Earnings summaries and quarterly performance for Otter Tail.

Executive leadership at Otter Tail.

Charles S. MacFarlane

Detailed

President and Chief Executive Officer

CEO

JO

Jennifer O. Smestad

Detailed

Vice President, General Counsel and Corporate Secretary

JS

John S. Abbott

Detailed

Senior Vice President, Manufacturing Platform; President, Varistar Corporation

TJ

Timothy J. Rogelstad

Detailed

Senior Vice President, Electric Platform; President, Otter Tail Power Company

TR

Todd R. Wahlund

Detailed

Vice President and Chief Financial Officer

Board of directors at Otter Tail.

Research analysts who have asked questions during Otter Tail earnings calls.

Recent press releases and 8-K filings for OTTR.

Otter Tail Corporation Announces Q4 2025 Earnings and 2026 Guidance

OTTR

Earnings

Guidance Update

New Projects/Investments

- Otter Tail Corporation reported diluted earnings per share of $6.55 for 2025, exceeding original expectations, despite a 9% decrease from the previous year.

- The company initiated its 2026 diluted earnings per share guidance range at $5.22-$5.62, with a midpoint of $5.42.

- The Electric segment's earnings increased over 7% in 2025 and are projected to increase 14% in 2026, driven by rate base investments and interim rate revenues.

- The Plastics segment's earnings decreased 15% in 2025 and are expected to decrease 36% in 2026 due to declining PVC pipe prices, partially offset by higher sales volumes from the Vinyltech expansion.

- Otter Tail Power's 5-year capital spending plan remains at $1.9 billion, supporting a 10% rate-based compound annual growth rate, and the company has no external equity needs through at least 2030. The company also increased its dividend by 10% to an annual indicated dividend of $2.31 per share.

Feb 17, 2026, 4:00 PM

Otter Tail Reports Q4 and Full-Year 2025 Results, Issues 2026 Guidance

OTTR

Earnings

Guidance Update

New Projects/Investments

- Otter Tail Corporation reported diluted earnings per share of $6.55 for 2025, exceeding original expectations, and initiated its 2026 diluted earnings per share guidance range at $5.22-$5.62, with a midpoint of $5.42.

- The company announced a 10% dividend increase, resulting in an annual indicated dividend of $2.31 per share, marking the 88th consecutive year of dividend payments.

- The Electric segment's earnings increased 7% in 2025 and are projected to increase 14% in 2026, while the Plastics segment's earnings decreased 15% in 2025 and are expected to decrease 36% in 2026 due to declining PVC pipe prices.

- Otter Tail Power's five-year capital spending plan remains at $1.9 billion, supporting a 10% rate-based compounded annual growth rate, including a $120 million battery storage project expected to be operational in 2028 and the Vinyltech expansion becoming fully operational in early 2026.

