Earnings summaries and quarterly performance for ONITY GROUP.

Executive leadership at ONITY GROUP.

Glen A. Messina

President and Chief Executive Officer

Aaron D. Wade

Executive Vice President and Chief Investment Officer

Dennis Zeleny

Executive Vice President and Chief Administrative Officer

Francois Grunenwald

Senior Vice President and Chief Accounting Officer

J. Andrew Peach

Executive Vice President, Originations and Chief Lending Officer

Jenna D. Evans

Executive Vice President and Chief Risk and Compliance Officer

Joseph J. Samarias

Executive Vice President, Chief Legal Officer and Secretary

Richard J. Bradfield

Executive Vice President and Chief Growth Officer

Scott W. Anderson

Executive Vice President and Chief Servicing Officer

Sean B. O’Neil

Executive Vice President and Chief Financial Officer

Board of directors at ONITY GROUP.

Research analysts who have asked questions during ONITY GROUP earnings calls.

Recent press releases and 8-K filings for ONIT.

- Onity Group Inc. subsidiaries, PHH Corporation and PHH Escrow Issuer LLC, closed an offering of $200 million in 9.875% Senior Notes due 2029 on January 30, 2026.

- This offering was an additional issuance, forming a single series with the $500.0 million aggregate principal amount of notes originally issued on November 6, 2024.

- The net proceeds from the offering will be used for general corporate purposes, including the repayment of mortgage servicing rights (MSR) indebtedness.

- The effective yield on this debt issuance was nearly 148 basis points lower than the original November 2024 issuance, which management believes will provide greater financial flexibility.

- Onity Group Inc.'s subsidiaries, PHH Corporation and PHH Escrow Issuer LLC, closed an offering of $200 million in 9.875% Senior Notes due 2029.

- This offering serves as an additional issuance, forming a single series with the $500.0 million aggregate principal amount of notes originally issued on November 6, 2024.

- The effective yield on this new debt issuance is nearly 148 basis points lower than the original debt issuance in November 2024.

- The net proceeds from the offering will be used for general corporate purposes, including the repayment of mortgage servicing rights (MSR) indebtedness.

- ONITY GROUP INC. announced that its subsidiaries, PHH Corporation and PHH Escrow Issuer LLC, priced an offering of $200 million in 9.875% Senior Notes due 2029.

- The notes were priced at 103.25% of the principal amount, resulting in an effective yield (YTW) of 8.515% per annum.

- The issuance and sale are expected to close on January 30, 2026, with net proceeds intended for general corporate purposes, including the repayment of mortgage servicing rights (MSR) indebtedness.

- These notes will form a single series of debt securities with the $500.0 million aggregate principal amount of such notes that were originally issued on November 6, 2024.

- Onity Group Inc. subsidiaries, PHH Corporation and PHH Escrow Issuer LLC, launched an offering of $150 million aggregate principal amount of 9.875% Senior Notes due 2029. This offering is an additional issuance to the $500.0 million aggregate principal amount of notes originally issued on November 6, 2024.

- The net proceeds from this offering will be used for general corporate purposes, including the repayment of certain indebtedness of PHH Mortgage Corporation (PMC) and PHH Asset Services LLC (PAS).

