscal year ending September 30, 2026.

- Shareholders also approved the New Jersey Resources 2026 Stock Award and Incentive Plan.

- Don Correll retired as Chair of the board, and Tom O'Connor was appointed as his successor. Amy Mansue and Bill Yardley were acknowledged as new directors.

- NJR emphasized the safety and sustainability of its dividend, noting it has been paid continuously since 1952 and increased for over 30 consecutive years, supported by a consistent payout ratio of approximately 60%.

- The company highlighted the growth prospects of its non-utility businesses, with CV expected to increase service capacity by over 50% and the storage and transport business projected to more than double in the next two years.

- Shareholders re-elected five directors for three-year terms and ratified Deloitte and Touche LLP as the independent registered public accounting firm for the fiscal year ending September 30, 2026.

- The Board's recommendations regarding the non-binding advisory vote on executive compensation and the 2026 Stock Award and Incentive Plan were approved.

- Don Correll retired as Chair of the Board, with Tom O'Connor succeeding him; Amy Mansue and Bill Yardley were acknowledged as new directors.

- Management affirmed the safety and sustainability of NJR's dividend, highlighting its continuous payment since 1952 and over 30 consecutive years of increases, supported by a consistent 60% payout ratio.

- The company's solar and midstream businesses are key to its long-term strategy, with CV on track to increase service capacity by over 50% and NFE expected to more than double in the next two years.

- The 2026 Annual Shareholders Meeting confirmed the re-election of five directors (Jane M. Kenny, Sharon C. Taylor, Stephen D. Westhoven, William T. Yardley, and Amy B. Mansue) for three-year terms expiring in 2029.

- Shareholders approved the non-binding advisory resolution on executive compensation, the 2026 Stock Award and Incentive Plan, and ratified Deloitte and Touche LLP as the independent auditor for the fiscal year ending September 30, 2026.

- Don Correll retired as Chair of the board, and Tom O'Connor was appointed as his successor.

- Management affirmed the safety and sustainability of NJR's dividend growth, highlighting continuous payments since 1952 and increases for over 30 consecutive years, supported by a consistent payout ratio of approximately 60%.

- The company's non-utility businesses are expected to drive growth, with CEV projected to increase service capacity by over 50% and NFE expected to more than double in the next two years.

- New Jersey Resources (NJR) reported exceeding initial earnings guidance and long-term growth targets for the fifth consecutive year in fiscal 2025.

- The company initiated fiscal 2026 Net Financial Earnings Per Share (NFEPS) guidance of $3.03-$3.18 per share, aligning with its long-term 7%-9% growth rate.

- NJR plans to invest approximately $5 billion in capital expenditures through fiscal 2030, a 40% increase over the previous five years, with over 60% directed to its utility, New Jersey Natural Gas, and no block equity issuance needed.

- Key growth drivers include Storage and Transportation (S&T) which is projected to more than double net financial earnings by 2027, and Clean Energy Ventures (CEV) which expects to expand capacity by over 50% in the next two years.

- New Jersey Resources (NJR) reported excellent results for fiscal 2025, exceeding initial earnings guidance and long-term growth targets for the fifth consecutive year.

- The company is guiding to Net Financial Earnings Per Share (NFEPS) of $3.03-$3.18 per share for fiscal 2026, consistent with its long-term 7%-9% growth rate.

- NJR plans to invest approximately $5 billion over the next five years through fiscal 2030, a 40% increase over the prior five years, with over 60% allocated to its utility, New Jersey Natural Gas.

- The Storage and Transportation (S&T) segment is expected to more than double net financial earnings by 2027, driven by recontracting and a planned over 70% increase in working gas capacity at Leaf River.

- Clean Energy Ventures (CEV) anticipates expanding in-service capacity by more than 50% over the next two years, supported by a robust pipeline of safe harbor projects.

Quarterly earnings call transcripts for NEW JERSEY RESOURCES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more