Feb 17, 2026, 4:00 PM

Otter Tail Corporation Announces Q4 and Full-Year 2025 Results and 2026 Outlook

OTTR

Earnings

Guidance Update

Dividends

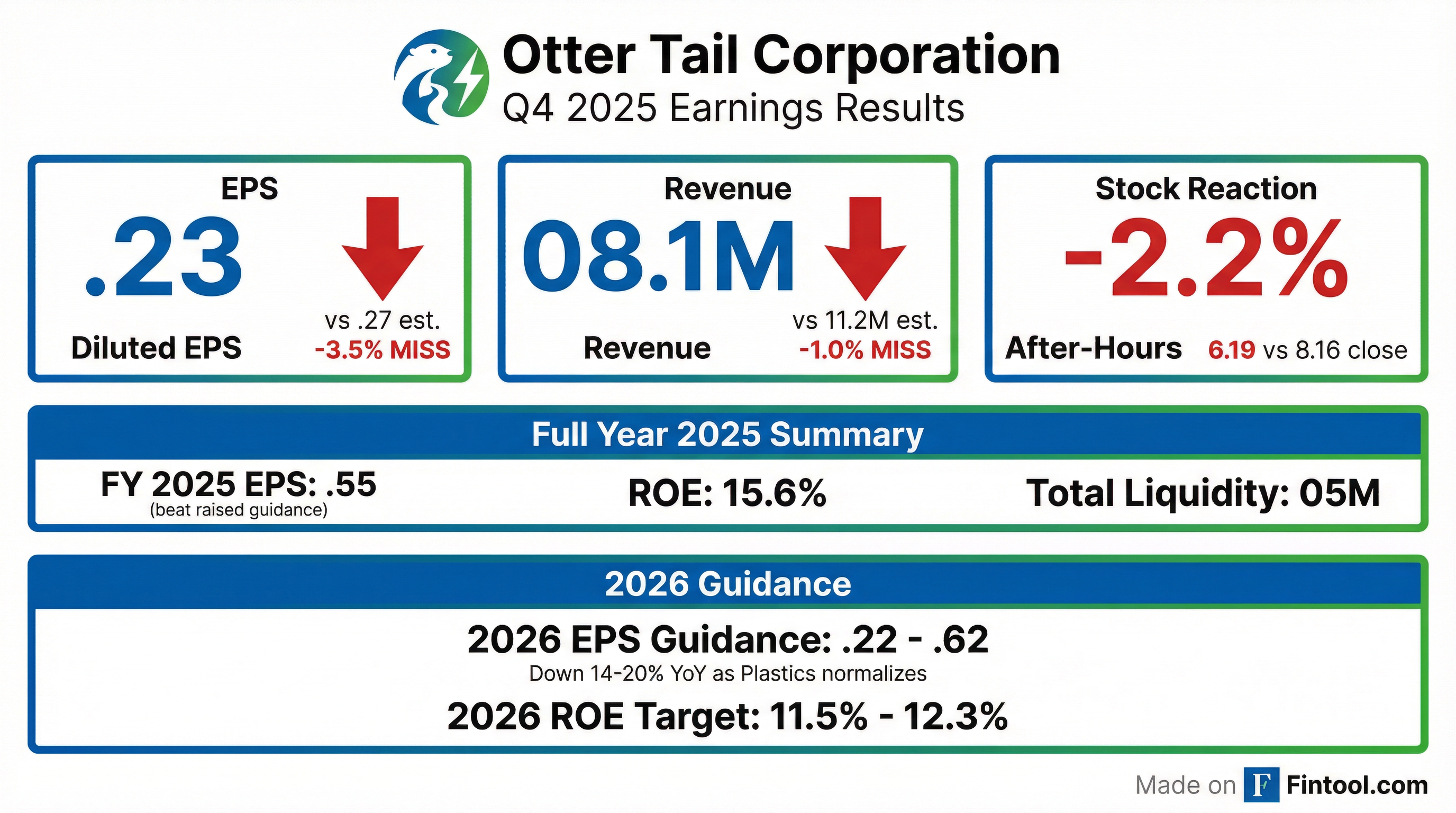

- Otter Tail Corporation reported diluted EPS of $1.23 for Q4 2025 and $6.55 for the full year 2025, which was at the upper end of its guidance range.

- The company initiated 2026 earnings guidance of $5.22 to $5.62, with a midpoint of $5.42, and projected a Return on Equity (ROE) of 12% at the guidance midpoint.

- An indicated dividend of $2.31 for 2026 represents a 10% increase from the 2025 annual dividend.

- Interim rate revenues went into effect in both Minnesota ($28.6 million) and South Dakota ($5.7 million) in late 2025/early 2026, with a settlement in principle reached for South Dakota in January 2026.

- The company forecasts no external equity needs through at least 2030 and plans $2,050 million in total capital expenditures from 2026 to 2030, while the Plastics segment earnings are projected to decline to $110 million in 2026 and $45-$50 million in 2028.

Feb 17, 2026, 4:00 PM

Otter Tail Corporation Reports Q4 2025 Earnings and Provides 2026 Guidance

OTTR

Earnings

Guidance Update

Dividends

- Otter Tail Corporation reported diluted earnings per share of $6.55 for the full year 2025, a 9% decrease from the previous year, and initiated its 2026 diluted EPS guidance range at $5.22-$5.62, with a midpoint of $5.42.

- The company increased its annual indicated dividend by 10% to $2.31 per share, marking the 88th consecutive year of dividend payments.

- The Electric segment's earnings increased over 7% in 2025 and are projected to increase 14% in 2026, driven by rate base investments and interim revenues, while the Plastics segment's earnings decreased 15% in 2025 and are expected to decrease 36% in 2026 due to declining PVC pipe prices.

- Otter Tail Power's 5-year capital spending plan remains at $1.9 billion, supporting a 10% compounded annual growth rate for rate base, with no external equity needs projected through at least 2030.

Feb 17, 2026, 4:00 PM

Otter Tail Corporation Announces Annual Earnings and Initiates 2026 Guidance

OTTR

Earnings

Guidance Update

Demand Weakening

- Otter Tail Corporation reported annual diluted earnings per share of $6.55 for the year ended December 31, 2025, and achieved a consolidated return on equity of 16%.

- The company initiated its 2026 diluted earnings per share guidance range of $5.22 to $5.62, with a projected 12% return on equity at the midpoint.

- Consolidated cash provided by operating activities was $386.0 million in 2025, and total available liquidity was $705.5 million as of December 31, 2025.

- The Electric segment's net income increased by $6.6 million (7.3%) in 2025, primarily due to higher retail revenues and lower operating and maintenance expenses.

- The Plastics segment's net income decreased by $30.3 million (15.1%) in 2025, mainly driven by a 15% decline in average sales prices, partially offset by an 8% increase in sales volumes.

Feb 17, 2026, 2:18 PM

Otter Tail Reports 2025 Results and Provides 2026 Guidance

OTTR

Earnings

Guidance Update

Demand Weakening

- Otter Tail Corporation reported its full-year 2025 diluted EPS of $6.55.