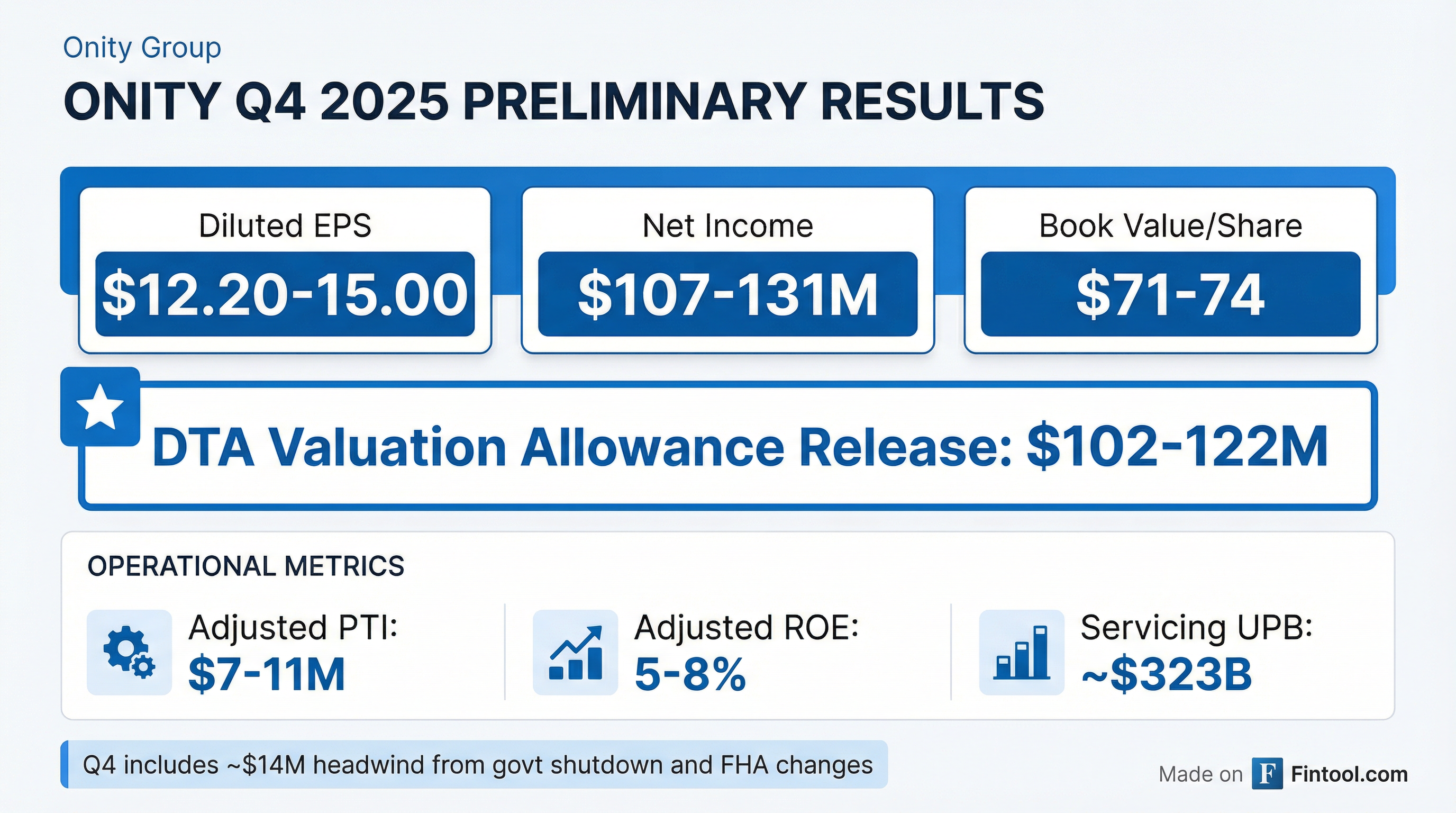

- Onity Group also announced preliminary estimated financial results for Q4 2025 and Full-Year 2025. For Q4 2025, estimated net income attributable to common stockholders is $107 to $131 million, with diluted earnings per share of $12.2 to $15.0.

- For Full-Year 2025, estimated net income attributable to common stockholders is $166 to $190 million, with diluted earnings per share of $19.3 to $22.1. The estimated book value per share for both periods is $71 to $74.

- Onity announced the sale of its Ginnie Mae HECM loans (reverse mortgages) to Finance of America, a transaction expected to close in Q1 or early Q2 2026, which will simplify its balance sheet and generate $100 million to $110 million in cash proceeds. Onity will continue to sub-service these assets for three years.

- The company reported strong financial performance for the third quarter, with a 25% Return on Equity (ROE) for the quarter and $31 million in adjusted pre-tax income. Book value per share was $62 and change, up $2.71 year-over-year, and the debt-to-equity ratio was 3.1 to 1 as of the end of Q3 2024.

- Onity expects to exceed its 16%-18% ROE guidance for the year and maintains a strong outlook for the rest of 2025 and 2026, driven by organic growth and an expanding sub-servicing client base, having signed nine new clients this year.

