Earnings summaries and quarterly performance for NETSCOUT SYSTEMS.

Executive leadership at NETSCOUT SYSTEMS.

Board of directors at NETSCOUT SYSTEMS.

Alfred Grasso

Director

Christopher Perretta

Director

John R. Egan

Lead Independent Director

Joseph G. Hadzima, Jr.

Director

Marlene Pelage

Director

Michael Szabados

Vice Chairman of the Board

Robert E. Donahue

Director

Shannon Nash

Director

Vivian Vitale

Director

Research analysts who have asked questions during NETSCOUT SYSTEMS earnings calls.

Kevin Liu

K. Liu & Company

6 questions for NTCT

Erik Suppiger

JMP Securities

2 questions for NTCT

Michael Richards

RBC Capital Markets

2 questions for NTCT

Simran Biswal

RBC Capital Markets

2 questions for NTCT

Matthew Swanson

RBC Capital Markets

1 question for NTCT

Simran B

RBC Capital Markets

1 question for NTCT

Recent press releases and 8-K filings for NTCT.

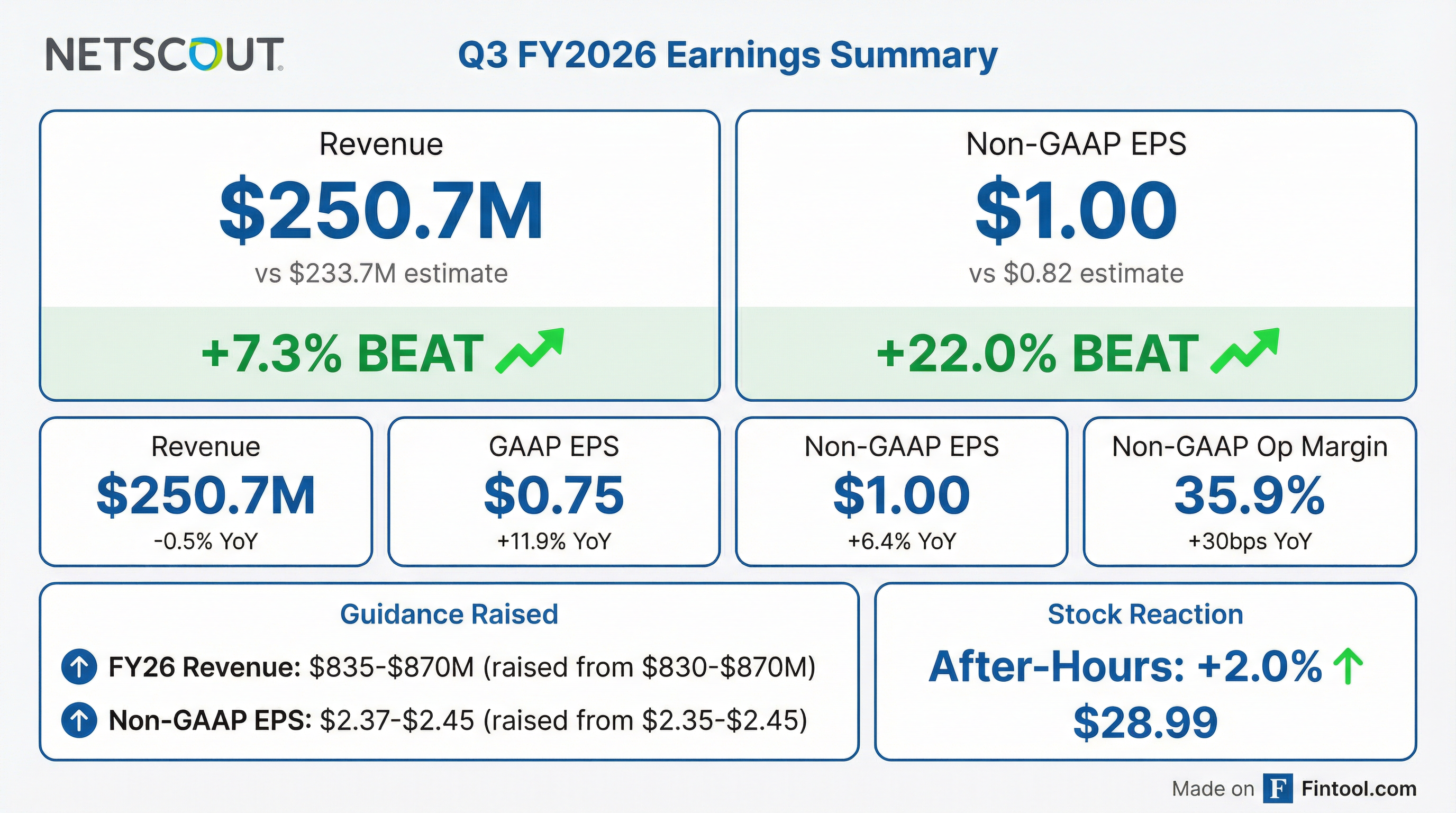

- NETSCOUT reported Q3 FY'26 revenue of $250.7 million and non-GAAP diluted net income per share of $1.00 for the period ended December 31, 2025.

- For the year-to-date period (YTD FY'26), revenue reached $656.4 million, with non-GAAP diluted net income per share of $1.96.

- The company generated $59.4 million in non-GAAP free cash flow for Q3 FY'26.

- NETSCOUT raised the midpoint of its FY'26 revenue outlook to $835-$870 million and its non-GAAP EPS outlook to $2.37-$2.45.

- NETSCOUT reported Q3 fiscal year 2026 total revenue of approximately $251 million and diluted earnings per share of $1, both ahead of expectations, partly due to product orders and service renewals pulled forward from Q4 as customers utilized year-end budgets.

- For the first nine months of fiscal year 2026, revenue was approximately $656 million, an increase of approximately 6% year-over-year, with diluted earnings per share of $1.96.

- The company is raising the midpoint of its fiscal year 2026 top and bottom line outlook, with revenue now expected to be in the range of $835 million-$870 million and non-GAAP diluted EPS in the range of $2.37-$2.45.

- Service assurance revenue increased 4.8% and cybersecurity revenue grew 9% for the first nine months of fiscal year 2026, driven by growth in both enterprise and service provider customer verticals.

- The company ended Q3 fiscal year 2026 with $586.2 million in cash, cash equivalents, short and long-term marketable securities, and investments, and plans to be active in the market for share repurchases.