- The company provided 2026 GAAP EPS guidance in the range of $5.22–$5.62, which is below its 2025 level and the consensus estimate of approximately $5.96.

- Valuation models suggest a fair value around $83 compared to a last close near $88, implying the market is pricing a premium for expected future growth.

- Analysts indicate that justifying this premium will require revenue increases and favorable margin or multiple expansion, although projected utility earnings growth and progress on large new load contracts could strengthen cash flow.

Feb 16, 2026, 11:08 PM

Otter Tail Corporation Announces Annual Earnings and Initiates 2026 Earnings Guidance

OTTR

Earnings

Guidance Update

New Projects/Investments

- Otter Tail Corporation announced annual diluted earnings per share of $6.55 for the year ended December 31, 2025, and initiated 2026 diluted earnings per share guidance of $5.22 to $5.62.

- The company achieved a consolidated return on equity of 16% in 2025 and projects a 12% return on equity at the midpoint of its 2026 guidance.

- In 2025, the Electric segment's net income increased by 7.3% to $97.6 million, while the Manufacturing segment's net income decreased by 15.8% to $11.5 million, and the Plastics segment's net income decreased by 15.1% to $170.4 million.

- Otter Tail Corporation reported consolidated cash provided by operating activities of $386.0 million in 2025 and had $705.5 million in total available liquidity as of December 31, 2025.

- The company plans total capital expenditures of $467 million for 2026, with a five-year plan (2026-2030) totaling $2.050 billion, primarily in the Electric segment.

Feb 16, 2026, 11:00 PM

Otter Tail Corporation Reports Q3 2025 Earnings, Raises 2025 Guidance and Long-Term EPS Growth Target

OTTR

Earnings

Guidance Update

New Projects/Investments

- Otter Tail Corporation reported diluted earnings per share of $1.86 for the third quarter of 2025, which, despite an 8% decrease from the prior year, outpaced expectations.

- The company increased the midpoint of its 2025 earnings guidance to $6.47 per share, with a new range of $6.32-$6.62, driven by better-than-expected plastics segment financial results.

- The targeted long-term earnings per share growth rate was raised to 7%-9% (from 6%-8%) off a 2028 base year, resulting in a targeted total shareholder return of 10%-12%.

- Otter Tail Power's updated five-year capital spending plan now totals $1.9 billion, expected to produce a 10% rate base compounded annual growth rate, and will be funded without external equity through at least 2030.

- The company filed a Minnesota rate case for a net revenue increase of $44.8 million and expects $5.7 million in annual interim rates from its South Dakota rate case to commence on December 1, 2025.

Nov 4, 2025, 4:00 PM

Otter Tail Corporation Announces Q3 2025 Results and Updates 2025 EPS Guidance

OTTR

Earnings

Guidance Update

New Projects/Investments

- Otter Tail Corporation reported diluted EPS of $1.86 for Q3 2025 and $5.32 year-to-date 2025.

- The company increased its 2025 EPS guidance midpoint to $6.47 from $6.26, with the Plastics segment's EPS guidance midpoint increasing by approximately $0.20 and the Electric segment's year-over-year EPS growth increasing to 8% from 7%.

- As of September 30, 2025, the trailing twelve months Return on Equity (ROE) was 16%. The company also updated its rate base growth CAGR to 10% from 9% and increased its long-term EPS growth rate target to 7-9% from 6-8% (2028 base year).

- Key regulatory updates include proposed interim rates for Minnesota, expected to go into effect January 2026, and for South Dakota, expected to go into effect December 1, 2025.

- The company projects significant capital expenditures totaling $2,047 million from 2026 to 2030, with $1,918 million allocated to the Electric segment.

Nov 4, 2025, 4:00 PM

Otter Tail Corporation Reports Q3 2025 Earnings, Raises 2025 Guidance, and Increases Long-Term EPS Growth Target

OTTR

Earnings

Guidance Update

New Projects/Investments

- Otter Tail Corporation reported diluted earnings per share of $1.86 for Q3 2025, which outpaced expectations despite an 8% decrease from the prior year.

- The company increased its 2025 diluted earnings per share guidance to a range of $6.32-$6.62, with the midpoint rising to $6.47 from $6.26, primarily driven by better-than-expected plastics segment financial results.

- Otter Tail Power's updated five-year capital spending plan now totals $1.9 billion, projected to achieve a 10% rate base compounded annual growth rate.

- The targeted long-term earnings per share growth rate was increased to 7% to 9% (from 6% to 8%) off a 2028 base year, with a targeted total shareholder return of 10% to 12%.

- The plastics segment's earnings decreased by $0.26 per share due to a 17% decline in average PVC pipe sales prices, partially offset by lower input costs and a 4% increase in sales volumes.

Nov 4, 2025, 4:00 PM

Quarterly earnings call transcripts for Otter Tail.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more