- Onity Group Inc. operates as a non-bank mortgage servicer and originator, utilizing a balanced business model across servicing and origination channels.

- The company reported a 25% Return on Equity (ROE) for the most recent quarter and $31 million in adjusted pre-tax income, marking its 12th consecutive quarter of profitability. It expects to exceed its 16%-18% ROE guidance for the year.

- Onity is strategically exiting the reverse servicing market by selling 40,000 Ginnie Mae HECM loans with a $9.6 billion unpaid principal balance (UPB) to Finance of America, anticipating $100 million to $110 million in cash proceeds. The company will continue to sub-service these assets for the next three years.

- The company is actively growing its sub-servicing business, having signed nine new clients this year, and is gaining market share in originations by growing faster than the overall industry.

- Onity maintains a competitive cost structure and focuses on organic growth, with a strong outlook for the remainder of the year and 2026.

- Onity Group Inc.'s subsidiary, PHH Mortgage Corporation, has entered into a strategic relationship with Finance of America Reverse (FAR) to sell reverse mortgage servicing rights (MSRs) for approximately 40,000 Ginnie Mae home equity conversion mortgage (HECM) loans with an unpaid principal balance of $9.6 billion as of September 30, 2025.

- As part of the agreement, PHH will become the subservicer for the reverse MSRs sold to FAR under a three-year subservicing agreement and will discontinue its reverse mortgage originations business upon closing.

- The transaction is estimated to generate net proceeds of $100 to $110 million and is expected to close in the first quarter of 2026, subject to regulatory approval and customary closing conditions.

- Onity Group intends to use the net proceeds to support growth, reduce debt, and explore a share repurchase program, expecting the transaction to be accretive to earnings and returns over the subservicing agreement term.

- ONIT reported strong third-quarter 2025 results, with Adjusted ROE of 25%, exceeding its 16-18% guidance, and Adjusted Pre-Tax Income of $31 million.

- The company's Adjusted Revenue increased 16% QoQ and 12% YoY to $265 million in Q3 2025.

- GAAP Diluted EPS was $2.03 and Book Value Per Share rose to $62.21, up over $2 QoQ and YoY.

- Originations volume reached a record $12 billion, a 39% increase year-over-year, while Servicing Average UPB grew to $312 billion.

- The company is focused on accelerating subservicing growth, with $24.1 billion in servicing additions in Q3 2025 and 9 new clients signed in FY'25.

- Onity Group reported strong Q3 2025 adjusted pre-tax income of $31 million and an annualized adjusted return on equity of 25%, exceeding its full year 2025 guidance.

- The company's balanced business model drove double-digit revenue growth year over year and sequentially, with originations volume increasing 39% year over year and 26% quarter over quarter.

- Book value per share grew to $62, a 5% increase from the prior year.

- The Rithm sub-servicing portfolio, which represented less than 5% of total adjusted revenues in Q3 2025 and was unprofitable after corporate allocations, will be transferred starting Q1 2026, with no material financial impact expected for full year 2026.

- Onity continues to invest in AI and technology to enhance business performance, improve customer experience, and drive cost leadership.

- Onity Group Inc. announced net income attributable to common stockholders of $18 million and diluted EPS of $2.03 for the third quarter of 2025, with adjusted pre-tax income of $31 million and an adjusted ROE of 25%.

- The company's book value per share improved to $62 as of September 30, 2025.

- Rithm Capital Corp. notified Onity that it will not renew its subservicing agreements effective January 31, 2026, which accounted for approximately $33 billion, or 10%, of Onity's total servicing and subservicing portfolio UPB and 55% of all delinquent loans as of September 30, 2025.

- Despite the termination, Onity does not expect a material financial impact on its business for the full year of 2026, as the Rithm portfolio was among the least profitable, and the company plans to replace the earnings contribution with more profitable relationships.

- Onity expects to exceed its 2025 adjusted ROE guidance range of 16% - 18% and anticipates releasing a significant portion of its $180 million deferred tax asset valuation allowance by year-end 2025.

Quarterly earnings call transcripts for ONITY GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more