- NETSCOUT reported Q3 fiscal year 2026 revenue of $250.7 million and diluted earnings per share of $1, both ahead of expectations and consistent with the prior year period.

- For the first nine months of fiscal year 2026, revenue increased approximately 6% year-over-year to $656 million, and diluted earnings per share grew approximately 15% to $1.96.

- The company raised the midpoint of its fiscal year 2026 outlook, with expected revenue now between $835 million and $870 million (representing 3.6% year-over-year growth at the midpoint) and non-GAAP diluted EPS between $2.37 and $2.45.

- Performance in Q3 was enhanced by approximately $15 million in product orders and service renewals pulled forward from Q4, as customers utilized remaining calendar year-end budgets.

- Growth for the first nine months was driven by a 4.8% increase in service assurance revenue and 9% growth in cybersecurity revenue, with the enterprise customer vertical growing 9.4%.

- NETSCOUT reported Q3 FY2026 total revenue of $250.7 million and diluted earnings per share of $1, an increase of approximately 6% year-over-year.

- For the first nine months of fiscal year 2026, revenue reached approximately $656 million, a 6% year-over-year increase, with diluted earnings per share of $1.96, up approximately 15%.

- The company raised the midpoint of its fiscal year 2026 outlook, now expecting revenue between $835 million and $870 million and non-GAAP diluted earnings per share between $2.37 and $2.45.

- Q3 FY2026 results were positively impacted by approximately $15 million in product and service order pull-ins from Q4 FY2026, driven by customers using remaining calendar year-end budgets.

- For the first nine months of FY2026, service assurance revenue increased by 4.8% and cybersecurity revenue grew by 9%, with the enterprise customer vertical revenue growing 9.4%.

- NETSCOUT SYSTEMS, INC. reported Q3 fiscal year 2026 revenue of $250.7 million and non-GAAP diluted net income per share of $1.00, surpassing expectations due to accelerated product orders and service renewals.

- The company raised the midpoint of its fiscal year 2026 outlook ranges, with expected revenue now between $835 million and $870 million and non-GAAP diluted net income per share projected from $2.37 to $2.45.

- For the first nine months of fiscal year 2026, total revenue increased to $656.4 million, and non-GAAP net income reached $143.6 million.

- As of December 31, 2025, the company's cash, cash equivalents, and marketable securities totaled $586.2 million, with no outstanding debt.

- NETSCOUT reported Q3 FY26 total revenue of $250.7 million and non-GAAP diluted EPS of $1.00 , exceeding expectations.

- For the first nine months of fiscal year 2026, total revenue increased to $656.4 million , with non-GAAP diluted EPS at $1.96.

- The company raised the midpoint of its fiscal year 2026 outlook ranges for revenue and both GAAP and non-GAAP net income per share. The updated revenue outlook is ~$835 to ~$870 million, GAAP diluted EPS is ~$1.15 to ~$1.23, and non-GAAP diluted EPS is ~$2.37 to ~$2.45.

- As of December 31, 2025, cash, cash equivalents, short and long-term marketable securities and investments increased to $586.2 million.

- NetScout reported strong financial performance with 15% revenue growth in Q2 and 11% growth for the first half of the year, driven by both service assurance and cybersecurity segments.

- The company anticipates a shift from 5G headwinds to tailwinds, as increased network capacity usage, fixed wireless, and growing AI traffic are expected to drive demand for its monitoring solutions.

- NetScout's cybersecurity business grew 13% in the first half, with new product initiatives like Adaptive DDoS aimed at expanding its footprint in the enterprise market.

- Leveraging its unique Deep Packet Inspection (DPI) data, NetScout is pursuing AI-related opportunities, including new AI Sensor and Streamer products, and maintains a strong competitive moat in the DPI space.

- Capital allocation priorities include investing in organic growth and tuck-in acquisitions, followed by returning capital to shareholders, as demonstrated by a recent repurchase of approximately 1.5 million shares for about $35 million.

- NetScout experienced a strong Q2 with 15% revenue growth and 11% growth for the first half of the fiscal year, driven by contributions from both its service assurance and cybersecurity businesses.

- The company indicates that previous headwinds, particularly in 5G carrier spending, are dissipating and becoming tailwinds as network capacity is being utilized and new deployments are occurring.

- The cybersecurity business grew 13% in the first half, with significant opportunities identified in the enterprise market, especially through adaptive DDoS and CyberStream products.

- NetScout views Artificial Intelligence (AI) as a key opportunity, both for integration into its products, such as the new AI Sensor and Streamer, and as a factor driving increased network traffic, leveraging its Deep Packet Inspection (DPI) data.

- Capital allocation priorities focus first on investing in organic growth, followed by tuck-in acquisitions, and then returning capital to shareholders, which recently included $35 million in share repurchases.

- NETSCOUT reported Q2 FY'26 GAAP revenue of $219.0 million and Non-GAAP diluted net income per share of $0.62 for the period ended September 30, 2025.

- The company raised its FY'26 outlook, now anticipating revenue between $830 million and $870 million and Non-GAAP EPS between $2.35 and $2.45.

- For the first half of FY'26, total revenue was $405.8 million, with Service Assurance revenue growing by 10.1% and Cybersecurity revenue by 12.7%.

- As of Q2 FY'26, NETSCOUT held $526.9 million in cash and securities and reported Non-GAAP Free Cash Flow of $4.3 million for the quarter.

- NetScout reported Q2 FY2026 revenue of $219 million, an increase of nearly 15% year-over-year, and diluted earnings per share of $0.62, up approximately 32% year-over-year. For the first half of fiscal year 2026, revenue was approximately $406 million, an increase of approximately 11% year-over-year, with diluted earnings per share of $0.95, up approximately 27% year-over-year.

- The company raised its full-year fiscal 2026 revenue outlook to a range of $830 million-$870 million (previously $825 million-$865 million) and non-GAAP diluted earnings per share to $2.35-$2.45 (previously $2.25-$2.40).

- The strong performance was driven by revenue growth in both cybersecurity and service assurance product lines, benefiting from the acceleration of certain orders originally anticipated in the second half of the fiscal year, including a significant U.S. government agency deal.

- NetScout ended the second quarter of 2026 with $526.9 million in cash, cash equivalents, and marketable securities, and repurchased approximately 741,000 shares of common stock for approximately $16.6 million during the quarter.

Quarterly earnings call transcripts for NETSCOUT SYSTEMS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more